Global Methyl Formate Market Size, Share, and COVID-19 Impact Analysis, By Source of Production (Synthetic Production and Biobased Production), By Application (Solvent in Chemical Processes, Intermediate in Esters Production, Agricultural Chemicals, Pharmaceuticals, Plasticizers, and Others), By End-Use (Chemicals Industry, Agriculture, Pharmaceuticals, Automotive, Textiles, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Chemicals & MaterialsGlobal Methyl Formate Market Size Insights Forecasts to 2035

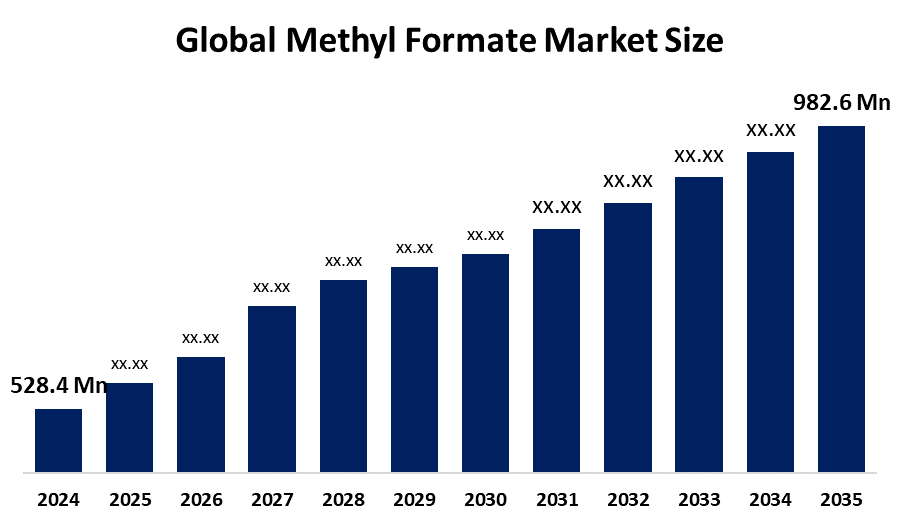

- The Global Methyl Formate Market Size Was Valued at USD 528.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.8% from 2025 to 2035

- The Worldwide Methyl Formate Market Size is Anticipated to Reach USD 982.6 Million by 2035

- North America is expected to Grow the fastest during the forecast period.

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The Global Methyl Formate Market Size was worth around USD 528.4 Million in 2024 and is predicted to Grow to around USD 982.6 Million by 2035 with a compound annual growth rate (CAGR) of 5.8% from 2025 to 2035. The methyl formate market is expanding because the demand for environmentally friendly and low-toxicity solvents used in coatings and agrochemical products is rising, and methyl formate is being used as a sustainable blowing agent for polyurethane, and its application in lithium-ion battery manufacturing is growing.

Overview

Methyl formate is a colourless, volatile and highly flammable ester that serves as a crucial chemical intermediate and environmentally friendly solvent. The substance is mainly utilized for the production of formic acid and N, N-dimethylformamide (DMF). It operates as a safe environmental solution with minimal global warming effects when used as a blowing agent in polyurethane (PU) foam for construction and automotive applications. The market grows because customers want environmentally friendly solvent options, which they can use in coatings and adhesives and cleaning products, while the pharmaceutical industry and agrochemical production processes experience strong market growth.

May 2024, UNEP’s Technical and Economic Assessment Panel (TEAP) identified methyl formate as a viable co-blowing agent supporting the phase-out of ozone-depleting substances under the Montreal Protocol. Industries have begun adopting alternative solutions because methyl bromide use has decreased to approximately 8,865 tonnes in 2022. The lithium-ion battery market presents substantial new opportunities because it serves as a specialized solvent and because bio-based production methods are developing. The industrial growth in Asia-Pacific countries, particularly China and India, drives the market. The sector is being led by BASF SE, Eastman Chemical Company, Mitsubishi Gas Chemical Company, Trivella Chemicals and LyondellBasell, who are working on increasing their production capacity through sustainable product development.

Report Coverage

This research report categorizes the methyl formate market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the methyl formate market. Recent market developments and competitive strategies, such as expansion, type launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the methyl formate market.

Global Methyl Formate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 528.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.8% |

| 2035 Value Projection: | USD 982.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 183 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Source of Production, By Application and COVID-19 Impact Analysis |

| Companies covered:: | BASF SE, Eastman Chemical Company, Mitsubishi Gas Chemical Company, Rao A. Group, Trivella Chemicals, Jiangsu Sopo (Group) Co., Ltd., Chevron Chemical Company, LyondellBasell, Sigma-Aldrich, Tradex Corporation, UBE Industries, Ltd., Shandong Jinling Chemical Co., Ltd., Dayang Chem (Hangzhou) Co., Ltd., Rashtriya Chemicals & Fertilizers Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global demand for eco-friendly, low-toxicity solvents used in paints, coatings and adhesives drives the methyl formate market. The market growth reaches two main drivers because companies now use its zero-global warming potential as an environmentally friendly blowing agent in construction and automotive polyurethane foams. The pharmaceutical sector requires high-purity methyl formate as its reaction medium, while lithium-ion battery production uses it as a solvent and electrolyte, which creates new business opportunities. The production process transforms basic raw materials into formic acid and DMF derivatives, which creates an industrial demand that remains constant throughout the year in the Asia-Pacific.

Restraining Factors

The global methyl formate market faces its main obstacles because manufacturers must deal with high production expenses, which result from changing feedstock prices for methanol and carbon monoxide. Strict safety regulations exist because of its high flammability, combined with supply chain problems and strong competition from alternative products, which obstruct market expansion and product usage.

Market Segmentation

The methyl formate market share is classified into source of production, application, and end-use.

- The synthetic production segment dominated the market in 2024, approximately 94% and is projected to grow at a substantial CAGR during the forecast period.

Based on the source of production, the methyl formate market is divided into synthetic production and biobased production. Among these, the synthetic production segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The synthetic market exists because manufacturers produce it from methanol and carbon monoxide, which creates products that maintain their quality and remain affordable. The method develops chemical processes that modern chemical infrastructure companies can use to produce polymers and coatings, and agrochemical products. The world demand for synthetic production receives backing through continuous facility development and sustainable technology investments, which establish synthetic production as the main method for global market needs.

- The solvent in chemical processes segment accounted for the largest share in 2024, approximately 31% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the methyl formate market is divided into solvent in chemical processes, intermediate in esters production, agricultural chemicals, pharmaceuticals, plasticizers, and others. Among these, the solvent in chemical processes segment accounted for the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The market dominates due to it shows a strong ability to dissolve substances evaporates quickly, and it works well with various types of resins and polymers. The product serves as an affordable and more eco-friendly solution that companies use to replace conventional volatile organic compounds in their production of coatings and adhesives, and chemical intermediates. The product maintains its position as market leader because it combines effective reaction media with blending capabilities that meet the rising need for environmentally friendly product solutions.

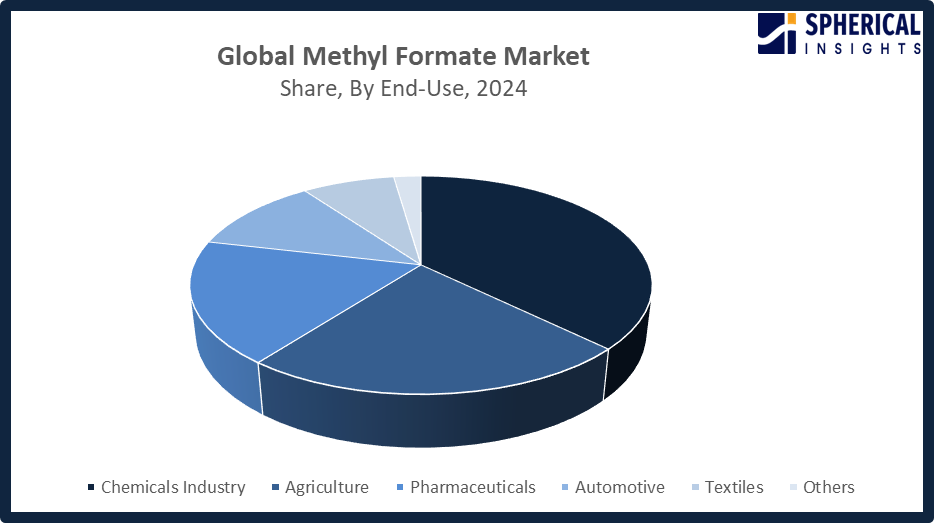

- The chemicals industry segment accounted for the highest market revenue in 2024, approximately 37% and is anticipated to grow at a significant CAGR during the forecast period.

Based on the end-use, the methyl formate market is divided into chemicals industry, agriculture, pharmaceuticals, automotive, textiles, and others. Among these, the chemicals industry segment accounted for the highest market revenue in 2024 and is anticipated to grow at a significant CAGR during the forecast period. It leads the market because it serves as a crucial intermediate for producing formic acid and dimethylformamide, and their related compounds. The product stands out as a dependable choice for industrial production because it delivers multiple beneficial uses through its pure nature and high operational efficiency. The chemical process applications depend on their established position, which results from rising industrial production and cleaner synthesis methods.

Get more details on this report -

Regional Segment Analysis of the Methyl Formate Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the methyl formate market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the methyl formate market over the predicted timeframe. Asia Pacific is expected to hold the 40% share of the global methyl formate market due to rapid industrialization, growing chemical, pharmaceutical, and agrochemical sectors, and increased adoption of sustainable solvents. Key contributors include China, India, and Japan. China leads with large-scale chemical manufacturing and demand for adhesives, coatings, and polymer intermediates. India drives growth through pharmaceuticals and agrochemicals, while Japan focuses on high-purity applications. Strong infrastructure, regulatory support for eco-friendly chemicals, and rising industrial output fuel regional growth. China’s 2026 Hazardous Chemicals Safety Law further strengthens compliance, transport, and safety standards for industrial chemicals such as methyl formate.

North America is expected to grow at a rapid CAGR in the methyl formate market during the forecast period. North America’s methyl formate market is expected to a 25% share grow rapidly due to rising demand for eco-friendly solvents, expanding pharmaceutical and chemical industries, and stricter environmental regulations. The U.S. and Canada are key contributors, with the U.S. leading in pharmaceutical production and regulatory incentives, and Canada focusing on industrial chemical applications. Adoption of low-VOC solvents and green chemistry investments drive growth. In July 2025, the EPA updated VOC emission standards for aerosol coatings, encouraging low-reactivity, environmentally preferable alternatives, indirectly boosting demand for greener chemicals like methyl formate across industrial applications nationwide.

Europe’s methyl formate market is growing due to strict environmental regulations, rising demand for low-VOC solvents, and expansion in the chemical and pharmaceutical sectors. Germany, France, and the UK lead, with Germany excelling in chemical manufacturing, France in agrochemicals, and the UK in sustainable processes. In February 2024, Regulation (EU) 2024/573 tightened fluorinated greenhouse gas restrictions, promoting low-global-warming alternatives and indirectly boosting methyl formate use in refrigeration and polyurethane foam-blowing applications across the region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the methyl formate market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Eastman Chemical Company

- Mitsubishi Gas Chemical Company

- Rao A. Group

- Trivella Chemicals

- Jiangsu Sopo (Group) Co., Ltd.

- Chevron Chemical Company

- LyondellBasell

- Sigma-Aldrich

- Tradex Corporation

- UBE Industries, Ltd.

- Shandong Jinling Chemical Co., Ltd.

- Dayang Chem (Hangzhou) Co., Ltd.

- Rashtriya Chemicals & Fertilizers Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Mitsubishi Gas Chemical Company (MGC) began constructing a methanol production demonstration facility at its Mizushima Plant. The facility will produce methanol using diverse gases, including CO, and industrial by product gases, showcasing innovative, sustainable production methods and advancing MGC's commitment to low-carbon chemical technologies

- In February 2025, BASF announced a mid-double digit million euro investment in a new alcoholates plant at Ludwigshafen, Germany. The facility will produce sodium and potassium methylate for biodiesel, pharmaceutical, and agricultural applications, replacing the existing plant with state-of-the-art technology. Start-up is expected in the second half of 2027

- In January 2024, Eastman Chemical Company launched a high-purity methyl formate grade in January for semiconductor applications, boosting electronics manufacturing quality. In March, it introduced a new line of methyl formate derivatives to enhance performance in specialty chemicals, targeting the pharmaceutical and coatings industries, strengthening its position in advanced chemical markets.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the methyl formate market based on the below-mentioned segments:

Global Methyl Formate Market, By Source of Production

- Synthetic Production

- Biobased Production

Global Methyl Formate Market, By Application

- Solvent in Chemical Processes

- Intermediate in Esters Production

- Agricultural Chemicals

- Pharmaceuticals

- Plasticizers

- Others

Global Methyl Formate Market, By End-Use

- Chemicals Industry

- Agriculture

- Pharmaceuticals

- Automotive

- Textiles

- Others

Global Methyl Formate Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the methyl formate market over the forecast period?The global methyl formate market is projected to expand at a CAGR of 5.8% during the forecast period.

-

2. What is the global methyl formate market?The global methyl formate market refers to the production, distribution, and consumption of methyl formate across various industrial applications worldwide.

-

3. What is the market size of the methyl formate market?The global methyl formate market size is expected to grow from USD 528.4 million in 2024 to USD 982.6 million by 2035, at a CAGR of 5.8% during the forecast period 2025-2035.

-

4. Which region holds the largest share of the methyl formate market?Asia Pacific is anticipated to hold the largest share of the methyl formate market over the predicted timeframe.

-

5. Who are the top 10 companies operating in the global methyl formate market?BASF SE, Eastman Chemical Company, Mitsubishi Gas Chemical Company, Rao A. Group, Trivella Chemicals, Jiangsu Sopo (Group) Co., Ltd., Chevron Chemical Company, LyondellBasell, Sigma-Aldrich, Tradex Corporation, and Others.

-

6. What factors are driving the growth of the methyl formate market?Key drivers include rising demand for eco-friendly, low-toxicity solvents, rapid growth in polyurethane foam (blowing agent) and pharmaceutical applications, increased use in agrochemicals, and expanding lithium-ion battery production.

-

7. What are the market opportunities in the methyl formate market?The opportunities include eco-friendly blowing agents, green solvents, pharmaceutical synthesis, lithium-ion battery components, agrochemicals, and bio-based production techniques in the APAC regions.

-

8. What are the main challenges restricting wider adoption of the methyl formate market?Main challenges restricting wider methyl formate market adoption include high feedstock price volatility (methanol), intense competition from substitutes, inherent flammability risks requiring costly handling/safety infrastructure, and logistical supply chain disruptions.

Need help to buy this report?