Containerboard Market Summary

The Global Containerboard Market Size was Estimated at USD 98.7 Billion in 2024 and is projected to Reach USD 217.8 Billion by 2035, Growing at a CAGR of 7.46% from 2025 to 2035. A number of significant factors are driving the containerboard market's expansion, such as the expanding e-commerce industry, the growing need for environmentally friendly packaging, and the acceleration of urbanization and industrialization in emerging nations.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific containerboard market accounted for 51.63% revenue share and dominated the market globally.

- In 2024, the regional containerboard market was dominated by the U.S. market.

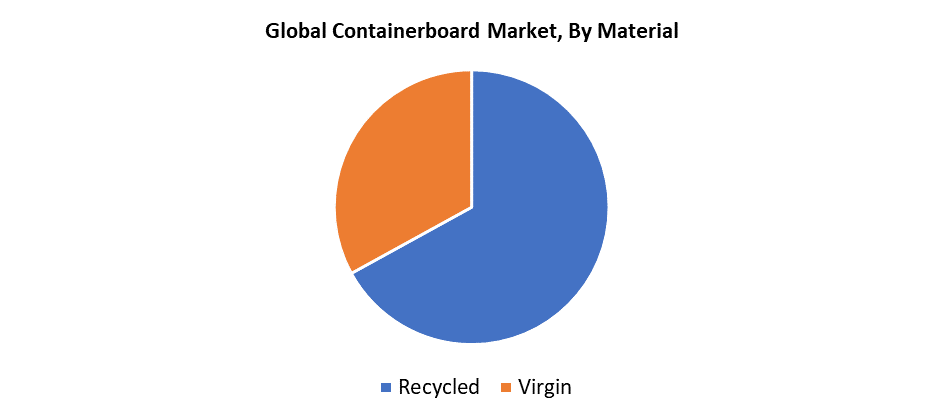

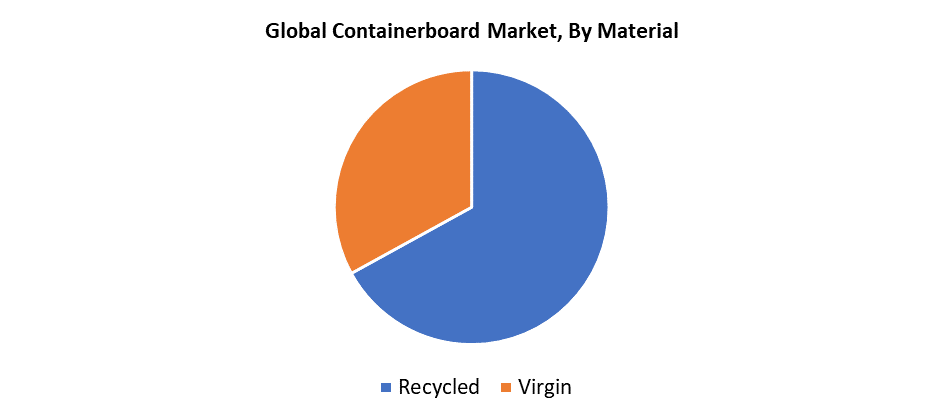

- With a revenue share of 67.82% in 2024, the recycled material category dominated the market by material.

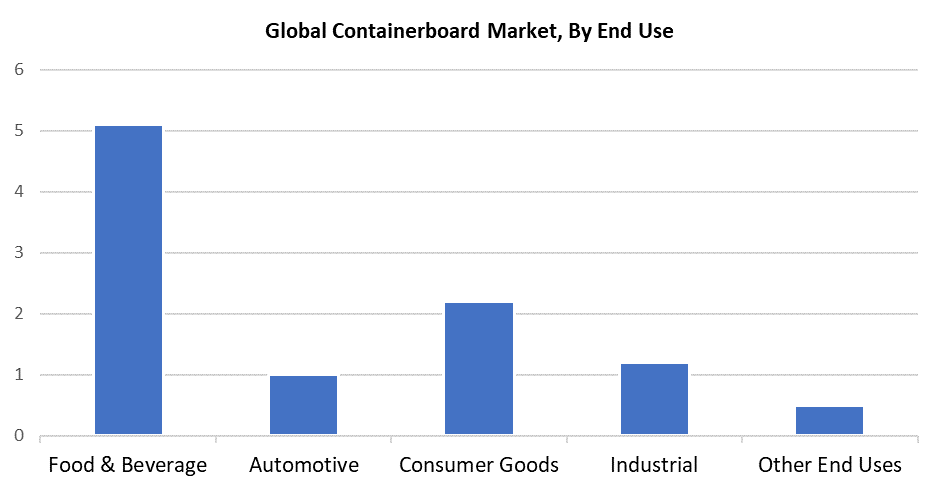

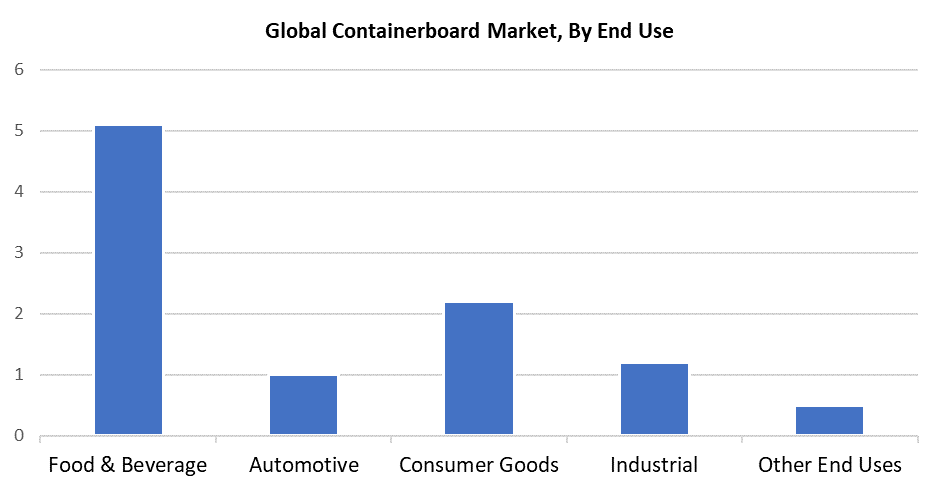

- In 2024, the food and beverage segment led the market by end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 98.7 Billion

- 2035 Projected Market Size: USD 217.8 Billion

- CAGR (2025-2035): 7.46%

- Asia Pacific: Largest market in 2024

The global containerboard market represents the worldwide trade of paperboard materials, which manufacturers use to create corrugated boxes and other packaging products. Multiple industries, including food and beverage, consumer goods, and e-commerce, create demand for packaging materials that leads to containerboard production and distribution. The containerboard market experiences fast growth because consumers increasingly choose packaging options that are recyclable and environmentally sustainable. The renewable content combined with strength, light weight, and flexibility makes containerboard suitable for packaging applications across food and beverage, consumer goods, healthcare, agriculture, and e-commerce sectors. The rise in packaged food consumption and internet shopping has led to greater demand for strong packaging materials that contain moisture-resistant characteristics, such as containerboard. The packaging material gains market appeal through its ability to cut shipping expenses and protect delicate items during transportation. The circular economy approach, which allows recycled containerboard to become new packaging material, boosts its environmental benefits, thus motivating companies to use containerboard for their sustainability goals.

The market experiences growth because of technological improvements in production and printing systems. Containerboard serves as an effective marketing and branding tool because it enables the printing of superior graphical designs. Emerging digital printing technologies allow manufacturers to produce customized high-volume liner and post-print products, which creates new business development opportunities. The entire value chain depends on the quality of recycled paper and wood fiber, which extends from raw material suppliers to manufacturers and distributors. The implementation of government regulations about virgin wood fiber usage and tree-cutting practices creates challenges for business growth because these measures aim to protect the environment. Industry consolidation through mergers and acquisitions, such as Mondi's recent European expansion, helps to drive long-term market growth while adding production capabilities and geographic market reach.

Material Insights

The containerboard market experienced recycled material segment dominance with a revenue share of 67.82% in 2024, because environmental concerns, together with sustainable packaging requirements, are rising. The durability of recycled fibers allows them to be used multiple times, which supports waste reduction programs and circular economic practices. This market remains the preferred choice because it provides affordability alongside governmental sustainability compliance, making it suitable for standard packaging across industrial and food sectors. The rising consumer and corporate understanding of sustainable practices drives the adoption of recycled containerboard to meet environmental supply chain targets. The shift toward sustainable packaging reflects how companies prefer recycled materials to decrease their environmental footprint while meeting market and regulatory changes.

The virgin material segment will experience a consistent CAGR of 6.7% during the forecast period. The rising demand for this product stems from its ability to provide dependable strength together with durability and superior printability, which are essential for packing heavy and fragile items. The main component used in manufacturing premium pulp for virgin containerboard consists of wood fibers, which originate from tree cutting. The high demand for virgin containerboard stems from its outstanding stacking strength, compression resistance, and moisture protection, which serve the needs of e-commerce operations and international trade, along with industries that require heavy-duty packaging solutions. The combination of these features makes it an ideal choice for transporting valuable or sensitive objects. Environmental regulations, along with concerns about natural resource depletion, may limit market expansion.

End Use Insights

Food and beverage businesses lead the containerboard industry because of rising needs for sustainable packaging solutions that are environmentally friendly, affordable, and long-lasting. The combination of strength, light weight, vibration, and crush resistance properties makes containerboard-based corrugated boxes ideal for storing and transporting food products. Containerboard reduces total packing and shipping costs, which makes it an affordable alternative for this industry. The two properties of containerboard recycling and biodegradability have driven the rising consumer interest in sustainable packaging solutions. Food and beverage producers aim to implement environmentally sustainable packaging methods that match this trend. The market growth reflects a broader movement toward environmentally sustainable packaging solutions, which maintain product protection while minimizing environmental harm.

The consumer goods sector is expected to drive the fastest market growth during the forecast period because of improving living standards and expanding purchasing power alongside fast urbanization in both developed and developing countries. Containerboard packaging represents a cost-effective, flexible solution for companies seeking to enhance their product presentation and appeal to customers. Well-designed, branded containerboard packaging plays a crucial role in building strong brand identities and helps products gain visibility in competitive markets. The rising popularity of consumer goods, along with market competition, and this trend will drive substantial containerboard packaging demand, which will lead to market expansion throughout the forecast period.

Regional Insights

The North American containerboard market accounted for 17.5% revenue share during 2024. The main growth factors include rising environmental awareness and legislation that mandates sustainable packaging solutions. The rising popularity of containerboard among industries results from consumer demand for packaging solutions that combine lightweight features with durability and environmental sustainability. The expanding retail sector, together with fast-growing e-commerce operations, drives increased demand for containerboard because it delivers affordable and efficient solutions required for supply chain operations and logistics. The regional focus on sustainable and energy-efficient building materials pushes developers to explore novel containerboard applications beyond packaging. Construction modernization projects and favorable economic conditions, together with supportive government policies, drive market growth. North America will see significant containerboard expansion because of its sustainability initiatives and developing end-use industries.

U.S. Containerboard Market Trends

The U.S. containerboard market dominated the North American region in 2024 because the packaged food industry continues to grow. The market receives steady demand because containerboard corrugated boxes serve as packaging material for glass products, as well as chemicals, food items, along with beverages and other consumer merchandise. Consumer tastes that favour quick packaged meals contribute to the market growth. The fast growth of e-commerce creates high demand for packaging materials that combine strength with lightweight design and affordable cost. Containerboard packaging experiences increasing popularity because internet purchasing continues its growth trend. Supply chain logistics and distribution improvements emphasize the need for proper packaging, which strengthens the US market's containerboard dominance in the regional market.

Europe Containerboard Market Trends

The European containerboard market holds the second-largest position globally because of its strong emphasis on sustainable packaging and environmentally safe packaging choices. Businesses must use containerboards made from recycled paper according to regulations that require recyclable and eco-friendly materials. The food along with beverage, and retail industries drive higher demand for packaging materials that offer extended durability and superior quality. The growth of e-commerce creates higher demand for dependable packaging solutions that are environmentally friendly. The manufacturing industry achieves enhanced product quality together with improved production efficiency through technological developments, which drive market expansion in Europe. The commitment of Europe to green policies, together with customer sustainability understanding, drives the shift toward eco-friendly packaging solutions. The need for distinctive packaging solutions creates support for the containerboard market growth in the region.

Asia Pacific Containerboard Market Trends

The Asia Pacific containerboard market dominates the global industry, accounting for 51.63% of worldwide revenue. The market expansion arises from industrial growth alongside growing consumer spending across the consumer goods sectors and the agricultural and food and beverage sectors. The demand for packaged goods increases because containerboard provides durable packaging solutions that meet the versatility needs of rising urban populations and growing individual incomes. Economic growth in key nations such as China and India have led to increased containerboard usage because of the manufacturing and packaging sectors. E-commerce industry growth creates substantial demand for containerboard as the region requires dependable, affordable, lightweight packing materials. The growing middle class with increased spending ability leads to higher packaged goods consumption, which maintains Asia Pacific's market leadership and predicts ongoing containerboard industry growth.

Key Containerboard Companies:

The following are the leading companies in the containerboard market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper

- Cascades Inc.

- Sappi Ltd

- Smurfit Westrock

- Mondi

- Greif

- OJI FIBRE SOLUTIONS (NZ) LTD

- Nine Dragons Worldwide (China) Investment Group Co., Ltd

- Georgia-Pacific

- Stora Enso

- Packaging Corporation of America

- Others

Recent Developments

- In January 2025, International Paper acquired DS Smith, which operates from its London headquarters. The merged entity intends to lead the packaging industry through its environmentally friendly solutions while boosting its presence in the expanding North American and European markets.

- In July 2024, Smurfit Kappa, together with WestRock, formed Smurfit Westrock, which established a global leader in eco-friendly packaging solutions. The new firm plans to become a global packaging partner by utilizing its combined capabilities and unmatched geographic presence throughout 40 nations through its complementary product offerings and advanced sustainability features.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the containerboard market based on the below-mentioned segments:

Global Containerboard Market, By Material

Global Containerboard Market, By End Use

- Food & Beverage

- Automotive

- Consumer Goods

- Industrial

- Other End Uses

Global Containerboard Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa