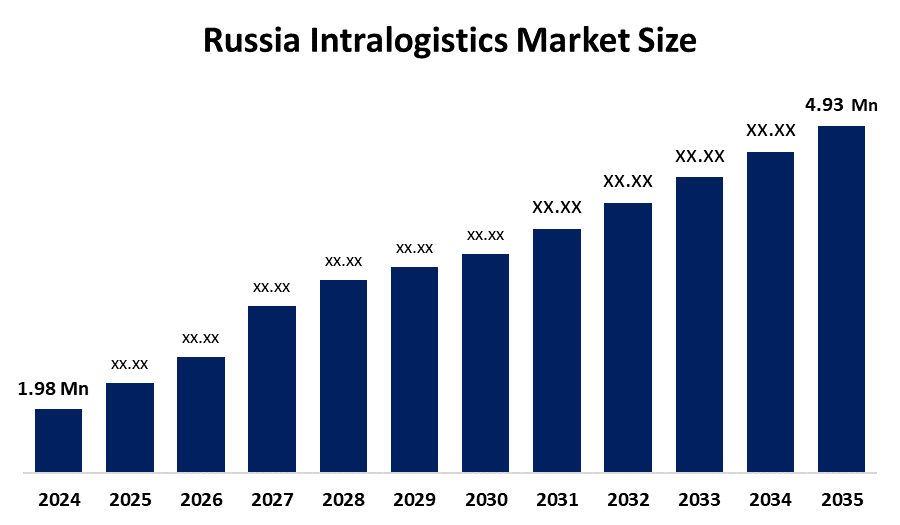

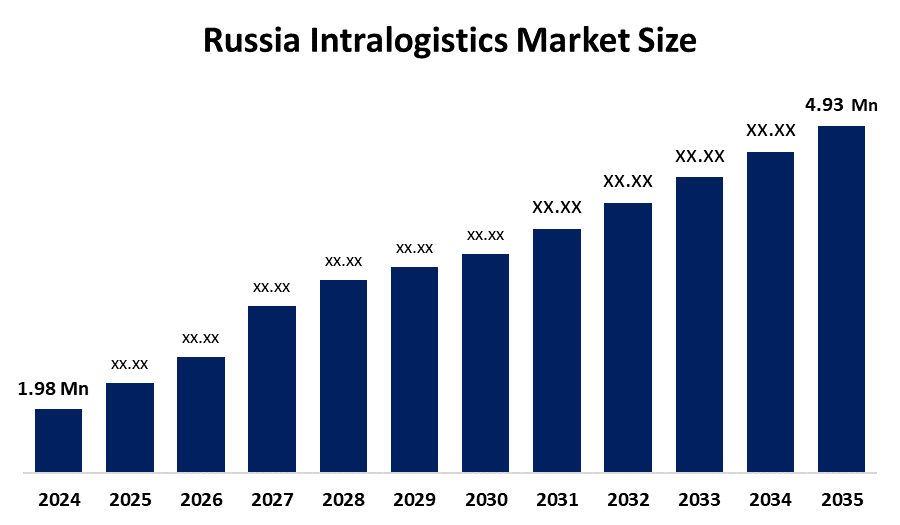

Russia Intralogistics Market Insights Forecasts to 2035

- The Russia Intralogistics Market Size Was Estimated at USD 1.98 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 8.65% from 2025 to 2035

- The Russia Intralogistics Market Size is Expected to Reach USD 4.93 Million by 2035

According to a research report published by Spherical Insights & Consulting, the Russia Intralogistics Market size is anticipated to reach 4.93 million by 2035, growing at a CAGR of 8.65% from 2025 to 2035. The increasing need for prompt and effective delivery is another factor driving market expansion. Customers in Russia are expecting their goods to be delivered precisely and promptly, which has led to an increase in demand for quick and efficient delivery.

Market Overview

The design, deployment, and upkeep of internal logistics systems are the key focuses of the intralogistics market, which is an essential component of supply chain management. It involves moving, storing, and managing commodities inside an organization, such as a factory, warehouse, or distribution center, in order to maximize the flow of goods and efficiently and economically meet the demands of the business. The design, installation, and upkeep of factory and warehouse systems are all part of the intralogistics business, which encompasses a number of industries like manufacturing, retail, e-commerce, and healthcare. Some of the most common uses of intralogistics are material handling, inventory control, order fulfillment, and reverse logistics.

Report Coverage

This research report categorizes the market for the Russia intralogistics market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Russia intralogistics market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Russia intralogistics market.

Driving Factors

The growing use of e-commerce in Russia is driving the intralogistics sector there. The growth of e-commerce in Russia and the need for dependable and efficient supply chain operations are driving the development of automated intralogistics systems. This is because online shopping is becoming more and more popular, and businesses are investing in automation technologies to manage the number of orders and expedite delivery times. In recent years, some e-commerce companies, such as Wildberries and Ozon, have used mobile robots to improve their operations.

Tariff Impact on Russia’s Intralogistics Market

Tariffs on imported automation equipment and software have increased costs for Russian intralogistics firms. This has slowed the adoption of advanced technologies like robotics, warehouse management systems, and smart conveyors. Domestic alternatives often lack the precision and scalability of foreign systems. As a result, operational efficiency and competitiveness have suffered. Tariffs have also discouraged foreign partnerships and supply chain integration

Impact of Russia-Ukraine War on Intralogistics Market

The Russia-Ukraine war has disrupted regional logistics routes and strained supply chains across Eastern Europe. Sanctions and geopolitical instability have reduced access to global suppliers and delayed infrastructure projects. Many companies face labor shortages and rising fuel costs, further complicating warehouse and transport operations. Foreign investment in logistics hubs has declined sharply. Overall, the war has created long-term uncertainty, stalling modernization in Russia’s intralogistics sector.

Restraining Factors

Intralogistics systems can have limited market potential due to their high installation costs, which can be a major obstacle to adoption. In addition to the expense of installation and upkeep, intralogistics systems usually necessitate large expenditures in infrastructure and technology, including specialized hardware, software, and equipment.

Market Segmentation

The Russia intralogistics market share is classified into component and end user industry.

- The hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia intralogistics market is segmented by component into hardware, software, and services. Among these, the hardware segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hardware dominates Russia’s intralogistics market due to high demand for conveyors, forklifts, and automated storage systems. These physical assets form the backbone of warehouse and distribution operations.

- The logistics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Russia intralogistics market is segmented by end user industry into logistics, food & beverages, and retail & e-commerce. Among these, the logistics segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The logistics sector commands the highest share among end users, driven by Russia’s vast geography and growing freight volumes. Warehousing, distribution centers, and courier services rely heavily on intralogistics solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Russia intralogistics market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daifuku Co. Ltd.

- Jungheinrich AG

- Kion Group AG

- Honeywell International Inc.

- Midea Group

- Vanderlande Industries B.V.

- SSI Schaefer AG

- KNAPP AG

- Beumer Group Gmbh and Co. KG

- Autostore

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments:

- In July 2025, a Russian asset management and financial investor agreed to purchase Jungheinrich AG's fully owned subsidiary, Jungheinrich Lift Truck OOO.

Market Segment

This study forecasts revenue at the Russia, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Russia intralogistics market based on the below-mentioned segments:

Russia Intralogistics Market, By Component

- Hardware

- Software

- Services

Russia Intralogistics Market, By End User Industry

- Logistics

- Food & Beverages

- Retail & E-commerce