Zeolite Market Summary

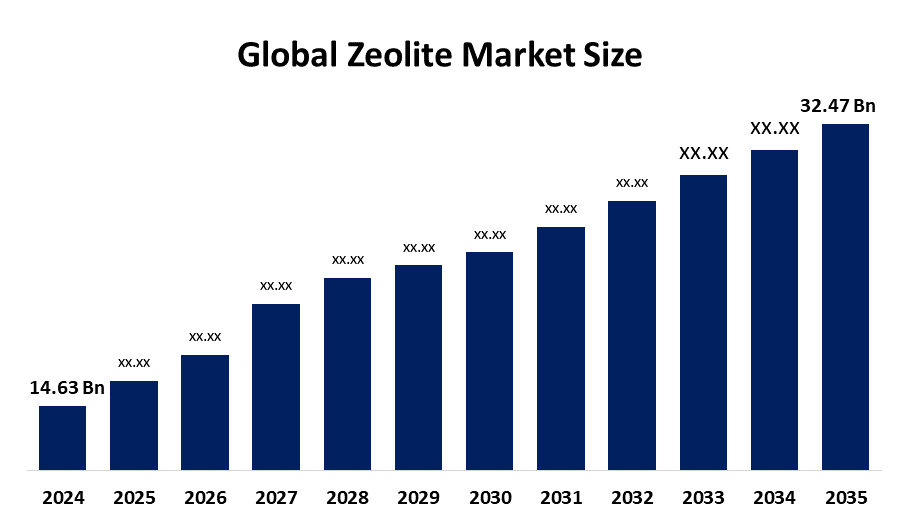

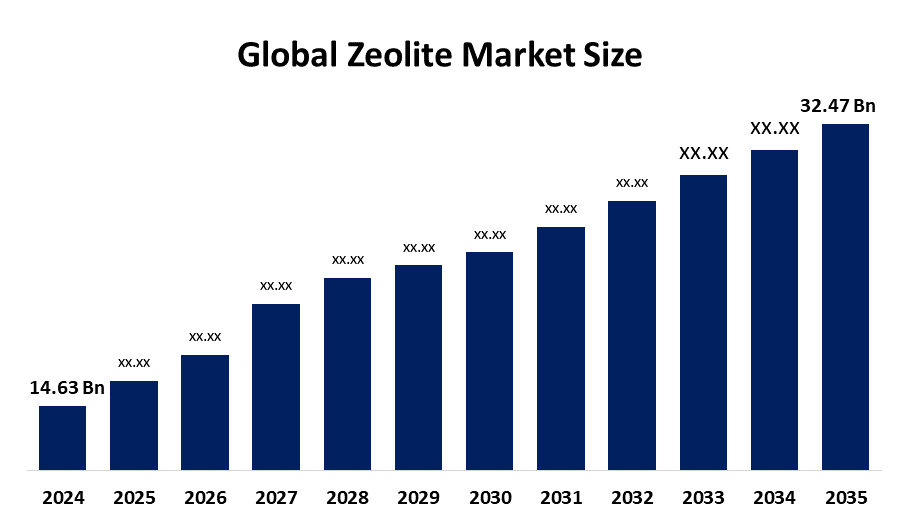

The Global Zeolite Market Size was Estimated at USD 14.63 Billion in 2024 and is projected to Reach USD 32.47 Billion by 2035, Growing at a CAGR of 7.52% from 2025 to 2035. Rising demand from the detergent, agricultural, and petroleum industries is one of the main factors driving the growth of the global zeolite market. Furthermore, technical developments, environmental laws, and growing awareness of the advantages of zeolites are propelling market expansion.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held a 33.4% revenue share, dominating the zeolite market globally.

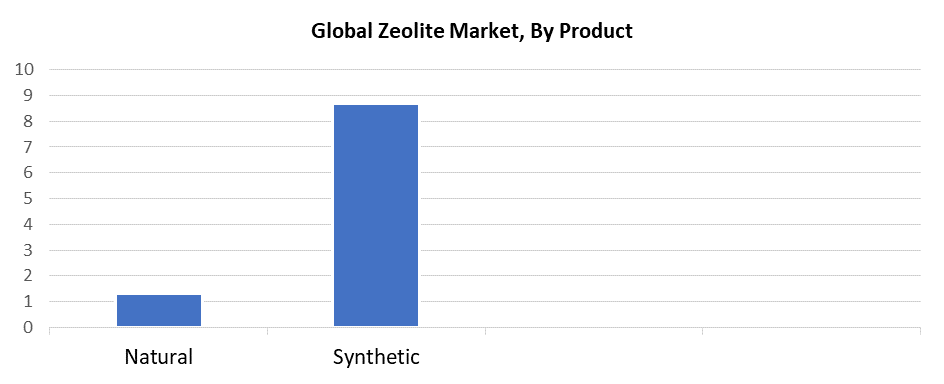

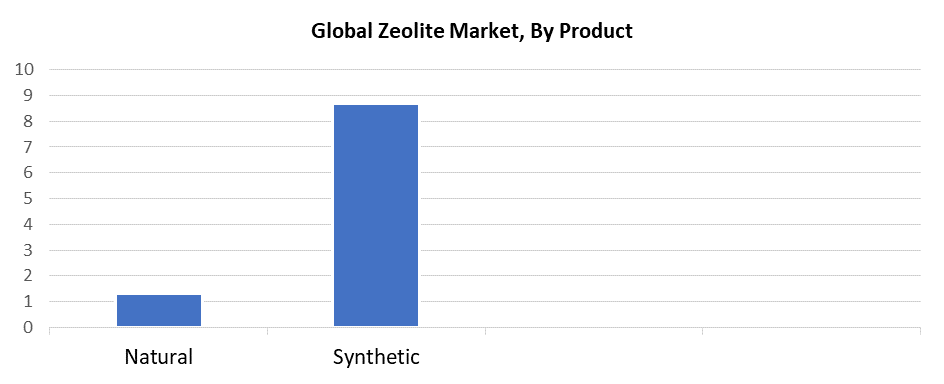

- In 2024, synthetic zeolite held a dominant market share of 87.4% by product.

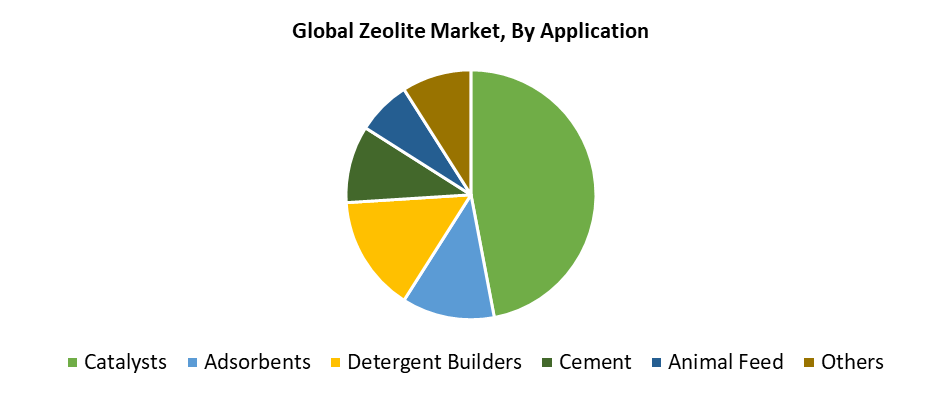

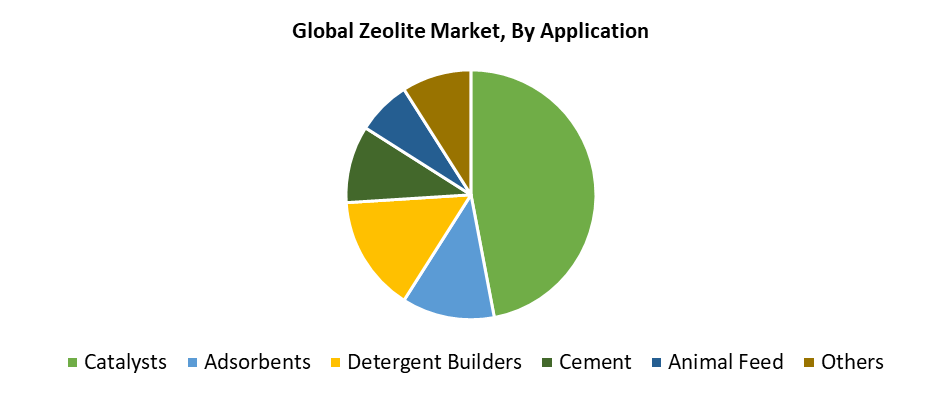

- In 2024, the catalyst segment accounted for 47.6% of zeolite revenue, dominating the market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 14.63 billion

- 2035 Projected Market Size: USD 32.47 billion

- CAGR (2025-2035): 7.52%

- Asia Pacific: Largest market in 2024

The market for zeolite minerals and materials, naturally occurring and synthetically created, is referred to as the global zeolite market. Zeolites are porous crystallized aluminosilicates and have many uses because of their adsorption and ion-exchange properties. The activity encompasses the production, commerce, and industrial uses of these minerals. One of the main driving forces is the increased need for water treatment products due to international pollution issues and regulations. Another important driver in the market is the shift in the detergent industry from conventional ingredients to green or environmentally friendly products and increased use of petroleum refining to obtain cleaner-burning fuels. Zeolites, because of their stability and overall good activity and selectivity in conversion processes, are widely used in the petrochemical industry as a catalyst to speed up chemical reactions. In addition, zeolites can be used in processes to produce detergents because of their high absorption of liquid ingredients.

The escalating complexity of petrochemical production and refining processes has also influenced the use of synthetic zeolites in catalytic applications that require precise molecular sieving properties and high selectivity for enhancing process efficiency and yield. Their usefulness in modern environmental management solutions, especially eliminating greenhouse gases, heavy metals, and volatile organic compounds (VOCs), supports their proliferation. Innovations in material science have advanced this aluminosilicate to better properties, to enhance its usefulness, thus demonstrating its viability in catalysis and water treatment applications. The new processing also means the material has wider applicability across applications and markets, fuelling growth in synthetic zeolites. As industries adopt advanced material solutions that allow for cleaner production and smarter infrastructure, synthetic zeolites are leading innovation that will drive long-term growth in the global zeolite industry.

Product Insights

Synthetic zeolites dominated the industry, accounting for 87.4% of the market share in 2024. Their broad industrial utilization for water treatment, detergent production, and petrochemical refining represents major engines of development. The advantageous high surface area and sponge-like morphology make synthetic zeolites the preferred adsorbent in the fluid catalytic cracking applications, as well as phosphate-free detergent builders. These materials are often used in detergents and water treatment systems to facilitate the removal of contaminants and enhance cleaning efficiency. The demand has risen exponentially due to the increase in global manufacturing of petrochemical derivatives, including plastics, solvents, and cosmetics. Research advancements in "green" and antibacterial synthetic zeolites are also expanding the potential for synthetic zeolites to be used in emergent industrial applications, such as emissions control and health care.

Natural zeolites experience significant growth due to their low costs and ability to be used for a variety of agricultural and construction purposes. They are an affordable, environmentally-friendly, and non-toxic source as they are mined from volcanic rocks and ash deposits. Because of their ion-exchange properties, they are very effective at removing contaminants from water, such as ammonium ions and heavy metals. They benefit from ongoing investment in infrastructure globally and are widely used in the construction industry as thermal insulation, lightweight aggregates, standard materials, and pozzolanic cement. Zeolites are used as conditioners in agriculture to improve nutrient release and increase water availability and retention ability of soils. Demand is further buoyed by the increasing demand for green materials and environmental movements.

Application Insights

In 2024, 47.6% of the total revenue for the market was derived from the catalyst segment. Their special structural characteristics of high surface area, pore size distribution, and ion exchange capabilities make them exceptionally strong catalysts for a range of chemical reactions. Zeolites break the long hydrocarbon molecules down into more valuable products, gasoline and diesel, and are widely used in petroleum refining, in particular by fluid catalytic cracking (FCC). Zeolites also serve as catalysts in more complex petrochemical processes such as methanol-to-olefins (MTO) and methanol-to-propylene (MTP) to form important building block chemicals, ethylene and propylene.

The detergent builder market remains a major application area for synthetic zeolites, especially Zeolite-A, due to their effectiveness in removing calcium and magnesium ions from hard water. The adoption of zeolite-based builders follows legislative pressure to eliminate phosphorus from household and industrial detergent products, along with the rising customer desire for eco-friendly cleaning products. Their strong ion-exchange capacity also provides water-softening efficacy, allowing detergents to clean better. The demand in this segment has benefited from the increased regulation and preference for detergent products with biodegradable, environmentally friendly constituents. BASF and Honeywell are developing complex detergent recipes, with zeolites as key ingredients, in light of the growing global demand for phosphate-free, environmentally safe cleaning products.

Regional Insights

The North American zeolite market will account for a significant revenue share in 2024. The expanding petrochemical industry and the increase in animal feed production are the main contributors to demand in the region. Zeolites are used as catalysts in petroleum refining and as additives to animal feed because they improve nutrient absorption and reduce pollutants. Given the increase in demand for new water treatment technologies, eco-friendly detergents, and emissions control devices, zeolite usage in this sector has increased considerably. The regional market is also growing at an accelerated pace based on continuous innovations in both the petrochemical and agricultural sectors and new investments in infrastructure. Innovations in technology and circular economy initiatives support the growth of the regional market.

U.S. Zeolite Market Trends

The U.S. is remaining North America's largest zeolite market due to strong demand from its expanding petrochemical sector and applications in detergents, animal feed, agriculture, and water treatment. Increased use of zeolites in the U.S. is being driven by a focus on pollution control systems, water reuse systems, and energy efficiency. Demand for zeolite and its derivatives is anticipated to grow in the coming years in the U.S., fueled by anticipated industrial investment and government support for environmentally friendly products.

Asia Pacific Zeolite Market Trends

The demand for zeolite is rapidly increasing in the Asia-Pacific region, resulting in the region dominating globally with a revenue share of 33.4%. The key factors driving this growth are widespread industrialization, the evolution in infrastructure, and the expansion of chemical development in countries such as China, India, and elsewhere in Southeast Asia. The Asia-Pacific region has a large and rapidly expanding market based on its huge population, growing environmental activism, and government policies promoting cleaner technologies. The region used significantly high amounts of fuel, such as gasoline and diesel, which creates a requirement for cars and fluid catalytic cracking catalysts. Zeolites are being used increasingly in manufacturing environmentally-friendly detergents, petrochemicals processing, cement, and water treatment. Across the region, the emphasis on improving water recycling infrastructure and reducing pollution has positively impacted the use of zeolite-based solutions across various markets.

Europe Zeolite Market Trends

With an increased focus on sustainability, compliance with environmental regulations, and industrial applications, Europe remains a major region in the zeolite market. Environmental regulations are strict in the region, and there is a move away from phosphate-based and environmental alternatives to synthetic zeolites, which are commonly employed in wastewater treatment, petrochemicals, and even detergents. Germany, France, and the United Kingdom are among those nations using zeolite-based solutions in water treatment, clean energy and construction, and green building technologies. And there are further developments in Europe, such as investment in research and development, innovation, and circular economy initiatives aimed at reducing the impact of industrial activity on the environment.

Key Zeolite Companies:

The following are the leading companies in the zeolite market. These companies collectively hold the largest market share and dictate industry trends.

- Albemarle Corporation

- Tosoh Corporation

- PQ Corporation (PQ Group)

- BASF SE

- Arkema Group (incl. CECA)

- Clariant AG

- W. R. Grace & Co.

- Zeochem AG

- Honeywell International Inc.

- Zeolyst International

- Others

Recent Developments

- In May 2025, Honeywell has acquired Johnson Matthey's Catalyst Technologies business. The combination of Honeywell's Energy and Sustainability Solutions (ESS) business unit and Johnson Matthey's Catalyst Technologies business is expected to create significant cost synergies and compelling high-growth opportunities for the portfolio.

- In February 2025, Taiyo Oil Co., Ltd. has selected Honeywell UOP Ethanol to Jet (ETJ) technology to produce Sustainable Aviation Fuel (SAF) at its Okinawa Operations in Japan. This facility has a production target of 200 million liters annually and will use Honeywell UOP's first ETJ license and basic engineering design in the Asia Pacific region.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the zeolite market based on the below-mentioned segments:

Global Zeolite Market, By Product

Global Zeolite Market, By Application

- Catalysts

- Adsorbents

- Detergent Builders

- Cement

- Animal Feed

- Others

Global Zeolite Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa