Compressor Oil Market Size & Trends

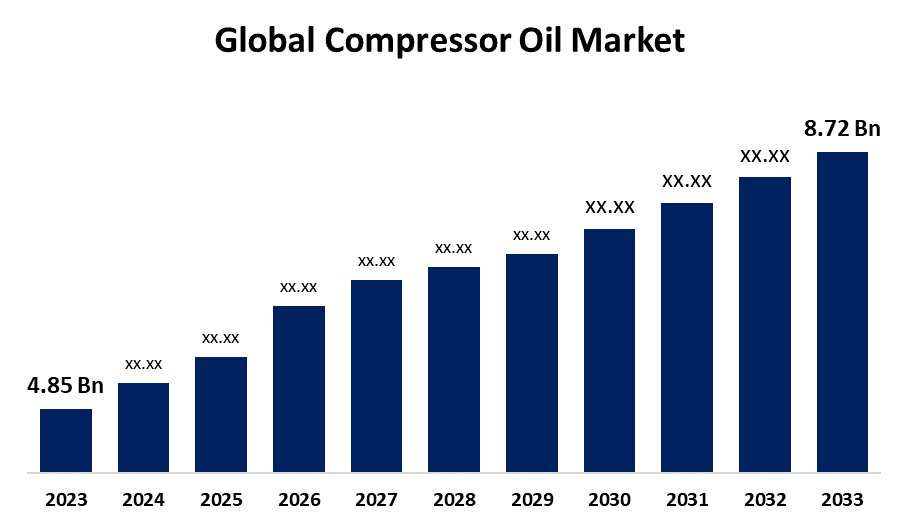

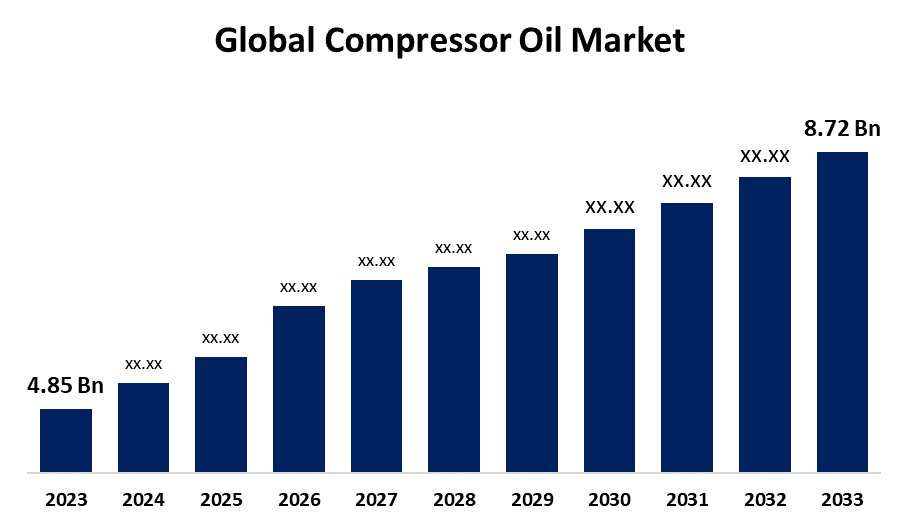

The Global Compressor Oil Market Size Was Estimated at USD 4.85 Billion in 2024 and is Projected to Reach USD 8.72 Billion by 2035, Growing at a CAGR of 5.48% from 2025 to 2035. The expansion of the compressor oil market exists because of several reasons, including industrial development, rising energy needs, and the requirement for efficient energy solutions. The growing market of compressor oil receives additional momentum from technological advancements in compressors, together with tougher environmental regulations and increasing demand from the gas and oil sectors.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 40.3% and dominated the market globally.

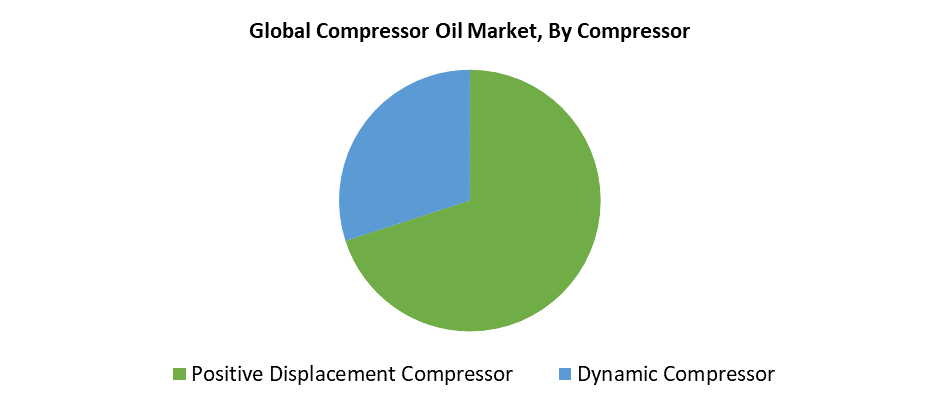

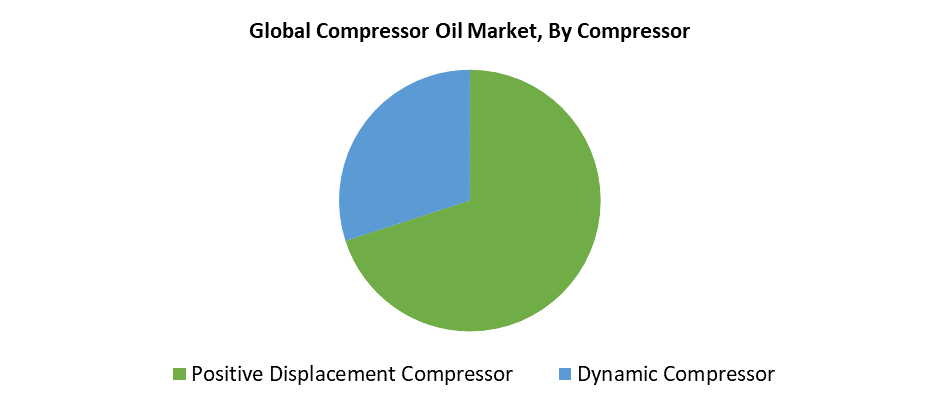

- In 2024, the positive displacement compressor segment had the highest market share by compressor.

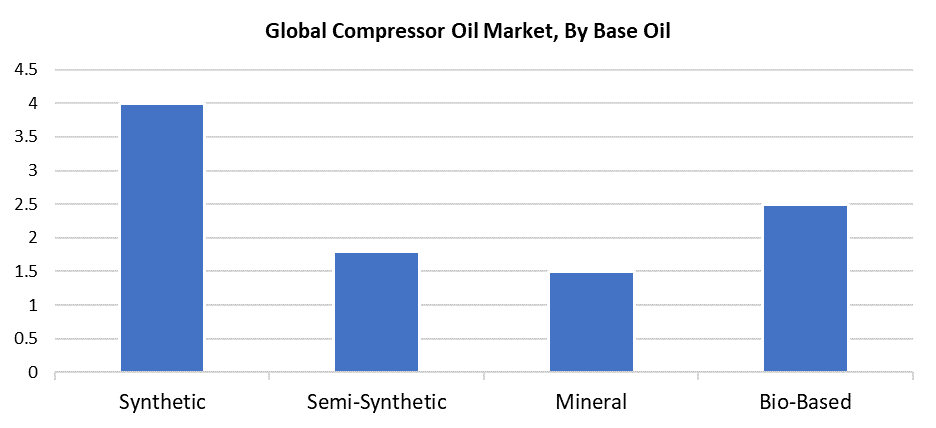

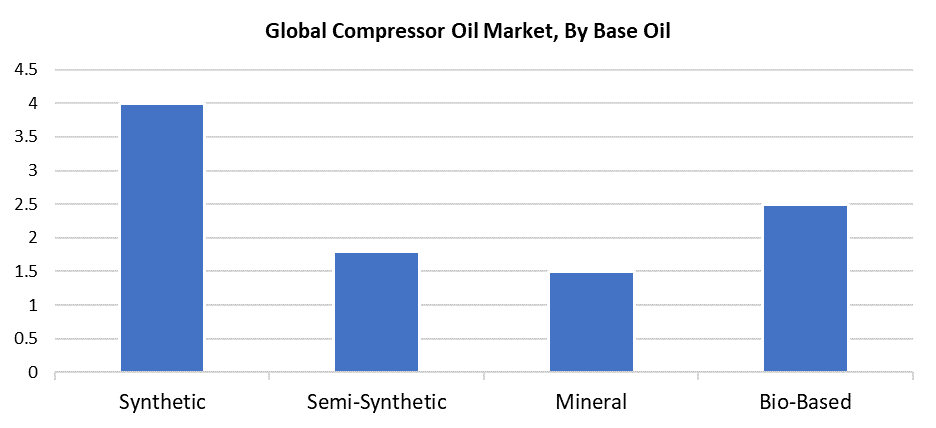

- In 2024, the synthetic base oil segment had the biggest market share by base oil.

-

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.85 Billion

- 2035 Projected Market Size: USD 8.72 Billion

- CAGR (2025-2035): 5.48%

- Asia Pacific: Largest market in 2024

The compressor oil market operates as a worldwide industry that develops and distributes specialty lubricants for compressors. The increasing market value of compressor oil stems from the growing industrial requirements of HVAC, automotive, and manufacturing sectors. The rising demand for specialized lubricants results from the expanding operations of chemical, food processing, aircraft, and construction sectors. The operation of machinery requires compressors to use lubricants, which ensure smooth performance while protecting components from wear and reducing maintenance downtime. Industrial activity growth in emerging nations has created higher demands for reliable lubrication systems and energy efficient compressors. Modern synthetic and bio based oils meet the rising industry requirements by offering advanced thermal stability and extended service periods along with reduced maintenance expenses, which enhances global business competitiveness.

The growth of the compressor oil market is strongly influenced by environmental concerns and regulatory requirements that operate as key drivers. Bio-based oils that reduce carbon footprints and meet stringent environmental standards are gaining popularity because of the increasing industrial focus on sustainability. New developments within lubrication technology work to decrease environmental damage while advancing energy diversification targets. The rising need for energy efficiency in the HVAC and automotive industries drives the creation of oils that possess superior heat dissipation properties alongside enhanced wear resistance capabilities. The advancements drive compressor operational dependability while extending component life, which creates market expansion through cost-effective, sustainable solutions.

Compressor Insights

The positive displacement compressor segment of the compressor oil market maintains its dominant position because of its widespread application in multiple sectors, including construction, petrochemical, and chemical industries. Industries that need to meet rising energy costs and environmental regulations rely on these energy-efficient compressors because they trap and compress air in a chamber. The demand for these compressors stems from their ability to sustain constant pressure levels while delivering optimal results in high-pressure environments, particularly for sectors that need precise and dependable operations. The growing interest in renewable energy has led to higher demand and market share for positive displacement compressors because they fit new applications, including energy storage and hydrogen generation. These systems demonstrate flexibility, which drives continuous growth across different industrial sectors.

The dynamic compressor market is projected to grow substantially throughout the forecast period because it serves vital purposes in mining operations, food processing, automotive applications, and petroleum refining. The oil and gas industry requires proper gas compression mainly for pipeline transmission and petrochemical uses, resulting in global demand for gas turbine maintenance and oil refinery operations that keep rising. The industry receives benefits from energy-efficient technologies because organizations follow rigorous environmental standards. The rising popularity of dynamic compressors stems from their enhanced compression capacity, together with improved energy efficiency. The increasing standards of living combined with urban development have led to higher HVAC system demand, which drives dynamic compressor usage in air conditioning applications. Technological progress, together with expanding industrial operations, leads to faster market share development and sector growth.

Base Oil Insights

The synthetic base oil segment is experiencing strong growth in the compressor oil market, driven by its superior performance, longevity, and environmental compatibility. Synthetic oils possess excellent thermal stability coupled with oxidation resistance and low volatility properties, which make them suitable for use in high-pressure and high-temperature compressor environments. Industries that need to reduce downtime and increase maintenance length are placing higher value on synthetic oil reliability. Synthetic oils gain increased demand from the automotive industry because they deliver enhanced efficiency and meet strict performance standards, which are especially important for hybrid and electric vehicles. Industries are moving toward synthetic solutions because of regulatory requirements that support low-toxicity and biodegradable alternatives. Research continues to develop new synthetic formulations that enhance their implementation across automated and precision industrial systems.

The bio-based oil segment is projected to achieve the fastest CAGR throughout the forecasted period, because of rising environmental awareness combined with worldwide industrial sustainability shifts. The biodegradable and environmentally advantageous substitute for conventional petroleum-based lubricants consists of oils derived from renewable resources that minimize environmental consequences and fossil fuel dependence. The industry uses bio-based compressor oils increasingly to meet environmental standards and achieve business sustainability targets. The automotive industry uses bio-based oils to enhance lubricant performance, together with wear reduction, while developing environmentally friendly car systems. Various industrial sectors use these solutions at increasing levels because they offer high-performing and environmentally sustainable benefits. The ongoing development of formulation and processing methods drives faster growth for this industry.

Regional Insights

The compressor oil market in North America maintains its steady growth because heavy industrial sectors, including automotive and aerospace, which depend heavily on compressors for their successful operations. Machine performance improvement and reduced downtime require high-performance lubricants, which drives this need. Rising temperatures combined with growing urban populations lead to increased air conditioning and refrigeration equipment usage, and this results in rising compressor oil consumption across residential, commercial, and industrial sectors. The region's dedication to sustainability, along with regulatory and energy efficiency requirements, pushes the adoption of synthetic and bio-based oils. North America continues to be a leading market driver because technological advancements, automated systems, and complex machinery drive the need for long-lasting premium lubricants.

U.S. Compressor Oil Market Trends

The United States leads the North American compressor oil market by generating 84.7% of total revenue in 2024 because of rising shale gas extraction and associated compressor operations in gas facilities. The expanding demand for high-performance oils stems from their ability to provide reliable service under extreme pressure and temperature conditions. The growing requirement for effective compressors in the building energy and power generation sectors drives increased lubricant demand because of their infrastructure development. The expansion of industrial production, together with manufacturing growth in the United States, drives compressor oil utilization because these products reduce operational downtime and boost machine operational efficiency. Modern compressor oil compositions that combine environmental sustainability with energy efficiency are gaining popularity because of rising HVAC applications in residential and automotive markets, plus technological progress and environmental regulations.

Asia Pacific Compressor Oil Market Trends

In 2024, the Asia Pacific compressor oil market dominated worldwide by generating 40.3% of total revenue. The growth is because of quick industrialization and urbanization alongside important sector growth in textiles, metallurgy, food processing, and chemicals. The rising requirement for compressor systems comes from major investments in energy and infrastructure made by countries including China and India, and Southeast Asian nations. The demand for high-performance compressor oils that enhance operational efficiency while minimizing downtime proves essential for today’s operations. Companies adopt advanced synthetic and bio-based oils because they transition to energy-efficient solutions, which stems from both rising energy prices and increasing environmental awareness. The continuous product development efforts of manufacturers lead to solutions that meet various industrial requirements, which ensures both international market success and consistent domestic market development.

Key Compressor Oil Companies:

The following are the leading companies in the compressor oil market. These companies collectively hold the largest market share and dictate industry trends.

- Shell plc

- Hitachi, Ltd.

- Atlas Copco Group

- Exxon Mobil Corporation

- Siemens AG

- Repsol

- FUCHS

- Chevron Corporation

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- KAESER KOMPRESSOREN

- Others

Recent Developments

- In February 2025, Chevron disclosed its plan to reduce employee numbers by 15% to 20% which will result in 6,830 to 9,100 position eliminations as part of an organizational reform. The layoffs target 45,000 employees across the organization since their purpose is to boost productivity levels, along with centralized operations and improved results. According to Vice Chairman Mark Nelson, the company plans to complete its workforce reductions by the end of 2026 to establish better competitiveness over the long term. Chevron did not reveal which specific locations will face workforce reductions.

- In October 2024, RSC Bio Solutions introduced FUTERRA Compressor Oils, synthetic lubricants that are known for their sustainability while meeting performance requirements for both industrial and marine applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the compressor oil market based on the below-mentioned segments:

Global Compressor Oil Market, By Compressor

- Positive Displacement Compressor

- Dynamic Compressor

Global Compressor Oil Market, By Base Oil

- Synthetic

- Semi-Synthetic

- Mineral

- Bio-Based

Global Compressor Oil Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa