Global Tallow Fatty Acid Market Size, Share, and COVID-19 Impact Analysis, By Type (Monounsaturated Fatty Acid, Polyunsaturated Fatty Acid, and Saturated Fatty Acid), By Form (Liquid and Solid), By End User (Animal Feed, Cosmetics and Personal Care Industry, Food and Beverages Industry, Biodiesel, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Tallow Fatty Acid Market Size Insights Forecasts to 2035

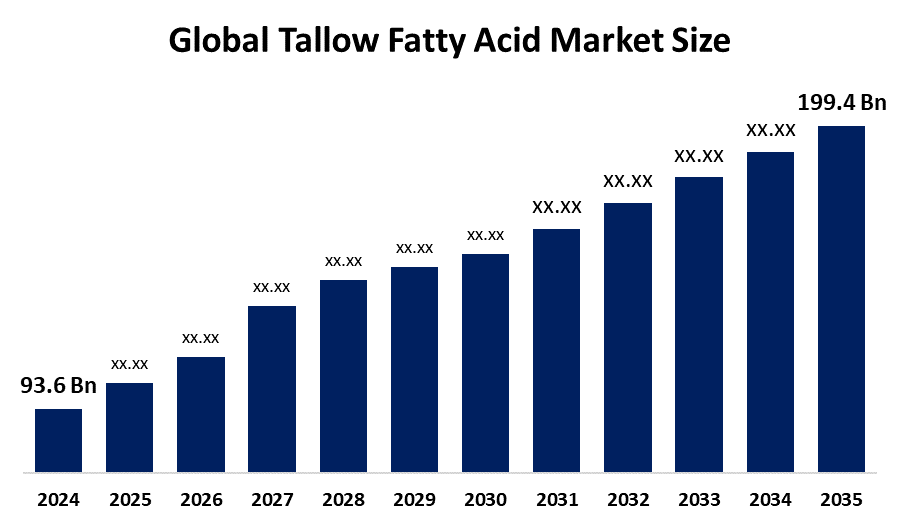

- The Global Tallow Fatty Acid Market Size Was Estimated at USD 93.6 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.12% from 2025 to 2035

- The Worldwide Tallow Fatty Acid Market Size is Expected to Reach USD 199.4 Billion by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Tallow Fatty Acid Market Size was worth around USD 93.6 Billion in 2024 and is predicted to Grow to around USD 199.4 Billion by 2035 with a compound annual growth rate (CAGR) of 7.12% from 2025 to 2035. The worldwide tallow fatty acid market experiences growth because people demand sustainable feedstock, which comes from waste materials for biofuels, because customers prefer personal care products that provide high moisturizing benefits and because the soap, detergent and lubricant industries need to use tallow fatty acids.

Market Overview

The global tallow fatty acid market revolves around the production and sale of fatty acids derived from animal tallow, a by-product of the meat and livestock industry. The versatile fatty acids from these products enable their application in soap and detergent, cosmetic and lubricant, candle and industrial chemical production. The market experiences growth because people need more personal care products, industrial uses of products expand, and people choose natural, sustainable materials instead of synthetic materials.

The U.S. introduced the Clean Fuel Production Tax Credit (Section 45Z) in January 2026 to replace the Blender's Tax Credit. The policy establishes domestic feedstock priorities, which include soybean oil and animal fats, thus decreasing imported tallow and used cooking oil incentives and altering renewable fuel market operations and trade relationships. The constant supply of animal fat resources maintains availability, while urbanization and increasing household incomes in developing countries produce new possibilities for product consumption. The development of technology in refining and processing methods results in both better product quality and a wider product application range. The main market companies, such as BASF SE, Oleon NV, Godrej Industries, Emery Oleochemicals and KLK Oleo, are using strategic growth through mergers and product development to expand their international market reach. The increasing use of biofuels together with green chemicals demonstrates major development possibilities in this sector.

Report Coverage

This research report categorizes the tallow fatty acid market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the tallow fatty acid market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the tallow fatty acid market.

Global Tallow Fatty Acid Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 93.6 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.12% |

| 2035 Value Projection: | USD 199.4 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | Cargill, Incorporated, Godrej Industries, Wilmar International Ltd, KLK Oleo, Emery Oleochemicals, BASF SE, AkzoNobel, Oleon NV, Vantage Specialty Chemicals, Baerlocher GmbH, FerroMac International, VVF L.L.C., Colgate Palmolive, Ajinomoto Co., Inc., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global tallow fatty acid market expands because personal care and cosmetic products, as well as soaps, require tallow fatty acids for their moisturizing and emulsifying functions. The combination of increased consumer hygiene awareness, together with rising disposable incomes and F&B sector growth, drives higher product consumption. The company achieves growth because its sustainable low-carbon feedstock functions as a biofuel and bio-lubricant feedstock, which environmental regulations demand. The industrial sector requires rubber and plastic materials, which are used for stabilization and lubrication purposes. The market generates advantages through its affordable pricing and the growing use of environmentally friendly products, which support circular economic systems.

Restraining Factors

High raw material price fluctuations, together with strict animal byproduct regulations and strong competition from plant-based products such as palm oil, stand as primary obstacles for the worldwide tallow fatty acid market. The market experiences restrictions because people choose vegan, ethical, and cruelty-free products, while supply chains face interruptions from livestock disease outbreaks.

Market Segmentation

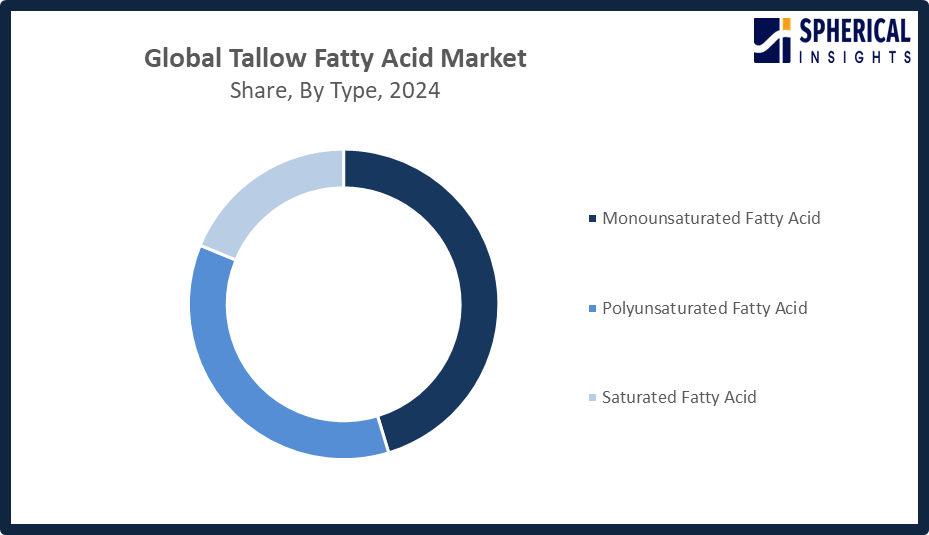

The tallow fatty acid market share is classified into type, form, and end user.

- The monounsaturated fatty acid segment dominated the market in 2024, approximately 45% and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the tallow fatty acid market is divided into monounsaturated fatty acid, polyunsaturated fatty acid, and saturated fatty acid. Among these, the monounsaturated fatty acid segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The market experienced its main growth through the monounsaturated fatty acid segment, which people use extensively in cosmetics and personal care products and lubricants. The product gains high demand because of its exceptional skin compatibility, product stability and multiple application possibilities, which manufacturers use in their formulations across different markets that now focus on natural, sustainable products.

Get more details on this report -

- The solid segment accounted for the largest share in 2024, approximately 57% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the form, the tallow fatty acid market is divided into liquid and solid. Among these, the solid segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The solid segment growth is due to its substantial saturated fatty acid content, which serves as a perfect match for making soaps, detergents, candles, and rubber materials. The market experienced strong growth because the product combines stability and hardness with various industrial and personal care uses and rising demand from new markets.

- The cosmetics and personal care industry segment accounted for the highest market revenue in 2024, approximately 40% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end user, the tallow fatty acid market is divided into animal feed, cosmetics and personal care industry, food and beverages industry, biodiesel, and others. Among these, the cosmetics and personal care industry segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The cosmetics and personal care industry segment accounted for the highest market growth due to rising demand for soaps, creams, lotions, and shampoos containing tallow fatty acids. The product attracts consumers through its emollient characteristics and affordable price, and natural source, while urbanization and rising disposable income levels in emerging markets drive higher product sales.

Regional Segment Analysis of the Tallow Fatty Acid Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the tallow fatty acid market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the tallow fatty acid market over the predicted timeframe. The tallow fatty acid market will experience its 43% market share in Asia-Pacific due to industrial growth, increasing consumer demand for personal care products, biodiesel production and urban development. The major tallow markets in Asia include China, India, Indonesia and Malaysia, which all possess strong livestock industries that provide raw tallow together with increased consumer income and a growing demand for sustainable natural products. The region experienced significant growth in January 2025 because fatty acids, which serve as essential components for soaps and cosmetics, detergents, food and industrial products, achieved widespread use. Hydrolysis-based production processes continue to operate while the market growth receives support from the production of fatty alcohols, amines and esters.

North America is expected to grow at a rapid CAGR in the tallow fatty acid market during the forecast period. The tallow fatty acid market in North America will experience a 25% share of rapid growth because consumers increasingly demand bio-based sustainable products, and the market for tallow fatty acids expands into personal care products, soaps, detergents and biodiesel and because Renewable Fuel Standard updates and Clean Fuel Production Tax Credits create supportive policies. The United States leads the market because industrial consumption remains high, refining technologies advance, and customers choose eco-friendly oleochemical products. The National Oilseed Processors Association recommended RFS volume increases in 2025, which would give preference to domestic feedstocks while restricting imported tallow and UCO to benefit local producers.

The European tallow fatty acid market shows continuous expansion due to increasing demand for soaps and detergents, personal care products, and bio-based chemicals, which coincide with the implementation of RED III sustainability regulations. The major countries in the market include Germany, France, and the UK, which maintain strong cosmetic and oleochemical sectors. The EU established RED III in June 2025, which required more stringent traceability through the Union Database for Biofuels, while providing better sustainability tracking for tallow and waste oils, which would decrease import levels and create supply and price effects within the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the tallow fatty acid market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, Incorporated

- Godrej Industries

- Wilmar International Ltd

- KLK Oleo

- Emery Oleochemicals

- BASF SE

- AkzoNobel

- Oleon NV

- Vantage Specialty Chemicals

- Baerlocher GmbH

- FerroMac International

- VVF L.L.C.

- Colgate Palmolive

- Ajinomoto Co., Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In May 2025, Cargill food scientist Israel Ortega and his team helped 75 leading Mexican food companies reformulate products like cakes, cookies, snacks, and coffee creamers to comply with WHO’s REPLACE initiative, successfully reducing industrially produced trans-fatty acids (iTFA) in the country’s food supply.

- In February 2025, KLK OLEO expanded operations in India by launching KLK OLEO India (KLKOI) in Mumbai. The company offers a wide oleochemical portfolio, from fatty acids and glycerine to specialty products like surfactants, serving industries including personal care, pharmaceuticals, food, lubricants, polymers, and industrial chemicals.

- In March 2025, Vantage announced the launch of four new personal care ingredients at the in-cosmetics Global tradeshow in Amsterdam. The products emphasize natural, efficacy-driven formulations for skin and hair care, reflecting Vantage’s expertise in premium natural oils and sustainable ingredients.

- In December 2024, the EU reinforced sustainability rules under RED III, tightening traceability requirements through the Union Database for Biofuels. The updated framework strengthens compliance standards for bio-based feedstocks such as tallow and waste oils, potentially restricting non-compliant imports and impacting European biofuel feedstock availability and pricing.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the tallow fatty acid market based on the below-mentioned segments:

Global Tallow Fatty Acid Market, By Type

- Monounsaturated Fatty Acid

- Polyunsaturated Fatty Acid

- Saturated Fatty Acid

Global Tallow Fatty Acid Market, By Form

- Liquid

- Solid

Global Tallow Fatty Acid Market, By End User

- Animal Feed

- Cosmetics and Personal Care Industry

- Food and Beverages Industry

- Biodiesel

- Others

Global Tallow Fatty Acid Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the tallow fatty acid market over the forecast period?The global tallow fatty acid market is projected to expand at a CAGR of 7.12% during the forecast period.

-

2. What is the market size of the tallow fatty acid market?The global tallow fatty acid market size is expected to grow from USD 93.6 billion in 2024 to USD 199.4 billion by 2035, at a CAGR of 7.12% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the tallow fatty acid market?Asia Pacific is anticipated to hold the largest share of the tallow fatty acid market over the predicted timeframe.

-

4. What is the global tallow fatty acid market?The global tallow fatty acid market is the worldwide industry producing animal fat–derived fatty acids for soaps, cosmetics, lubricants, and chemicals.

-

5. Who are the top 10 companies operating in the global tallow fatty acid market?Cargill, Incorporated, Godrej Industries, Wilmar International Ltd, KLK Oleo, Emery Oleochemicals, BASF SE, AkzoNobel, Oleon NV, Vantage Specialty Chemicals, Baerlocher GmbH, and Others.

-

6. What factors are driving the growth of the tallow fatty acid market?The drivers include soaring demand for sustainable biodiesel, increased use in personal care and soap manufacturing, rising popularity of natural ingredients, and growing industrial applications for eco-friendly lubricants and plastics.

-

7. What are the market trends in the tallow fatty acid market?Key trends include rising demand for sustainable, traceable sourcing in personal care, increased biofuel feedstock usage, and growth in eco-friendly, biodegradable products.

-

8. What are the main challenges restricting wider adoption of the tallow fatty acid market?The challenges restricting wider adoption of the tallow fatty acid market include high raw material price volatility, intense competition from plant-based alternatives, strict environmental regulations, and growing consumer demand for vegan/cruelty-free products.

Need help to buy this report?