Global Earthmoving Equipment Market Insights Forecasts to 2035

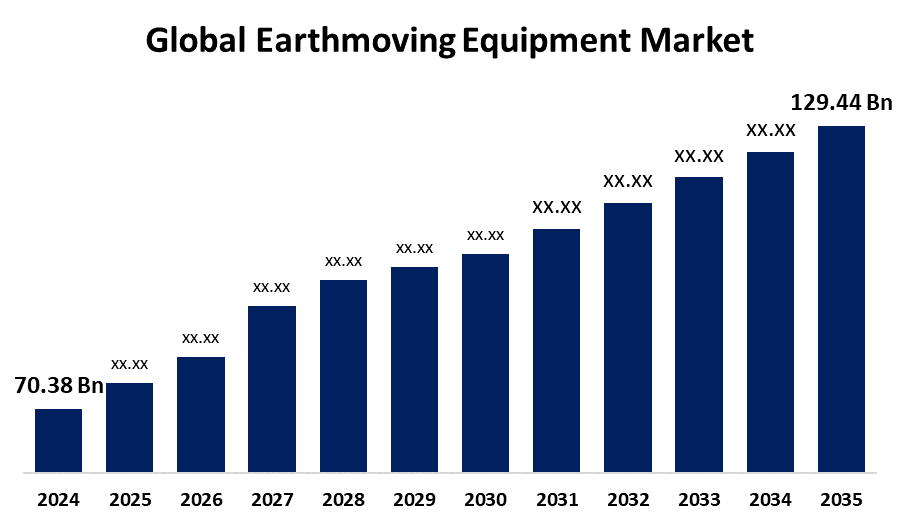

- The Global Earthmoving Equipment Market Size Was Estimated at USD 70.38 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.7% from 2025 to 2035

- The Worldwide Earthmoving Equipment Market Size is Expected to Reach USD 129.44 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Earthmoving Equipment Market

The global earthmoving equipment market encompasses the production and sale of heavy machinery designed for moving and excavating large quantities of soil and rock. This equipment includes various types such as excavators, bulldozers, loaders, graders, and dump trucks, which are crucial in construction, mining, and infrastructure projects. Earthmoving machines help prepare sites by digging, leveling, and transporting materials, enabling efficient and large-scale earth manipulation. These machines vary in size and function but collectively support a wide range of applications from road building to mining operations. Technological advancements have improved the precision and performance of these machines, often incorporating automation and digital controls. The market represents a vital sector within heavy equipment industries, reflecting the ongoing need for infrastructure development and resource management worldwide. Overall, earthmoving equipment plays an essential role in facilitating construction and mining activities, making it a critical component of modern industrial operations.

Attractive Opportunities in the Earthmoving Equipment Market

- Integration of AI, IoT, telematics, and real-time monitoring enhances operational efficiency and safety on construction sites. This shift enables predictive maintenance, reduces downtime, and lowers operational costs, opening up opportunities for innovative smart equipment.

- As industries focus on sustainability and reducing emissions, there’s a rising market for eco-friendly machinery. Electric and hybrid earthmoving equipment presents a promising growth area, driven by stricter environmental regulations and green infrastructure initiatives.

- Infrastructure development in emerging regions like Asia Pacific offers untapped potential. Additionally, the growing rental market provides flexible equipment access, especially for small contractors and startups, enabling broader market penetration without the burden of ownership costs.

Global Earthmoving Equipment Market Dynamics

DRIVER: Rapid urbanization and increasing infrastructure development worldwide

The global earthmoving equipment market is primarily driven by rapid urbanization and increasing infrastructure development worldwide. As cities expand and populations grow, there is a heightened demand for residential, commercial, and industrial construction projects, which require earthmoving machinery for site preparation and excavation. Additionally, rising investments in transportation infrastructure, such as roads, highways, and railways, further boost the need for efficient earthmoving equipment. The mining sector also significantly contributes to market growth, with increased demand for minerals and natural resources requiring advanced machinery for extraction and material handling. Technological advancements, including automation, GPS integration, and fuel-efficient engines, have enhanced equipment productivity and reduced operational costs, encouraging adoption. Furthermore, government initiatives promoting smart cities and sustainable infrastructure projects stimulate demand for modern and eco-friendly earthmoving machines. Collectively, these factors are accelerating market expansion by increasing the need for versatile, high-performance earthmoving equipment across various industries.

RESTRAINT: Shortage of skilled operators

One major challenge is the high initial cost of purchasing and maintaining heavy machinery, which can be prohibitive for small and medium-sized enterprises. Additionally, the maintenance and operational expenses, including fuel consumption and spare parts, add to the overall cost of ownership. The market is also impacted by environmental regulations aimed at reducing emissions and promoting sustainability, which require manufacturers to invest heavily in developing eco-friendly technologies, thereby increasing product costs. Another restraint is the shortage of skilled operators, as operating advanced earthmoving equipment demands specialized training and expertise. Economic fluctuations and uncertainties, such as slowdowns in construction or mining activities, can lead to reduced demand for these machines. Finally, the availability of cheaper used equipment in secondary markets can deter investments in new machinery, affecting the overall market growth negatively.

OPPORTUNITY: Increasing adoption of smart and automated machinery

The global earthmoving equipment market presents significant opportunities beyond the usual growth drivers. One key opportunity lies in the increasing adoption of smart and automated machinery, which can improve safety and efficiency on construction sites. Integration of technologies such as artificial intelligence, IoT (Internet of Things), and telematics enables real-time monitoring and predictive maintenance, reducing downtime and operational costs. Additionally, there is a growing demand for electric and hybrid earthmoving equipment as industries move toward sustainable and eco-friendly solutions, opening new markets for innovative products. Emerging economies with expanding infrastructure needs offer untapped potential for market expansion. Moreover, the rental market for earthmoving equipment is gaining traction, providing flexible access to machinery without the burden of ownership costs. This trend is especially attractive for small contractors and startups. Lastly, aftermarket services, including parts, maintenance, and repair, present lucrative revenue streams as customers seek to extend equipment lifespan and maximize performance.

CHALLENGES: Rapid pace of technological advancement

One significant challenge is the rapid pace of technological advancement, which requires manufacturers and operators to continuously adapt to new systems and equipment. This can lead to compatibility issues and increased training demands for operators. Supply chain disruptions, such as shortages of critical components like semiconductors, have also created delays and increased production costs. Additionally, fluctuating raw material prices impact manufacturing expenses, affecting pricing strategies. The complexity of integrating advanced technologies like automation and telematics poses cybersecurity risks, as connected machines may become vulnerable to hacking or data breaches. Furthermore, there is a growing emphasis on operator safety and stringent workplace regulations, requiring manufacturers to design equipment that meets high safety standards without compromising performance. Finally, competition from low-cost manufacturers and counterfeit products challenges established brands in maintaining market share and quality assurance. These challenges require strategic innovation and adaptability to sustain growth.

Global Earthmoving Equipment Market Ecosystem Analysis

The global earthmoving equipment market ecosystem includes manufacturers who produce machinery like excavators and bulldozers, supported by component suppliers providing engines and advanced technologies. Distributors and dealers connect these products to end-users such as construction and mining companies. Service providers offer maintenance and repairs, while technology firms supply telematics and fleet management solutions. Regulatory bodies influence the market by setting safety and environmental standards. Together, these players form a network that drives production, sales, operations, and innovation in the earthmoving equipment industry.

Based on the product, the loader segment dominated the earthmoving equipment market with a revenue share over the forecast period

Loaders are highly versatile machines used extensively in construction, mining, and infrastructure projects for loading, transporting, and moving materials. Their efficiency in handling various tasks, such as digging, lifting, and grading, makes them indispensable on job sites. The growing demand for efficient earthmoving solutions has sustained the loader segment’s market leadership, supported by continuous technological advancements that enhance their performance, fuel efficiency, and operator comfort.

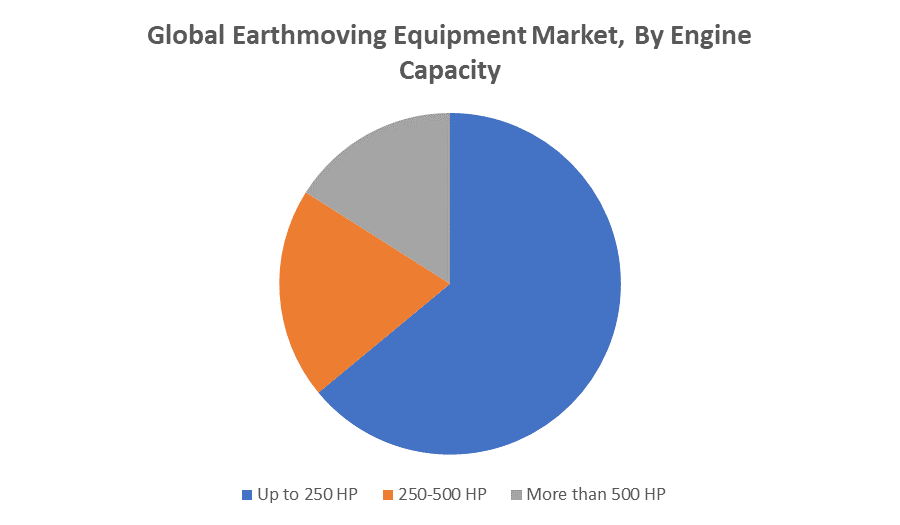

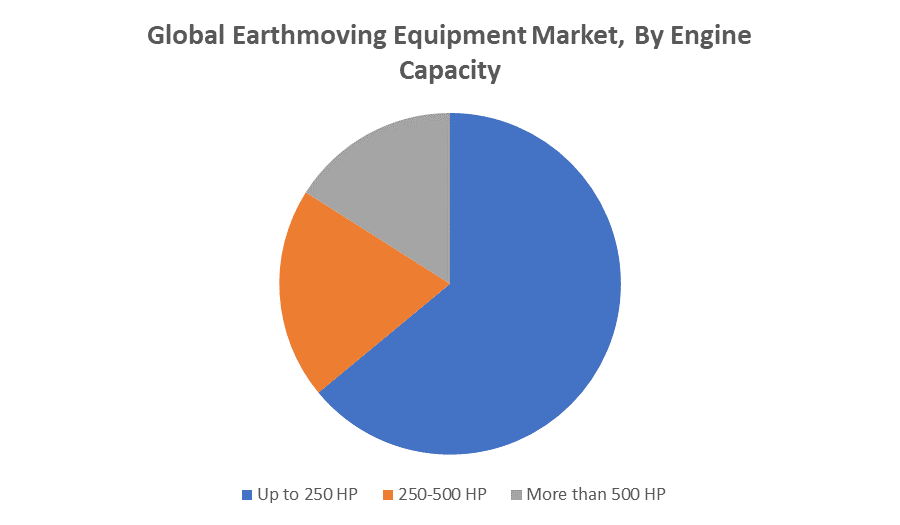

Based on the engine capacity, the up to 250 HP segment accounted for the largest market share during the forecast period

The up to 250 HP segment includes earthmoving equipment with engines powerful enough to handle a wide range of construction and mining tasks while offering better fuel efficiency and easier maneuverability compared to higher-capacity machines. Its popularity stems from its versatility, cost-effectiveness, and suitability for small to medium-scale projects. As a result, equipment within this engine capacity range is widely adopted by contractors and operators, driving its dominant position in the market.

Asia Pacific is anticipated to hold the largest market share of the earthmoving equipment market during the forecast period

Asia Pacific is anticipated to hold the largest market share in the earthmoving equipment market during the forecast period. This dominance is driven by rapid urbanization, expanding infrastructure projects, and growing industrialization across countries like China, India, and Southeast Asia. The region’s increasing investments in construction, mining, and transportation sectors fuel strong demand for versatile and efficient earthmoving machinery. Additionally, government initiatives aimed at improving connectivity and economic development further boost market growth. The combination of a large workforce and rising adoption of advanced equipment makes Asia Pacific a key contributor to the global earthmoving equipment market.

Europe is expected to grow at the fastest CAGR in the earthmoving equipment market during the forecast period

Europe is expected to grow at the fastest CAGR in the earthmoving equipment market during the forecast period. This rapid growth is driven by increased investments in infrastructure modernization, sustainable construction practices, and the adoption of advanced, eco-friendly earthmoving technologies. Stricter environmental regulations in the region encourage manufacturers to innovate and supply low-emission, fuel-efficient machinery. Additionally, government initiatives aimed at rebuilding and upgrading transportation networks and urban infrastructure contribute to rising demand. The focus on digitalization and automation further accelerates market expansion, making Europe a key growth hotspot in the earthmoving equipment industry.

Recent Development

- In January 2025, SANY Group launched the ST230V Compact Track Loader, which is specially targeted for North America and Europe markets. Equipped with significant efficiency and maneuverability capabilities, this addition to the portfolio is expected to strengthen the company’s position in related markets.

- In January 2025, Bobcat Company launched the new Bobcat B760 backhoe loader and a diverse product lineup comprising mini-track loaders, compact excavators, portable power equipment, and skid-steer loaders.

Key Market Players

KEY PLAYERS IN THE EARTHMOVING EQUIPMENT MARKET INCLUDE

- Caterpillar Inc.

- Komatsu Ltd.

- Volvo Construction Equipment

- Hitachi Construction Machinery

- John Deere

- Liebherr Group

- SANY Group

- Doosan Infracore

- JCB

- Terex Corporation

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the earthmoving equipment market based on the below-mentioned segments:

Global Earthmoving Equipment Market, By Product

- Dozer

- Excavator

- Loader

- Motor Grader

- Dump Truck

Global Earthmoving Equipment Market, By Engine Capacity

- Up to 250 HP

- 250-500 HP

- More than 500 HP

Global Earthmoving Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa