Shea Butter Market Summary

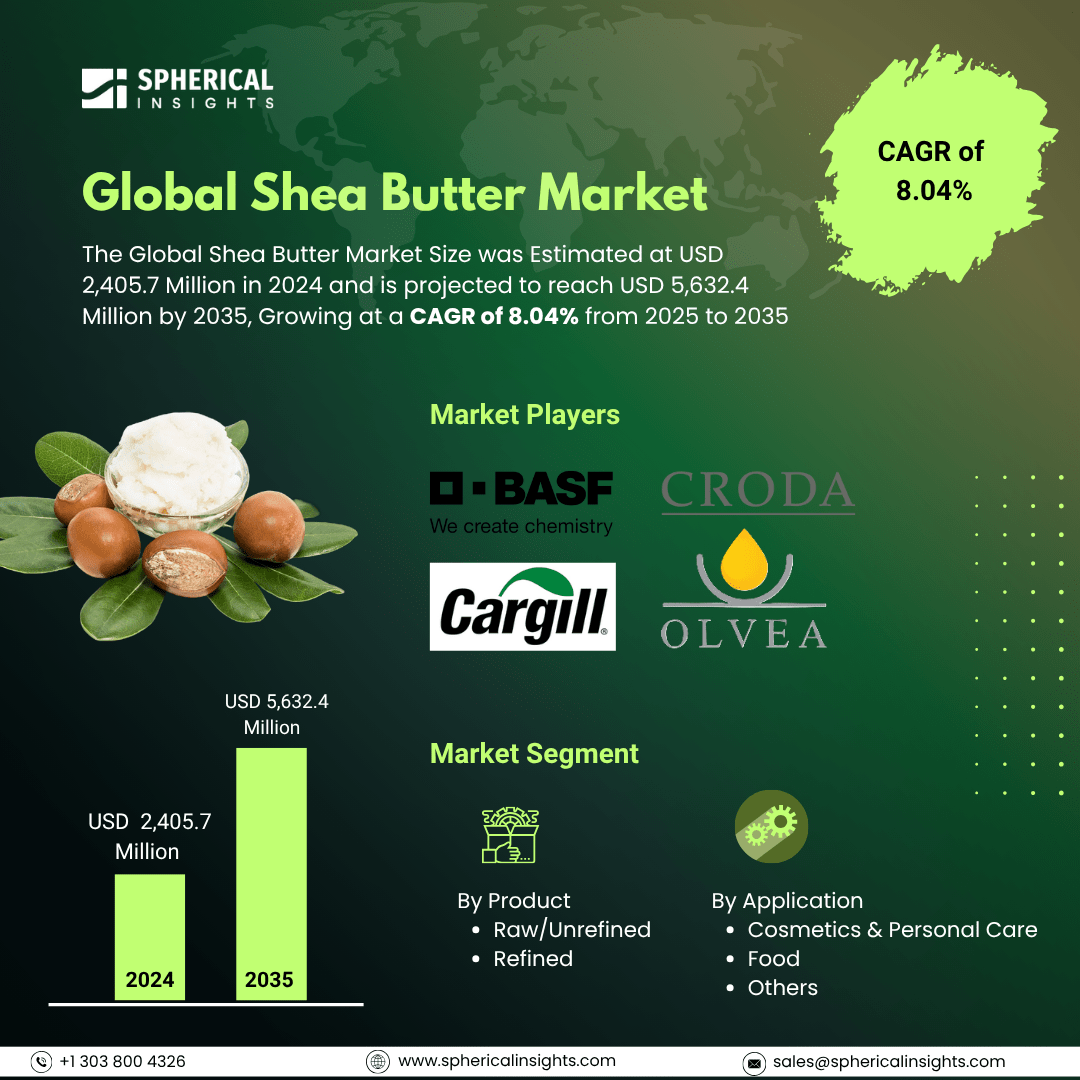

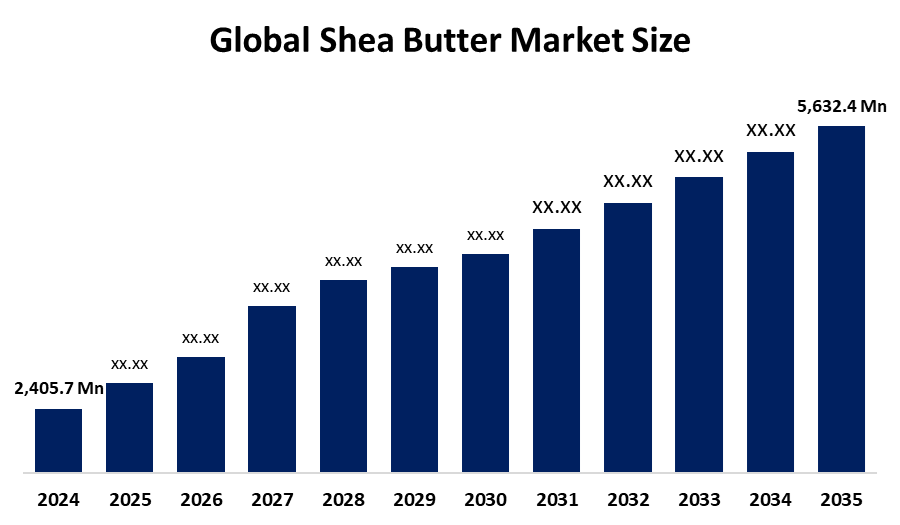

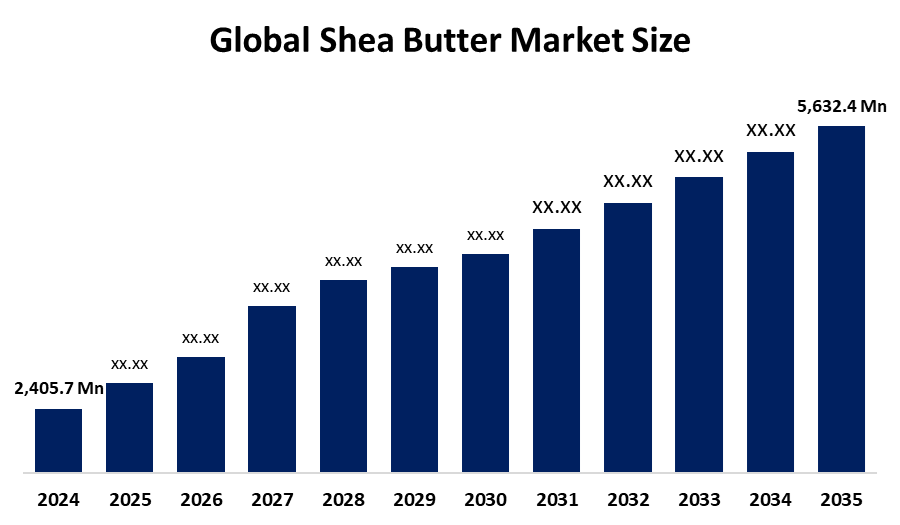

The Global Shea Butter Market Size was Estimated at USD 2,405.7 Million in 2024 and is Projected to reach USD 5,632.4 Million by 2035, Growing at a CAGR of 8.04% from 2025 to 2035. Several factors are contributing to the Growth of the Global Shea Butter Market, but the main one is consumers' Growing preference for natural and organic ingredients in food and personal care goods.

Key Regional and Segment-Wise Insights

- In 2024, European Shea Butter Market Size had the largest revenue, accounting for 29.7% by region.

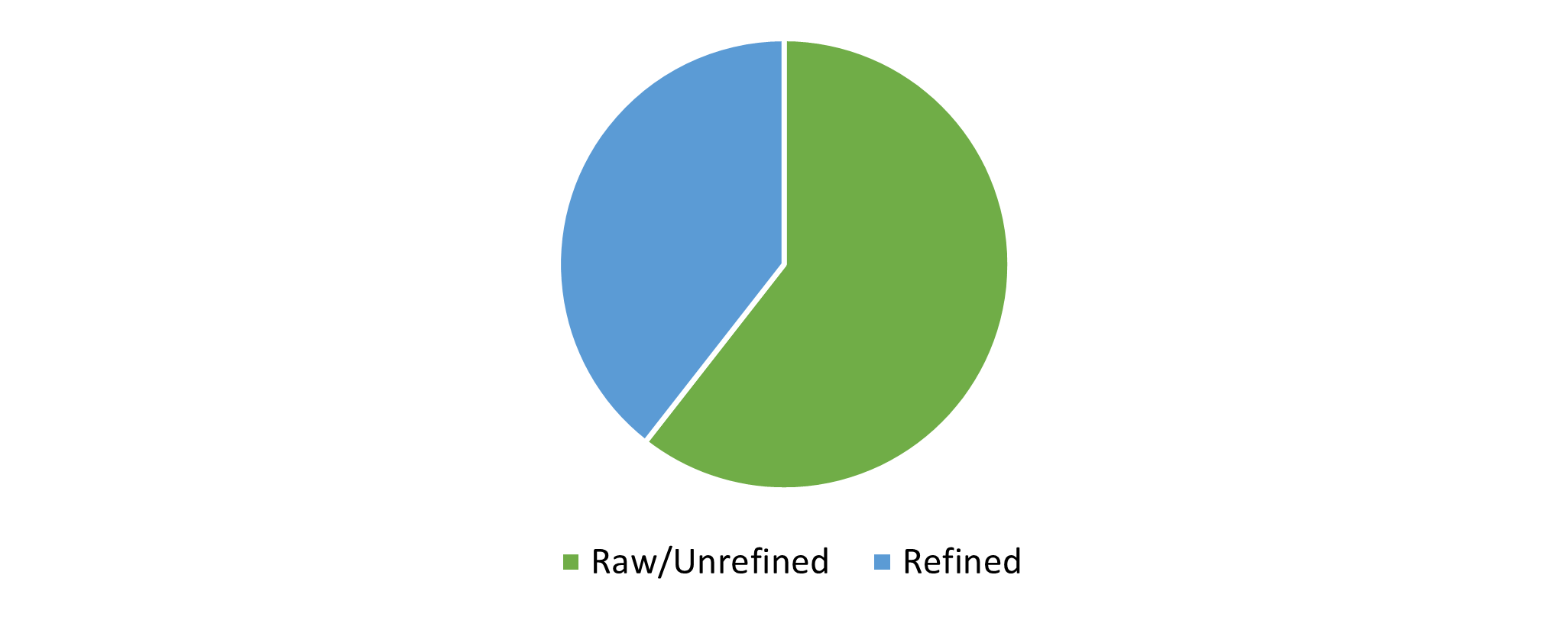

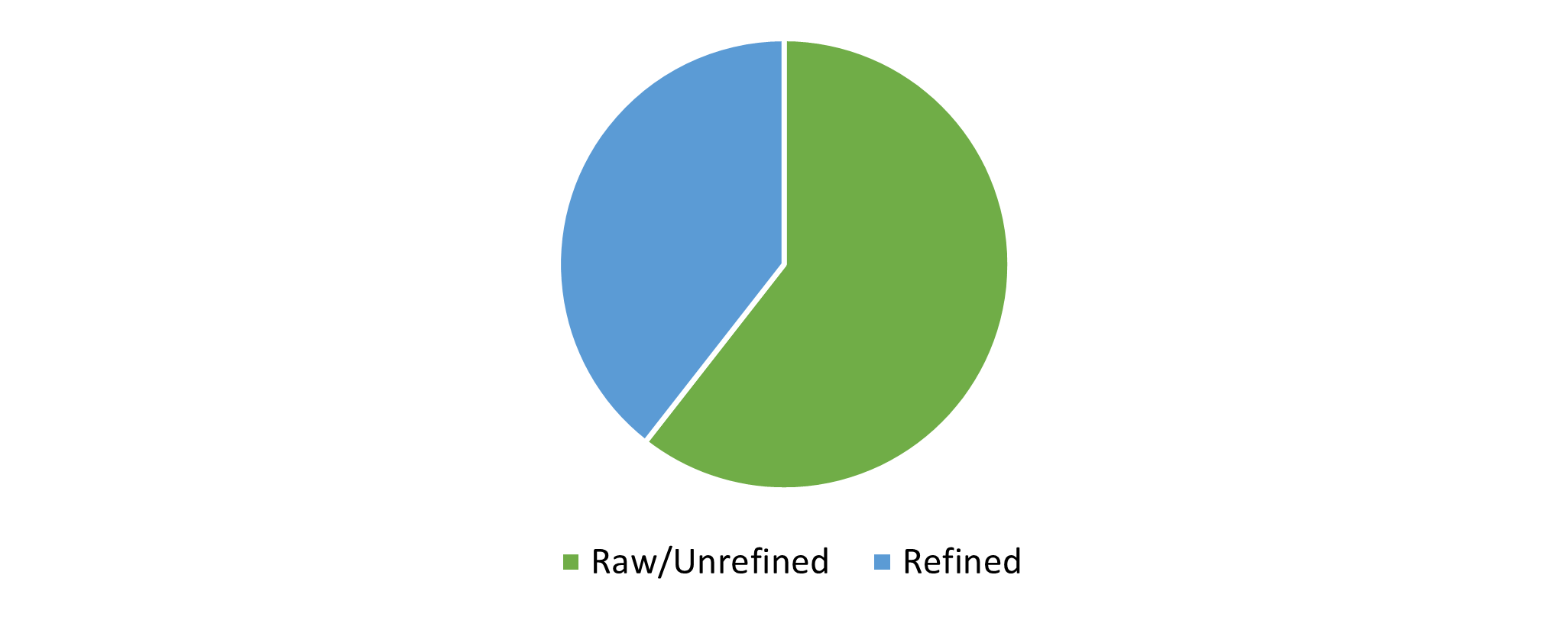

- In 2024, raw/unrefined products generated the largest revenue of 61.7% based on product.

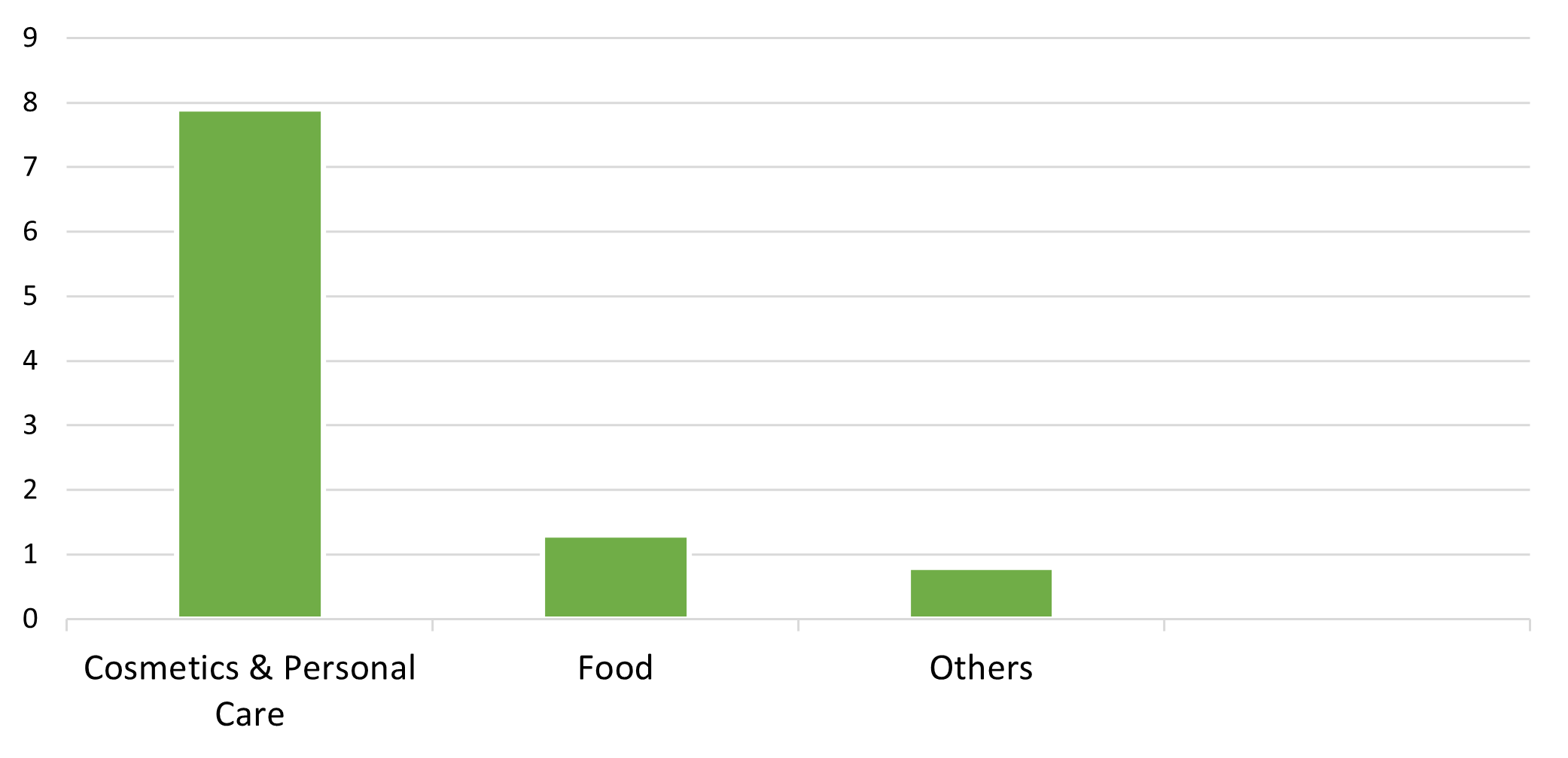

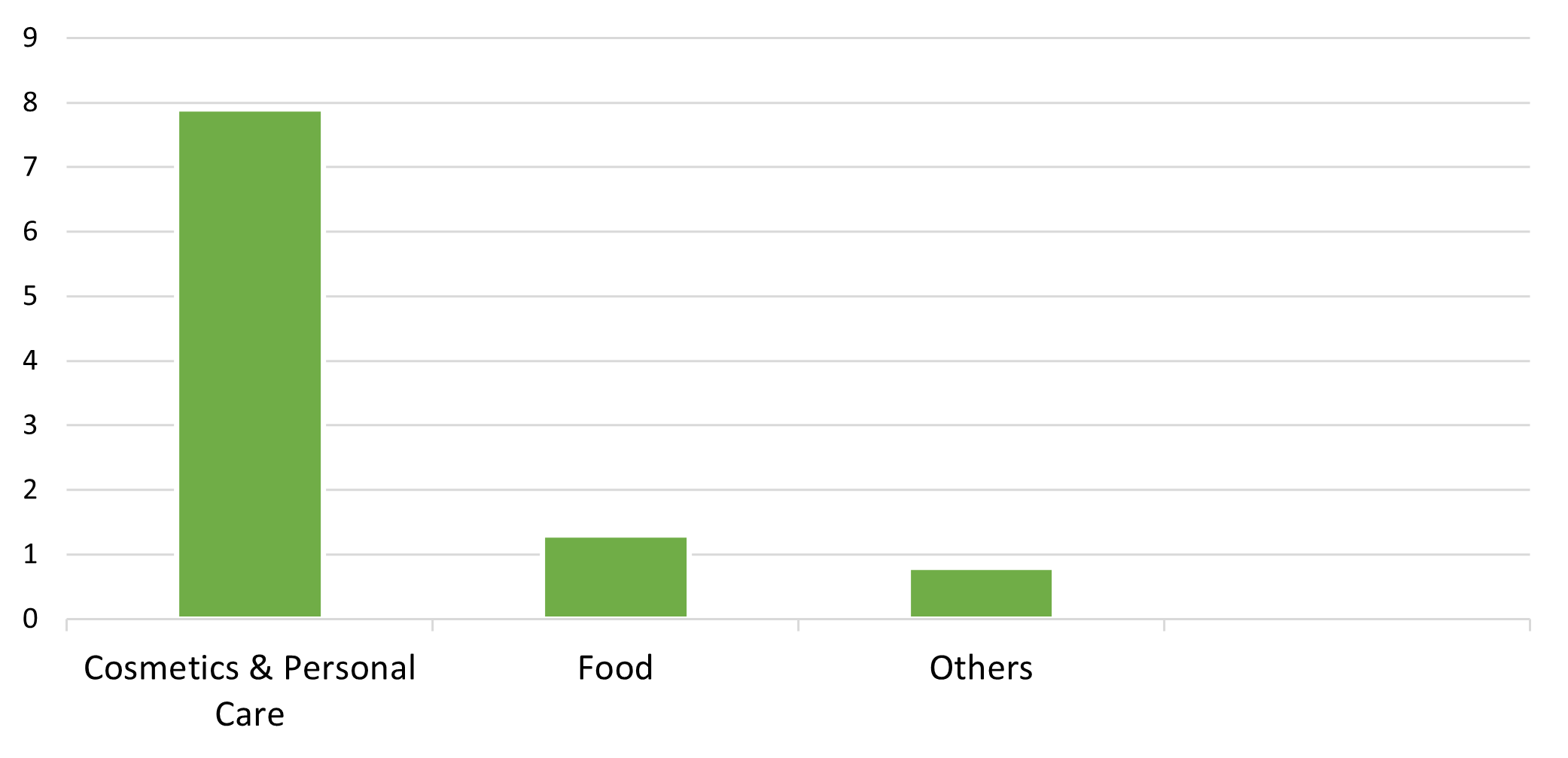

- In 2024, Cosmetics and personal care products accounted for 79.47%, dominating the market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2,405.7 Million

- 2035 Projected Market Size: USD 5,632.4 Million

- CAGR (2025-2035): 8.04%

- Europe: Largest market in 2024

The term "shea butter market" refers to the worldwide industry that produces, processes, ships, and sells shea butter, a naturally occurring fat that comes from the nuts of the shea tree. Shea butter is rich in vitamins, minerals, antioxidants, and fatty acids (such as oleic, stearic, palmitic, and linoleic acids), among other essential elements that support the skin's natural oil balance and soothe dry skin. Because of its hydrating, moisturizing, and anti-inflammatory qualities, shea butter is becoming more and more popular in the food, cosmetics, and personal care sectors, which has led to a sizable and expanding shea butter industry. As fast-paced lifestyles, particularly in developing regions like Asia Pacific, tend to push consumers to consume more packaged or ready-to-eat food products, this will drive industry growth. In addition, the growing use of shea butter in newborn formula and baby food production is improving the market's outlook.

Additionally, Market growth stems from international collaboration and regulatory systems focused on the quality, safety, and sustainability of products. Collaborative partnerships between the African and U.S. groups are advancing economic development and outlining sustainable production practices of shea butter. Additionally, as interest grows in India’s personal care and cosmetics industry, more emphasis is being put on shea butter. Shea butter is appealing to Indian producers due to its nourishing and moisturizing characteristics that are predominant in skincare and haircare products. Growth in the market is also a result of the rising rate of various diseases and the increasing tendency of the public to explore natural remedies for ailments and pains. In addition, the demand for shea butter in a variety of resorts, salons, and wellness facilities that offer massage and spa services is driven by the growing consumer awareness of the therapeutic outcomes of massage and spa modalities in relieving stress and discomfort. Additionally, shea butter gives commercially available delicacies like cakes, cookies, chocolates, candies, spreads, sauces, and dips a nutty flavor and a creamy, smooth texture.

Product Insights

In 2024, the sales of Raw/unrefined shea butter comprised 61.74% of the global shea butter market. There is a demand for unrefined shea butter in skincare product formulations because consumers are increasingly seeking natural and organic ingredients. Raw and unrefined shea butter can help limit dermal irritation and is a good alternative for many chemical-laden cosmetic products. Because of this characteristic, raw and unrefined shea butter can help treat sunburn, psoriasis, dry, itchy skin, chapped or dry lips, acne-susceptible skin, stretch marks, frostbite, and rash. For example, through stimulating tissues, unrefined shea butter protects the skin's youthfulness and prompts the skin to produce more collagen. It is healing, moisturizing, and soothing; as a result, it can be beneficial for dry and damaged skin and hair. The self-care movement and increased consumer awareness about ingredient purity have contributed to the allure of products containing unrefined shea butter.

Refined shea butter sales are projected to grow at 6.8% CAGR from 2025-2035. The refined shea butter has a minimum shelf life of 18 months and can be certified organic and kosher, making it an acceptable culinary substrate with a reasonably acceptable shelf life. The rise in demand for refined shea butter, especially in food goods, may indicate that customers desire premium, verified ingredients that satisfy legal requirements and their health preferences, as is evident in Europe, where consumers desire natural and ethically sourced ingredients. Organic shea butter is available from manufacturers like All Organic Treasures GmbH, a German supplier. Its refined form is a white solid fat, inedible form that is nearly tasteless and odourless, with high amounts of oleic acid and stearic acid.

Application Insights

Shea butter played a dominant role in the global market for cosmetics and personal care products, accounting for 79.47% of total sales in 2024. Shea butter's market dominance is a result of the increasing customer desirability of organic and plant-derived beauty products. Beyond its emollient property, shea butter is used in lotions, lip balms, shampoos, and face creams for its anti-inflammatory and regenerative properties. The shea butter cosmetics market is further propelled by the increasing consumer concern for chemical-laden substitutes and growing awareness of skin health and care. Fair trade and ethically-sourced shea butter from West Africa are responding to the demand by customers for ethical and sustainably-sourced items. The movement towards sustainable ingredients and clean beauty has helped to maintain Shea butter's strong position in the global cosmetics industry.

Shea butter sales in the food industry are projected to grow at a CAGR of 8.2% from 2025 to 2035. Shea butter is gaining traction in the food industry due to its enhanced nutritional properties and usability. Shea butter can serve as a natural antioxidant, food additive, temperate edible oil with no trans fats, and functional food ingredient, to name a few. It contains vitamins A, E, and F, among other nutrients, which can help with the growth and circulation of healthy skin cells. The texture of shea butter works well in ingredients like chocolates, baked goods, baked goods and frying oils to improve texture, shelf life, and create healthy fats. Shea butter, with its plant origin, is of particular interest in the vegan food industry. This interest fits well into the rise in demand for plant-based and ethical food options. As shea butter can be used as a substitute for dairy butter in many food items (either alone or when blended with other nut fats such as almond or palm stearin), it is expected that demand will continue to grow in the food industry over the forecast period.

Regional Insights

In 2024, the North American shea butter market accounted for 27.53% of the global market's total revenue. Several inherent benefits of producing cosmetics using cocoa butter alternatives might facilitate the growth of an industry. Because the base is odourless and smooth, it can be used in various products such as medicines, cosmetics, and occasionally, food and beverages. Shea butter-based products are being introduced into the product portfolio of many American brands that claim to be natural, including The Body Shop and L'Occitane. Because of its healing and moisturizing qualities, shea butter is an essential part of natural and organic personal care products, which are highly sought after in the area.

U.S. Shea Butter Market Trends

From 2025 to 2035, the U.S. shea butter market is expected to grow at a CAGR of 7.6%. It is being directed by a combination of regulatory oversight and the increased interest in natural ingredients for food, skin care, and cosmetics in the U.S. Shea butter is widely recognized, due to its versatility, as a treatment for a variety of skin conditions, including eczema, sunburn, and wrinkles. Hence, the increased demand for make-up products for the face, such as BB, CC, etc., in the U.S. will also support the expansion of the market for shea butter, given that the creams contain anti-sun and pore/wrinkle reduction, antioxidant protection, and hydration.

Europe Shea Butter Market Trends

In 2024, the European shea butter market accounted for more than 29.7% of the global market share. Shea butter market share growth is concentrated in Europe, considering well-established confectionery industries in the region, where shea butter is often used interchangeably with cocoa butter in the production of confectionery, including chocolates. Demand for eco-friendly and ethically produced products has increased particularly effervescently in the food and cosmetics industry, which fuels the clear growth of the shea butter market in Europe. Furthermore, the region's vitality is expected to continue because the Sub-Saharan nations where shea butter, and the shea nuts used to make it, are produced, have an abundance of raw materials available, in proximity that allows for a sustainable and dependable supply chain.

Asia Pacific Shea Butter Market Trends

The Asia Pacific shea butter market is projected to grow at a CAGR of 7.4% from 2025 to 2035. The region's large population, particularly China and India, is going to be driving this increase. The large population will give producers access to a very large group of consumers, which will help them comprehend the size and preferences of the market and thus how to introduce new products. Also, the growth of the shea butter market in the Asia Pacific region is being bolstered by programs offered by various organizations, particularly the Global Shea Alliance (GSA). The GSA, which is a sizable non-profit with over 600 members across the globe, began actions to encourage and increase the profile of shea butter in the Asia Pacific cosmetic & health space as of December 2022.

Key Shea Butter Companies:

The following are the leading companies in the Shea Butter Market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Croda International Plc

- Cargill, Inc.

- Olvea Group

- Suru Chemicals

- Sophim S.A.

- Clariant AG

- Ghana Nuts Company Ltd.

- Agrobotanicals, LLC

- AAK AB

- Others

Recent Developments

- In February 2022, in Tamale, the Ghana Shea Landscape Emission Reductions Project (GLSERP), worth $54.5 million, began. The GLSERP aims to enhance the shea value chain, particularly for the thousands of women involved in the whole value chain, and lessen the impact of climate change on the delicate ecosystem of the Northern Savannah Landscape.

- In July 2021, the Fuji Oil Group's Responsible Shea Kernels Sourcing Policy outlines a commitment to sustainability through three key commitments. For example, to protect parkland, they plant 6,000 shea and native tree seedlings each year. They also increase the production capabilities of cooperatives and support the empowerment of women in the shea kernel space. Furthermore, they help them produce high-value products and offer training in terms of safety, quality, and skills in job creation in the area. All of these are ultimately contributing to the economic growth, community development, and environmental stewardship in the area.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the shea butter market based on the below-mentioned segments:

Global Shea Butter Market, By Product

Global Shea Butter Market, By Application

- Cosmetics & Personal Care

- Food

- Others

Global Shea Butter Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa