Global Lithium-Ion Battery Market Size, Share, and COVID-19 Impact Analysis, By Type (Lithium Iron Phosphate (LFP), Lithium Cobalt Oxide (LCO), Lithium Nickel Manganese Cobalt Oxide (LI-NMC), Lithium Nickel Cobalt Aluminum Oxide (LI-NCA), Lithium Titanate (LTO)), By Capacity (0 to 3,000 mAh, 3,000 to 10,000 mAh, 10,000 to 60,000 mAh, 60,000 mAh and Above), By End-Use (Automotive, Aerospace, Marine, Medical Devices, Industrial, Power, Telecommunication, Consumer Electronics, Others) and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2021 - 2030

Industry: Energy & PowerGlobal Lithium-Ion Battery Market Insights Forecasts to 2030

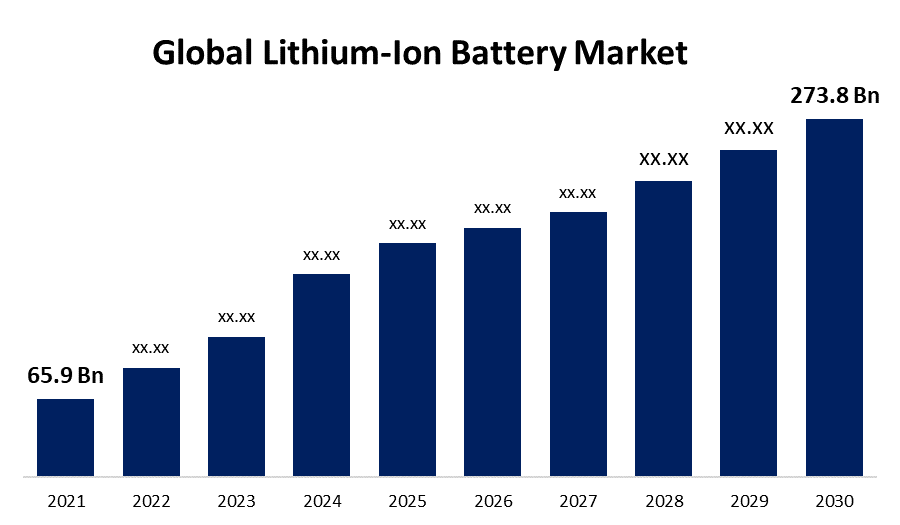

- The Lithium-Ion Battery Market Size was valued at USD 65.9 Billion in 2021.

- The Market is Growing at a CAGR of 19.3% from 2021 to 2030

- The Worldwide Lithium-Ion Battery Market is expected to reach USD 273.8 Billion by 2030

- Europe is expected to Grow the fastest during the forecast period

Get more details on this report -

The Global Lithium-ion Battery Market Size is expected to reach USD 273.8 Billion by 2030, at a CAGR of 19.3% during the forecast period 2021 to 2030. The increased awareness of the importance of keeping the environment clean has fueled the expansion of renewable energy projects such as solar installations and nuclear power plants, particularly wind energy projects are fueling the growth of lithium-ion batteries. Furthermore, the expanding acceptance of lithium-ion battery systems in the medical industry is driving the market growth.

A lithium-ion battery, often known as a Li-ion battery, is a rechargeable battery that stores energy by reversibly reducing lithium ions. Lithium-ion batteries are a mostly preferred rechargeable battery alternative for usage in a wide range of uses such as portable devices, automotive, and stationary applications to provide an uninterrupted power source. These batteries have been frequently used in space-constrained portable systems due to their high energy density, high full-charge voltage, and lack of memory effects.

Lithium-ion batteries for in-vehicle use are currently available in three sizes: cylindrical, prismatic, and pouch. Many vehicle models are expected to use the well-balanced prismatic type at the moment, but as the shift to BEVs grows, OEMs will demand greater capacities and differentiation by vehicle performance, and in terms of shape, the pouch type has benefits as an automotive lithium-ion battery. Researchers are actively working to improve the power density, safety, cycle durability, recharge time, cost, flexibility, and other characteristics, as well as research methods and uses, of these batteries.

COVID-19 Impact Lithium-Ion Battery Market

The COVID-19 pandemic had an impact on market growth in 2020. This has proved to be a major limitation on market expansion due to numerous causes, including end-users cutting operational expenses, as well as disruptions in spare part procurement resulting from decreased production activity and logistics concerns. Although the Asia-Pacific area has the highest availability of the necessary battery material, the pandemic has increased this vulnerability. Battery manufacturers have adopted further precautions to ensure that their offerings are accessible to end users who have established long-term contracts with them.

Global Lithium-Ion Battery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 65.9 Billion |

| Forecast Period: | 2021-2030 |

| Forecast Period CAGR 2021-2030 : | 19.3% |

| 2030 Value Projection: | USD 273.8 Billion |

| Historical Data for: | 2017-2020 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Capacity, By End-Use, By Region, COVID-19 Impact Analysis |

| Companies covered:: | Honda Automobile Co., Ltd., Hyundai Motor, Samsung SDI Co., Ltd., Hitachi Astemo, Ltd., NXP Semiconductors N.V., Proterial, Ltd., Contemporary Amperex Technology Co., Limited., Mikuni Corp., Dana Incorporated, Eaton Corporation, Faurecia SE, Gentherm Inc., Tesla, Visteon Corporation, BYD Company Ltd., Norsk Hydro ASA, Bharat Electronics Limited (BEL), Duracell, Inc., Sensata Technologies, Inc., TE Connectivity Ltd., ZF Friedrichshafen AG, LG Chem, Panasonic Holding Corporation, General Electric, Renault Group, Johnson Controls, A123 System, Okaya Power Group, TDS Lithium-Ion Battery Gujarat Private Limited, Telemax India Industries Pvt. Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Key Market Drivers

Rising prevalence in battery electric vehicles (BEVs) is propelling growth of the market

Electric vehicles use lithium-ion batteries for propulsion. The growing application of electric vehicles and battery electric vehicles (BEVs) has increased lithium-ion battery utilization, which is anticipated to grow more rapidly in the future. The market for these energy-efficient, pollution-reducing vehicles has expanded as consumers' penetration of electric vehicles has increased. In 2021, global sales of battery electric vehicles (BEVs) and plug-in hybrid electric vehicles accounted for around 6.75 million units, representing a significant rise of 110% over the preceding year. China has a higher proportion of BEVs on its road than the EU, but with an expected sales rate of over 50% for cars in 2030.

Rising battery usage in electricity grids and the development of energy storage systems have a significant impact in market

The adoption of stringent government rules to control rising pollution levels is likely to stimulate manufacturers to develop these batteries in order to meet market demand. The power sector is attempting to develop and store alternative energy to supply the electricity in the future. Some of the major drivers promoting the lithium-ion battery's widespread adoption of smart grid and energy storage systems include low operating cost, low self-discharge rate, and small construction footprint. For example, one of the world's largest Battery Energy Storage Systems is Australia's largest lithium-ion battery facility. Neoen, a French independent power producer, owns and operates the 300 MW battery complexes.

Key Market Challenges

Excessive heating of batteries is hindering market growth

Although lithium-ion batteries can store a lot of energy in a small amount of space, they tend to heat up quickly and could catch fire if something goes wrong. Lithium-ion battery overheating occurs as a result of high-rate discharge or an anomalous rate of discharge, for example a short circuit. For example, in August 2021, 18 fires erupted in the Bolt EV and Bolt EVU, resulting in the withdrawal of almost 150,000 vehicles. The reason was a manufacturing failure in the cell, which was produced at LG's Ochang factory in South Korea. This resulted in a total loss of USD 2 billion, with LG liable for USD 1.9 billion.

Key Market Opportunities

Increased R&D for innovations has accelerated acceptance in the automotive sector.

Although lithium-ion batteries can store a lot of energy in a small amount of space, they tend to heat up quickly and could catch fire if something goes wrong. Lithium-ion battery overheating occurs as a result of high-rate discharge or an anomalous rate of discharge, for example, a short circuit. For example, in August 2021, 18 fires erupted in the Bolt EV and Bolt EVU, resulting in the withdrawal of almost 150,000 vehicles. The reason was a manufacturing failure in the cell, which was produced at LG's Ochang factory in South Korea. This resulted in a total loss of USD 2 billion, with LG liable for USD 1.9 billion.

Market Segmentation

Type Insights

The lithium cobalt oxide segment accounted the largest market share over the forecast period.

On the basis of type, the global lithium-ion battery Market is segmented into lithium iron phosphate, lithium cobalt oxide, lithium nickel manganese cobalt oxide, lithium nickel cobalt aluminum oxide, lithium titanate. Among these, the lithium cobalt oxide segment is dominating the market and is going to continue its dominance over the forecast period. Lithium-ion batteries are in high demand for applications such as smartphones, tablets, laptops, and cameras due to their high energy density, high safety level, and widespread usage. These batteries are expected to drive market expansion throughout the forecast period. Such batteries are also used in vehicles and immovable applications such as telecom towers and house inverters where an uninterrupted power source is required, which is driving their adoption and hence supporting the market's growth. However, the Congo Republic contributes 69% of the world's cobalt, much of which is exported to China for smelting and processing into metallic cobalt. China accounts for 66% of global cobalt refining (2018), implying a country risk. Its price is easily influenced by the market price and demand for copper and nickel because it is a by-product.

Capacity Insights

The 3,000 to 10,000 mAh segment is dominating the market with the largest revenue share over the forecast period.

On the basis of application, the global lithium-ion battery Market is segmented into 0 to 3,000 mAh, 3,000 to 10,000 mAh, 10,000 to 60,000 mAh, 60,000 mAh and above. Among these, the 3,000 to 10,000 mAh segment is dominating the market with the largest revenue share of 53.8% over the forecast period since these capacity batteries have applications across a wide range of industries including consumer electronics, electric vehicles, power equipment, and aerospace. These batteries are frequently paired whole to form modules, which are utilized in applications that need oversize loads. A battery-operated energy storage system by including a large capacity and a moderate electrical efficiency provides a low quantity of energy for an extended period of time, enough to power a few critical appliances.

End-Use Insights

The consumer electronics segment accounted the largest revenue share of more than 46.2% over the forecast period.

On the basis of end use, the global lithium-ion battery Market is segmented into automotive, aerospace, marine, medical devices, industrial, power, telecommunication, consumer electronics, and others. Among these, the consumer electronics segment accounted for the largest revenue share of over 46.2% over the forecast period. Portable batteries are commonly found in portable devices and consumer electronics items. Portable batteries are used in a variety of consumer electronics, such as mobile phones, laptops, computers, tablets, torches or flashlights, LED lighting, vacuum cleaners, digital cameras, wristwatches, calculators, hearing aids, wearable devices, and other similar items. The constant advancement of the consumer electronics industry has resulted in a growth in the use of lithium-ion batteries in various applications. These provide numerous benefits such as improved rated power, lower emissions, and higher reliability.

Regional Insights

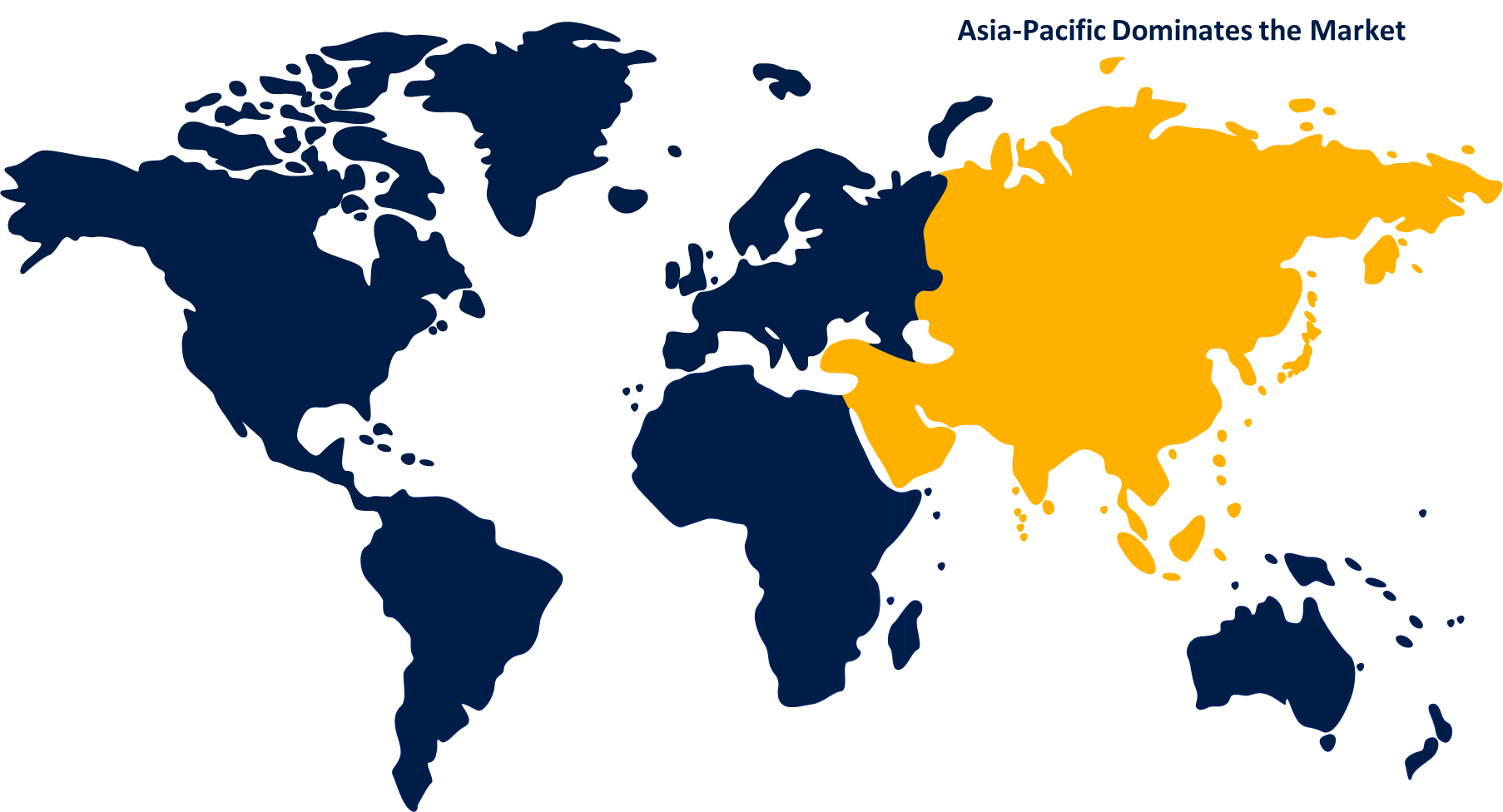

Asia Pacific dominates the market with the largest market share over the forecast period.

Get more details on this report -

Asia Pacific is dominating the market with more than 47.6% market share over the forecast period. Since Asia Pacific has emerged as a worldwide manufacturing powerhouse, the use of tools powered by lithium-ion batteries has immensely expanded. As environmental concerns have grown, China has banned traditional fossil fuel-powered scooters from all of its main cities in an effort to decrease pollution, resulting in a spike in e-scooter sales in the country. One of the primary factors driving up the market for lithium-ion batteries is the burgeoning electric automotive market in Asia Pacific nations including India and China. For example, the battery business was split off as LG Energy Solution in 2020. The company has excellent partnerships with Hyundai and GM among OEMs. LG Energy Solution, for instance, formed a joint venture with GM, Ultium Cells LCC, and began production in Lordstown in 2022.

Europe, on the other hand, had the second largest revenue share of the lithium-ion battery market due to rising automotive production, increased demand for energy storage solutions, increased utilization of electric vehicles due to ecological considerations, and huge investments in lithium-ion battery scientific research. In 2021, Germany controlled the European market. Germany is the world's largest industry for storage technologies for energy and renewable energy developments.

According to Spherical Insights, the European Parliament approved the Commission's proposal to establish fuel economy limits based on the "European Green Deal," which might efficiently decrease carbon dioxide emissions from passenger cars as well as light-duty commercial vehicles by 100% from their existing strict limits in 2035 and effectively ban ICE vehicles, including HEVs. Furthermore, certain countries/regions have adopted regulations prohibiting the sale of ICE vehicles in the UK by 2030 and France by 2040.

North America, on the other hand, had the third greatest revenue share due to rising consumer electronics and electronic vehicle purchases, which will boost market penetration. The United States led the lithium-ion battery marketplace throughout North America. The rise in revenues of automotive and electric vehicles throughout the area, as well as the growing adoption of lithium-ion batteries for smartphones, is driving the growth and advancement of the lithium-ion battery market in North America.

Key Market Developments

- In February 2023, Evonik announced that it will expand its fumed aluminum oxide production unit in Yokkaichi, Japan. The facility will concentrate on the development of specialized solutions for lithium-ion battery technology, which is utilized in electric vehicles.

- In March 2023, Honda and LG Energy Solution held the official groundbreaking ceremony for a new joint venture EV battery plant in Fayette County, near Jeffersonville, Ohio, measuring more than 2 million square feet. The joint venture will supply lithium-ion batteries with cutting-edge technology to help Honda's plans to produce battery-electric vehicles (EV) in North America. By the end of 2025, the company intends to begin mass production of pouch-type lithium-ion batteries, which will be supplied exclusively to Honda car factories producing EVs for North American sales.

- In December 2022, ASPLSAN Enerji began large-scale production of rechargeable lithium-ion cylindrical cells at its Kayseri plant. Its battery cell manufacturing facility architecture and mechanical systems in the production line have been developed and manufactured in such a way that it can produce not only NMC but all lithium-ion cell chemistries. The annual output capacity is 220 MWh, which equates to 21.6 million cells per year.

List of Key Market Players

- Honda Automobile Co., Ltd.

- Hyundai Motor

- Samsung SDI Co., Ltd.

- Hitachi Astemo, Ltd.

- NXP Semiconductors N.V.

- Proterial, Ltd.

- Contemporary Amperex Technology Co., Limited.

- Mikuni Corp.

- Dana Incorporated

- Eaton Corporation

- Faurecia SE

- Gentherm Inc.

- Tesla

- Visteon Corporation

- BYD Company Ltd.

- Norsk Hydro ASA

- Bharat Electronics Limited (BEL)

- Duracell, Inc.

- Sensata Technologies, Inc.

- TE Connectivity Ltd.

- ZF Friedrichshafen AG

- LG Chem

- Panasonic Holding Corporation

- General Electric

- Renault Group

- Johnson Controls

- A123 System

- Okaya Power Group

- TDS Lithium-Ion Battery Gujarat Private Limited

- Telemax India Industries Pvt. Ltd.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the global lithium-ion battery market based on the below-mentioned segments:

Lithium-Ion Battery Market, Type Analysis

- Lithium Iron Phosphate (LFP)

- Lithium Cobalt Oxide (LCO)

- Lithium Nickel Manganese Cobalt Oxide (LI-NMC)

- Lithium Nickel Cobalt Aluminum Oxide (LI-NCA)

- Lithium Titanate (LTO)

Lithium-Ion Battery Market, Capacity Analysis

- 0 to 3,000 mAh

- 3,000 to 10,000 mAh

- 10,000 to 60,000 mAh

- 60,000 mAh and Above

Lithium-Ion Battery Market, End-User Analysis

- Automotive

- Aerospace

- Marine

- Medical Devices

- Industrial

- Power

- Telecommunication

- Consumer Electronics

- Others

Lithium-Ion Battery Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. Which region is dominating the Lithium-Ion Battery market?Asia Pacific is dominating the Lithium-Ion Battery market with more than 47.6% market share.

-

2. What is the market size of mRNA therapy?The global lithium-ion battery market is expected to grow from USD 65.9 Billion in 2021 to USD 273.8 Billion by 2030, at a CAGR of 19.3% during the forecast period 2021-2030.

-

3. Which are the key companies in the market?Honda Automobile, Hyundai Motor, Samsung SDI, Hitachi Astemo, NXP Semiconductors, Dana Incorporated, Eaton Corporation, BYD Company Ltd., Visteon Corporation

-

4. What are the major driving factors for the lithium-ion battery?Increasing adoption of battery electric vehicles, the requirement of battery-operated material-handling equipment, increasing demand for consumer electronic products and advancements in smart electronic devices, and adoption in the renewable energy sector

Need help to buy this report?