China General Surgery Devices Market Size, Share, By Type ( Disposable Surgical Supplies, Surgical Non-Woven, General Surgery Procedural Kits, Examination and Surgical Gloves, Venous Access Catheters, and Others), By Application (Thoracic, Urology and Gynecology, Orthopedic, Ophthalmology, Plastic Surgery, Cardiology, Wound Care, Audiology, and Others), By End Use (Hospitals, Ambulatory Surgical Centers, Specialty Clinics), and China General Surgery Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareChina General Surgery Devices Market Size Insights Forecasts to 2035

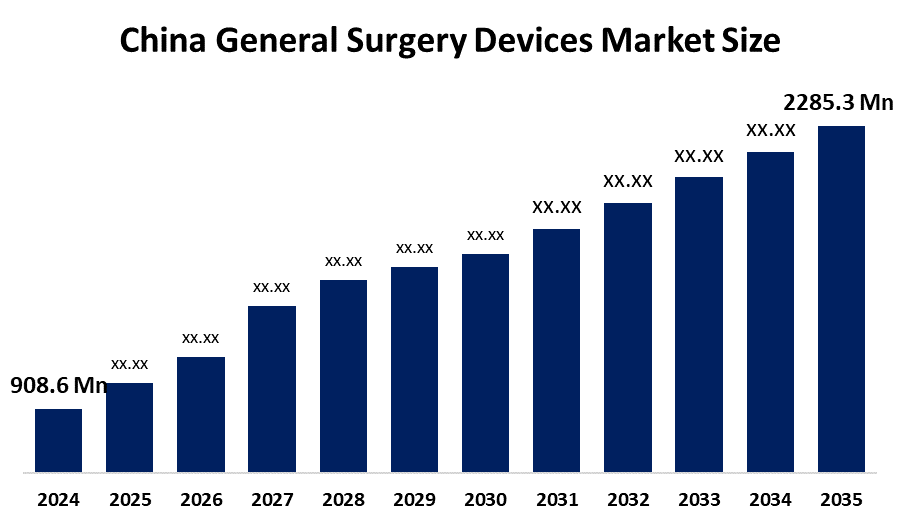

- China General Surgery Devices Market Size 2024: USD 908.6 Mn

- China General Surgery Devices Market Size 2035: USD 2285.3 Mn

- China General Surgery Devices Market CAGR: 8.75%

- China General Surgery Devices Market Segments: Type, Application, and End Use

Get more details on this report -

Scalpels, forceps, retractors, sutures, staplers, electrosurgical instruments, and laparoscopic and robotic surgical instruments are all part of the general surgery devices market in China. In hospitals, specialized clinics, and outpatient surgical centers, these instruments are necessary for carrying out both simple and complicated surgical procedures. A growing and aging population, an increase in the prevalence of chronic and lifestyle-related diseases, trauma cases, and greater healthcare costs in China are all contributing factors to the market's growth. Modern surgical instruments are being used by hospitals more frequently in an effort to increase productivity, lower complications, and improve patient outcomes.

Medical device innovation and the development of healthcare infrastructure have been aggressively encouraged by the Chinese government. The Healthy China 2030 Plan's policies promote the use of minimally invasive technologies, the modernization of surgical facilities, and the domestic manufacturing of high-quality medical equipment. Incentives are offered to encourage R&D in surgical technology, and regulatory improvements streamline device approvals while guaranteeing safety requirements.

A major motivator is innovation, which has improved procedural accuracy and patient safety through developments in robotic-assisted and minimally invasive surgery, electrosurgical instruments, energy devices, and disposable surgical equipment. AI-assisted surgery, digital surgical planning, and smart sensors are examples of emerging technologies that improve intraoperative monitoring, lower human error, and facilitate the widespread use of cutting-edge surgical techniques in Chinese hospitals.

Market Dynamics of the China General Surgery Devices Market:

A growing and aging population, an increase in the prevalence of chronic and lifestyle-related disorders, and an increase in trauma and accidents are the main factors driving the general surgery devices market in China. The demand for cutting-edge surgical equipment is being driven by higher healthcare spending, better access to healthcare facilities, and rapid urbanization. Technological developments in laparoscopic instruments, electrosurgical devices, surgical staplers, and minimally invasive surgery (MIS) have improved patient outcomes and procedural efficiency, promoting use in hospitals and specialist centers. Furthermore, government initiatives to upgrade healthcare infrastructure and support medical device innovation stimulate market growth.

The market has a lot of room to grow, but there are obstacles to overcome, such as the high price of cutting-edge surgical equipment, the scarcity of qualified surgeons in lower-tier cities, and the strict regulatory clearance procedures for new medical devices. Hospitals may see an increase in operating costs if they rely on imported equipment for expensive procedures.

Expanding the use of robotic-assisted and minimally invasive surgical equipment, increasing penetration in tier-2 and tier-3 cities, and increasing the use of disposable surgical instruments to prevent infections. Long-term market expansion in China is supported by the potential for improving procedure accuracy and lowering complications through the integration of AI, smart sensors, and digital surgical planning.

Market Segmentation

The China general surgery devices market share is classified into type, application, and end use.

By Type:

On the basis type of China general surgery devices market is categorized into disposable surgical supplies, surgical non-woven, general surgery procedural kits, examination and surgical gloves, venous access catheters, and others. Among these, the disposable surgical supplies segment held the majority market share in 2024 and is predicted to grow at a remarkable rate during the predicted period. The enormous number of surgical procedures carried out in China, along with the increasing focus on infection control and patient safety, are the main reasons for the predominance of disposable surgical supplies. Hospitals, ambulatory surgical centers, and clinics favour single-use goods because they lower the danger of cross-contamination and hospital-acquired infections.

By Application:

Based on application, the China general surgery devices market is divided into thoracic, urology and gynecology, orthopedic, ophthalmology, plastic surgery, cardiology, wound care, audiology, and others. Among these, the orthopedic segment accounted for the largest market share in 2024 and is expected to grow at a significant rate of CAGR during the projected period. The high frequency of bone and joint problems, a growth in osteoarthritis and trauma-related injuries, and China's increasingly aging population, which has raised the need for surgical procedures, are the main factors driving the orthopedic segment's domination.

By End Use:

The China general surgery devices market is classified by end use into hospitals, ambulatory surgical centers, specialty clinics. Among these, the hospitals segment dominated the market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The enormous volume of surgical procedures, the availability of cutting-edge surgical infrastructure, and the presence of highly qualified surgeons and interdisciplinary care teams are all factors contributing to hospitals' dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the China general surgery devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Top Key Companies in the China General Surgery Devices Market:

- Johnson & Johnson

- Medtronic plc

- Stryker Corporation

- B. Braun Melsungen AG

- Boston Scientific Corporation

- Olympus Corporation

- ConMed Corporation

- Intuitive Surgical

- Teleflex Incorporated

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the China, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the China general surgery devices market based on the following segments:

China General Surgery Devices Market, By Type

- Disposable surgical Supplies

- Surgical Non-woven

- General Surgery Procedural Kits

- Examination and Surgical Gloves

- Venous Access Catheters

- Others

China General Surgery Devices Market, By Application

- Thoracic

- Urology and Gynecology

- Orthopedic

- Ophthalmology

- Plastic Surgery

- Cardiology

- Wound Care

- Audiology,

- Others

China General Surgery Devices Market, By End Use

- Hospitals

- Ambulatory Surgical Centers

- Specialty Clinics

Frequently Asked Questions (FAQ)

-

1. What is the China general surgery devices market?The China general surgery devices market focuses on surgical instruments, disposable supplies, procedural kits, and devices used across multiple surgical specialties. It includes products for thoracic, orthopedic, urology, gynecology, ophthalmology, plastic surgery, cardiology, wound care, audiology, and other applications.

-

2. What is the market's size and rate of expansion?The market is expected to increase at a compound annual growth rate (CAGR) of 8.75% from 2025 to 2035, from its 2024 valuation of USD 908.6 million to USD 2,285.3 million.

Need help to buy this report?