Italy Ophthalmic Devices Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Diagnostic & Monitoring Devices, Surgical Devices, and Vision Care Devices), By Disease Indication (Cataract, Glaucoma, Diabetic Retinopathy, Other), and Italy Ophthalmic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareItaly Ophthalmic Devices Market Insights Forecasts to 2035

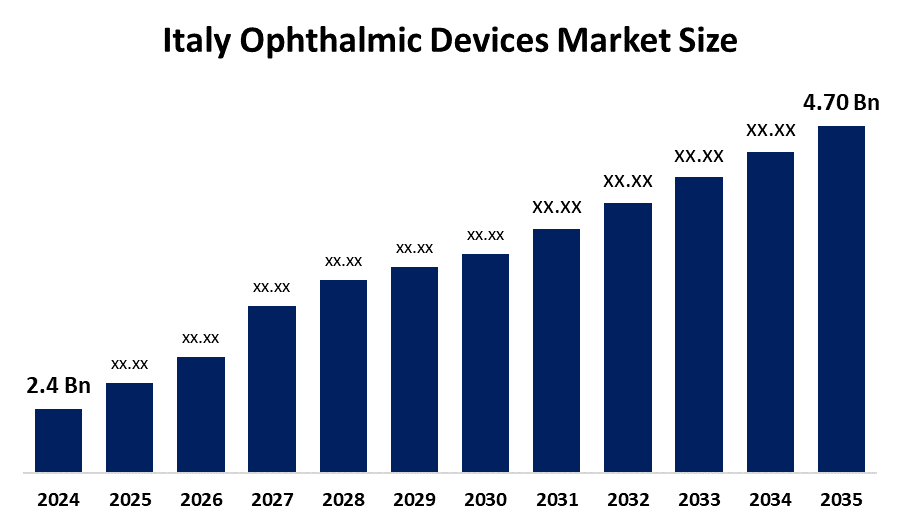

- The Italy Ophthalmic Devices Market Size Was Estimated at USD 2.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.3% from 2025 to 2035

- The Italy Ophthalmic Devices Market Size is Expected to Reach USD 4.70 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Italy ophthalmic devices market size is anticipated to reach USD 4.70 billion by 2035, growing at a CAGR of 6.3% from 2025 to 2035. Italy’s ophthalmic devices market is driven by a rising elderly population, increasing prevalence of eye disorders such as cataracts and glaucoma, growing demand for minimally invasive eye surgeries, technological advancements, and expanding access to advanced ophthalmic care across hospitals and clinics.

Market Overview

Italy’s ophthalmic devices market comprises medical instruments and equipment used for diagnosing, monitoring, and treating eye-related disorders, including cataracts, glaucoma, retinal diseases, and refractive errors. The market is experiencing steady growth due to Italy’s aging population, as older adults are more prone to vision impairment and chronic eye conditions. Rising awareness about early eye diagnosis, increasing prevalence of diabetes-related eye diseases, and improved access to specialized ophthalmic care are also supporting market expansion. Additionally, strong healthcare infrastructure, reimbursement support for essential eye treatments, and growing demand for surgical interventions contribute significantly to market growth.

Several key trends are shaping the Italy ophthalmic devices market. First, the increasing adoption of minimally invasive ophthalmic surgeries is driving demand for advanced surgical devices, as these procedures offer faster recovery and improved patient outcomes. Second, the growing popularity of premium intraocular lenses is notable, as patients increasingly prefer solutions that reduce dependence on spectacles after cataract surgery. Third, the expansion of outpatient and ambulatory surgical centers is influencing device demand, as these facilities favor compact, efficient, and cost-effective ophthalmic equipment. Fourth, rising digitalization in eye care, including electronic diagnostic imaging and data-driven patient management, is improving diagnostic accuracy and workflow efficiency across clinics and hospitals.

Technological advancements play a crucial role in market development. Innovations such as femtosecond laser-assisted cataract surgery, advanced optical coherence tomography systems, and AI-enabled diagnostic tools are transforming ophthalmic practice in Italy. These technologies enhance surgical precision, enable early detection of retinal and optic nerve disorders, and support personalized treatment planning. Continuous investment in research and development by global and regional manufacturers is expected to further strengthen the adoption of advanced ophthalmic devices across the country.

Report Coverage

This research report categorizes the market for the Italy ophthalmic devices market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Italy ophthalmic devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Italy ophthalmic devices market.

Italy Ophthalmic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.3% |

| 2035 Value Projection: | USD 4.70 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 165 |

| Segments covered: | By Device Type,By Disease Indication |

| Companies covered:: | Alcon Inc. Johnson & Johnson Vision Carl Zeiss Meditec AG Bausch + Lomb Corp. EssilorLuxottica S.A. Hoya Corporation CooperVision, Inc. Topcon Corporation NIDEK Co., Ltd. Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Italy ophthalmic devices market is driven by a rapidly aging population and a rising incidence of age-related eye disorders such as cataracts, glaucoma, and macular degeneration. The increasing prevalence of diabetes is boosting demand for retinal diagnostics and treatment devices. Growing awareness about early eye screening, coupled with improvements in healthcare infrastructure, supports market growth. Technological advancements in diagnostic imaging and surgical devices enhance treatment outcomes, while expanding access to minimally invasive ophthalmic procedures and supportive reimbursement policies further stimulate demand across hospitals and eye clinics.

Restraining Factors

The Italy ophthalmic devices market faces restraints from the high cost of advanced ophthalmic equipment and surgical technologies, which can limit adoption by smaller clinics. Strict regulatory requirements and lengthy approval processes may delay product launches. Additionally, budget constraints within public healthcare systems can restrict investments in premium ophthalmic devices.

Market Segmentation

The Italy ophthalmic devices market share is classified into device type and disease indication.

- The diagnostic & monitoring devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy ophthalmic devices market is segmented by device type into diagnostic & monitoring devices, surgical devices, and vision care devices. Among these, the diagnostic & monitoring devices segment accounted for the largest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The dominance of diagnostic & monitoring devices in the market is driven by the increasing need for early detection and management of eye disorders such as glaucoma, diabetic retinopathy, and age-related macular degeneration. Growing awareness of preventive eye care, rising prevalence of chronic eye diseases, and the adoption of advanced imaging technologies like optical coherence tomography (OCT) and fundus cameras support strong demand. Hospitals, clinics, and specialized eye care centers prioritize diagnostic devices to ensure accurate, timely treatment and improved patient outcomes.

- The cataract segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Italy ophthalmic devices market is segmented by disease indication into cataract, glaucoma, diabetic retinopathy, and other. Among these, the cataract segment accounted for the largest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. The cataract segment dominates market due to the high prevalence of age-related cataracts among the country’s aging population. Increasing life expectancy and a growing elderly demographic drive demand for cataract surgeries. Advancements in intraocular lens technology and minimally invasive surgical techniques have improved patient outcomes, encouraging more procedures. Additionally, awareness campaigns and better access to specialized ophthalmic care have increased early diagnosis and treatment rates, making cataract-related devices the most widely used in the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Italy ophthalmic devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alcon Inc.

- Johnson & Johnson Vision

- Carl Zeiss Meditec AG

- Bausch + Lomb Corp.

- EssilorLuxottica S.A.

- Hoya Corporation

- CooperVision, Inc.

- Topcon Corporation

- NIDEK Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Italy, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Italy ophthalmic devices market based on the below-mentioned segments:

Italy Ophthalmic Devices Market, By Device Type

- Diagnostic & Monitoring Devices

- Surgical Devices

- Vision Care Devices

Italy Ophthalmic Devices Market, By Disease Indication

- Cataract

- Glaucoma

- Diabetic Retinopathy

- Other

Frequently Asked Questions (FAQ)

-

1. What is the market size of Italy’s ophthalmic devices market?The market is witnessing steady growth due to rising eye disorders, an aging population, and increasing adoption of advanced diagnostic and surgical devices.

-

2. What are the key driving factors for this Italy’s ophthalmic devices market?Growing prevalence of cataracts, glaucoma, and diabetic retinopathy, aging population, technological advancements, and increasing awareness of early eye care.

-

3. What are the restraining factors in this Italy’s ophthalmic devices market?High costs of advanced ophthalmic devices, strict regulatory approvals, and budget constraints in public healthcare systems.

-

4. Which device segment dominates the Italy’s ophthalmic devices market?Diagnostic & monitoring devices dominate due to the high demand for early detection and monitoring of eye disorders.

-

5. Which disease segment holds the largest share?The cataract segment holds the largest share because of its high prevalence among Italy’s elderly population and growing surgical procedures.

Need help to buy this report?