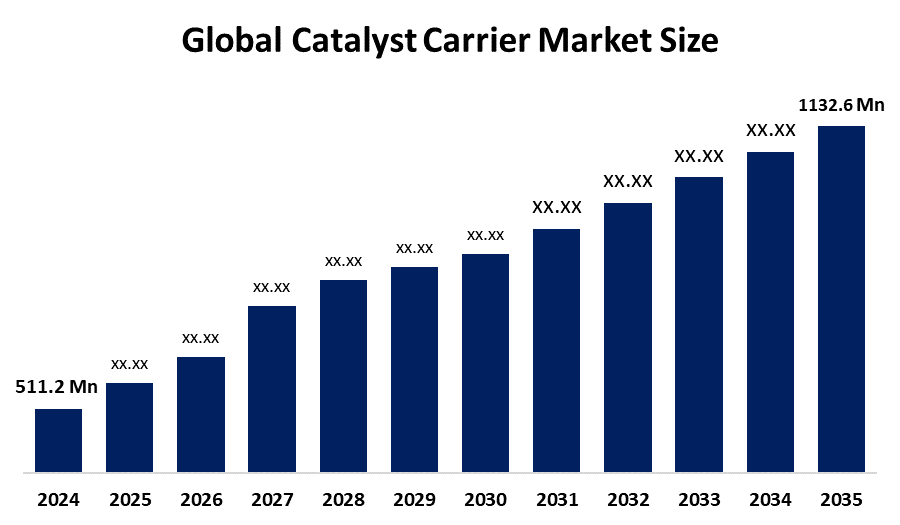

Global Catalyst Carrier Market Insights Forecasts to 2035

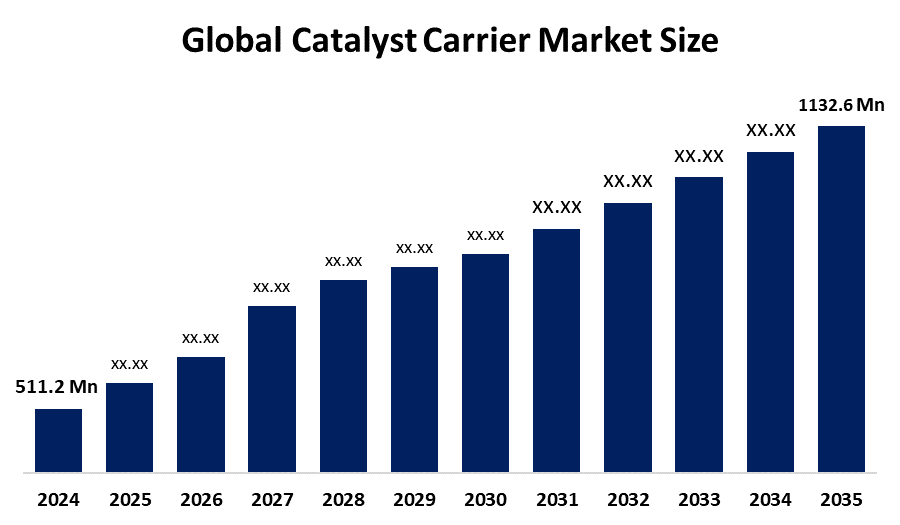

- The Global Catalyst Carrier Market Size Was Estimated at USD 511.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.5% from 2025 to 2035

- The Worldwide Catalyst Carrier Market Size is Expected to Reach USD 1132.6 Million by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Catalyst Carrier Market

The catalyst carrier market consists of materials such as activated carbon, alumina, silica, zirconia, and ceramics that serve as supports for catalysts in various chemical processes. These carriers play a vital role in heterogeneous catalysis by enhancing surface area, improving heat resistance, and maintaining structural integrity during reactions. Commonly used in industries like petrochemicals, chemical manufacturing, and automotive, catalyst carriers help optimize catalyst performance and longevity. Activated carbon is widely used for its cost-effectiveness and high porosity, while alumina and other oxide-based carriers are preferred in high-temperature and demanding reaction environments. Catalyst carriers are available in various shapes such as spheres, extrudates, and rings, tailored for different reactor types and process conditions. The market is categorized based on material type, shape, and end-use industry. As industrial processes become increasingly complex and efficiency-driven, the demand for high-performance catalyst carriers continues to rise, supporting innovations in catalytic technologies across a range of applications.

Attractive Opportunities in the Catalyst Carrier Market

- Growing sustainability concerns are driving the innovation of environmentally friendly and bio-based catalyst carriers that can replace traditional materials, supporting green chemistry initiatives and reducing environmental impact.

- Nanotechnology offers the potential to design catalyst carriers with superior surface area, porosity, and efficiency, leading to better catalytic performance and expanding applications in various industries.

Global Catalyst Carrier Market Dynamics

DRIVER: Increasing demand for efficient and sustainable chemical processes

The catalyst carrier market is driven by several key factors that are accelerating its growth across various industrial sectors. One of the primary drivers is the increasing demand for efficient and sustainable chemical processes, which require high-performance catalysts supported by reliable carriers. The rise in global refining and petrochemical activities, particularly in response to growing energy needs and cleaner fuel mandates, is also boosting the use of catalyst carriers. Additionally, stringent environmental regulations aimed at reducing industrial emissions and improving air quality have led to increased adoption of advanced catalytic technologies in industries such as automotive and manufacturing. Technological advancements in carrier materials, including improved thermal stability, surface area, and porosity, are enhancing catalyst performance and expanding their applications. The shift toward green chemistry and renewable energy sources further supports demand, particularly in emerging areas such as hydrogen production and biomass conversion. These trends collectively contribute to sustained growth in the catalyst carrier market.

RESTRAINT: High cost of advanced carrier materials like alumina

The catalyst carrier market faces several restraining factors that can limit its growth. One major issue is the high cost of advanced carrier materials like alumina, zirconia, and other metal oxides, which can be expensive to produce and process. This makes it difficult for small and medium-sized companies to adopt them widely. The fluctuating prices and limited availability of raw materials also create supply chain risks. Additionally, manufacturing catalyst carriers requires complex processes and technical expertise, which can raise production costs and slow down innovation. Environmental and regulatory concerns related to the sourcing and disposal of certain materials can further increase compliance costs. Another limiting factor is that catalyst systems often have long operational lifespans, so they don’t need to be replaced frequently, which slows down market demand. Together, these challenges can hinder the broader adoption and development of catalyst carriers in some industries.

OPPORTUNITY: Development of eco-friendly and bio-based carrier materials

The catalyst carrier market offers several new opportunities beyond its usual growth areas. One key opportunity is the development of eco-friendly and bio-based carrier materials, which can replace traditional ones and support sustainability efforts. Advances in nanotechnology also create potential for designing carriers with improved performance, such as better surface area and efficiency. Another opportunity lies in the growing demand for specialized carriers in the production of fine and specialty chemicals, where custom solutions are needed for specific reactions. Emerging fields, such as fuel cells, carbon capture, and chemical recycling, are also creating new applications for catalyst carriers. Additionally, research into smart materials, such as carriers that can respond to changes or repair themselves, could lead to exciting innovations. Collaborations between research centers and industry are helping to turn these ideas into real products, offering fresh chances for companies to grow and expand in both established and developing markets.

CHALLENGES: Need for continuous innovation to meet evolving industry demands

The catalyst carrier market also faces several challenges beyond the commonly known restraining factors. One key challenge is the need for continuous innovation to meet evolving industry demands, such as higher efficiency, selectivity, and environmental compatibility in catalytic processes. This requires significant investment in research and development, which may not always guarantee immediate returns. Another challenge is scaling up new carrier technologies from the lab to commercial production while maintaining quality and performance consistency. Additionally, the lack of standardized testing methods and performance benchmarks across different regions and industries can create confusion and slow down product adoption. Intellectual property issues, including patent protection and licensing restrictions, may also hinder the widespread use of certain advanced carrier technologies. Furthermore, integrating new catalyst carriers into existing industrial systems often requires changes in equipment and processes, leading to high switching costs and operational risks for end users, especially in conservative or highly regulated sectors.

Global Catalyst Carrier Market Ecosystem Analysis

The global catalyst carrier market ecosystem includes raw material suppliers, manufacturers, technology developers, end users, and regulators. Suppliers provide key materials like alumina and activated carbon, while manufacturers produce carriers in various forms. Technology developers and research centers drive innovation in advanced and eco-friendly carriers. End users in oil & gas, chemicals, and automotive apply these carriers in catalytic processes. Regulatory bodies ensure compliance with safety and environmental standards. Supporting entities like distributors and testing labs help maintain quality and supply, creating a collaborative network that drives market growth and innovation.

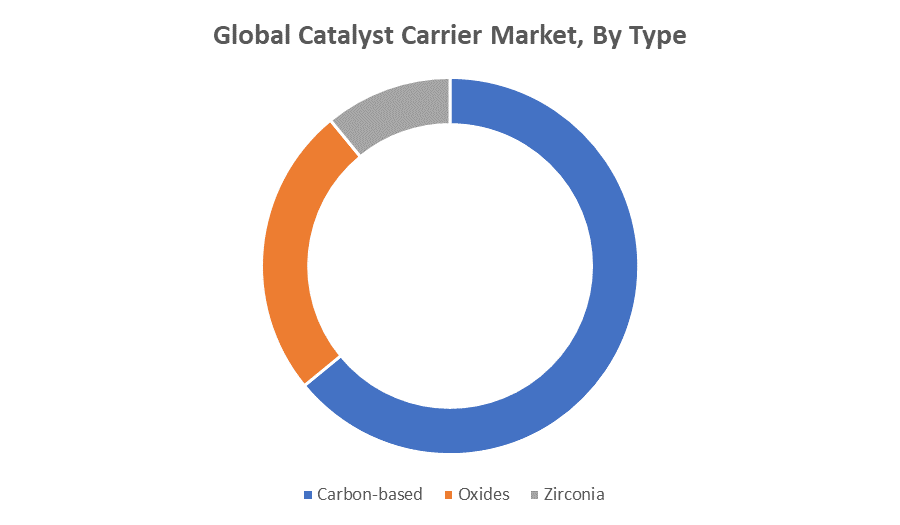

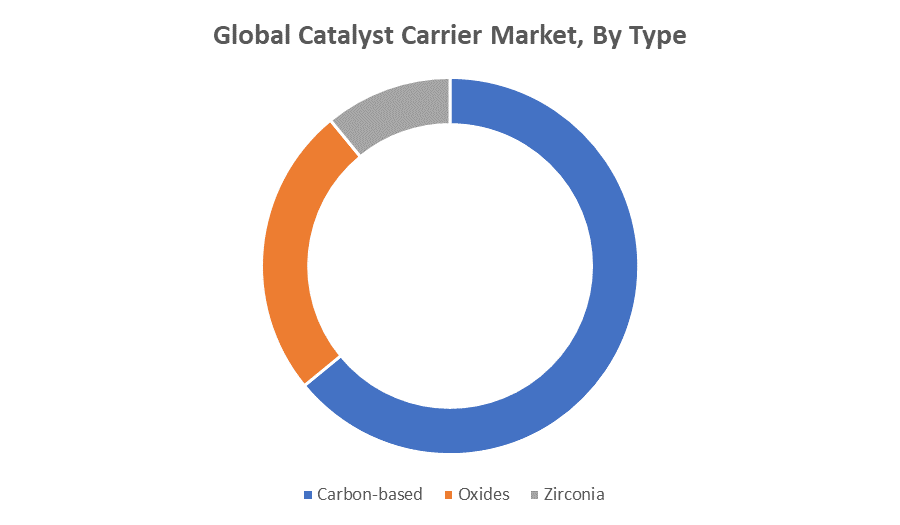

Based on the type, the carbon-based type dominated the global catalyst carrier industry with the highest revenue share over the forecast period

The carbon-based catalyst carriers dominated the global market, holding the highest revenue share throughout the forecast period. Their dominance is attributed to properties like high surface area, excellent porosity, chemical stability, and cost-effectiveness. These characteristics make carbon-based carriers especially suitable for various catalytic processes, including hydrogenation and oxidation reactions. Their versatility and efficiency have driven widespread adoption across industries such as petrochemicals, refining, and chemicals manufacturing, securing their leading position in the catalyst carrier market.

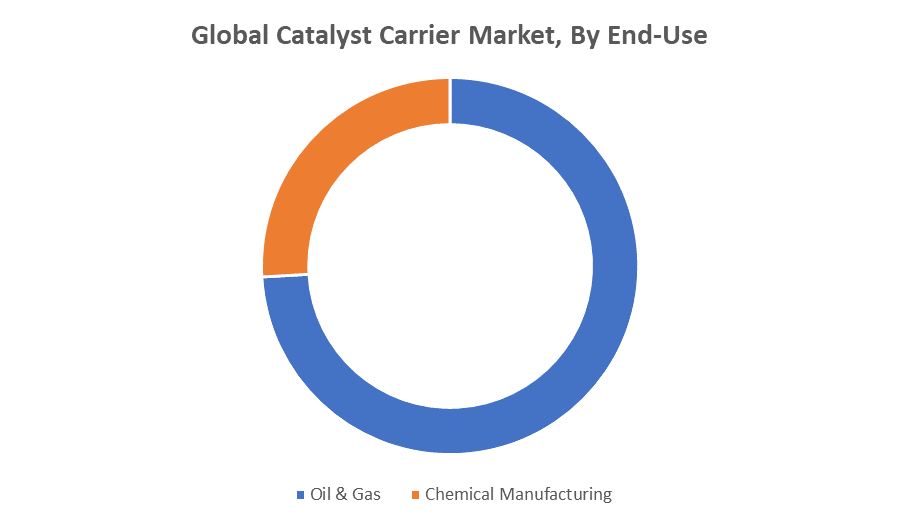

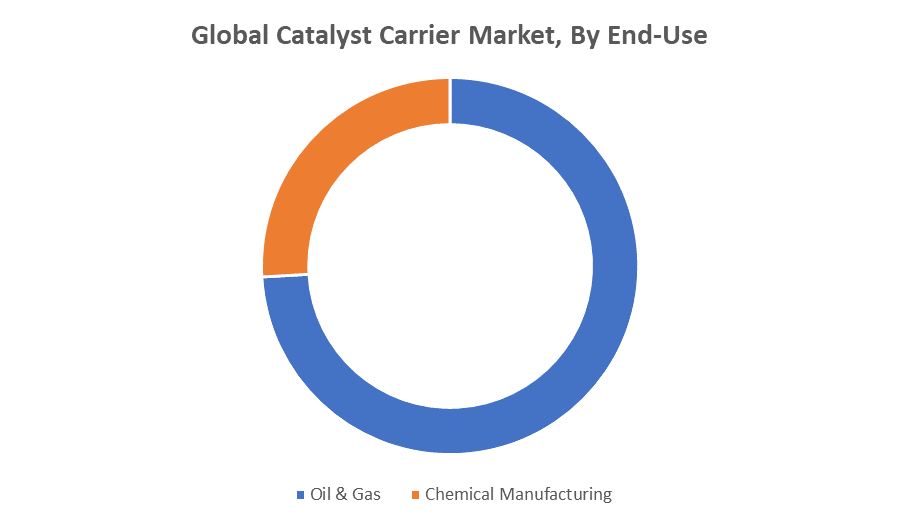

Based on the end-use, the oil & gas end-use dominated the global catalyst carrier industry with a significant revenue share during the forecast period

The oil & gas sector dominated the global catalyst carrier market, capturing a significant revenue share throughout the forecast period. This dominance is driven by the extensive use of catalyst carriers in refining processes such as hydrocracking, hydrotreating, and catalytic reforming. The sector’s continuous need for efficient and high-performance catalysts to produce cleaner fuels and meet stringent environmental regulations further supports the strong demand. As a result, the oil & gas industry remains the largest end-user, playing a crucial role in shaping the growth of the catalyst carrier market.

North America is anticipated to hold the largest market share of the catalyst carrier market during the forecast period

North America is anticipated to hold the largest market share in the catalyst carrier market during the forecast period. This leadership is driven by the region’s well-established oil & gas refining and petrochemical industries, strong focus on advanced technology adoption, and stringent environmental regulations that encourage the use of efficient catalytic processes. Additionally, significant investments in research and development, along with the presence of key market players, contribute to North America’s dominant position in the global catalyst carrier market.

Asia Pacific is expected to grow at the fastest CAGR in the catalyst carrier market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the catalyst carrier market during the forecast period. This rapid growth is fueled by increasing industrialization, expanding oil & gas refining capacities, and rising demand for chemicals and petrochemicals in countries like China, India, and South Korea. Additionally, growing environmental regulations and investments in clean energy technologies are driving the adoption of advanced catalyst carriers in the region. The combination of these factors positions Asia Pacific as the fastest-growing market in the catalyst carrier industry.

Recent Development

- In February 2024, BASF introduced a high-performance alumina catalyst carrier designed for hydrogen production. This carrier offers improved thermal stability and mechanical strength, making it suitable for harsh operating conditions.

- In April 2024, Clariant launched CATOFIN 312, a new catalyst for propane dehydrogenation. The catalyst boasts a 20% longer lifespan and enhanced selectivity, contributing to more efficient chemical processes.

Key Market Players

KEY PLAYERS IN THE CATALYST CARRIER MARKET INCLUDE

- BASF SE

- Clariant AG

- Saint-Gobain NorPro

- Haldor Topsøe A/S

- Johnson Matthey Plc

- W.R. Grace & Co.

- Grace Catalysts Technologies

- Engelhard Corporation

- Axens

- Catalysts & Chemicals Industries S.A.

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the catalyst carrier market based on the below-mentioned segments:

Global Catalyst Carrier Market, By Type

- Carbon-based

- Oxides

- Zirconia

Global Catalyst Carrier Market, By End-use

- Oil & Gas

- Chemical Manufacturing

Global Catalyst Carrier Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa