Plant-based Seafood Market Summary

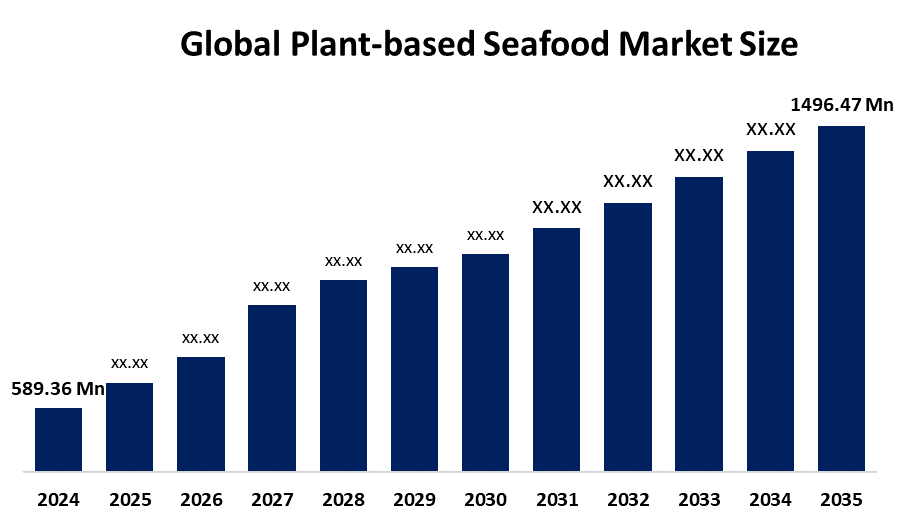

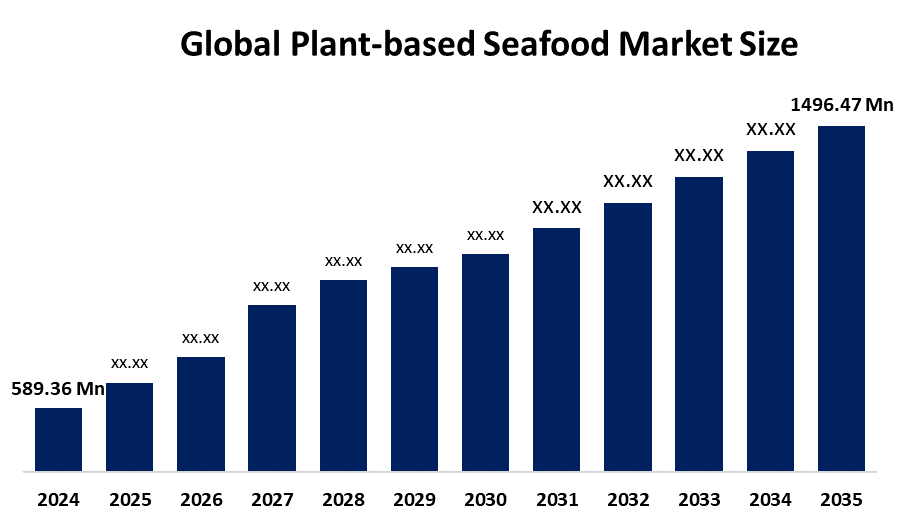

The Global Plant-based Seafood Market Size Was Estimated at USD 589.36 Million in 2024 and is Projected to Reach USD 1496.47 Million by 2035, Growing at a CAGR of 8.84% from 2025 to 2035. The market for plant-based seafood is expanding as a result of growing consumer awareness of the harm traditional fishing causes to the environment, growing health consciousness, and improvements in food technology that enhance the flavor and texture of plant-based substitutes.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 36.37% and dominated the Market globally.

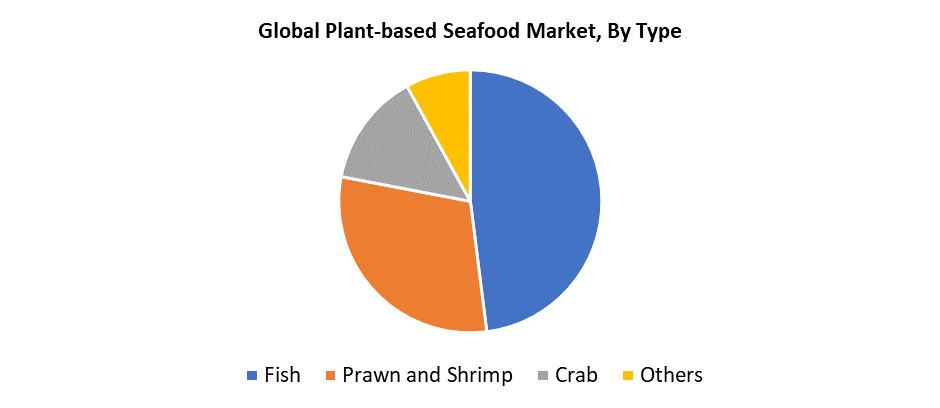

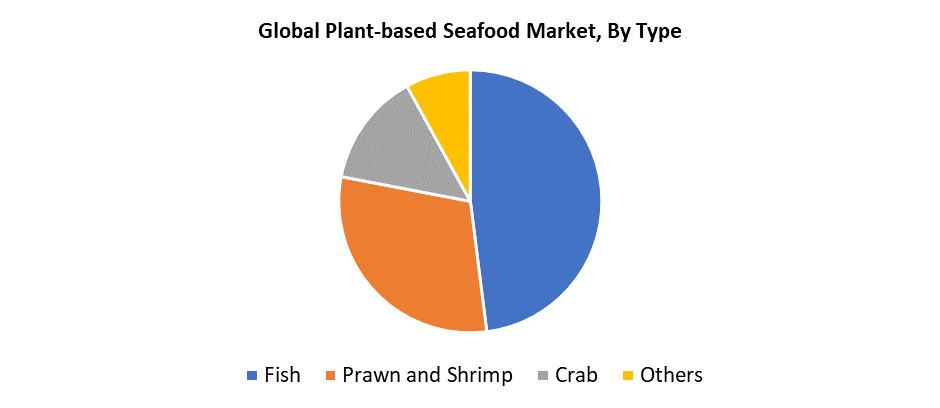

- In 2024, the fish segment had the largest market share by type, accounting for 48.26%.

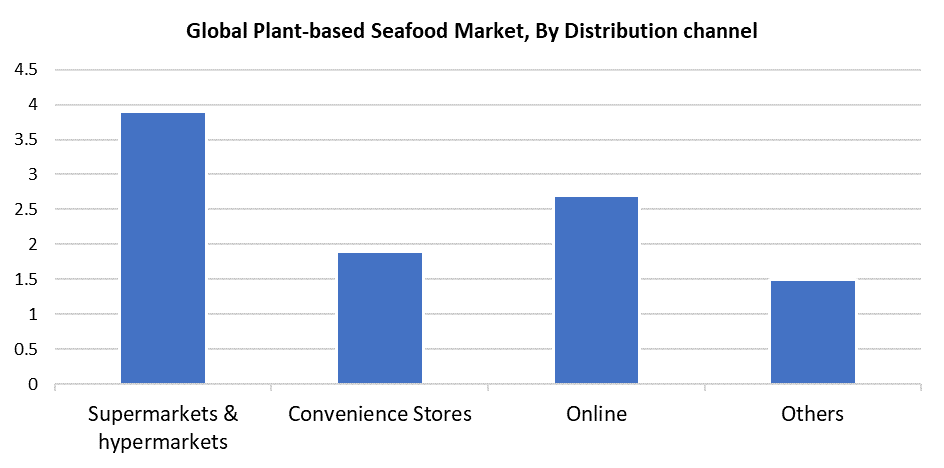

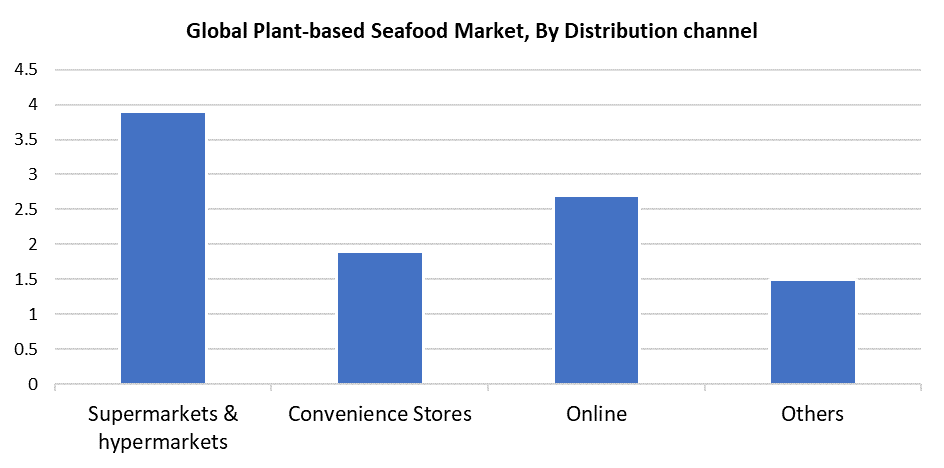

- In 2024, the Supermarkets and hypermarkets segment had the biggest market share by distribution channel, accounting for 39.42%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 589.36 Million

- 2035 Projected Market Size: USD 1496.47 Million

- CAGR (2025-2035): 8.84%

- North America: Largest market in 2024

The food sector, which focuses on manufacturing and selling seafood replacement products from plant-based materials, is identified as the plant-based seafood market. Plant-based seafood benefits from expanding market opportunities because of consumers' rising environmental awareness and their search for healthier dietary alternatives. People seek sustainable food alternatives because they worry about overfishing, together with declining fish stocks and ocean contamination. Plant-based seafood products duplicate traditional seafood tastes while protecting the environment from standard fishing practices. The combination of algae with soy and legumes creates ingredients for plant-based seafood, which delivers clean-label and allergy-free products. Health-conscious people choose plant-based seafood because it delivers more protein and omega-3 fatty acids but avoids cholesterol, saturated fats, and mercury. The increasing interest in flexitarian, vegetarian, and vegan lifestyles continues to drive market growth for sustainable seafood alternatives.

The growing popularity of plant-based seafood stems from both ethical concerns and scientific research. People who protect animal welfare now select plant-based seafood products to save ocean life from destructive industrial fishing methods. Plant-based seafood products serve as ocean preservation tools that match these essential values. The food industry has developed innovative technology to enhance plant-based seafood products so they replicate authentic seafood taste, texture, and visual appearance. The shift toward these alternatives becomes more straightforward since they attract diverse groups of consumers. Plant-based seafood continues to grow popular in retail stores and foodservice establishments due to its safer qualities, which protect customers against seafood allergies and dietary restrictions.

Type Insights

The fish segment dominated the plant-based seafood market by generating 48.26% of global revenue in 2024. Traditional fish consumption continues to drop because consumers worry about its fat content, cholesterol levels, and mercury pollution, which drives the market growth. The plant-based fish substitute contains no cholesterol, and manufacturers enhance it with omega-3 fatty acids to replicate its nutritional profile. The protection of marine ecosystems stands as a critical factor because overfishing and ocean pollution threaten these environments. The popularity of sustainable plant-based fish products continues to rise among customers who want to reduce their environmental footprint. Plant-based fish substitutes maintain the same familiar flavors and textures as traditional fish, which makes them suitable for vegetarians, vegans, and flexitarians. Market growth in this segment receives strong support from its taste combined with sustainability and health benefits.

The plant-based prawn and shrimp segment is anticipated to grow at a CAGR of 8.7% between 2025 and 2035 because food technology advances have improved their flavor and texture. The enhancements in plant-based prawn and shrimp products make them more attractive to consumers who want traditional seafood flavors without environmental damage and ethical concerns. The availability of these products in grocery stores, supermarkets, and dining establishments has increased while foodservice chains have partnered with plant-based producers to add these substitutes to their regular menus. The growing presence of plant-based seafood offerings in both retail and foodservice channels is accelerating customer adoption rates, which drives market growth and boosts the demand for sustainable seafood alternatives.

Distribution Channel Insights

Supermarkets and hypermarkets dominated the plant-based seafood distribution network with 39.42% sales revenue in 2024. The extensive shelf space and diverse product range of plant-based seafood allows it to reach consumers beyond health store customers. These retail formats drive customer experimentation and repeated sales through their extensive range of brands combined with innovative products such as vegan shrimp, plant-based fish fillets, and crab cakes. Targeted marketing campaigns and in-store tastings, together with promotional programs, help consumers learn about the health benefits, sustainability features, and allergy-free nature of plant-based seafood. The market's main distribution channels remain supermarkets and hypermarkets because these locations provide easy access to products during regular shopping and maintain strong relationships with leading manufacturers.

The online marketplace for plant-based seafood products is expected to achieve an 8.3% CAGR between 2025 and 2035 because consumers find online purchasing convenient and accessible. The platform enables buyers to explore a wide selection of items while checking product features and customer feedback, which leads many to select plant-based seafood items for their first experience. More people chose online grocery shopping during the COVID-19 pandemic because they wanted to minimize health risks. Plant-based seafood brands currently emphasize online product introductions to access broader audiences who seek sustainable and health-conscious seafood alternatives. The direct-to-consumer approach and growing online retail infrastructure propel strong growth throughout the online distribution network of plant-based seafood products.

Regional Insights

In 2024, the North American region dominated the plant-based seafood market globally, accounting for 36.37% of worldwide sales, because more people adopted flexitarian, vegetarian, and vegan diets and sought sustainable food choices. The consumption of plant-based alternatives, which people consider safer and healthier, has exploded because of concerns about traditional seafood pollutants, including mercury and microplastics, cholesterol, and fat reductions. The strong public understanding of environmental sustainability, together with overfishing issues, drives the market growth in this region. The North American food industry has developed a dynamic group of innovative startups and creative food companies that utilize advanced food technologies to develop authentic plant-based seafood alternatives. The innovation, along with increasing consumer acceptance, has established North America as a leading force in the expanding market.

Europe Plant-based Seafood Market Trends

The European plant-based seafood industry is anticipated to experience a CAGR of 8.4% during the forecasted period because of the rising adoption of vegetarian and flexitarian diets and vegan lifestyles, which stem from ethical food concerns, animal rights, and seafood health risks. People in the UK, Germany, and France drive sustainable product demand because they have increasing awareness of fishing industry impacts on ocean environments. The demand for plant-based seafood products emerges from consumers who want to avoid mercury exposure and are concerned about traditional seafood production methods. The European Green Deal and other stringent environmental policies in Europe motivate the creation of sustainable food products, thus promoting market growth. The expansion of supermarkets combined with product processing improvements, including plant-based prawn development, enables the market to grow in specific regions.

Asia Pacific Plant-based Seafood Market Trends

The Asia Pacific plant-based seafood market will achieve a CAGR of 8.6% between 2025 and 2035 due to food technology advancements creating plant-based alternatives for popular regional seafood dishes, including shrimp, fish, and crab. These domestically made food items, such as shrimp dumplings and plant-based sushi, serve to satisfy urban residents who maintain their culinary traditions. The rising adoption of healthy lifestyles together with environmental awareness has driven the market toward sustainable alternatives, which thrive particularly in seafood-consuming nations like China, Japan, and South Korea. The younger generation has developed more environmental awareness because of ocean resource depletion and marine environment contamination. The rising number of vegetarians and vegans across the region supports market growth because plant-based seafood offers an ethical and nutritional choice that matches contemporary dietary and moral values.

Key Plant-Based Seafood Companies:

The following are the leading companies in the plant-based seafood market. These companies collectively hold the largest market share and dictate industry trends.

- Beyond Meat

- Daiya Foods

- Ocean Hugger Foods

- Kuleana

- Turtle Island Foods

- New Wave Foods

- Good Catch

- Miyoko's Creamery

- Gardein

- Loma Linda

- Others

Recent Developments

- In July 2024, in Japan, NH Foods, a food processing company based in Osaka, introduced a plant-based substitute for tuna sashimi in the restaurant industry. By mimicking the flavor and texture of raw tuna, this new product seeks to provide customers with a genuine culinary experience. Because of worries about the sustainability of marine resources, the alt-seafood industry is expanding gradually.

- In October 2023, NESTLE has launched a new line of plant-based white fish substitutes, such as fingers, nuggets, and fillets. These vegan-certified goods have won accolades for their flavor, consistency, and nutritional content.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the plant-based seafood market based on the below-mentioned segments:

Global Plant-based Seafood Market, By Type

- Fish

- Prawn and Shrimp

- Crab

- Others

Global Plant-based Seafood Market, By Distribution channel

- Supermarkets & hypermarkets

- Convenience Stores

- Online

- Others

Global Plant-based Seafood Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa