Commercial Seeds Market Summary

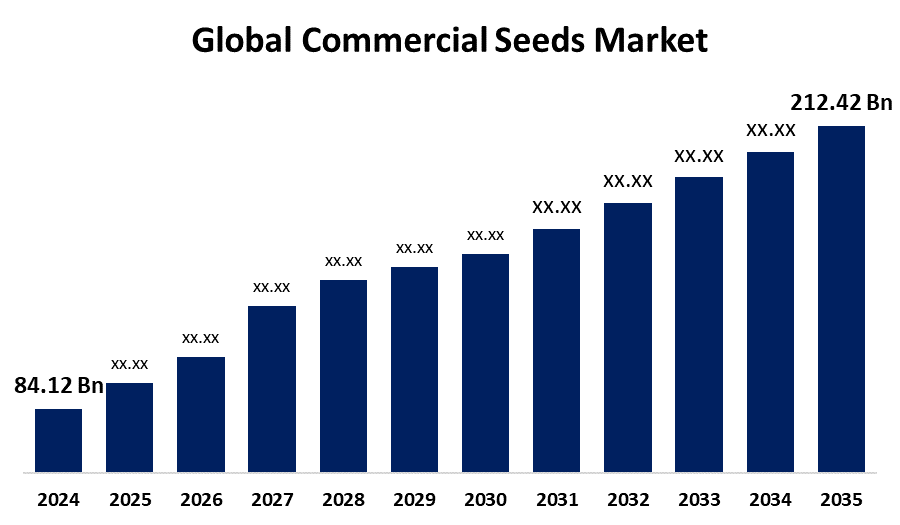

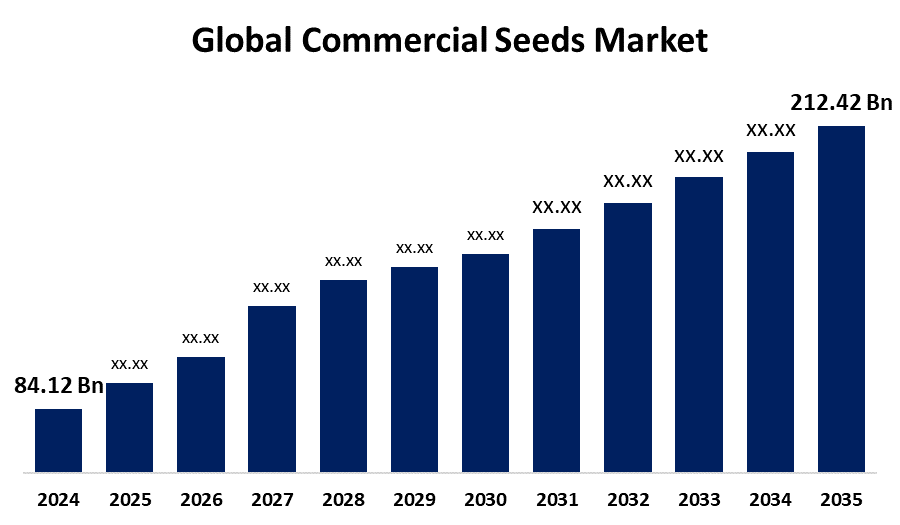

The Global Commercial Seeds Market Size Was Valued at USD 84.12 Billion in 2024 and is Projected to Reach USD 212.42 Billion by 2035, Growing at a CAGR of 8.79% from 2025 to 2035. The global population increase, which demands higher agricultural yields, and biotechnology breakthroughs that result in the creation of high-yielding, disease-resistant, and climate-resilient seeds are the primary factors driving the expansion of the commercial seeds market.

Key Regional and Segment-Wise Insights

- In 2024, the commercial seeds market in North America held the largest revenue share worldwide, accounting for 32.7%.

- In 2024, the United States held a dominating revenue share in the North America regional market.

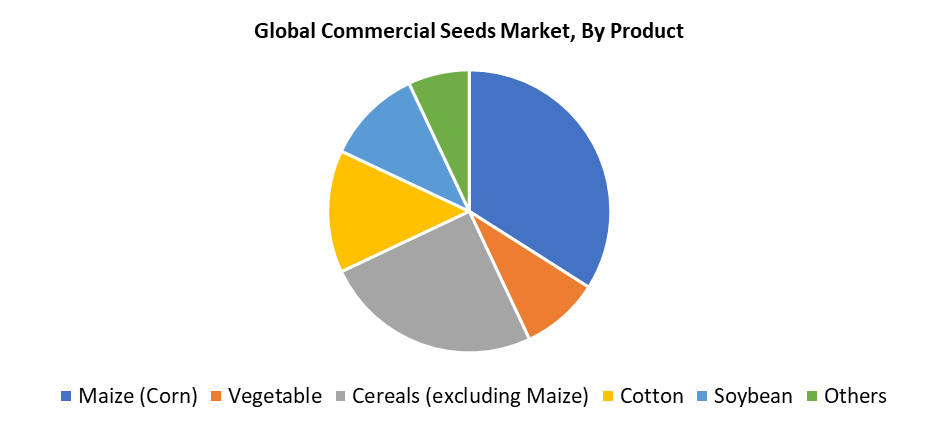

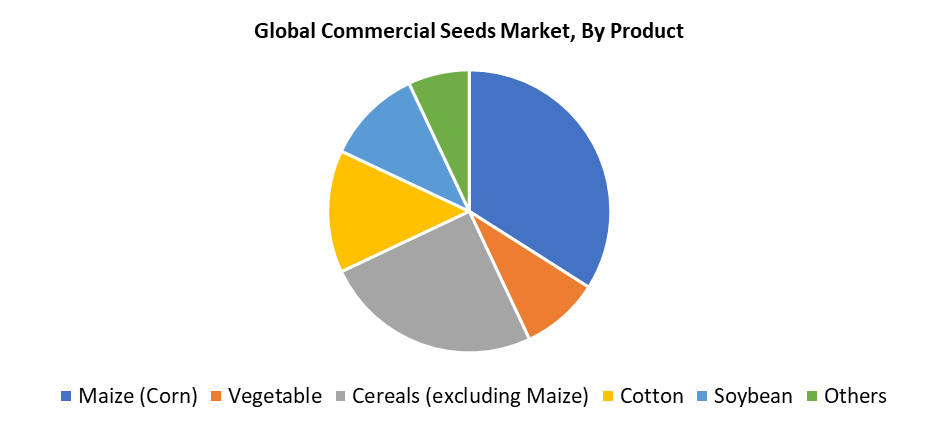

- By product, the maize (corn) sector led the global commercial seeds market in 2024 with a 34.5% share.

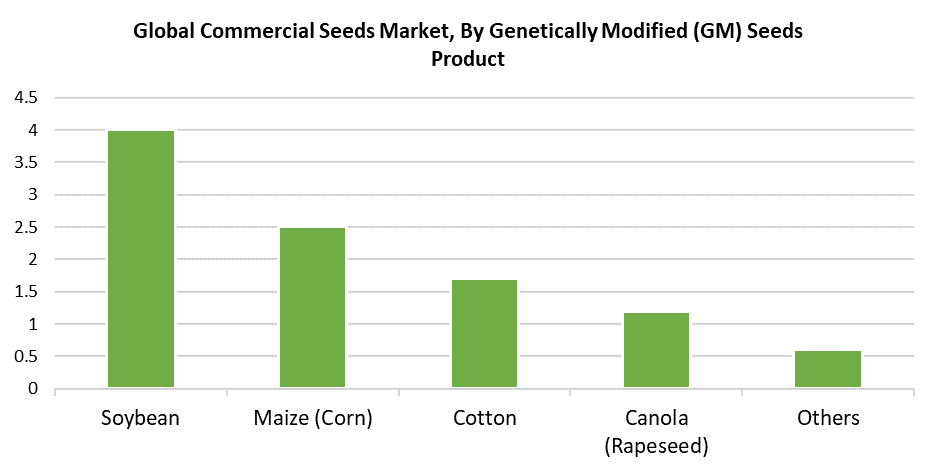

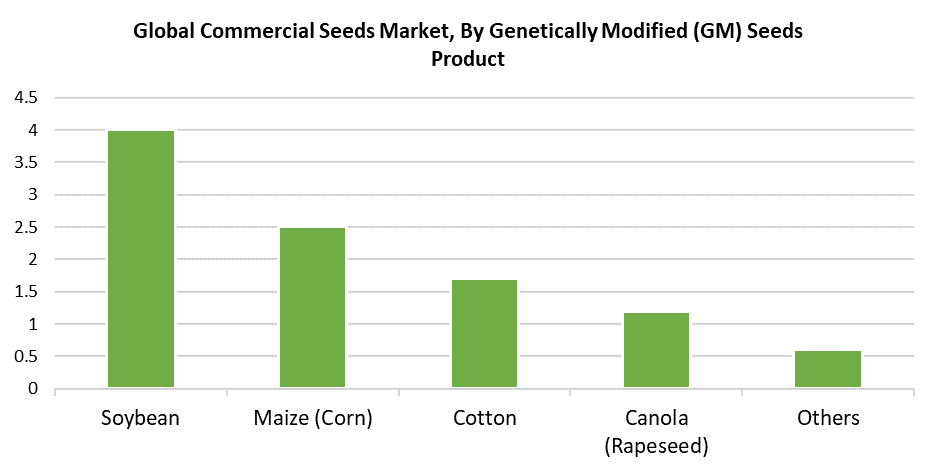

- In 2024, the soybean segment held a dominant revenue share in the global market based on genetically modified seeds products.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 84.12 Billion

- 2035 Projected Market Size: USD 212.42Billion

- CAGR (2025-2035): 8.79%

- North America: Largest market in 2024

The commercial seeds market refers to the worldwide sector that produces seeds and handles their distribution for commercial agricultural farming. The commercial seeds market experiences rapid growth because farmers need to boost agricultural production while addressing worldwide food supply concerns. Modern farming relies heavily on genetically modified (GM) and hybrid seeds, as they deliver increased crop production and enhanced crop quality. Modern molecular biology advancements enable cost-effective genetic mapping alongside gene-editing methods, which help scientists develop crops that possess valuable traits such as drought and herbicide resistance and pest resistance. The technological advancements support reduced input costs while saving resources and achieving better output. Farmers from developed and emerging nations are rapidly adopting premium seeds because they now better understand their advantages.

The commercial seed industry continues to expand because of the changing climate conditions worldwide. The necessity for tough seed varieties that survive environmental stress has increased because of unpredictable weather conditions, extended droughts, and catastrophic climate events. The preference for flood-resistant rice, heat-tolerant crops, and drought-resistant maize continues to grow in regions at risk. The government provides farmers with assistance through subsidies and incentives, which motivates them to select high-yielding climate-resilient seeds. The growing demand for seeds that possess improved nutritional value and suitability for organic farming has emerged because consumers want sustainable food products with superior nutrition. The integration of seed manufacturers through mergers and acquisitions enables them to develop stronger innovation capabilities and expand their worldwide distribution networks.

Product Insights

The maize segment dominated the global commercial seeds market in 2024 by holding a 34.5% revenue share due to its multiple industrial and food-related applications. The industrial sector depends on maize for starch production, sweetener manufacturing, biofuels, and textile materials additionally require this crop. The plant's tolerance for various soil conditions and climatic environments makes it widely cultivated across developing countries, which continue to face food security challenges. Growers find maize more appealing because it produces high yields under both optimal and challenging environmental conditions. The rising demand among developing countries and impoverished nations has driven higher import volumes, which subsequently propelled market expansion. The continuous development of hybrid and conventional seed technologies reinforces maize's fundamental role in agricultural advancement as well as worldwide economic advancement.

The commercial cereal seed segment is anticipated to experience the fastest growth throughout the forecasted period, because worldwide consumer interest in organic and non-GMO foods increases. Industrialized nations, including the European Union, witnessed a rising trend of consumers selecting non-GMO cereals because of their health concerns. The strict GMO regulations of these markets accelerate the switch to conventional and organic grain seed usage. Numerous governments offer monetary support through grant programs and subsidy initiatives that promote sustainable agricultural approaches. These cereal crops serve as vital ecological components that enhance biodiversity levels, together with soil health and natural pest control methods. The market for non-GMO commercial cereal seeds will experience substantial growth because sustainability and food safety have become the most important issues.

Genetically Modified (GM) Seeds Product Insights

The soybean segment commanded the highest revenue share in the worldwide commercial seeds market in 2024 because of its essential functions across food production, industrial usage, and animal feed applications. Modern industrial farming areas are witnessing increased adoption of genetically modified (GM) soybean seeds because of their improved pest and disease resistance combined with their ability to yield higher outputs. Farmers consider these GM variants cost-effective because they deliver enhanced herbicide tolerance together with pest resistance and environmental adaptability. The global consumption of soy-based products continues to increase because Asian and European consumers embrace plant-based proteins while biodiesel production expands. The continuous increase in demand will drive the segment's expansion, which will solidify soybeans as the market leader.

The maize segment is predicted to grow at a significant CAGR throughout the forecasted period because of the rising implementation of genetically modified (GM) maize. The seeds attract farmers in regions that face agricultural and financial challenges because they offer pest, herbicide resistance, drought tolerance, and yield improvement. Genetically modified maize serves to maintain food availability and decrease pest damage as well as climate-related crop stress in developing nations that grow maize as their primary food crop. The international food markets require GM maize because it provides essential support to both industrial food manufacturing processes and nutritional improvement initiatives. The acceptance rate of GM maize is rising because of worsening climate change alongside growing food security concerns in Africa and select Asian regions. The production of GM maize leads to better crop yields and sustainable agricultural practices.

Regional Insights

The global commercial seeds market is dominated by the North America region, capturing 32.7% of revenue share in 2024 due to its widespread use of genetically modified (GM) and hybrid seeds and advanced farming techniques. High-performance seeds are essential to the production of important crops including maize, soybeans, wheat, and cotton in the United States and Canada, to increase productivity and efficiency. The area gains from significant R&D expenditures, a strong biotech infrastructure, and a supportive regulatory framework that encourages seed technology innovation. The market expansion continues because of rising interest in precision agriculture, climate-resilient crops, and sustainable farming practices. The commercial seeds market will maintain its leading position in North America because of ongoing innovation, government support, and global dominance in genetically modified (GM) crop adoption.

U.S. Commercial Seeds Market Trends

The United States held the leading position in the North American commercial seeds market throughout 2024 because of its advanced agricultural methods, strong export markets, and new technological developments. The United as the world leader in producing corn, soybeans, wheat, cotton, and vegetables, relies on premium commercial seeds to boost yields and enhance pest resistance and adaptability to changing climate conditions. The demand for high-quality seed varieties stays strong because China, Mexico, and Japan stand as major export destinations. The Farm Bill, along with other government programs, provides funding and subsidies to support agricultural innovation. The industry leaders, Syngenta, Bayer, and Corteva, develop seeds which have been designed to resist pests and drought conditions. The expansion of digital agriculture and precision farming practices drives additional requirements for superior seed varieties. Asian and Latin American markets drive strong domestic production through their increasing exports.

Europe Commercial Seeds Market Trends

The European commercial seed market experiences significant growth because of climate adaptation technologies, together with breakthrough technological advances and environmental programs. The expanding market growth stems from rising consumer interest in high-quality, sustainable, and climate-resistant crop varieties and organic products. The strict EU regulations about genetically modified seeds have driven both conventional and organic breeding to pursue innovative approaches. The development of climate-adaptive crops stands as a central focus for France, Germany, and the Netherlands, where important companies such as Limagrain and KWS operate. The industry maintains strong growth through substantial government support, which includes financial incentives as well as scientific research funding and regulations for sustainable agriculture. The rising consumer preference for organic fruits and vegetables directly drives up seed demand. Europe maintains its lead position as a global commercial seed leader because of its expanding trade and export activities involving both hybrid and organic seeds.

Asia Pacific Commercial Seeds Market Trends

The seed market in Asia Pacific will experience substantial growth because of its massive population, which represents approximately 60% of the world's population and requires grains and vegetables for sustenance. Food consumption growth and dietary shifts toward protein-based diets raise the need for improved seed varieties. The governments across the region promote agricultural development through seed subsidy programs for hybrid and high-yield varieties in India, and genetic modification support in China to secure food availability. Research and development in biotechnology, together with seed technology, receives substantial funding primarily from China, India, and Australia. International business partnerships with regional companies accelerate market growth, yet initiatives such as India's "Self-Reliant Agriculture" program push native seed innovation forward. The combined factors establish Asia Pacific as the global leader in seed market growth with strong CAGR projections.

Key Commercial Seeds Companies:

The following are the leading companies in the commercial seeds market. These companies collectively hold the largest market share and dictate industry trends.

- Syngenta Global AG

- TAKII & CO., LTD.

- Rijk Zwaan Zaadteelt en Zaadhandel B.V.

- KWS SAAT SE & Co. KGaA

- SAKATA SEED AMERICA

- Bayer Group

- Corteva

- Dow

- Vilmorin-Mikado

- Advanta Seeds

- Others

Recent Developments

- In November 2024, Corteva unveiled a new and patented non-GMO hybrid technique for wheat that should guarantee significant increases in crop output. The new approach uses the same amount of land resources but increases yield potential by 10%. The company adds that studies have demonstrated that the technology is more drought-resistant, allowing farmers to achieve better outcomes in water-stressed regions. Hard Red Winter, the resulting wheat, is anticipated to be introduced to the North American market in 2027.

- In June 2023, in Karacabey, Turkey, the seed breeding firm Takii opened a brand-new, advanced seed producing facility. The plant, which is located in the province of Bursa, was set up to enhance the business's flower and vegetable seed production process. With the establishment of two significant R&D locations in Antalya, the facility expands the company's current footprint in the nation. It is anticipated that this action will improve Takii's distribution efforts to clients around the world and fortify its global footprint.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the commercial seeds market based on the below-mentioned segments:

Global Commercial Seeds Market, By Product

- Maize (Corn)

- Vegetable

- Cereals (excluding Maize)

- Cotton

- Soybean

- Others

Global Commercial Seeds Market, By Genetically Modified Seeds Product

- Soybean

- Maize (Corn)

- Cotton

- Canola (Rapeseed)

- Others

Global Commercial Seeds Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa