United States Biofuels Market Size, Share, and COVID-19 Impact Analysis, By Feedstock (Corn, Sugarcane, Vegetable Oils, and Others), By Application (Transportation, Aviation, Energy Generation, Heating, and Others), and United States Biofuels Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited States Biofuels Market Size Insights Forecasts to 2035

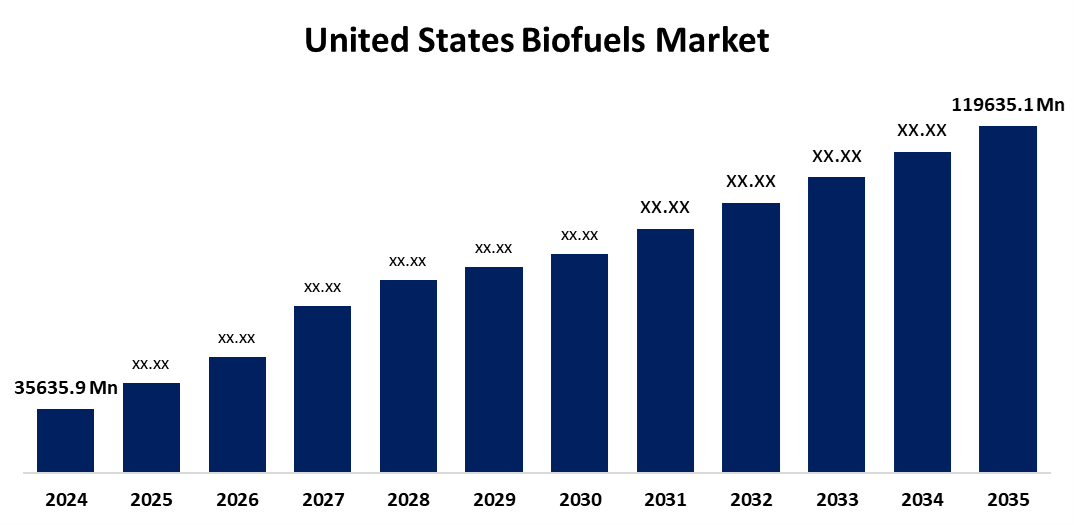

- The US Biofuels Market Size Was Estimated at USD 35635.9 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.64% from 2025 to 2035

- The US Biofuels Market Size is Expected to Reach USD 119635.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United States Biofuels Market is anticipated to reach USD 119635.1 million by 2035, growing at a CAGR of 11.64% from 2025 to 2035. The expansion of the United States biofuels market is propelled because they offer a low-carbon alternative for industries that are difficult to reduce, such as trucking, shipping, and aircraft. Biofuels are especially crucial to the decarbonisation of transportation.

Market Overview

Biofuel is a renewable fuel derived from biomass, which comprises biological resources including organic waste, plants, and algae. The US states have a significant number of state and federal incentives for biofuel conversion. There are many geographic incentives located in Washington, where there are four incentive programs and nearly thirteen biofuel-related laws. Sustainability-related policies and incentives benefit users as they help advance the renewable economy. Sustainability-related policies and incentives can minimize land use changes by requiring the use of sustainable feedstocks such as algae, non-food crops, and agricultural wastes. Sustainable feedstocks will guarantee that the production of biofuel doesn't harm vital ecosystems or compete with conventional food crops. Conclusively, rules that oppose land use modification for biofuels and favour sustainable feedstocks can aid drive biofuel advances towards a more ecologically pleasant and sustainable basis. The incentives can consist of grants or loans for sustainable feedstocks and penalties for land use changes.

Report Coverage

This research report categorizes the market for the United States biofuels market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United States biofuels market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United States biofuels market.

United States Biofuels Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 35635.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.64% |

| 2035 Value Projection: | USD 119635.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Feedstock, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Green Plains Inc, International Flavors & Fragrances Inc, Archer-Daniels Midland Co, Bunge Global SA, Chevron Corp, Renewable Energy Group, Inc, Enviva, U.S. Gain, Gevo, Inc., and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of the United States biofuels market is boosted by the increasing demand for cleaner fuels. Clean energy sources are often substituting traditional fossil fuels because they often release less greenhouse gases and other pollutants, and due to the increased awareness of the effects of air pollution and climate change. The increasing demand for biofuels in the transportation sector and other industries is a response to consumers' demand for sourcing sustainable and renewable energy. In September 2023, the U.S. Department of Energy (DOE) invested USD 23.6 million in funding to nine universities and several industry projects for the development of affordable biofuels and other bioproducts that have a low carbon footprint.

Restraining Factors

The United States biofuels market faces obstacles, like laws and policies regulating biofuel standards could have a significant effect on market demand and investment choices in the biofuels sector. Uncertainty about future regulations deters suppliers and investors and restricts innovation and investment.

Market Segmentation

The United States biofuels market share is classified into feedstock and application.

- The sugarcane segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United States biofuels market is segmented by feedstock into corn, sugarcane, vegetable oils, and others. Among these, the sugarcane segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. The segment is driven by the crushed sugarcane stalks. It produces sugar-rich cane juice, which is then fermented with yeast to produce ethanol. Sugarcane is being adopted as a feedstock in processing plants by biofuel-producing companies to create growth in this segment over the forecast period.

- The transportation segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Based on the application, the United States biofuels market is segmented into transportation, aviation, energy generation, heating, and others. Among these, the transportation segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is propelled by growing use of biofuel as a substitute for traditional fuel sources for vehicles like cars and buses. Furthermore, biofuels have minimal carbon emissions, and few modifications are required.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United States biofuels market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Green Plains Inc

- International Flavors & Fragrances Inc

- Archer-Daniels Midland Co

- Bunge Global SA

- Chevron Corp

- Renewable Energy Group, Inc

- Enviva

- U.S. Gain

- Gevo, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United States, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United States biofuels market based on the following segments:

United States Biofuels Market, By Feedstock

- Corn

- Sugarcane

- Vegetable Oils

- Others

United States Biofuels Market, By Application

- Transportation

- Aviation

- Energy Generation

- Heating

- Others

Need help to buy this report?