North America Biodiesel Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Vegetable Oils, Used Cooking Oil, Animal Fats, Algae and Others), By Blend Type (B5, B10, B20, and B100), By End User (Transportation, Power Generation, Agriculture, Marine and Industrial Heating), and North America Biodiesel Market Insights, Industry Trends, Forecast to 2035

Industry: Chemicals & MaterialsNorth America Biodiesel Market Insights Forecasts to 2035

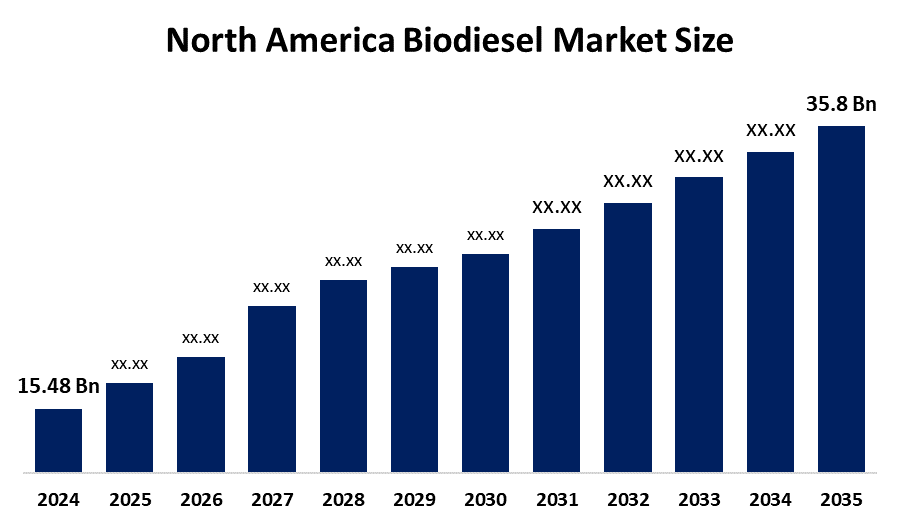

- The North America Biodiesel Market Size Was Estimated at USD 15.48 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 7.92% from 2025 to 2035

- The North America Biodiesel Market Size is Expected to Reach USD 35.8 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The North America Biodiesel Market Size Is Anticipated To Reach USD 35.8 Billion By 2035, Growing At A CAGR Of 7.92% From 2025 to 2035. The market is driven by the rising concerns over greenhouse gas emissions, and the need for sustainable energy solutions has led to greater adoption of biodiesel, a renewable, cleaner-burning alternative to traditional fossil fuels.

Market Overview

The biodiesel market in the United States operates under government regulations that establish sustainable energy policies and greenhouse gas emission reduction targets. This situation grows more severe because people now worry about their energy supply security while international oil prices remain unstable. Biodiesel production occurs through the transesterification process, which converts vegetable oils and animal fats into biodiesel that can be used either as pure biodiesel or in diesel fuel blends. The fuel finds extensive application in commercial trucking and municipal bus fleets which include school buses and delivery vehicles used by companies such as Walmart and UPS.

In January 2024, the USDA declared that it would distribute 19 million in grants to support domestic biofuel production across 22 states. The grants will be made to U.S. business owners through the Higher Blends Infrastructure Incentive Program.

The US Department of the Treasury will release a long-awaited proposal that defines the requirements for obtaining the 45Z tax credit that first became available in 2025 because Republicans extended it through their tax and energy legislation last summer. In December 2025, the American Petroleum Institute (API) joined organizations representing ethanol producers, oil refiners, fuel marketers, travel plazas, truck stops and convenience store retailers to express the need for long-term policy certainty across the transportation fuel sector.

Report Coverage

This research report categorises the North America biodiesel market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the North America biodiesel market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the North America biodiesel market.

North America Biodiesel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 15.48 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.92% |

| 2035 Value Projection: | USD 35.8 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Feedstock, By Blend Type |

| Companies covered:: | Archer Daniels Midland Chevron Renewable Energy Group Valero Energy Cargill Nestle Marathon Petroleum ASB Biodiesel New Leaf Biofuel Renewable Energy Group Bio Fuel Oasis Others Key players |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The biodiesel market in North America is driven by the biodiesel market grows because of three factors, which include increasing environmental problems and government regulations that include the Renewable Fuel Standard (RFS) and the rising need for low-carbon fuels. The requirement to decrease greenhouse gas (GHG) emissions and achieve climate targets, which include the Paris Agreement, drives demand from hard-to-abate sectors like trucking and shipping. The U.S. Renewable Fuel Standard (RFS) functions as a vital force that establishes yearly biofuel blending obligations that transportation fuels must fulfil.

Restraining Factors

The biodiesel market in North America is restrained by producers facing reduced profit margins because they encounter two primary challenges, which include rising competition for vegetable oils and waste residues, such as used cooking oil and tallow.

Market Segmentation

The North America biodiesel market share is categorised into feedstock, blend type, and end user.

- The vegetable oils segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Biodiesel Market Size is segmented by feedstock into vegetable oils, used cooking oil, animal fats, algae and others. Among these, the vegetable oils segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the increasing need for sustainable petroleum alternatives and the governmental efforts which support biofuel development. The process of converting vegetable oils into biodiesel has become more efficient because of technological advancements that have been developed.

- The B20 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on blend type, the North America Biodiesel Market Size is segmented into B5, B10, B20, and B100. Among these, the B20 segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The segmental growth is driven by the product delivering environmental advantages together with its outstanding operational capabilities. The fuel can be used in all diesel engines without any need for engine modifications, which results in wide-scale adoption of the fuel. B20 fuel achieves reduced emissions when compared to standard diesel fuel enhances its market value and driving industry growth.

- The transportation segment accounted for the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The North America Biodiesel Market Size is segmented by end user into transportation, power generation, agriculture, marine and industrial heating. Among these, the transportation segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth of the segment is driven by the diesel engines used in trucking operations, logistics work, and heavy-duty vehicle operations, which use this fuel because government regulations require its38 mandatory blending with other fuels. The system controls over 50% of the market share in application studies because it offers two main advantages, which include its ability to work with current systems and its positive impact on the environment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the North America Biodiesel Market Size, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland

- Chevron Renewable Energy Group

- Valero Energy

- Cargill

- Nestle

- Marathon Petroleum

- ASB Biodiesel

- New Leaf Biofuel

- Renewable Energy Group

- Bio Fuel Oasis

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

In December 2025, ABC and RFA announced the launch of American Biofuels Maritime Initiative. The new group plans to work with President Trump’s Administration and Congress to establish strong policies that accelerate the use of American-made energy and biofuels in the global maritime sector.

Market Segment

This study forecasts revenue at the North America, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the North America biodiesel market based on the below-mentioned segments:

North America Biodiesel Market, By Feedstock

- Vegetable Oils

- Used Cooking Oil

- Animal Fats

- Algae

- Others

North America Biodiesel Market, By Blend Type

- B5

- B10

- B20

- B100

North America Biodiesel Market, By End User

- Transportation

- Power Generation

- Agriculture

- Marine

- Industrial Heating

Frequently Asked Questions (FAQ)

-

What is the North America biodiesel market size?North America biodiesel market size is expected to grow from USD 15.48 billion in 2024 to USD 35.8 billion by 2035, growing at a CAGR of 7.92% during the forecast period 2025-2035

-

What is biodiesel, and its primary use?The biodiesel market in the United States operates under government regulations that establish sustainable energy policies and greenhouse gas emission reduction targets. Biodiesel production occurs through the transesterification process, which converts vegetable oils and animal fats into biodiesel that can be used either as pure biodiesel or in diesel fuel blends.

-

What are the key growth drivers of the market?Market growth is driven by the biodiesel market grows because of three factors, which include increasing environmental problems and government regulations that include the Renewable Fuel Standard (RFS) and the rising need for low-carbon fuels.

-

What factors restrain the North America biodiesel market?The market is restrained by producers facing reduced profit margins because they encounter two primary challenges, which include rising competition for vegetable oils and waste residues, such as used cooking oil and tallow

-

How is the market segmented by feedstock?The market is segmented into vegetable oils, used cooking oil, animal fats, algae and others.

-

Who are the key players in the North America biodiesel market?Key companies include Archer Daniels Midland, Chevron Renewable Energy Group, Valero Energy, Cargill, Neste, Marathon Petroleum, ASB Biodiesel, New Leaf Biofuel, Renewable Energy Group, and BioFuel Oasis

Need help to buy this report?