Global Continuous Glucose Monitoring Devices Market Size, Share, and COVID-19 Impact Analysis, By Component (Transmitters, Sensors & Receivers), By Demography (Child Population, Adult Population), By Application (Gestational Diabetes, Type-2 Diabetes & Type-1 Diabetes), By End User (Hospitals, Homecare), By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033.

Industry: HealthcareGlobal Continuous Glucose Monitoring Devices Market Insights Forecasts to 2033.

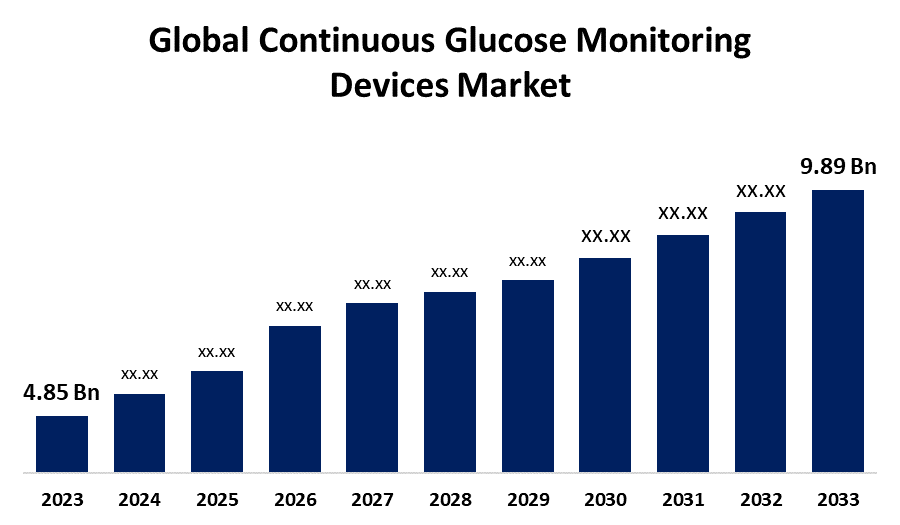

- The Global Continuous Glucose Monitoring Devices Market Size was Valued at USD 4.85 Billion in 2023

- The Market Size is Growing at a CAGR of 7.39% from 2023 to 2033

- The Worldwide Global Continuous Glucose Monitoring Devices Market Size is Expected to Reach USD 9.89 Billion by 2033

- Asia Pacific Market is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Continuous Glucose Monitoring Devices Market Size is Anticipated to Exceed USD 9.89 Billion by 2033, Growing at a CAGR of 7.39% from 2023 to 2033.

Market Overview

Continuous sugar monitoring (CGM), sometimes known as glucose continuous glucose monitoring, is a system that automatically examines blood glucose levels throughout the day. Real-time glucose monitoring can help to make more educated decisions about daily medication, nutrition, and physical activity. A small sensor for CGM is implanted beneath the skin, often on the arm or abdomen. The sensor detects interstitial glucose, which exists in the intercellular fluid. Every few minutes, the sensor monitors the glucose level and sends the results to a monitor via wireless data transmission. Furthermore, CGMS-based technologies have created a blueprint for a closed-loop bionic or artificial pancreas. As a result, glucose monitoring device manufacturers place a strong emphasis on producing novel and cutting-edge CGMS. It has a wide range of applications in healthcare settings (hospital ICUs, diagnostic centers, and clinics), for individuals of all ages, and in diverse geographic locations. The key market drivers for the CGM market are increased awareness of diabetes prevention, new product releases, government initiatives, and the CGM device market.

Report Coverage

This research report categorizes the market for the global Continuous Glucose Monitoring Devices market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global Continuous Glucose Monitoring Devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global Continuous Glucose Monitoring Devices market.

Global Continuous Glucose Monitoring Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 4.85 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 7.39% |

| 2033 Value Projection: | USD 9.89 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Component, By Demography, By Application, By End User, By Region |

| Companies covered:: | Dexcom, Inc., Abbott Laboratories, Medtronic plc, Senseonics Holdings, Inc., Insulet Corporation, Ascensia Diabetes Care Holdings AG, MicroPort Scientific Corporation, Ypsomed AG, Roche Diabetes Care, Inc., GlySens Incorporated, Lifespan Inc., Nemaura Medical Inc., OrSense Ltd., AgaMatrix Holdings LLC, Integrity Applications Inc., Biolinq Inc., Diabeloop SA, Diabetology Ltd., Novo Nordisk A/S, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The global market for continuous glucose monitoring devices is driven by various factors, including the rising incidence of prediabetes, which is also driving market expansion. Prediabetes is a condition in which blood sugar levels are higher than usual but not high enough to be diagnosed with type 2 diabetes. It is a dangerous medical disorder that raises the chance of acquiring type 2 diabetes, heart disease, and stroke. Unfortunately, the number of people diagnosed with prediabetes is increasing rapidly. The primary cause of the increase in prediabetes instances is the rise in obesity prevalence. Obesity is a significant risk factor for prediabetes and type 2 diabetes. As more individuals embrace sedentary lifestyles and eat poor diets, the prevalence of obesity rises, resulting in an increase in prediabetes. According to the CDC and the US Department of Health and Human Services, it is anticipated that 97.6 million individuals in the United States aged 18 and up will have prediabetes in 2021. As the elderly population grows, so does the need for CGM devices. CGM devices are essential for diabetics, particularly the elderly, who may be unable to monitor their blood glucose levels as regularly as necessary. These devices deliver real-time glucose measurements, allowing patients and healthcare providers to better manage their diabetes.

Restraining Factors

The global market for continuous glucose monitoring devices is hampered by the high cost associated with these devices. While they offer significant benefits in monitoring glucose levels continuously, their expense can limit access for individuals, especially in regions with limited healthcare resources or for those without adequate insurance coverage. The affordability barrier may hinder the widespread adoption and accessibility of these devices, impacting market penetration and potential growth in certain demographics and regions.

Market Segmentation

The Global Continuous Glucose Monitoring Devices Market is classified into components, demography, application and end-user.

- The sensors segment is expected to hold the largest share of the global continuous glucose monitoring devices market during the forecast period.

Based on the component, the global continuous glucose monitoring devices market is divided into transmitters, sensors, and receivers. Among these, the sensors segment is expected to hold the largest share of the global continuous glucose monitoring devices market during the forecast period. Technological developments to increase sensor accuracy are projected to drive industry growth during the forecast period. Sensors are essential components of continuous glucose monitoring (CGM) systems. CGM sensors are made of a metallic filament that is thinner than a needle and implanted into the fatty layer immediately under the skin. The sensor is secured using adhesive tape to monitor glucose levels in the surrounding area. CGM monitors employ glucose oxidase to measure blood glucose levels. Glucose is transformed to hydrogen peroxidase by the glucose oxidase, which combines with platinum in the sensor to produce an electrical signal that is relayed to the transmitter.

- The adult population segment is expected to grow at the fastest pace in the global continuous glucose monitoring devices market during the forecast period.

Based on the demography, the global continuous glucose monitoring devices market is divided into the child population and the adult population. Among these, the adult population segment is expected to grow at the fastest pace in the global continuous glucose monitoring devices market during the forecast period. This is due to an increase in the incidence of diabetes in geriatric populations. According to the International Diabetic Federation (IDF), an estimated 537 million people aged 20 to 79 were diagnosed with diabetes in 2021. According to the same estimate, around 643 million people are expected to live with diabetes by 2030.

- The type-2 diabetes segment is expected to grow at the fastest pace in the global continuous glucose monitoring devices market during the forecast period.

Based on the application, the global continuous glucose monitoring devices market is divided into gestational diabetes, type-2 diabetes and type-1 diabetes. Among these, the type-2 diabetes segment is expected to grow at the fastest pace in the global continuous glucose monitoring devices market during the forecast period. The number of Type 2 diabetes patients that require insulin. For example, the IDF (International Diabetes Federation) predicted that there would be around 537 million type-2 diabetics globally in 2021, with one in every ten diabetic patients at risk of acquiring the condition. Furthermore, the CGM is projected to be used more often in the type 1 diabetes population because of its clinically proven usefulness in minimizing the risk of hypoglycemia in this group.

- The homecare segment is expected to hold the largest share of the global continuous glucose monitoring devices market during the forecast period.

Based on the end user, the global continuous glucose monitoring devices market is divided into hospitals and homecare. Among these, the homecare segment is expected to hold the largest share of the global continuous glucose monitoring devices market during the forecast period. These devices provide patients with lower insulin dosages and allow for continuous monitoring of blood glucose levels. Homecare settings are predicted to drive demand for CGM devices due to their effective and simple blood glucose monitoring. Furthermore, the fear of viral propagation, the greater vulnerability of diabetes patients during COVID-19, and the necessity to closely monitor blood glucose levels throughout the pandemic period all contributed to its increasing popularity among patients.

Regional Segment Analysis of the Global Continuous Glucose Monitoring Devices Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the global continuous glucose monitoring devices market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the global continuous glucose monitoring devices market over the predicted timeframe. Some of the reasons contributing to market expansion include rising diabetes prevalence, increased acceptance of CGM devices, technical improvements, and the existence of important firms. Additionally, the federal government's attempts to control the condition on a larger scale are supporting market expansion. Owing to the high diabetes population and good reimbursement policies. According to the Centers for Disease Control and Prevention's National Diabetes Statistics Report 2022, approximately 130 million individuals in the United States have diabetes or prediabetes. High per capita income and rising healthcare spending are two significant drivers expected to fuel market expansion.

Asia Pacific is expected to grow the fastest during the forecast period. According to the Asian Diabetes Prevention Initiative, about 60% of the world's diabetics live in Asia Pacific. The disease's high incidence in developing nations like India and China has fueled regional market expansion. Furthermore, rising healthcare expenditure, increased corporate investment, and favorable regulatory regulations all have a beneficial impact on market growth in this area.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the global continuous glucose monitoring devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dexcom, Inc.

- Abbott Laboratories

- Medtronic plc

- Senseonics Holdings, Inc.

- Insulet Corporation

- Ascensia Diabetes Care Holdings AG

- MicroPort Scientific Corporation

- Ypsomed AG

- Roche Diabetes Care, Inc.

- GlySens Incorporated

- Lifespan Inc.

- Nemaura Medical Inc.

- OrSense Ltd.

- AgaMatrix Holdings LLC

- Integrity Applications Inc.

- Biolinq Inc.

- Diabeloop SA

- Diabetology Ltd.

- Novo Nordisk A/S

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In January 2024, Medtronic plc announced that MiniMed 780G system with Simplera Sync has achieved CE Mark clearance. Simplera Sync is a technique that improves the user experience by simplifying the two-step insertion procedure.

- In December 2023, Tandem Diabetes Care (NASDAQ: TNDM), a leading insulin delivery and diabetes technology firm, has launched updated t: slim X2 insulin pump software with Dexcom G7 Continuous Glucose Monitoring (CGM) integration in the US.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Global Continuous Glucose Monitoring Devices Market based on the below-mentioned segments:

Global Continuous Glucose Monitoring Devices Market, By Components

- Transmitters

- Sensors

- Receivers

Global Continuous Glucose Monitoring Devices Market, By Demography

- Child Population

- Adult Population

Global Continuous Glucose Monitoring Devices Market, By Application

- Gestational Diabetes

- Type-2 Diabetes

- Type-1 Diabetes

Global Continuous Glucose Monitoring Devices Market, By End User

- Hospitals

- Homecare

Global Continuous Glucose Monitoring Devices Market, By Region

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?