Photoinitiator Market Summary

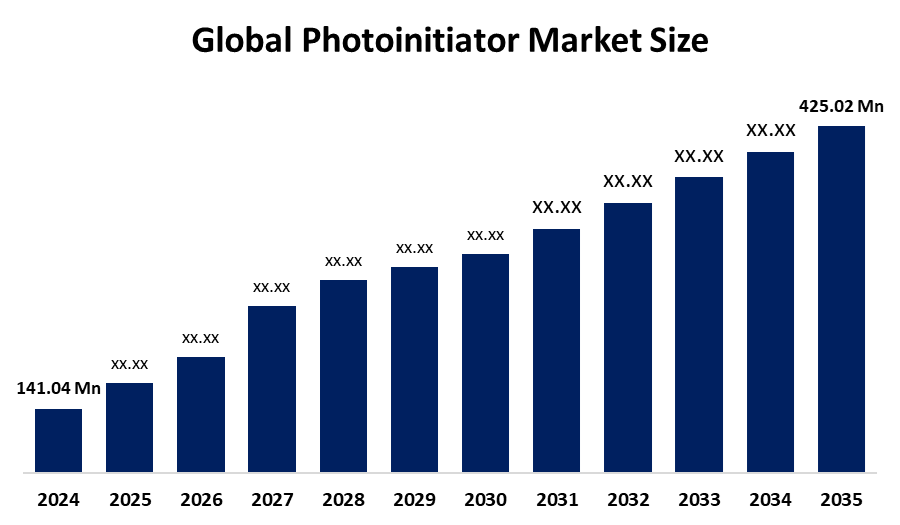

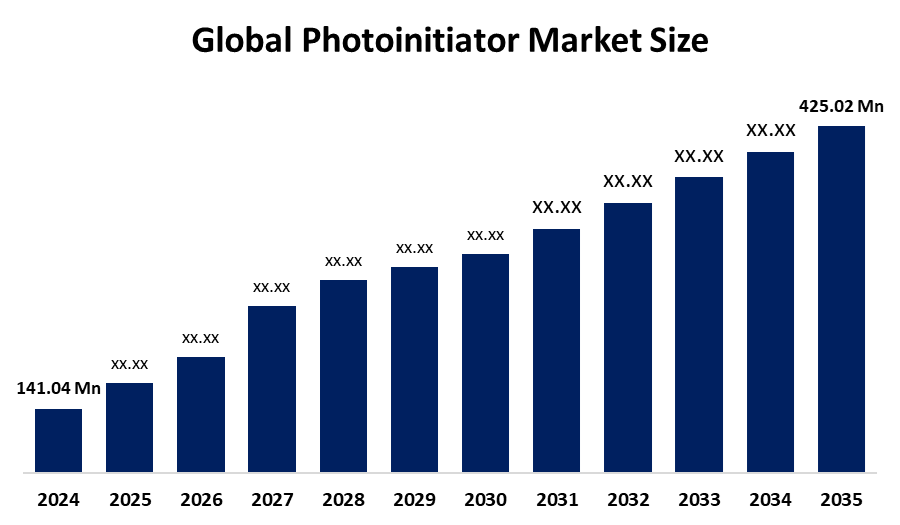

The Global Photoinitiator Market Size was Estimated at USD 141.04 Million in 2024 and is projected to reach USD 425.02 million by 2035, Growing at a CAGR of 10.55% from 2025 to 2035. The Growing use of UV curing technology and the growing need for environmentally friendly coatings and inks are the main factors propelling the photoinitiator market's expansion. The market has been further stimulated by improvements in UV curing technologies, such as LED curing systems, which have resulted in quicker processing times and increased energy efficiency.

Key Regional and Segment-Wise Insights

- In 2024, North America's revenue share was projected to be 33.4%, resulting in the largest market globally.

- The U.S. Photoinitiator Market Size is one of the most well-established in the world, accounting for more than 84.7% of North America's total demand in 2024.

- In 2024, the free Radical Segment held a Market Share of 72.7% by type.

- With a revenue share of 36.5% in 2024, the coatings sector dominated the global market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 141.04 Million

- 2035 Projected Market Size: USD 425.02 Million

- CAGR (2025-2035): 10.55%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The global industry that involves the production, distribution, and use of photoinitiators, which are chemical materials that induce chemical reactions in the presence of light, constitutes the photoinitiator market. The photoinitiator market has grown to be a vital component of the modern industrial landscape, primarily serving the industries that take advantage of curing technologies, like UV or visible light curing. The movement of the marketplace is aided by the demand for low-VOC and environmentally friendly formulations in both consumer and industrial applications. The market is also booming because of ongoing research and development to produce their own visible-light-sensitive and water-compatible photoinitiators. These products are meeting the demand within food-grade coatings and materials used in biomedical applications. To maximize curing speed and performance, even in high-speed printing and coatings lines, companies must work with the resin formulators and the equipment suppliers strategically.

Photoinitiators benefit greatly from the growth of worldwide car production. Beyond just car manufacturing enhancement, mostly through UV-curable coatings and adhesives to meet requirements such as performance, durability, and/or appearance, automotive manufacturers predominantly rely on photoinitiators to rapidly cure coatings at room temperature without the need for heat. Global manufacturers are now also working towards less toxic, non-migratory photoinitiators by developing new materials in the wake of regional regulations such as REACH and FDA approvals. Also supporting the long-term demand growth for photoinitiators is the ongoing development of sustainable packaging, high-quality printing, and downsizing of medical devices. North America and Europe, for example, are concerned for photoinitiator technology innovation and development, showing their proactive stance in sustainable industrial practice and environmental conservation.

Type Insights

In 2024, free radical photoinitiators accounted for over 72.7% of the global revenue share, and they are the most popular kind because of their versatility and effectiveness across a variety of applications, such as adhesives, coatings, and inks. Some of the common types used include acyl phosphine oxides, α-hydroxyketones, and benzoin ethers. They not only provide fast cure speeds, high reactivity, and excellent surface cure properties, which reduce production times and energy consumption in the electronics, automotive, and packaging industries, but their revenue share was also enhanced by their overall high-volume usage in LED-based curing systems, especially for printing and varnishing applications.

Cationic photoinitiators are emerging faster. Epoxy-based composites are being used more frequently in electronics, automotive parts, and high-performance coatings. They are suitable for certain industrial applications because they can cure in ambient environments with low oxygen inhibition. Cationic types are particularly useful for applications that require thick-section curing or that have shadow areas since they continue to cure long after light exposure has ceased due to their post-irradiation reactions. Capacity in electronics and 3D printing is growing as a result of cationic photoinitiators' dependability in producing high-performance and dimensionally stable parts. The increasing selection of cationic initiators is being driven by the increased demand for low-emission and energy-efficient curing systems, particularly in North America and Europe, where emissions policies are very strict.

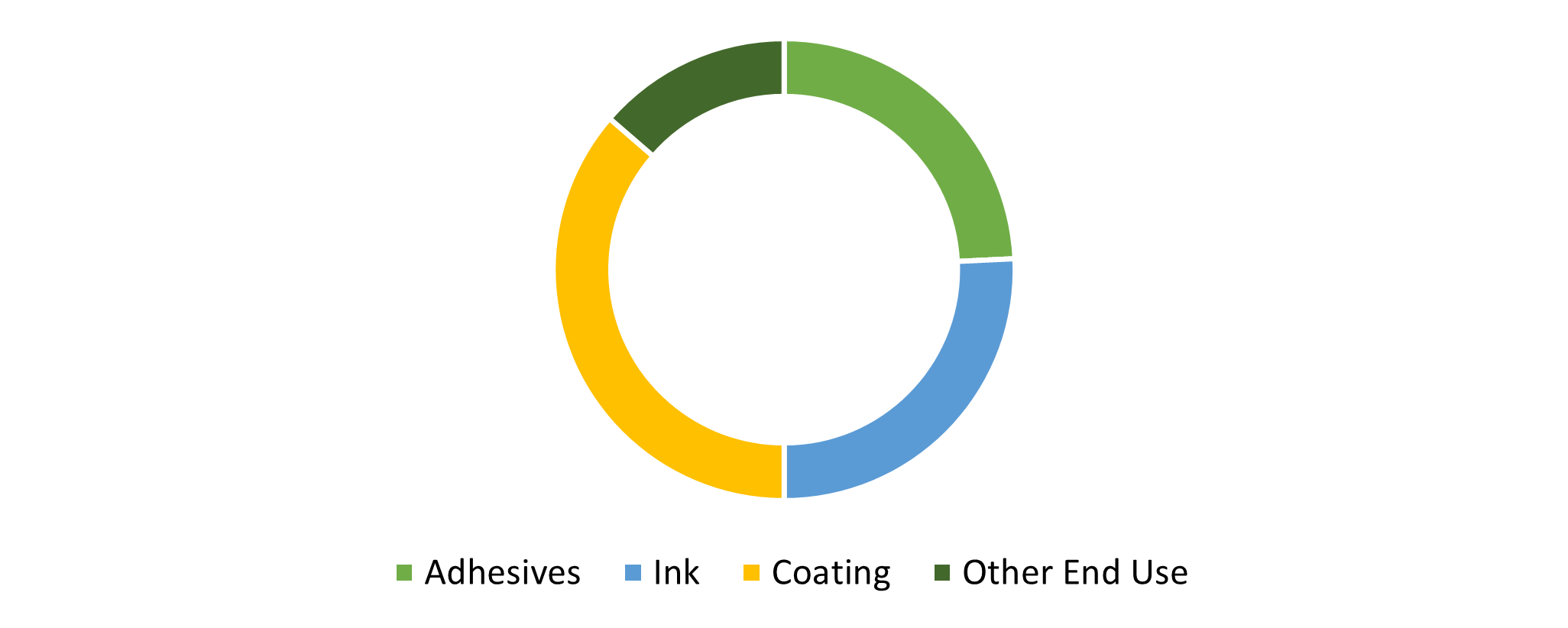

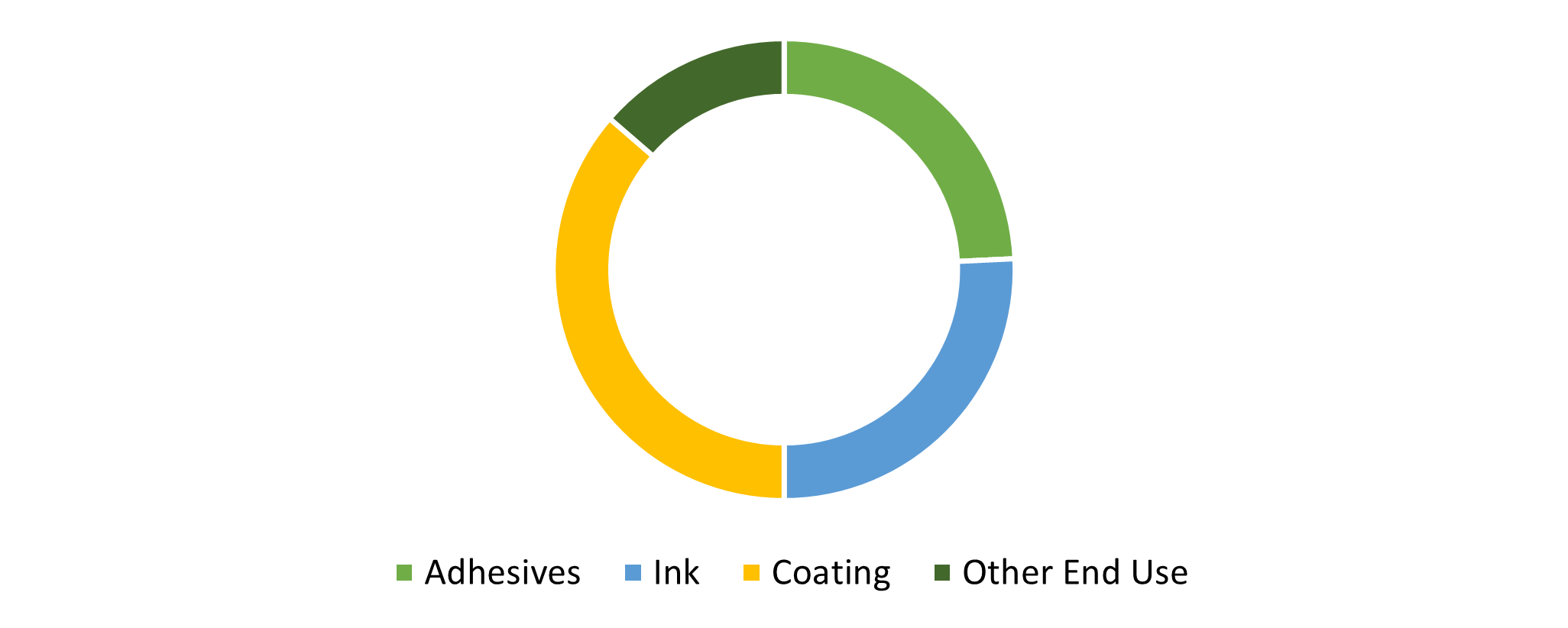

End Use Insights

In 2024, the coatings segment held a 36.5% sales share, leading the global market. The coatings market greatly benefits from the wide use of photoinitiators in numerous coatings applications in consumer, automotive, and industrial applications. Photoinitiators are used in metal protection, plastic finishes, wood coatings, and automotive topcoats due to their exceptional mechanical properties, compatibility with solvent-free formulations, and fast curing via UV. Fast curing is important in high-performance coatings where production schedules can be shortened and throughput increased. This drives the need for photoinitiators in coatings to provide fast drying, more durable coatings, and improved finish quality.

The inks market is steadily expanding, driven by digitization across the packaging and commercial printing markets. UV-curable inks are essential for applications including labels, shrink sleeves, and flexible packaging because they use low energy, dry quickly, and have chemical and abrasion resistance. Photoinitiators are used in this space to enhance drying times and improve print quality on multiple substrates. The use of photoinitiators is important in the packaging and commercial printing industries because both productivity and print quality are paramount. Faster production cycles and the vibrant, long-lasting print outputs that are necessary in a competitive market are made possible by photoinitiators in inks.

Regional Insights

North America contributed around 33.4% revenue share in 2024, resulting in the largest market globally. The growth is mainly driven by the rapid uptake in the digital printing, industrial coatings, and medical device adhesives applications. The United States contributes most in terms of consumption, driven by an innovative graphics industry, strict VOC regulations incentivizing UV-curable systems, and significant R&D ecosystems. Innovation in high-performance and low-migration photoinitiators is driven by the electronics and packaging industries' increasing demand. Moreover, the North American market growth is sustained by stringent environmental regulations for low-VOC products.

U.S. Photoinitiator Market Trends

In 2024, the U.S. photoinitiator market is one of the most mature markets in the world and represents more than 84.7% of total North American demand. The widespread use of digital UV inks, medical-grade adhesives, and high-end coatings is primarily driving growth. The need for low-VOC solutions due to strict environmental regulations is another factor driving the quick adoption of UV-curable systems in electronics, packaging, and healthcare. In the coming years, the photoinitiator market is expected to be propelled by regulatory support for sustainable printing methods and increased investments in high-performance formulations. The region's culture of innovation and strict environmental regulations is likely to demonstrate significant influence on the market dynamics, particularly in specialized applications requiring consistency and detail.

Asia Pacific Photoinitiator Market Trends

The Asia Pacific photoinitiator market is projected to be the fastest-growing market in 2024. This occurred because of the fast-growing industrial manufacturing centres and demand from industries such as packaging, electronics, and automotive. The region benefits from low costs of production and increasing domestic demand for UV-curable and 3D printed products. There has been a surge in applications for UV-curable coatings and adhesives in countries like China, Japan, and South Korea due to strong infrastructure investments, favourable regulatory frameworks, and a large base of electronics and plastic production facilities. China commanded the regional markets because of its advanced photopolymer technologies, low cost of production, and availability of input materials. The sheer presence of a large printing industry in China also impacted the total consumption of photoinitiators in the region.

Europe Photoinitiator Market Trends

The photoinitiator market in Europe is gradually developing due to prevalent production bases for industrial coatings, inks, and adhesives in Germany, France, and the UK. Safer, non-toxic alternatives for traditional photoinitiators have been created for compliance with EU REACH. The label printing and wood coatings sectors are also significantly penetrated. Furthermore, the region will be increasingly drawn to energy-efficient curing technologies such as photoinitiators, as a result of stricter environmental regulations and early adoption of ecological practices, especially in UV and LED-based technologies. Additionally, the tighter EU emissions regulations are pushing European manufacturers to produce sustainable low-VOC solutions, which should raise market revenue during the forecast period.

Key Photoinitiator Companies:

The following are the leading companies in the Photoinitiator market. These companies collectively hold the largest market share and dictate industry trends.

- IGM Resins

- Arkema S.A.

- Tronly New Electronic Materials Co., Ltd.

- Lambson Ltd (part of Aditya Birla Group)

- BASF SE

- Evonik Industries AG

- ADEKA Corporation

- Rahul Photoinitiators Pvt. Ltd.

- Tianjin Jiuri New Materials Co., Ltd.

- Eutec Chemical Co., Ltd.

- Others

Recent Developments

- In January 2023, Everlight Chemical brought to market a novel water-based photoinitiator type. Water-based coatings utilize water as their main ingredient, which leads to lower VOC emissions compared to conventional solvent-based dispersion or dilution methods. The production lines can be cleaned easily, and operators can switch between lines quickly, thereby decreasing manufacturing expenses. The rising environmental consciousness, together with escalating energy conservation standards and tightening regulations, has driven water-based coatings to become more popular among users.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the photoinitiator market based on the below-mentioned segments:

Global Photoinitiator Market, By Type

Global Photoinitiator Market, By End Use

- Adhesives

- Ink

- Coating

- Other End Use

Global Photoinitiator Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa