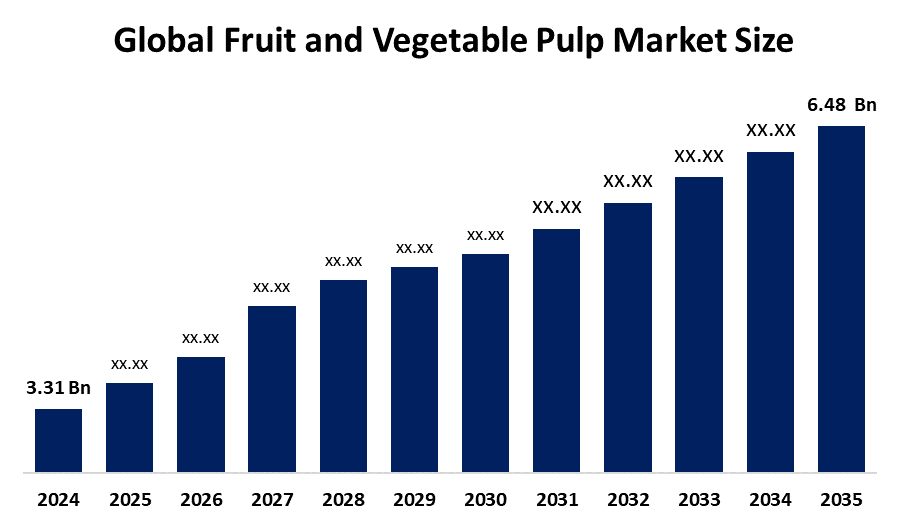

Global Fruit & Vegetable Pulp Market Insights Forecasts to 2035

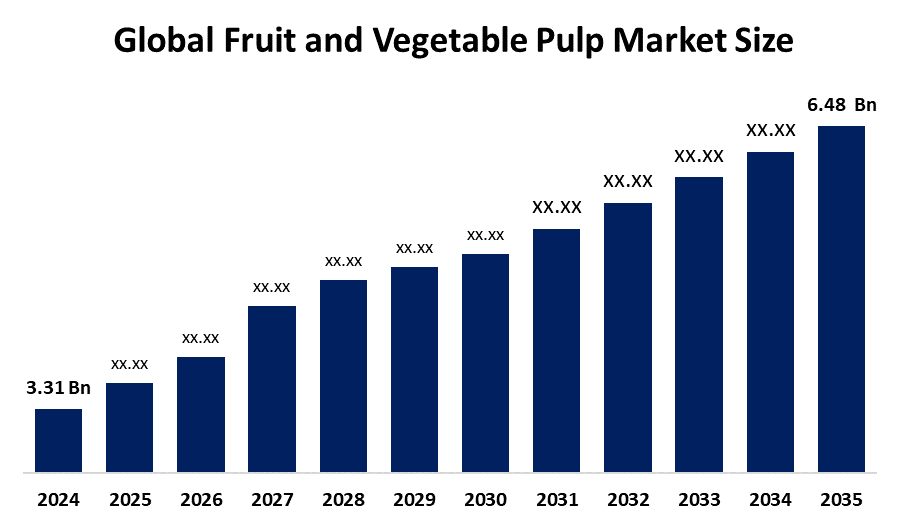

- The Global Fruit and Vegetable Pulp Market Size Was Estimated at USD 3.31 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.3% from 2025 to 2035

- The Worldwide Fruit and Vegetable Pulp Market Size is Expected to Reach USD 6.48 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Fruit & Vegetable Pulp Market

The fruit and vegetable pulp market involve the production and supply of pulps obtained from fresh fruits and vegetables. Pulp is the soft, moist, and fibrous part of the produce, typically used in food and beverage applications such as juices, purees, baby food, sauces, and bakery fillings. It retains the flavor, color, and nutritional properties of the original fruit or vegetable, making it a popular ingredient in natural and processed food products. The market includes a wide range of pulp types such as mango, tomato, banana, guava, apple, and carrot, among others. These pulps are processed and preserved through methods like pasteurization and aseptic packaging to ensure long shelf life and quality. The industry serves multiple sectors including food processing, hospitality, and health food manufacturing. Available in frozen, canned, or aseptic forms, fruit and vegetable pulps offer convenience and consistency for manufacturers while supporting year-round production of seasonal products.

Attractive Opportunities in the Fruit & Vegetable Pulp Market

- There is significant potential in creating pulp-based functional foods and beverages enriched with probiotics, dietary fibers, or plant proteins. Expanding into non-traditional applications like cosmetics, personal care, and nutraceuticals can also unlock new revenue streams by leveraging the natural properties of fruit and vegetable pulps.

- Growing urbanization and changing dietary habits in emerging markets present untapped potential for pulp-based convenience products. Additionally, advancements in eco-friendly and sustainable packaging can provide a competitive edge and attract environmentally conscious consumers, aligning with global sustainability trends.

Global Fruit & Vegetable Pulp Market Dynamics

DRIVER: Increasing consumer preference for natural and healthy food products

Increasing consumer preference for natural and healthy food products has significantly boosted demand for pulps used in juices, smoothies, baby food, and health supplements. The rising awareness of the nutritional benefits of fruits and vegetables, such as vitamins, minerals, and antioxidants, has further encouraged their inclusion in daily diets. Additionally, the expansion of the food and beverage industry and growing demand for convenience foods are promoting the use of ready-to-use pulps in processed products. Technological advancements in food processing and preservation have improved the shelf life and quality of pulps, supporting year-round availability. Moreover, the trend towards clean-label products and minimal food processing aligns with the use of natural fruit and vegetable pulps. The increasing adoption of plant-based diets and functional foods is also contributing to market growth, as manufacturers seek healthy, versatile ingredients.

RESTRAINT: High cost of production and processing

One of the primary challenges is the high cost of production and processing, especially for pulps that require cold storage, aseptic packaging, or specialized equipment. Seasonal availability and perishability of raw fruits and vegetables can disrupt supply chains and affect consistent production. Additionally, fluctuations in agricultural output due to climate change, pests, and diseases can impact the availability and pricing of raw materials. Strict food safety regulations and quality standards may also pose hurdles for producers, particularly small and medium enterprises. Limited infrastructure in certain regions for cold chain logistics and storage facilities can further restrict market expansion. Moreover, synthetic flavorings and concentrates, which are often cheaper and more shelf-stable, may compete with natural pulps in processed food applications. Consumer concerns about preservatives and additives in packaged pulp products can also affect purchasing decisions.

OPPORTUNITY: Development of innovative product formulations

One key opportunity lies in the development of innovative product formulations, such as pulp-based functional foods and beverages enriched with probiotics, fibers, or plant proteins. There's also potential for expanding into non-traditional applications like cosmetics, personal care, and nutraceuticals, where fruit and vegetable pulps are valued for their natural properties. Growing consumer interest in exotic and tropical fruits opens avenues for diversified pulp offerings catering to global tastes. Additionally, advancements in sustainable and eco-friendly packaging can create a competitive edge and appeal to environmentally conscious consumers. Emerging markets with increasing urbanization and changing dietary habits offer untapped potential for pulp-based convenience products. Strategic collaborations with foodservice chains, health food brands, and e-commerce platforms can further enhance market reach. Lastly, the development of organic and minimally processed pulp variants could attract health-focused consumers seeking cleaner, more natural product options.

CHALLENGES: Maintaining consistent quality and taste across batches

One major challenge is maintaining consistent quality and taste across batches due to natural variations in raw materials. This can affect product uniformity, especially for large-scale manufacturers. Another challenge is managing efficient logistics and supply chain coordination, particularly for exports, where pulps must be transported under strict temperature controls to prevent spoilage. Entering highly competitive markets dominated by established brands also presents difficulties for new players in gaining consumer trust and shelf space. Additionally, ensuring traceability and transparency in sourcing, especially for organic or specialty pulps, is complex and resource-intensive. Meeting evolving consumer preferences and dietary trends quickly enough to remain relevant adds further pressure. Lastly, the need for continuous innovation in flavors, packaging, and product applications to differentiate in a crowded market remains an ongoing challenge for industry players.

Global Fruit & Vegetable Pulp Market Ecosystem Analysis

The global fruit and vegetable pulp market ecosystem includes farmers, processors, suppliers, and distributors. Farmers supply raw produce to processing companies, which convert it into pulp using methods like pasteurization and aseptic packaging. Equipment manufacturers and raw material suppliers support production, while regulatory bodies ensure quality and safety. Distributors and logistics providers transport pulps to end users, including food and beverage, baby food, and cosmetics industries. Retailers and e-commerce platforms deliver finished products to consumers, completing the supply chain.

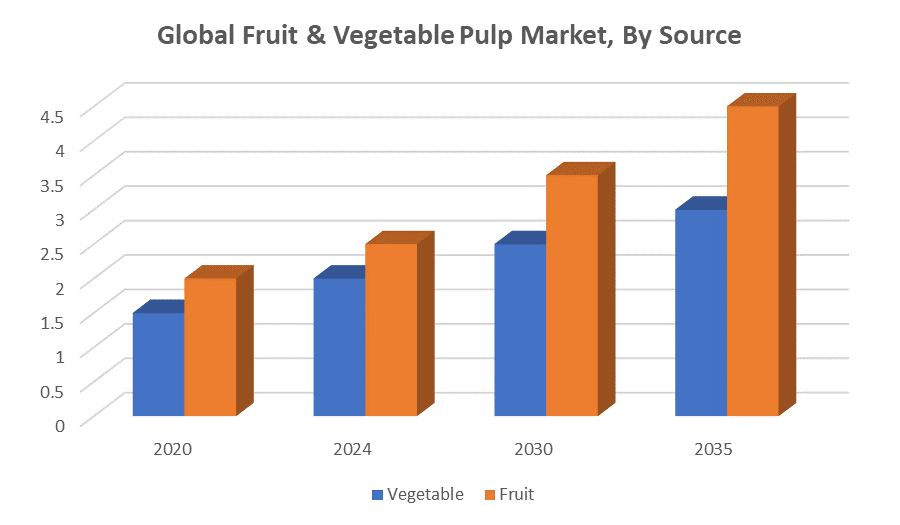

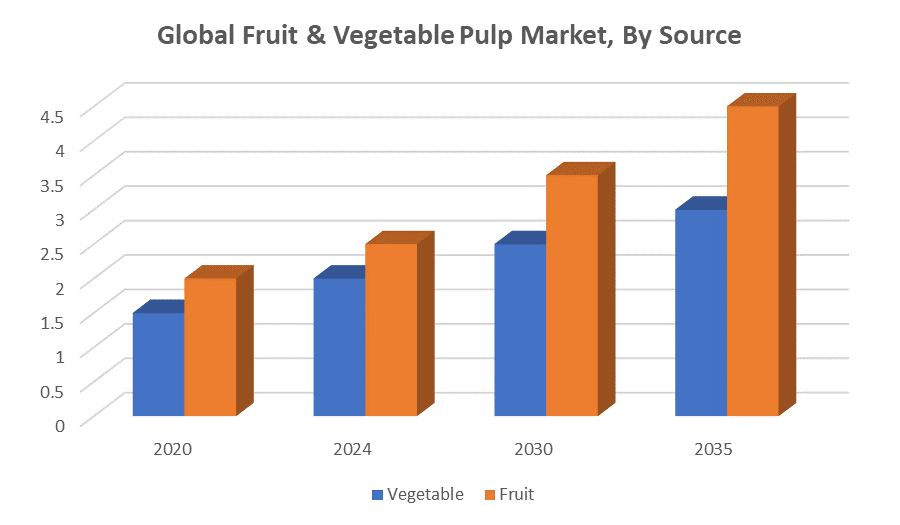

Based on the source, the fruit pulp segment is likely to register the fastest CAGR during the forecast period.

The fruit pulp segment growth is driven by the rising demand for natural and nutritious food ingredients, as consumers increasingly prefer fruit-based products such as juices, smoothies, yogurts, baby food, and desserts. The fruit pulp segment benefits from its wide application range, rich flavor profiles, and high nutrient content, making it a preferred choice across the food and beverage industry.

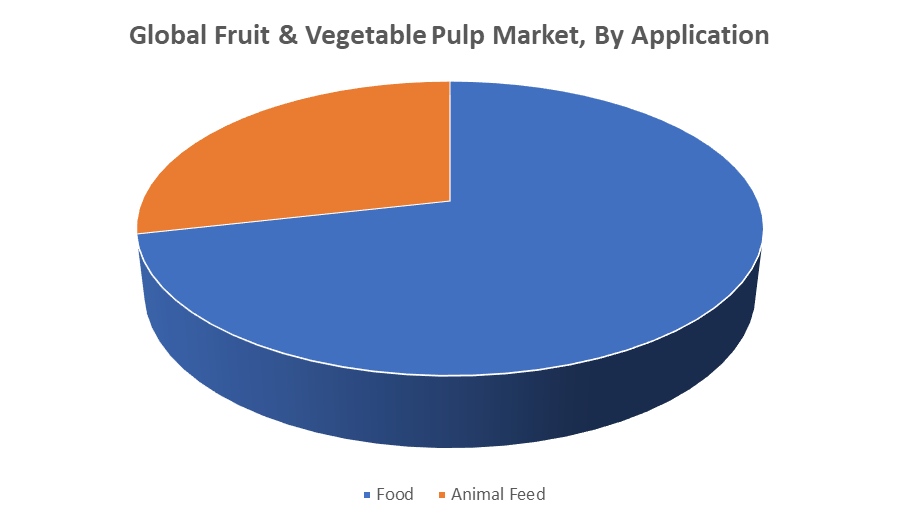

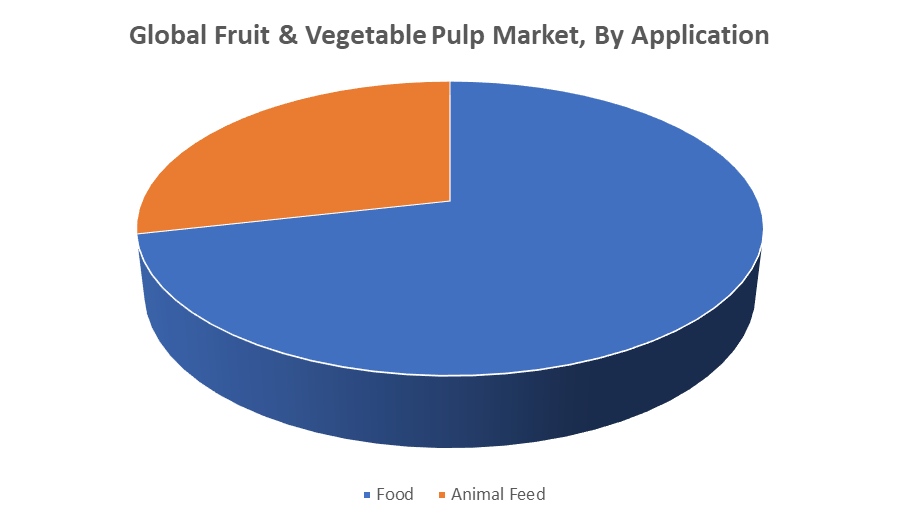

Based on the application, the food segment is anticipated to hold the largest share during the forecast period

The food segment dominance is attributed to the extensive use of fruit and vegetable pulp in a variety of food products, including bakery items, dairy products, sauces, jams, baby food, and ready-to-eat meals. The growing demand for natural ingredients and clean-label food products has further increased the incorporation of pulps in food formulations, driving the segment's expansion within the overall market.

Asia Pacific is anticipated to hold the largest market share of the fruit & vegetable pulp market during the forecast period

Asia Pacific is anticipated to hold the largest market share of the fruit and vegetable pulp market during the forecast period. This dominance is attributed to favorable climatic conditions that support extensive fruit cultivation, a steady supply chain, and rising consumer demand for natural and nutritious food products. Major countries like India and China contribute significantly due to their large-scale agricultural activities and expanding food processing industries. The region’s growing population and increasing focus on health and wellness also drive the consumption of fruit and vegetable pulps, making Asia Pacific the leading market globally.

Europe is expected to grow at the fastest CAGR in the fruit & vegetable pulp market during the forecast period

Europe is anticipated to experience the CAGR in the fruit and vegetable pulp market during the forecast period. This growth is driven by a combination of factors, including increasing consumer demand for natural and organic ingredients, advancements in food processing technologies, and a growing emphasis on health and wellness. The region's strong food processing industry and established supply chains further support this upward trend. As a result, Europe is poised to play a significant role in the global expansion of the fruit and vegetable pulp market.

Recent Development

- In October 2024, Sorma Group introduced PulpVision, an optical sorter for kiwis that detects color variations within the fruit pulp, and BIOSCAN, a device measuring the Brix value of fruit, enhancing sorting accuracy and quality control.

- In January 2024, Thai Natural fruit juice specialist Manee Manao launched "Manee Tangmo," a frozen watermelon puree with no added sugar or additives, catering to the growing demand for clean-label products.

Key Market Players

KEY PLAYERS IN THE FRUIT & VEGETABLE PULP MARKET INCLUDE

- Cargill, Inc.

- Dole Packaged Foods

- AGRANA Beteiligungs AG

- Ingredion Incorporated

- Tate & Lyle PLC

- Dohler Group

- J.R. Simplot Company

- Tetra Pak International S.A.

- PureCircle Ltd.

- Golden State Fruit Packers

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the fruit & vegetable pulp market based on the below-mentioned segments:

Global Fruit & Vegetable Pulp Market, By Source

Global Fruit & Vegetable Pulp Market, By Application

Global Fruit & Vegetable Pulp Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa