Enterprise Networking Market Summary

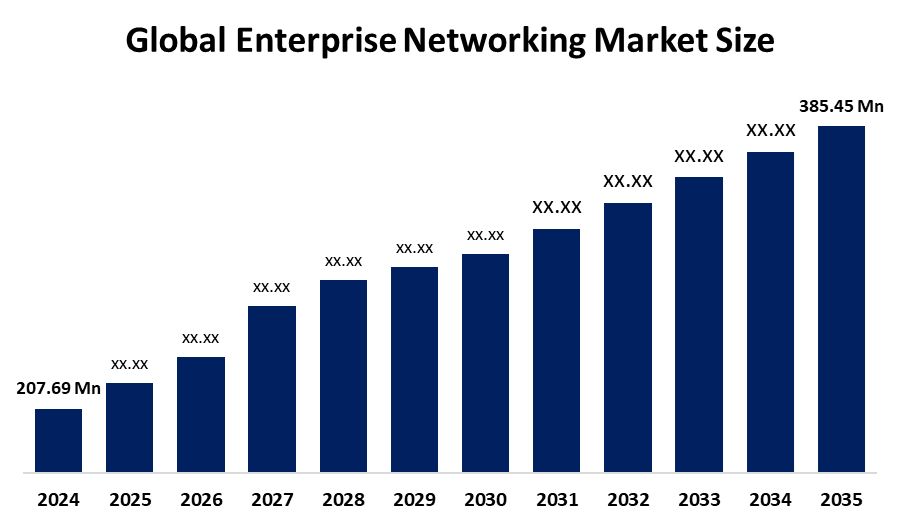

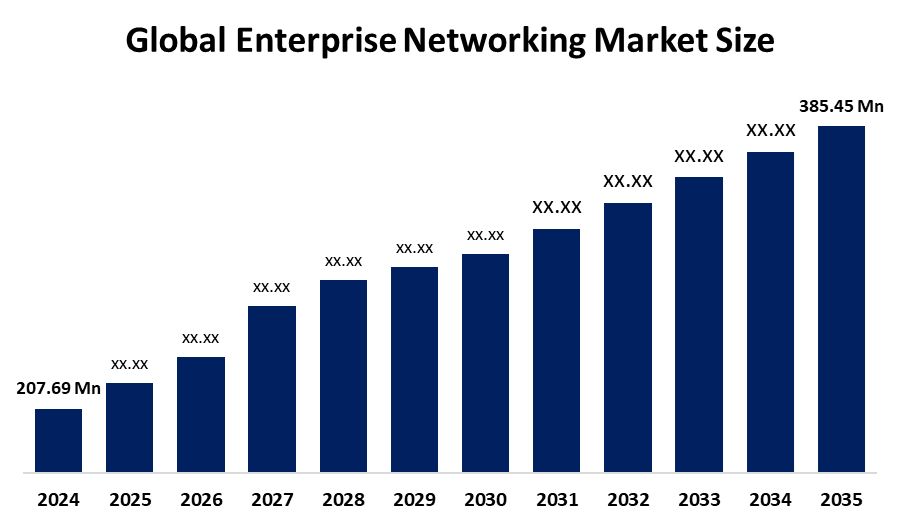

The Global Enterprise Networking Market Size was Estimated at USD 207.69 Billion in 2024 and is Projected to reach USD 385.45 Billion by 2035, Growing at a CAGR of 5.78% from 2025 to 2035. The requirement for reliable, secure, and scalable network solutions to enable digital transformation and remote work practices is the main driver of the enterprise networking market's growth. Significant factors contributing to this market expansion include the proliferation of IoT devices, the use of cloud computing, and increased data traffic.

Key Regional and Segment-Wise Insights

- In 2024, The Asia Pacific Enterprise Networking Market held a 39.6% Market share, Dominating the Global Sector.

- The adoption of cloud computing and the move toward remote and hybrid work styles are driving the enterprise networking industry in the United States.

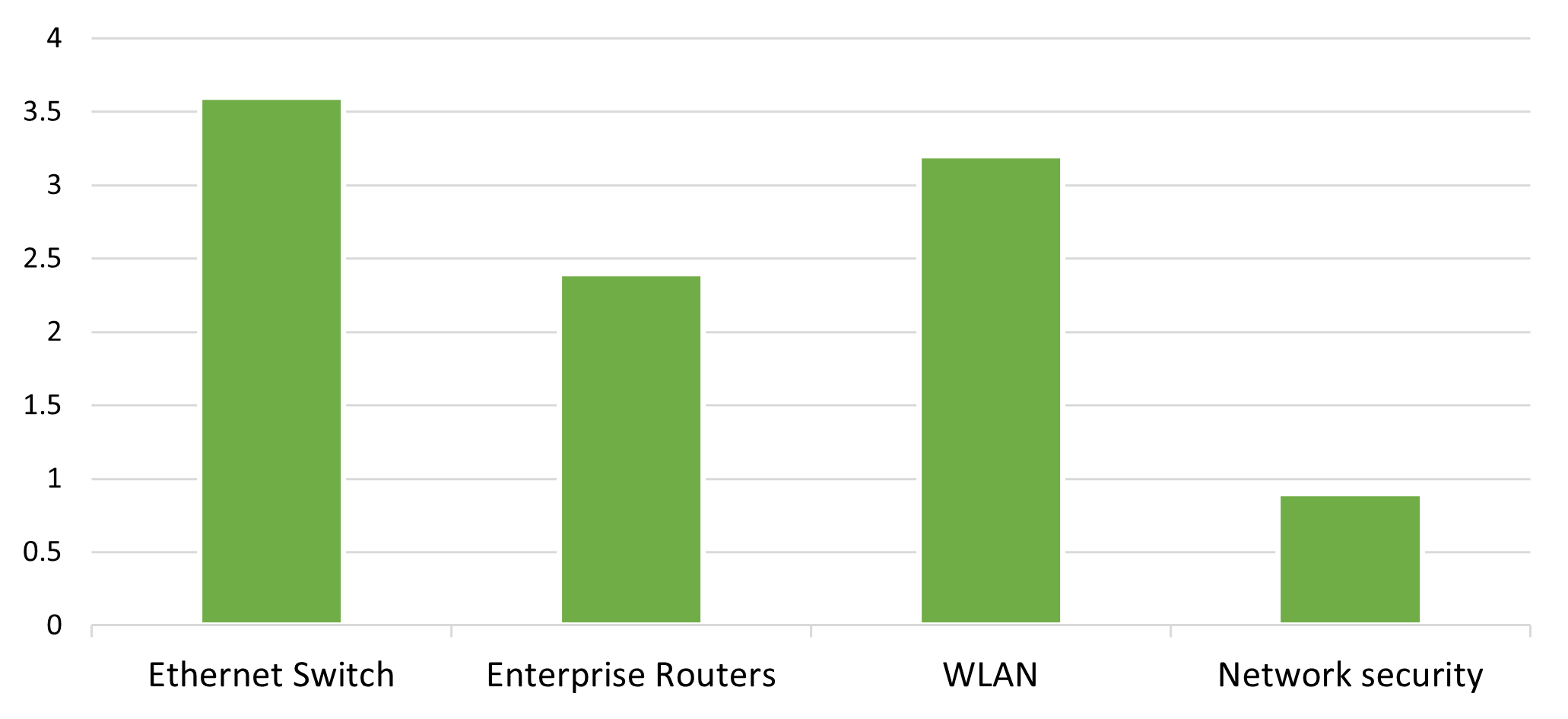

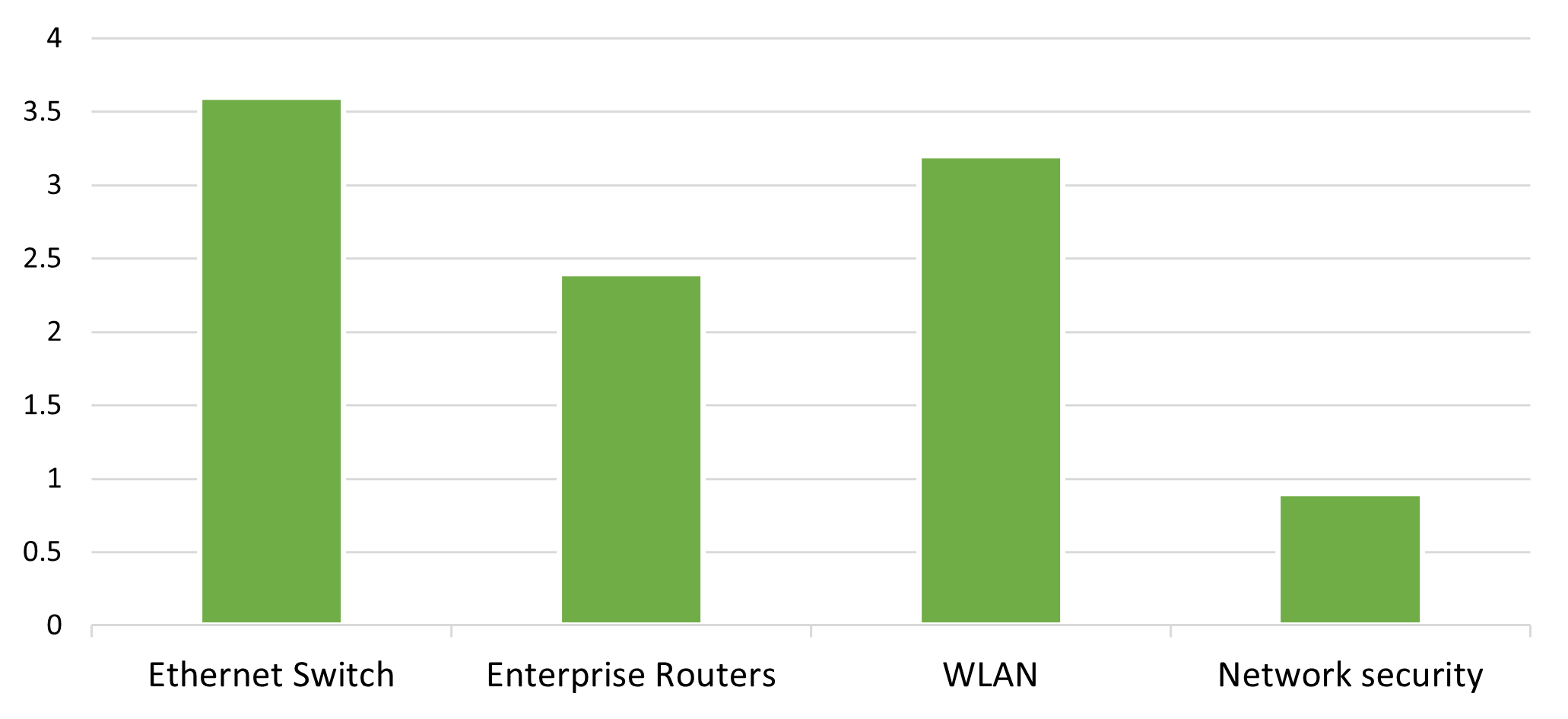

- In 2024, the Ethernet switch segment held the largest proportion, accounting for 36.6% based on equipment.

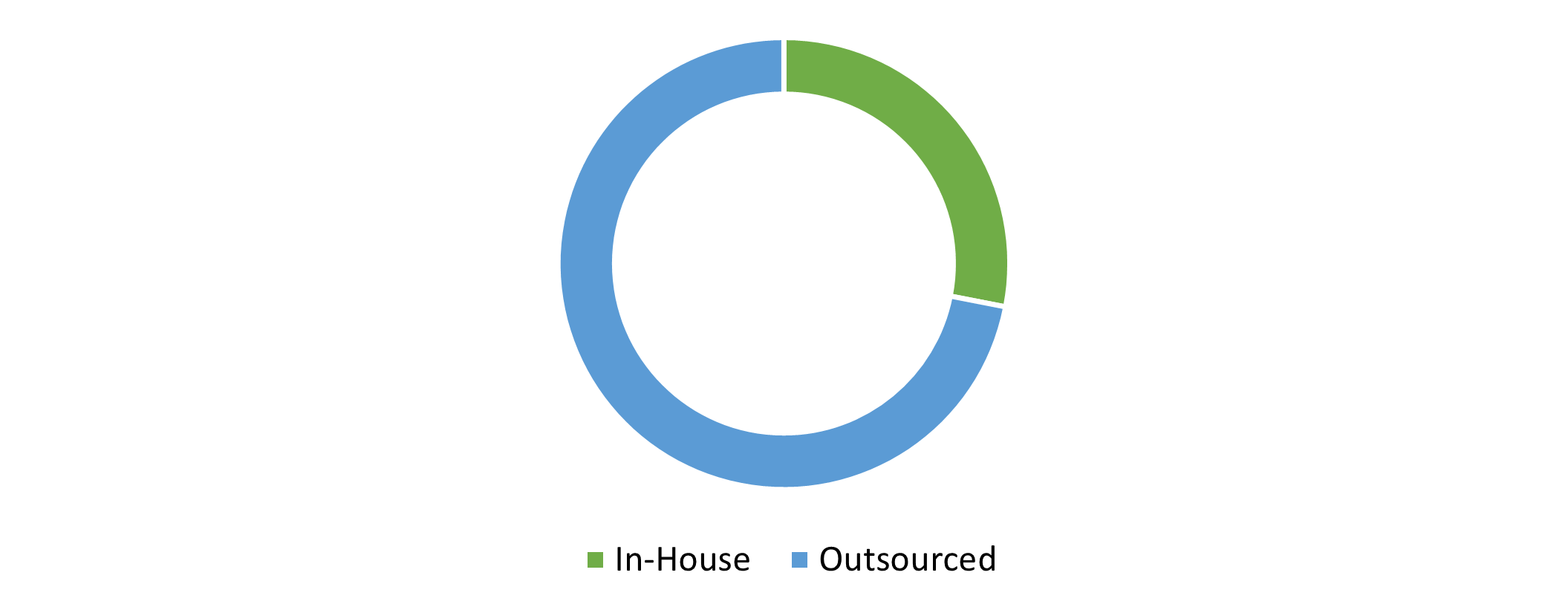

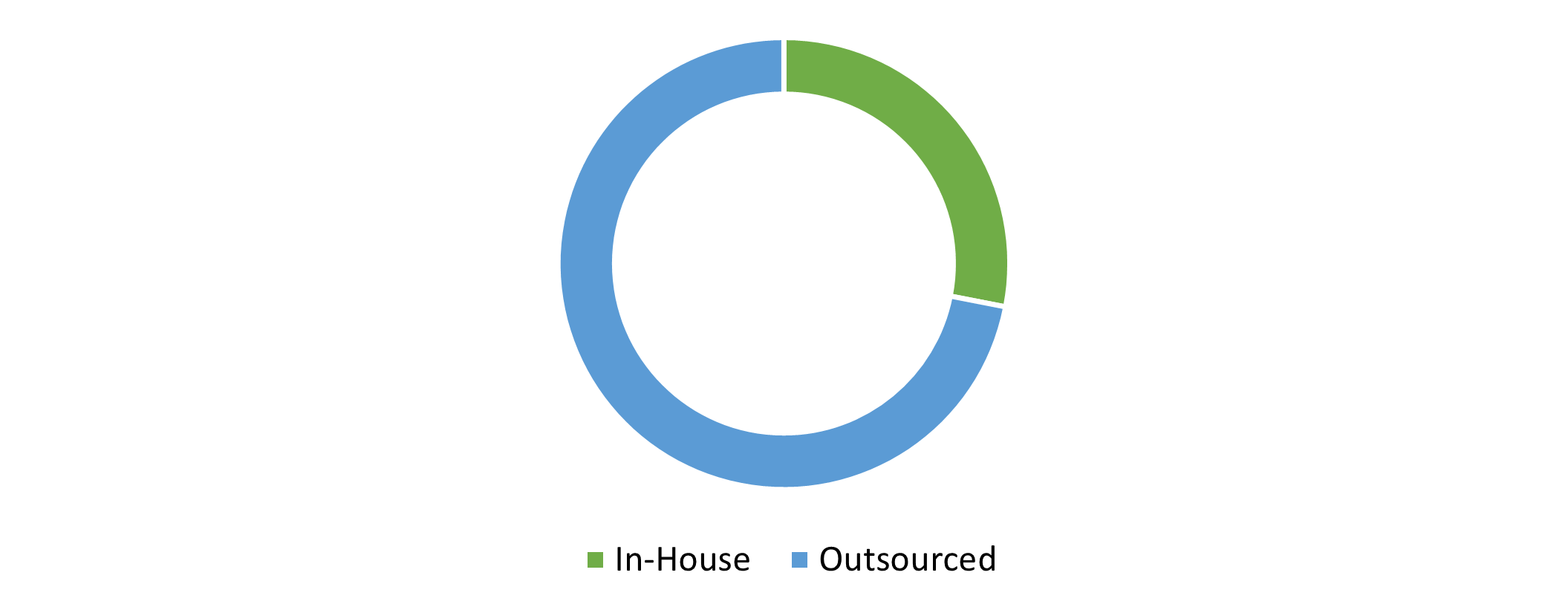

- In 2024, the outsourced category held the biggest market share by type of infrastructure.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: 207.69 Billion

- 2035 Projected Market Size: 385.45 Billion

- CAGR (2025-2035): 5.78%

- Asia Pacific: Largest market in 2024

The phrase "enterprise networking" pertains to the marketplace offering products and services that are necessary for connectivity and communication systems inside and between organizations, like data centers, cloud services, devices, and remote offices. It includes technologies, software, and services that enable safe, competent transfer of information and assets inside a company and with outside parties with whom the company does business, organizations, partners, and clients. With the continued evolution of cloud services and the digitalization of many industries, the enterprise networking market is growing moderately. Growth in enterprise networking is being driven by the increasing demand for seamless communication solutions and the need for high-speed data access. Increased sophistication of networking requirements has been driven by the increased proliferation of Internet of Things (IoT) devices as well as the need for authenticated information management and security.

New technologies such as 5G, cloud computing, the Internet of Things (IoT), edge computing, machine learning (ML), and artificial intelligence (AI) are transforming networking in the future and have numerous ramifications for business and society in general. When organizations utilize new technologies and applications, they need to invest in new tools, infrastructure, and expertise to manage and secure their networks. Major players often use strategic partnerships and mergers and acquisitions (M&A) as strategies to increase their market share and enhance their product lines. They are also financing research and development (R&D) projects in order to stay on the cutting edge of advances in technology. growing demand for immediate data access and seamless connectivity. Businesses increasingly rely on successful communication and data sharing in today's digital environment to retain their competitive edge.

Equipment Insights

The Ethernet switch segment has demonstrated the largest revenue share at 36.6% in 2024. Ethernet switches allow connectivity and communication between devices by forwarding Ethernet frames between the devices connected to the switches. The higher demand for high-speed Ethernet switches will likely present new sources of growth for players in the industry. The government's efforts to speed up digital transformation have also increased wireless LAN networks, switches, and routers demand and is expected to push future demand in the market.

During the forecast period, the WLAN segment is expected to experience strong growth. The prolonged existence of over-IP audio and video applications on mobile devices heightened the sensitization effect of users and devices themselves in the enterprise space. WAN solutions make enterprise networking possible by connecting sites and allowing data to be shared between them. WAN solutions allow businesses to create secure and efficient communication networks that place a focus on fast data and information transmission. WAN solutions include WAN implementation technologies such as Ethernet, routers, switches, and protocols such as TCP/IP. Undertaking the successful building and administration of business networks depends on WAN solutions.

Infrastructure Type Insights

In 2024, outsourcing had the largest market share in the category. The increased interest in corporate networking outsourcing is fueled by the need for businesses to reduce costs, improve efficiencies, share information, leverage core capabilities, and ensure business continuity while adhering to emerging technology and market trends. In addition, outsourcing provides businesses with the option to allow external vendors to manage and maintain their networks, enabling internal resources and on-staff time to be devoted to core competencies, while assessing corporate innovations and growth opportunities.

Over the forecast period, the in-house category is projected to experience significant growth. The operational costs of outsourcing can be lowered by creating networking products in-house. Using in-house production allows for complete control over the final product. In-house production allows production disruptions to be more effectively managed by modifying personnel and supplies to meet shifting requirements. By managing the process in its totality, businesses can have greater control over product quality, which will help them maintain high quality. This makes in-house production facilities increasingly more relevant, as an eye towards quality control increases.

Regional Insights

In 2024, the market for enterprise networking in North America accounted for 26.7% market share. North America has been known to embrace technologies and technical innovations early. In particular, the region's innovation-based culture and presence of technology leaders encourage an appetite for new enterprise networking technologies. Concurrently, enterprise networking market projections are being driven by a combination of the region's accelerating deployment of fifth-generation (5G) broadband connectivity and ongoing digital transformation. Our deep knowledge of enterprise networking is grounded in the strong demand for fast and reliable connectivity driven by remote work, Emerging IoT applications, hybrid cloud installations, and multi-cloud deployments. The market in North America is expanding at an exceptional rate as the region dramatically and widely deploys advanced technologies like Software-Defined Networking (SDN) and Software-Defined Wide Area Networking (SD-WAN), which enable improvements in network security and agility.

U.S. Enterprise Networking Market Trends

The expansive growth of the U.S. enterprise networking industry is fueled by rapid growth in cloud technologies and the increase in remote/hybrid work. Enterprises are increasingly prioritizing high-performance, secure ICT network infrastructure to support remote workers and cloud-based applications. Network performance is bolstered by new investments in SD-WAN, 5G, and network automation, which improve scalability, agility, and operational efficiency. Existing networks are constantly upgrading to accommodate higher data consumption and dependency on real-time information from analytics. Increased demand for data, an increase in IoT deployments, and improved cybersecurity are all improving network infrastructure. Furthermore, future growth is largely driven by initiatives surrounding digital transformation.

Asia Pacific Enterprise Networking Market Trends

In 2024, the Asia Pacific enterprise networking market dominated the global market with a 39.6% market share. This region is the richest market for enterprise networking solutions, driven by its large population, rapidly growing economy, and established IT market. Countries like China and India have driven all sorts of advanced new networking technologies as part of their digital transformation projects. One of the reasons behind the growth of this region is the huge transformation happening in so many of the countries in the region, as well as their willingness to adopt cloud services. The gradual growth in production activity in this region is further evidence of the demand to have higher precision equipment. There is a current need for an appropriate networking infrastructure for the area as a result of the continued growth of cloud services, e-commerce, and the increasing use of smartphones and other IoT products.

Europe Enterprise Networking Market Trends

The enterprise networking sector in Europe continues its steady growth as organizations utilize next-generation wireless technologies, like Wi-Fi 6 and Wi-Fi 7, which can enable low-latency, high-speed applications underpinned by corporate needs. The prime movers in enterprise networking across Europe, including government-supported digitization programs and strict cybersecurity regulations, encourage organizations to invest in stronger and safer networking infrastructure. Organizations are tightening their networks and reducing costs, as their reliance on network automation and managed IT services increases, and use increased internet penetration to utilize more cloud services and work remotely. Sustainability is rising in importance, and organizations are prioritizing energy-efficient networking options as part of their ESG goals. Together, these various factors demonstrate a clear trend in Europe concerning enterprise networking, which is safer, smarter, and greener.

Key Enterprise Networking Companies:

The following are the leading companies in the Enterprise Networking Market. These companies collectively hold the largest market share and dictate industry trends.

- A10 Networks, Inc.

- Broadcom

- ALE International, ALE USA Inc.

- Hewlett Packard Enterprise Development LP

- Juniper Networks, Inc.

- Cisco Systems, Inc.

- Huawei Technologies Co., Ltd.

- Dell Inc.

- Riverbed Technology

- ZTE Corporation

- Others

Recent Developments

- In March 2025, Broadcom Inc. has announced VeloSky, a converged networking system that allows Communications Service Providers (CSPs) to deliver connected fiber, cellular, and satellite access from one appliance. VeloSky empowers service providers to maximize the uptake and use of their satellite and 5G solutions, opening new revenue streams and expanding existing business models. With VeloSky, the only solution based on the VeloRAIN (Robust AI Networking) architecture, enterprises' networks gain unparalleled visibility, prioritization, and automation, allowing organizations to work more efficiently and improve the experiences of the users they serve.

- In November 2024, Cisco has new wireless technology that is technologically smart, secure, and guaranteed with intelligent wi-fi 7 access points and unified subscription licensing. These innovations can support intelligent environments in new and flexible ways. In addition to providing a flexible platform for future-proofing their workplaces, these innovations allow clients to solve their connection, security, and assurance problems.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the enterprise networking market based on the below-mentioned segments:

Global Enterprise Networking Market, By Equipment

- Ethernet Switch

- Enterprise Routers

- WLAN

- Network security

Global Enterprise Networking Market, By Infrastructure Type

Global Enterprise Networking Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa