Dark Spirits Market Summary

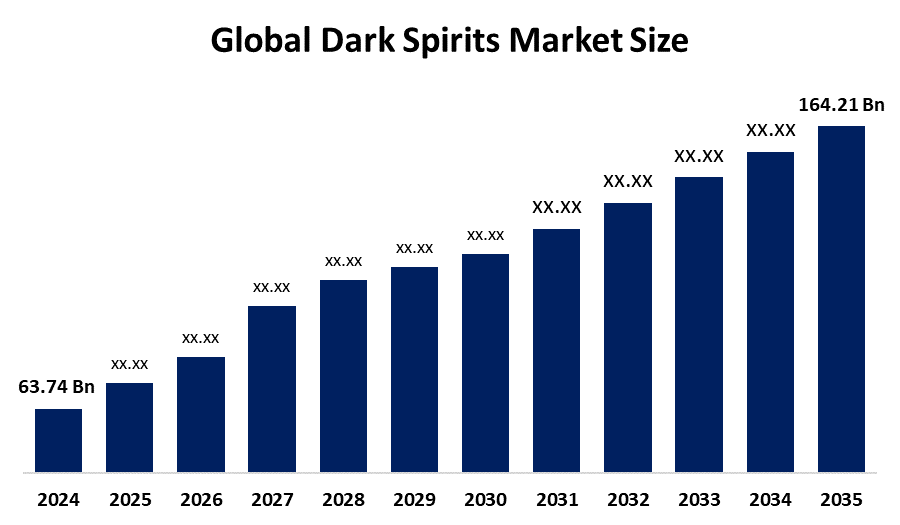

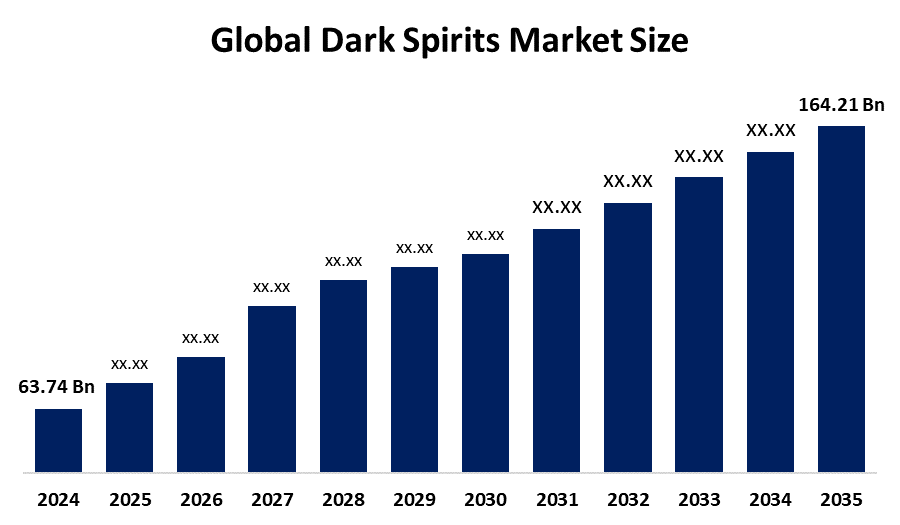

The Global Dark Spirits Market Size Was Estimated at USD 63.74 Billion in 2024 and is Projected to Reach USD 164.21 Billion by 2035, Growing at a CAGR of 8.98% from 2025 to 2035. Premiumization, the emergence of artisan distilleries, the growing appeal of cocktail culture, and the growth of e-commerce, especially in emerging regions, are the main factors driving the market for dark spirits.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 30.5% and dominated the market globally.

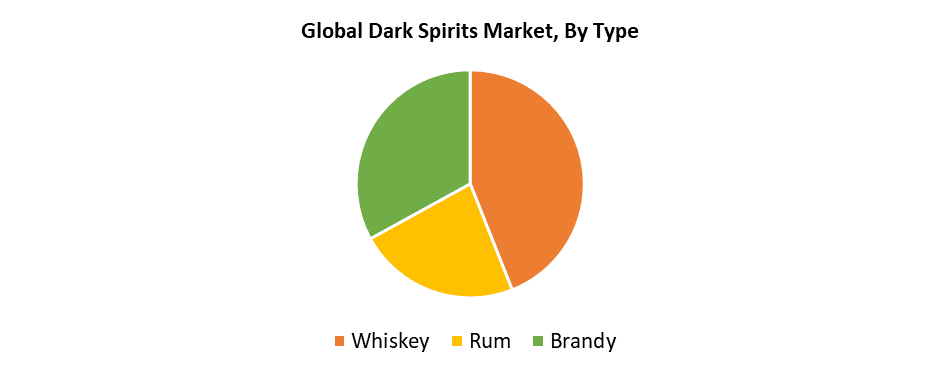

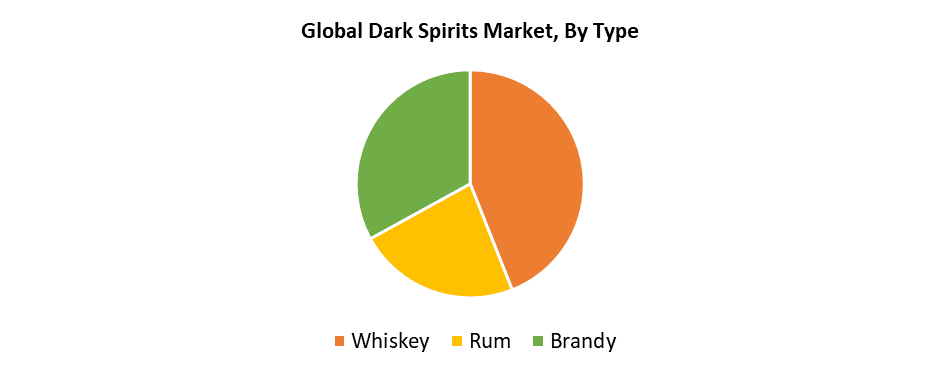

- In 2024, the whiskey segment had the highest market share by type, accounting for 44.7%.

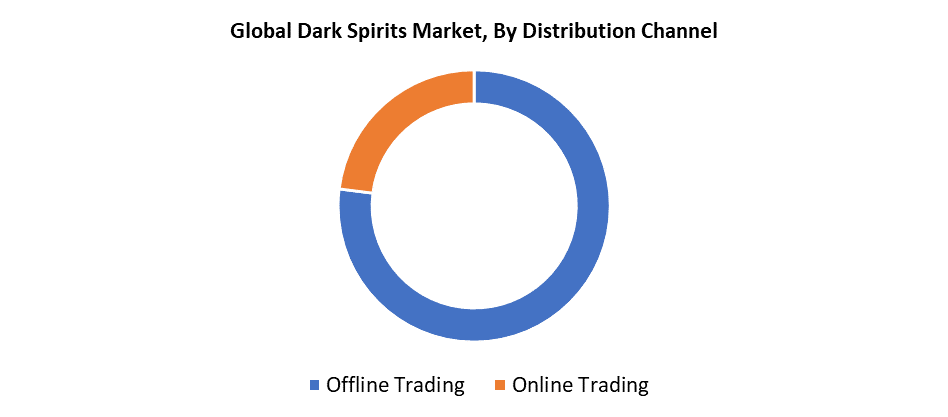

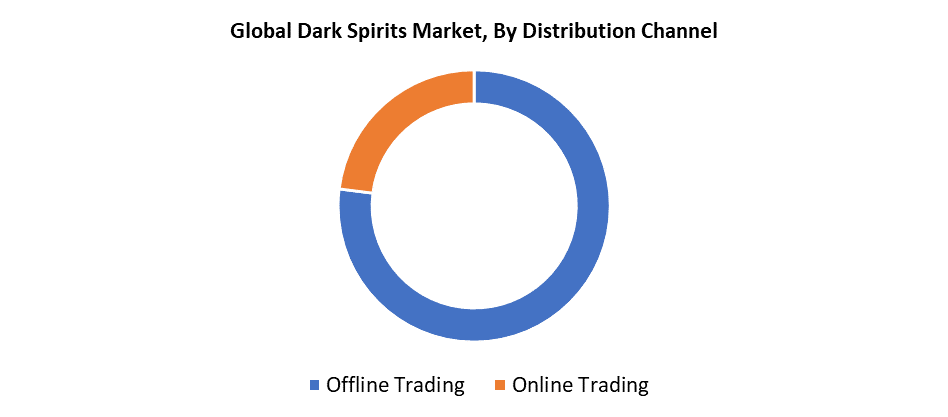

- In 2024, the offline trading channel segment had the biggest market share by distribution channel, accounting for 77.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 63.74 Billion

- 2035 Projected Market Size: USD 164.21 Billion

- CAGR (2025-2035): 8.98%

- Asia Pacific: Largest market in 2024

The Dark Spirits Market refers to the global marketplace that deals with the production, distribution, and consumption of barrel-aged alcoholic beverages, which develop distinctive colors and flavors. The expanding premium alcoholic beverage market strongly supports the growth of the dark spirits industry. Aged spirits, including whiskey, rum, and brandy, have gained increasing popularity because younger consumers and enthusiasts want sophisticated drinking experiences. The growing popularity of craft distilleries, along with small-batch production methods, has driven up demand for artisanal dark spirits, which feature unique flavors and authentic production methods. The expanding cocktail culture throughout bars and restaurants, and homes drives rising demand for dark spirits. The trend shows a strong presence in the US and UK markets because consumers there possess extra spending power and enthusiasm for trying new exotic and value-added spirits.

Emerging economies like India show a rising demand for premium dark spirits because of urban growth, an expanding middle class, and increasing disposable income. The market remains led by mass-produced spirits, yet consumers now prefer aged and handmade spirits because these provide distinctive drinking experiences. The growing number of bars and breweries, combined with e-commerce platforms, enables premium brands to reach broader customer bases while creating better market access and awareness. The industry experiences transformation through environmental awareness as sustainable production methods and packaging solutions become vital market differentiators. The rapid market growth faces obstacles because of steep taxes, together with consumer preferences for beverages with reduced alcohol content.

Type Insights

The whiskey segment generated 44.7% of the dark spirit market revenue share worldwide during 2024 and dominated the market globally. The primary factors behind whiskey growth include increasing whiskey consumption in Japan and expanding middle-class income in China and India. People are increasingly choosing whiskey because of its complex taste and low-fat content, and handcrafted production methods. The premiumization trend, along with workmanship value, drives demand for whiskey in North America and Europe, where this spirit functions as a refined lifestyle product. The whiskey appeal to millennials stems from its genuine heritage as depicted in contemporary entertainment media and musical culture. The cultural value of whiskey leads to increased sales, which solidifies its position as the market leader.

The brandy market is projected to grow at an 8.7% CAGR between 2025 and 2035 owing to growing demand from consumers for artisan and luxury spirits. In North America, Europe, and Asia Pacific, regions where consumers are now understanding the complexity of aged brandies, this expansion is especially evident. As consumers increasingly learn about flavor, quality, production techniques, and aging of spirits, they are seeking more branded, expertly developed products. Additionally, the premiumization trend and interest in complex and elevated consumption experiences also add support for the division's growth. Due to rising disposable incomes and growing consumer demand for authentic, unique products, brandy is perfectly positioned as a growth driver in the emerging dark spirits category.

Distribution Channel Insights

The offline trading channel held a dominant position in the worldwide dark spirits market because it held 77.5% of total sales in 2024 through its extensive network of suppliers that included liquor stores and restaurants, along with bars, pubs, supermarkets, and specialty shops. The market benefits from black spirits' social popularity because they are commonly served plain or with flavored juices and sparkling water to enhance customer pleasure. The distribution of spirits through domestic suppliers allows premium goods to reach wider markets because they offer a wide selection at affordable prices. The rising trend of social drinking, together with Western drinking customs adoption across different countries, will maintain offline sales as the principal market growth driver in the upcoming years.

The online segment of the dark spirits market will experience a 9.7% CAGR during the period from 2025 to 2035 because of modern trade technology advancements and customer convenience improvements. Distributors currently enhance their delivery services by using digital platforms to give their customers direct access to products at their doorsteps. Brands, together with merchants, leverage social media platforms and digital marketing strategies to build brand visibility while reaching out to larger audiences who are primarily young technology-oriented consumers. E-commerce channels experience a surge in super-premium spirit sales because government authorities actively promote online alcoholic beverage sales. The combination of these factors has driven rapid growth in internet trade, which now serves as a vital growth channel in today's dark spirits market landscape.

Regional Insights

The North American dark spirits industry will represent 21.3% of total global revenue during 2024 because of the increasing popularity of premium and craft spirits, particularly whiskey and bourbon. The area's dynamic cocktail culture, along with expanding small-batch and craft distillery appeal, appeals to Millennials and younger consumers who seek distinctive premium products. The United States stands as the leading producer of whiskey through innovative barrel aging techniques and a rapidly expanding boutique distillery network. The market growth receives additional support from increasing disposable income levels and sustainable trends such as packaging sustainability and sustainable sourcing practices. The expansion of direct-to-consumer sales channels and e-commerce platforms enables better product accessibility. The increasing dark spirits market of the region receives strong support from the expanding Hispanic and multicultural populations because they create higher demand for dark rum alongside other spirits.

Europe Dark Spirits Market Trends

The European dark spirits market is expected to grow at a CAGR of 7.5% between 2025 and 2035 because of the strong consumer interest in whiskey and rum, and brandy in key markets, including the UK and Germany, and France. The whiskey market maintains its strong position because Scotland and Ireland possess a rich heritage and worldwide recognition. Premiumization represents a growing consumer trend that makes customers willing to pay higher prices for exclusive limited-edition products. Customers now place greater value on products that incorporate organic ingredients and environmentally friendly packaging because sustainability, along with ethical sourcing methods, influences their purchasing decisions. The on-trade industry supports growth through changing mixology trends, which include cocktail bars and high-end restaurants. The rising direct-to-consumer platforms and e-commerce services, together with regional distilleries' unique maturing methods, help meet the increasing demand for authentic experiences.

Asia Pacific Dark Spirits Market Trends

In 2024, the Asia Pacific dark spirits market led globally with 30.5% revenue share because of urbanization and rising disposable incomes, and Western-style alcoholic beverage preferences. Among alcoholic beverages, whiskey dominates the market in Japan and India since domestic production remains strong. The rising affluent urban middle class shows growing interest in premium black spirits. The growth of e-commerce and broader distribution channels gives faster market access to younger consumers. Urban cities that experience cocktail culture development lead to increased alcohol consumption within bars and restaurants. Local distilleries in Australia and India strengthen supply networks, and the relaxation of advertising and tax regulations supports the importation of premium products. International brands extend their distribution through alliances with local partners. Social media platforms, along with influencer marketing and experiential events, enhance market growth for the Asia Pacific dark spirits industry.

Key Dark Spirits Companies:

The following are the leading companies in the dark spirits market. These companies collectively hold the largest market share and dictate industry trends.

- Diageo

- LT Group, INC

- Asahi Group Holdings

- Kirin Holdings

- Suntory Holdings

- Bacardi Limited

- Pernod Ricard

- The Brown-Forman Corporation

- Anheuser-Busch InBev

- Rémy Cointreau

- Others

Recent Developments

- In June 2024, Global spirits firm Casa Lumbre, with headquarters in Mexico, released a second batch of their popular Contraluz 11:11 Mezcal Reposado. Crafted entirely from Maguey Espadín, the limited-edition product has been aged for 11 months and 11 days in Sakura casks and American Oak bourbon barrels.

- In May 2024, Pernod Ricard, together with ecoSPIRITS, established a five-year global licensing deal to elevate their partnership to new heights. Through this licensing arrangement, Pernod Ricard's spirits brands gained access to distribute their products worldwide in on-trade venues with ecoSPIRITS' circular packaging technology.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the dark spirits market based on the below-mentioned segments:

Global Dark Spirits Market, By Type

Global Dark Spirits Market, By Distribution Channel

- Offline Trading

- Online Trading

Global Dark Spirits Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa