Canned Wines Market Summary

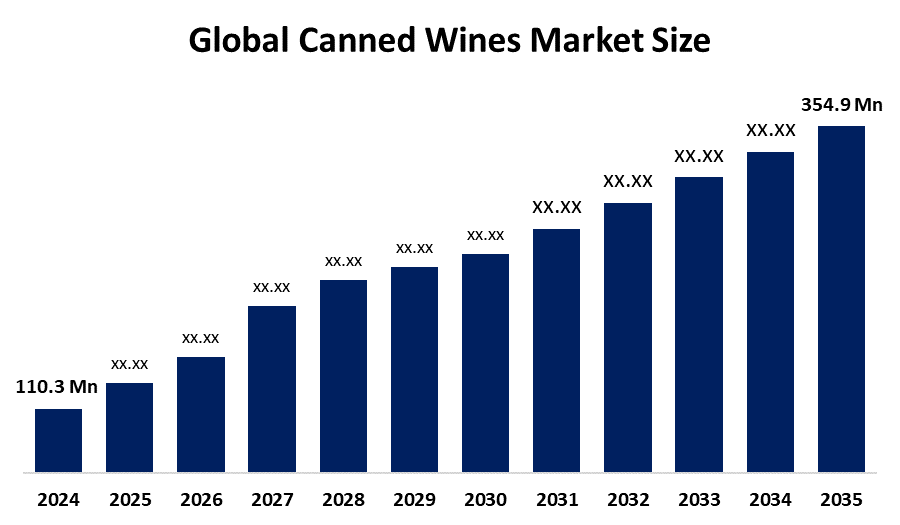

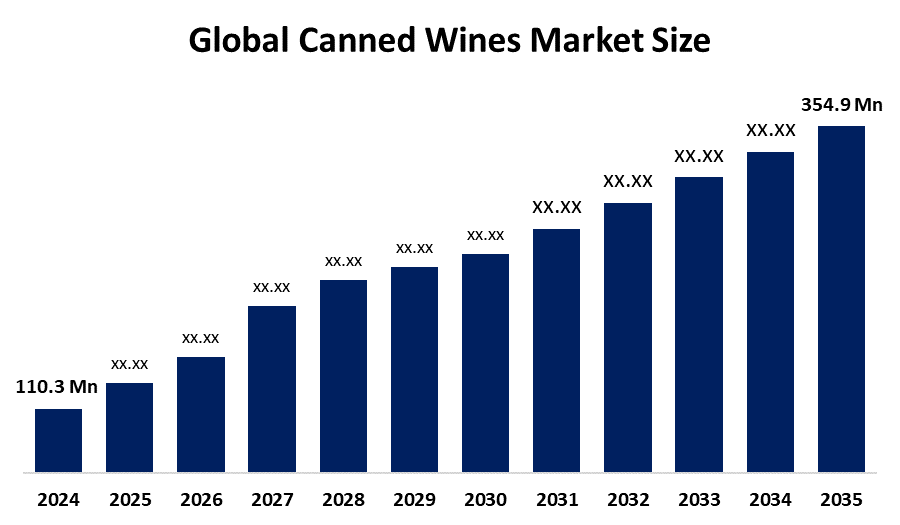

The Global Canned Wines Market Size Was Estimated at USD 110.3 Million in 2024 and is Projected to Reach USD 354.9 Million by 2035, Growing at a CAGR of 11.21% from 2025 to 2035. The market for canned wines is expanding as a result of consumer demand for single-serve, sustainable packaging, portability, and convenience. Its rise is also fueled by its inventive flavors, growing appeal among millennials, and suitability for outdoor events.

Key Regional and Segment-Wise Insights

- In 2024, the North American canned wine market had the biggest worldwide revenue share, accounting for 36.4%.

- In 2024, the United States held a commanding revenue share in the regional market.

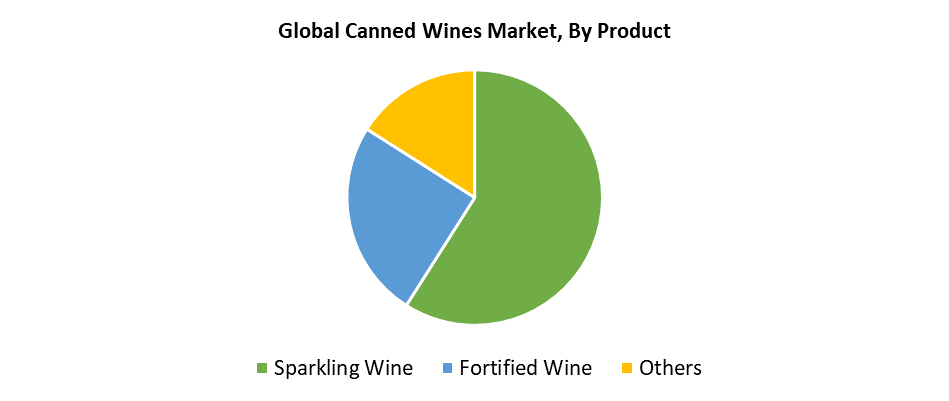

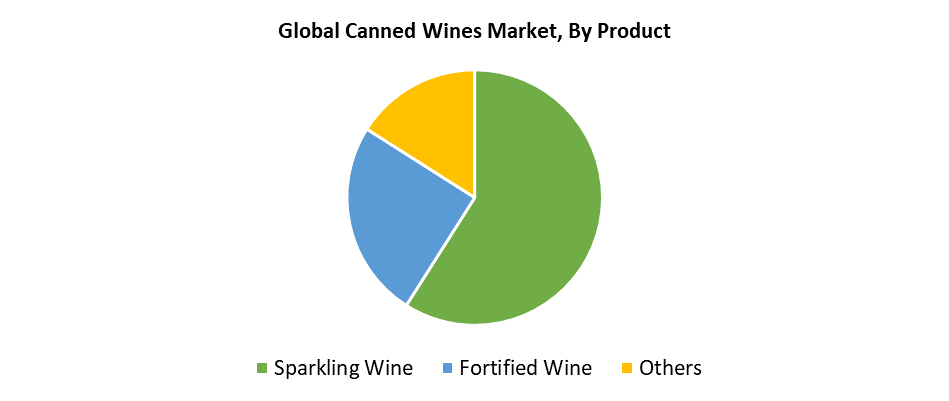

- In 2024, the sparkling wine category had the biggest revenue share in the global canned wine market by product, accounting for 59.4%.

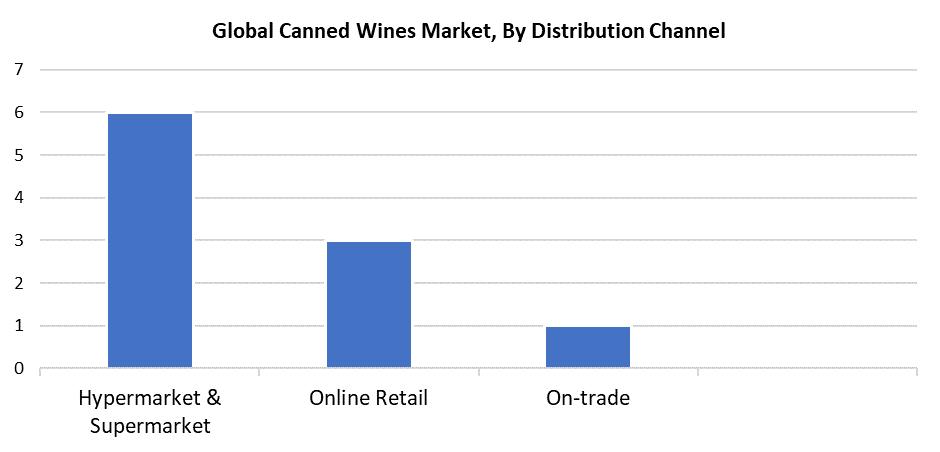

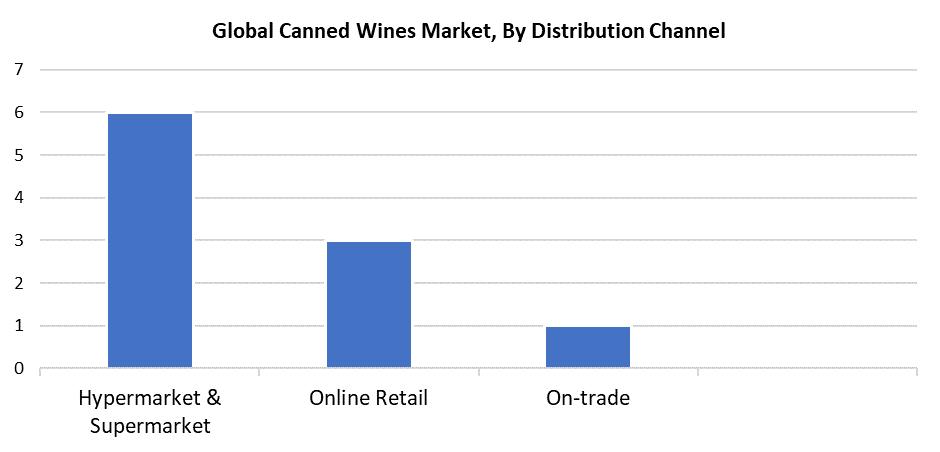

- In 2024, the supermarket and hypermarket category had the biggest revenue share in the global canned wine market by distribution channel.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 110.3 Million

- 2035 Projected Market Size: USD 354.9 Million

- CAGR (2025-2035): 11.21%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The wine business sector that produces and sells wine through aluminum cans instead of glass bottles exists as the canned wine market. Red, white, rosé, and sparkling wine varieties are available in this market, which serves consumers who want environmentally friendly, portable, and convenient options. The canned wine industry continues to grow because customers want inexpensive, portable, convenient beverages. The combination of busy lifestyles and short work hours has made ready-to-drink (RTD) products, including canned wines, more popular among customers. The single-serve portable design of these products makes them popular for outdoor events such as beach vacations, hiking, and camping. Aluminum cans prove to be stronger and safer than glass bottles while being easier to store and freeze. Their cost-effectiveness in production and retail pricing attracts younger consumers as well as casual drinkers, primarily millennials, who want affordable yet accessible alcoholic beverages.

The rising acceptance of canned wines stems mainly from health-oriented environmental movements. The environmental impact of aluminum cans is smaller than glass or plastic containers, and they can be recycled extensively, and their lightweight nature makes them cheaper to transport. The health movement has driven customers toward beverages that offer moderation through low-alcohol and low-calorie, and additive-free wines, which are typical characteristics of canned wine products. The introduction of wine spritzers along with flavored wines and wine-based cocktails has expanded their consumer base. The conjunction of factors, together with rising environmental awareness, has led modern consumers toward sustainable enjoyment through canned wines.

Product Insights

The sparkling wine sector emerged as the leading segment of canned wines during 2024, accounting for 59.4% because it attracts broad consumer interest and matches key modern lifestyle trends. Three types of sparkling canned wines, including Prosecco, sparkling rosé, and wine spritzers, deliver refreshing and light options for casual and celebratory occasions. The portable single-serve design of these products specifically attracts Gen Z and millennial consumers who want both moderation and sustainability, and easy usage. The packaging design provides convenience to occasional drinkers by eliminating full bottle opening, which prevents waste. New consumer requirements for ready-to-drink outdoor-friendly alcoholic beverages have driven both established and emerging companies to innovate, which has expanded the market appeal for everyday use and special occasions.

From 2025 to 2035, the fortified wine category is anticipated to expand at the fastest CAGR in the canned wine market due to grssowing consumer demand for artisanal, premium, and craft alcoholic beverages. As vintage and legacy drinks, products like sherry, port, and vermouth are becoming more and more popular among consumers who are looking for distinctive and complex flavor profiles. Convenient canned versions of these classic wines have been reimagined by manufacturers in response to the trend toward boutique and experiential drinking. A specialized but growing market that appreciates originality and authenticity is served by canned fortified wines, which provide both quality and accessibility. This market is anticipated to have strong, long-term growth as consumers increasingly experiment with different drinking experiences.

Distribution Channel Insights

The canned wine industry experienced its highest revenue share through supermarket and hypermarket retail channels in 2024 because of expansive product offerings and intensive marketing efforts, along with consumers seeking complete shopping solutions. These retail formats enable shoppers to browse through numerous canned wine brands and flavors at various price points during their single visit to the store. Retailers have expanded their canned wine offerings and implemented in-store displays and product sampling to attract customers who then make spontaneous purchases as demand for canned wine continues to rise. The strategic placement of products on store shelves, along with specific seasonal promotions, enhances their visibility to customers. A strong distribution network continues to play a vital role in reaching new customers and expediting market expansion.

The worldwide canned wines market will experience its fastest compound CAGR through online retail sales during the forecast period. Online retail expansion results from growing internet access and wine brands actively engaging consumers through social media channels. E-commerce platforms offer customers more wine varieties, along with different brands and price options compared to physical retail stores. Through online platforms, customers easily discover wines while evaluating and selecting products based on their taste preferences, along with their budget and environmental commitments. The platform also delivers detailed content for experienced wine enthusiasts and fundamental education for those starting to drink. Specialized and high-priced products become more affordable to consumers through direct-to-consumer business operations, while these models also enhance product accessibility. Online shopping holds a pivotal position in the market's future growth because of its numerous advantages.

Regional Insights

The global canned wines market in 2024 was dominated by the North America region with a 36.4% revenue share because wine consumption keeps growing while canned wine brands expand across the United States and Canada markets. The inexpensive nature of aluminum cans, together with their practicality and environmental benefits, makes canned wine a preferred choice for casual gatherings and outdoor events among Millennials and Gen Z consumers. The middle class's changing view of canned wine as a cost-effective alternative to bottled wine drives its increasing demand. The area's strong outdoor culture, along with its travel festivals and leisure activities, supports the market growth. The lightweight nature of canned wine containers, along with their portability and reduced risk of breakage, makes them suitable for consumers. The framework of consistent regional expansion will likely continue through ongoing innovation and lifestyle alignment throughout the upcoming years.

U.S. Canned Wines Market Trends

The North American canned wines market in 2024 experienced significant revenue growth in the United States because of rising brand competition, which drove innovation alongside rising wine consumption trends. The industry has grown substantially because customers are choosing convenient portable options, which include the rising popularity of ready-to-drink (RTD) beverages. American producers now develop natural, low-alcohol canned wines to serve the rising number of health-conscious customers. Environmental packaging solutions, especially aluminum cans, have advanced to satisfy consumer demands for sustainable products. The combination of outdoor lifestyle values with social drinking practices and multiple sales channels has positioned the United States to lead the world in canned wine market expansion.

Europe Canned Wines Market Trends

The rising popularity of outdoor events such as sporting events, music festivals, and picnics led to a significant revenue share of the European canned wine market in 2024. The recyclable aluminum packaging of canned wines, alongside their lower carbon footprint compared to glass bottles, makes them highly desirable to the region because of its sustainability focus. Local wine producers throughout France, Italy, and Spain who target younger urban consumers have adopted canned wine and ready-to-drink products because these formats offer convenience and modern drinking experiences. The European canned wine industry continues to grow steadily because consumers in Germany, France, and the UK support environmentally friendly packaging through their shifting drinking behaviors and rising environmental awareness.

Asia Pacific Canned Wines Market Trends

The Asia Pacific canned wines market will register the fastest CAGR throughout the forecast period because of its growing base of young working-class consumers. China, together with Japan, South Korea, and India, serve as main drivers for this development through their expanding wine market and their growing preference for ready-to-drink (RTD) beverages. Canned wines have become popular in Japan despite the general decline of the traditional wine market, thus benefiting companies such as Suntory Holdings and Mercian. The Indian market for RTD beverages continues to grow because consumers prefer quick, affordable, portable alcoholic drinks. The growing population, together with increasing urban development and changing drinking patterns, generates substantial prospects for new product development along with market growth across this region.

Key Canned Wines Companies:

The following are the leading companies in the canned wines market. These companies collectively hold the largest market share and dictate industry trends.

- E. & J. Gallo Winery

- Canned Wine Co.

- SUNTORY HOLDINGS LIMITED

- Sans Wine Co.

- Maker Wine Company

- Sula Vineyards Limited

- Union Wine Company

- Archer Roose Wines

- Others

Recent Developments

- In January 2025, the partnership between Spritz Society and GALLO enables GALLO to assist Spritz Society with broadening its retail distribution of canned products. Starting in Illinois, South Carolina, Florida, and Texas, the arrangement will extend to all major retail outlets during March 2025. GALLO will supply the canned products, which include Pink Lemonade, Lemon Iced Tea, Peach, and Pickle cocktails.

- In August 2024, Archer Roose stated that its Sauvignon Blanc cans can be purchased from over 150 Dave & Buster's store locations throughout the United States. The company continues its partnership with Regal Cinemas and sports venues, including BMO Stadium (Los Angeles) and Shell Energy Stadium (Houston), as it seeks to boost product exposure and sales through major entertainment venue alliances.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the canned wines market based on the below-mentioned segments:

Global Canned Wines Market, By Product

- Sparkling Wine

- Fortified Wine

- Others

Global Canned Wines Market, By Distribution Channel

- Hypermarket & Supermarket

- Online Retail

- On-trade

Global Canned Wines Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa