Clinical Trial Packaging Market Summary

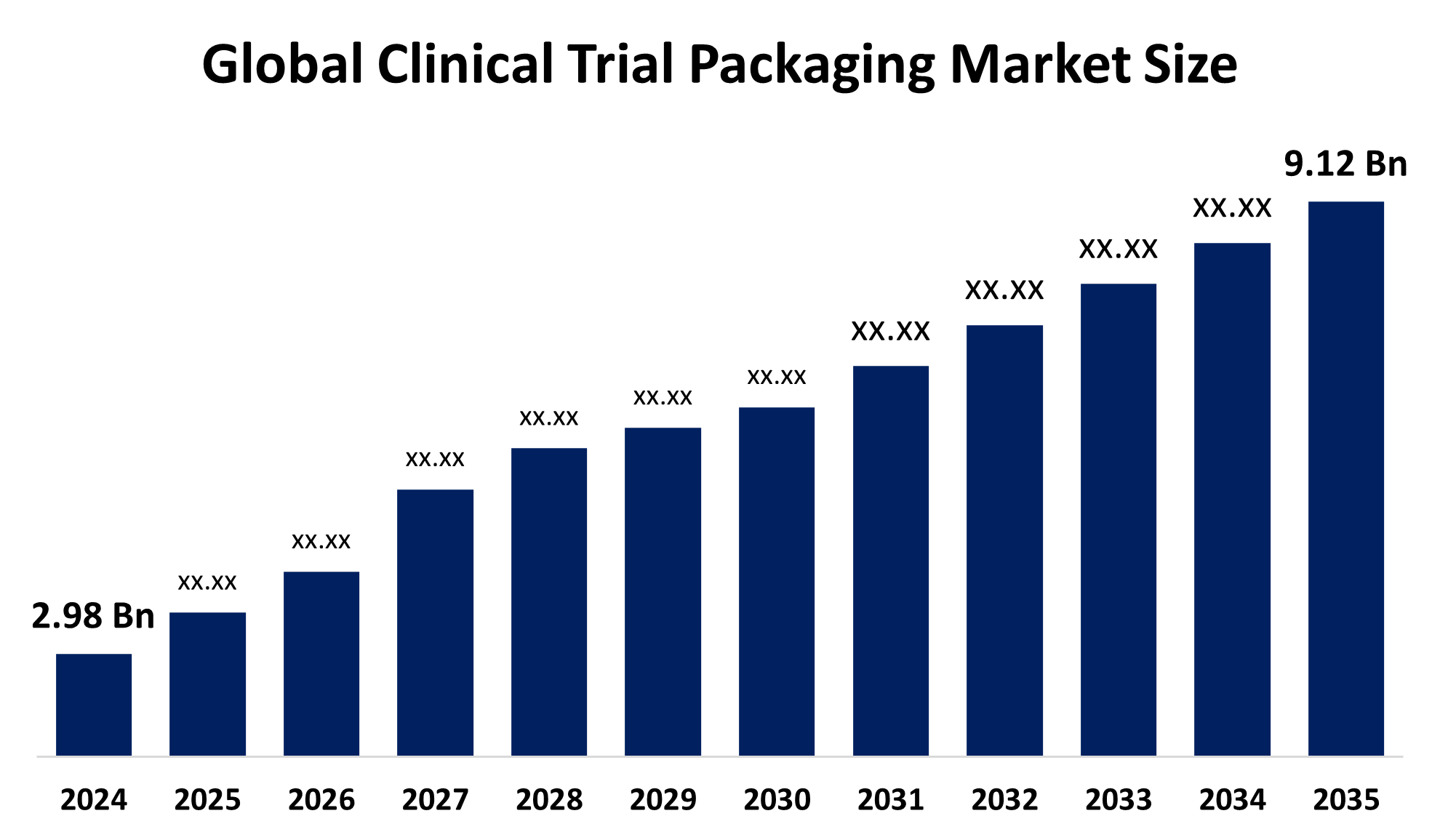

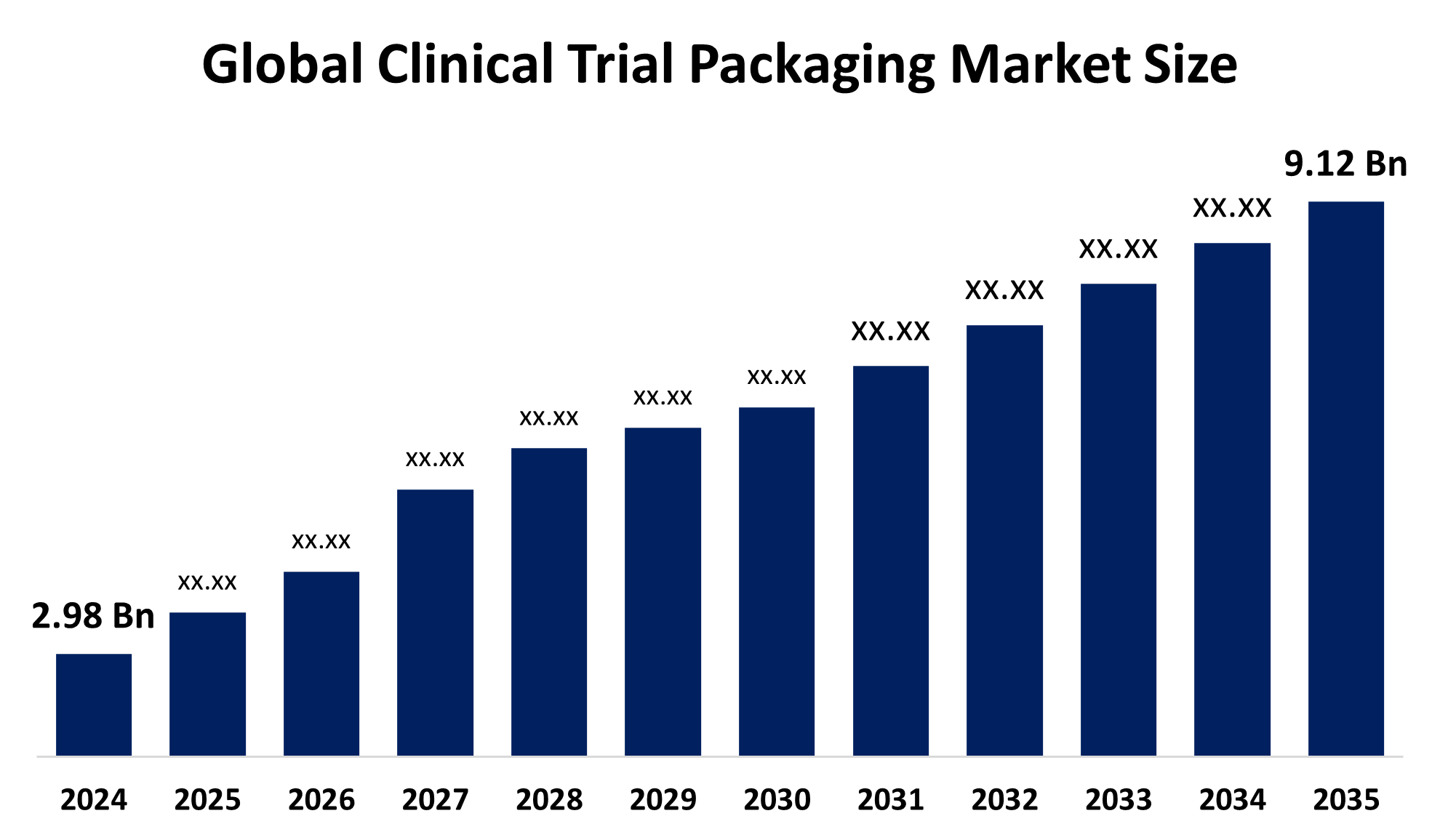

The Global Clinical Trial Packaging Market Size was Estimated at USD 2.98 Billion in 2024 and is Projected To Reach USD 9.12 billion by 2035, Growing at a CAGR of 10.70% from 2025 to 2035. The market for clinical trial packaging is expanding as a result of more clinical studies, improved medication research, and a rising demand for specialized packaging. This growth is also being fueled by elements such as increased prevalence of chronic diseases, legal mandates, and patient safety concerns.

Key Regional and Segment-Wise Insights

- In 2024, North America held the greatest revenue share of nearly 36.54% and led the clinical trial packaging market.

- The clinical trial packaging market is dominated by the United States because of its high R&D costs, intricate trial designs, and stringent regulations.

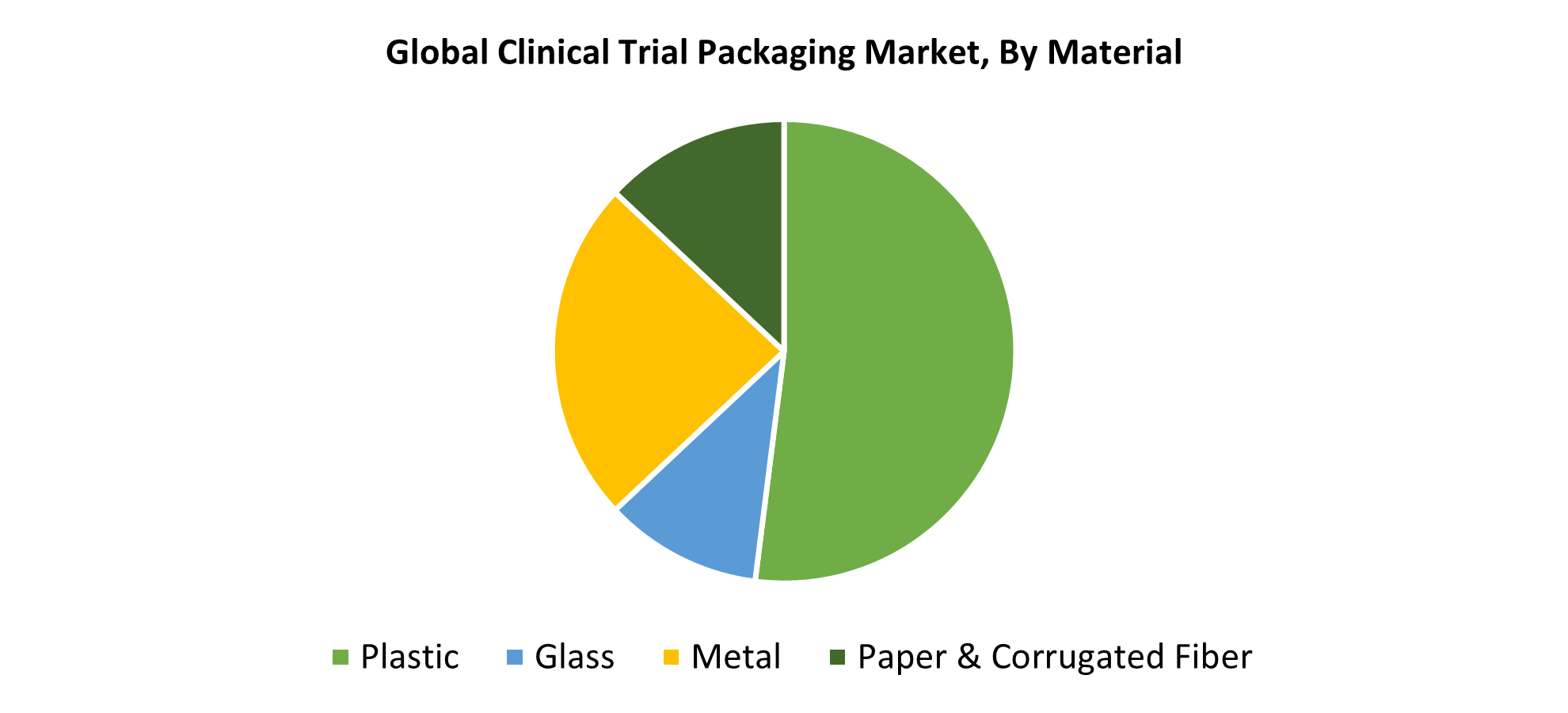

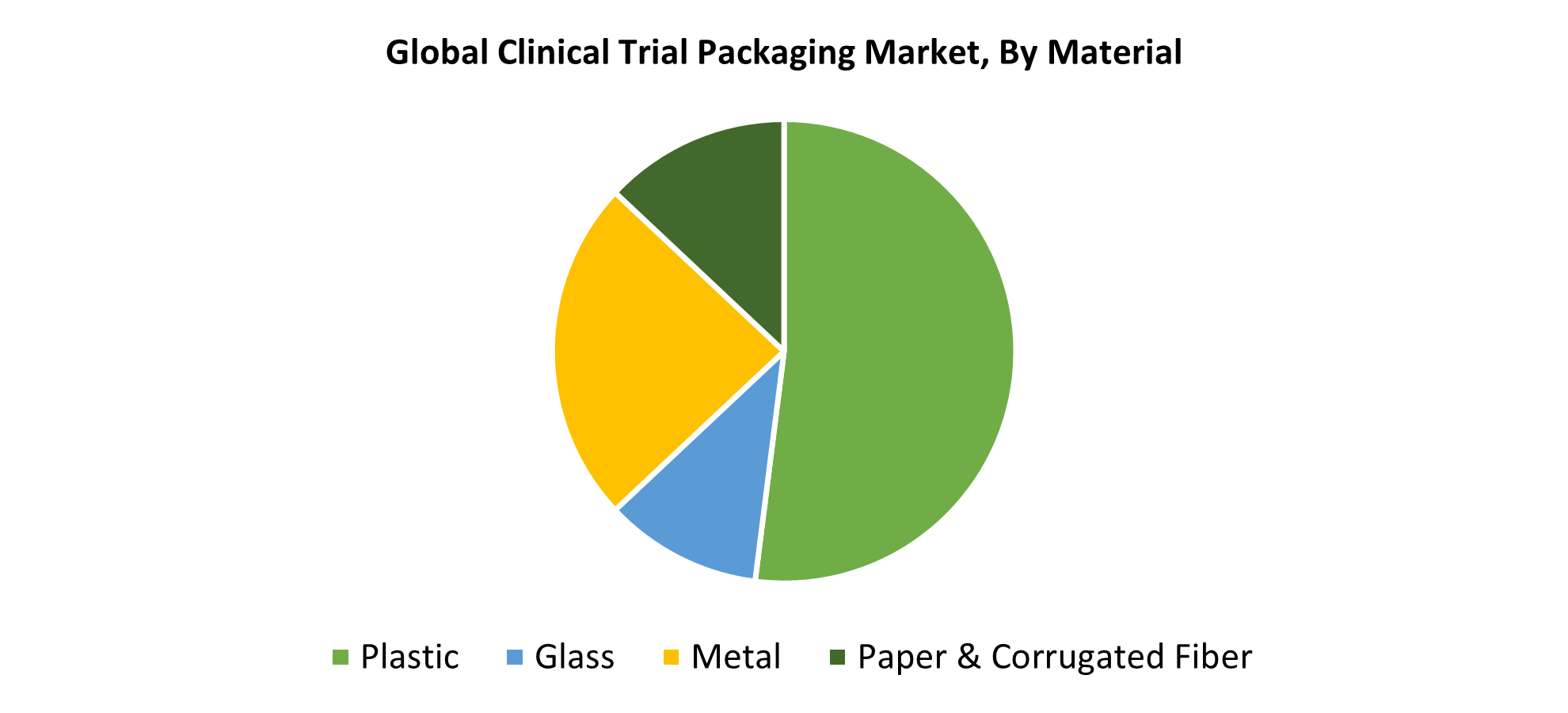

- In 2024, plastic material held the largest revenue share of 52.48% and led the market based on materials.

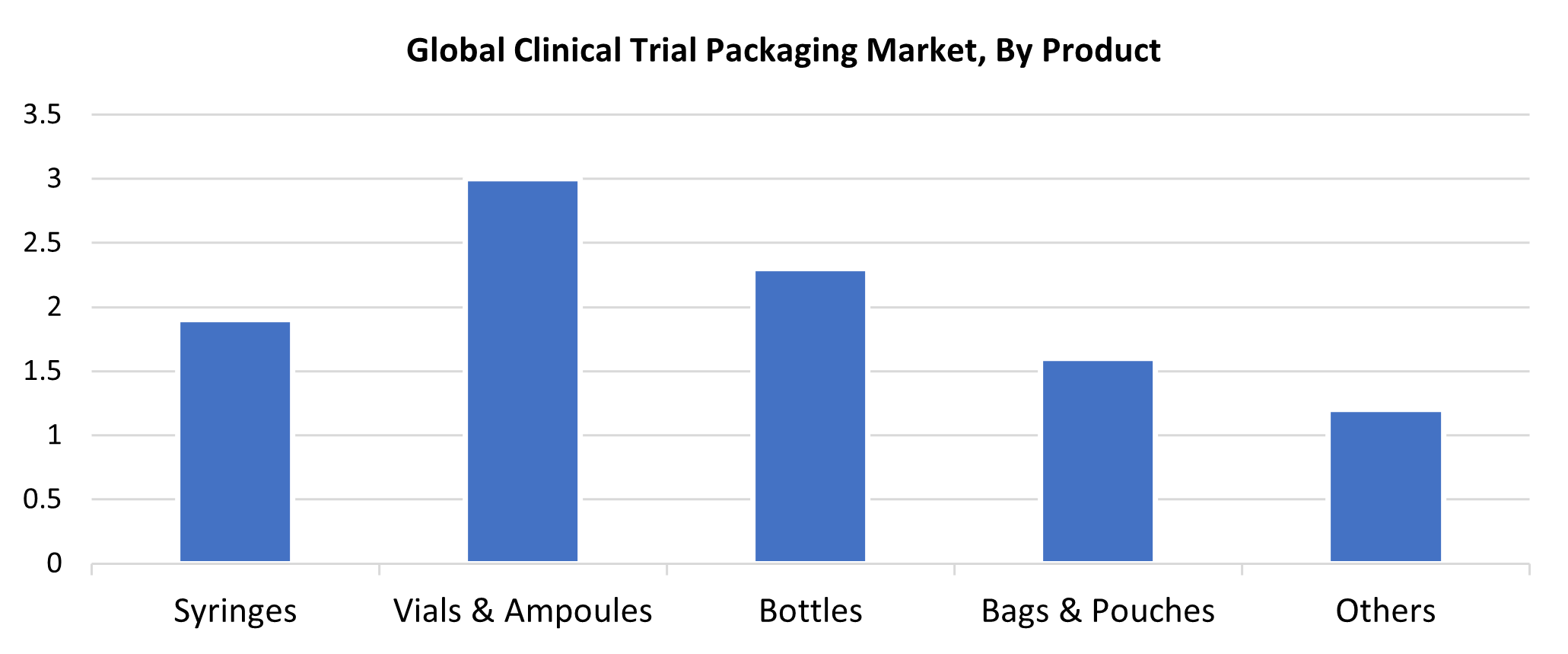

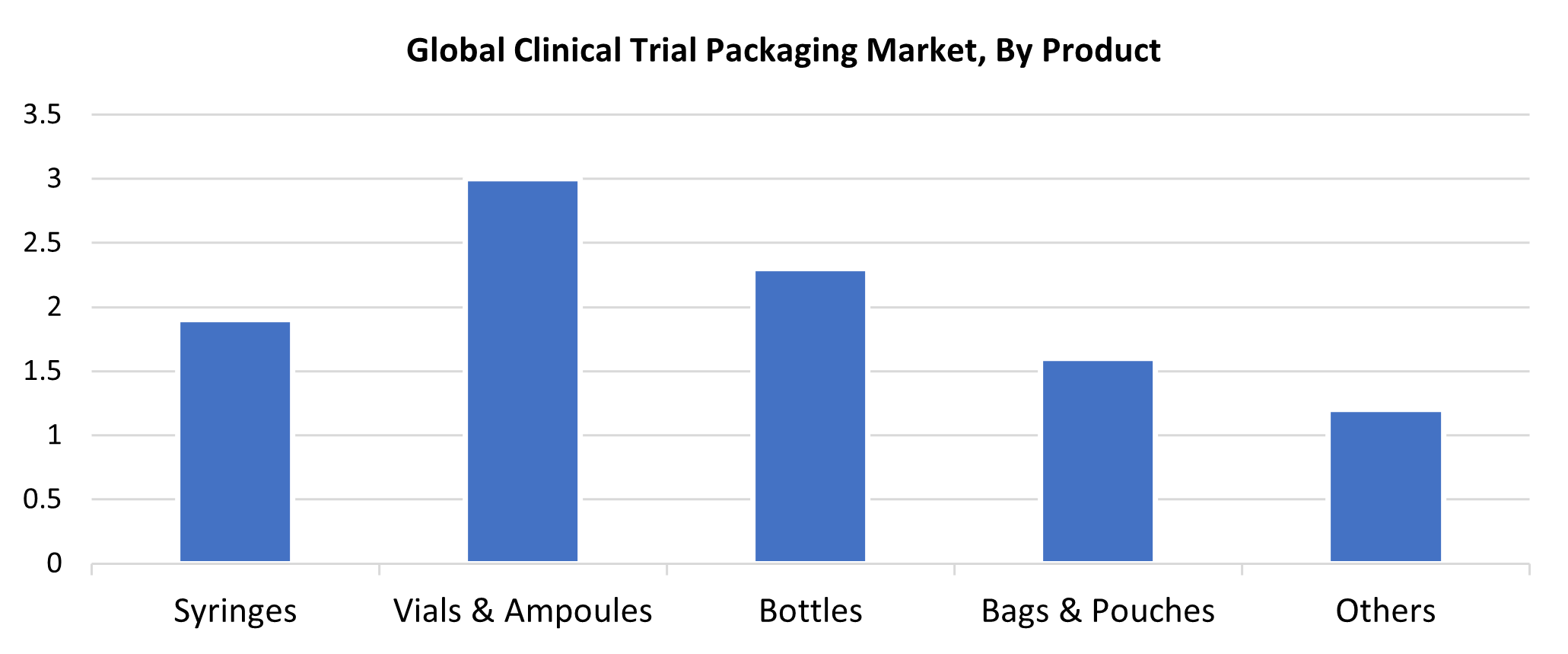

- Vials & Ampoules dominated the market and generated the highest revenue share of 30.6% in 2024 based on product.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 2.98 Billion

- 2035 Projected Market Size: USD 9.12 Billion

- CAGR (2025-2035): 10.70%

- North America: Largest market in 2024

- Asia Pacific: Fastest-growing regional market

The clinical trial packaging market refers to the particular packaging formats used to protect, store, and transport investigational products (drugs, devices, etc) during clinical trials. This packaging safeguards the product, conforms to regulatory requirements, and enables the trial participant to administer the investigational product as instructed. The rise of clinical trials globally, driven by increasing pharmaceutical R&D spend and a surge in new drug discovery, is the main driver of growth in the clinical trial packaging market. The growth of clinical trial packaging is further amplified as regulatory bodies (e.g., FDA and EMA) require tightly controlled and regulated trial designs that ensure well-organized and compliant clinical trials that demonstrate consumer safety and efficacy. Clinical trial packaging was positively impacted during the COVID-19 pandemic, mainly due to the increase in demand for clinical trial packaging because of unprecedented vaccine development.

As a result of the greater complexity of clinical trials, especially due to the growth in multi-site and international studies and adaptation trial modalities, the market continues to grow. These studies require complex packaging solutions to maintain stability, ensure accurate dosing and traceability across different time zones and locations. Two other significant factors influencing the clinical trial packaging market are serialization requirements and regulatory compliance. Clinical trial materials must specifically adhere to stringent labeling, recordkeeping, and monitoring standards due to the stratified monitoring requirements for Phase III studies and trials using banned products. This environment has encouraged the use of standardized package formats that comply with GMPs, which facilitate traceability and audit-readiness while maintaining blinding and randomization.

Material Insights

In 2024, the plastic material segment provided the maximum revenue share at nearly 52.48%. Plastic is commonly used by pharmaceutical companies because it is affordable, lightweight, and versatile. Plastic is often used for bottles, pouches, and vials. Plastic's continued dominance is driven by the increasing demand for sterile, single-use packaging for clinical trials and the increase in clinical research activity in emerging countries. The drawbacks of the glass material are avoided by these plastic properties. In addition to lowering carbon emissions, new recyclable and biodegradable polymers are generating new packaging applications that are acceptable under packaging standards, addressing environmental concerns.

The metal category is expected to grow at the fastest CAGR of 10.6% during the forecast period. Because of its incredible mechanical strength, light-proof, and barrier properties, metal, particularly aluminum, is used in clinical trial packaging. Metal is typically available in canisters and foil pouches. Aluminum is lightweight, especially about glass packaging. During clinical trials, metal ensures that the drugs are protected from light, moisture, and gases. The requirement for barrier protection and maximum drug product shelf life is the primary motivation for using metal in clinical trial packaging.

Product Insights

In 2024, the vials & ampoules segment held the maximum market revenue share of 30.6% share of the market total. Both vials and ampoules are the most commonly used primary packaging forms in clinical research, as they can accommodate liquid, lyophilized, and powder (solid) medications. Vials and ampoules are also utilized in early-phase studies where there is a need for long-term stability. Ampoules provide a one-time use option that is impermeable, while vials offer re-usability and the potential for re-sealing. Durable, inert packaging, including vials and ampoules, is becoming more popular as the usage of parenteral drugs and temperature-sensitive biologics increases.

In clinical protocols, oral liquids, capsules, and tablets are packaged in bottles made of glass or high-quality plastic. Bottles are an attractive delivery system for outpatient clinical trial contexts and continuous medication regimens because of their packaging design that facilitates labeling and administering dosage. The prevalence of bottles is further aided by the increased demand for oral medication formulations in clinical protocols, as well as the need for inexpensive, tamper-evident packaging opportunities.

Region Insights

In 2024, North America accounted for more than 36.54 % of the total revenue, resulting in the largest region in the clinical trial packaging market. North America has one of the largest numbers of clinical trials organizations and clinical research centers, contributing to the success of this region with a vast pharmaceutical industry. As research and development (R&D) activities continue to grow, the North American pharmaceutical industry is expected to be positive during the forecast period. For instance, the FDA is moving towards the implementation of patient-centered trials, leading to demand for tracking-enabled smart packaging. The growth of personalized medicine and orphan drugs requires specialty packaging such as small batch, high-accuracy labeling. To satisfy needs, businesses like PCI Pharma Services and Catalent offer sophisticated serialization and anti-counterfeiting technologies.

U.S. Clinical Trial Packaging Market Trends

The United States is the leading market for clinical trial packaging, mostly due to complicated trial designs, significant R&D expenses, and regulatory concerns. The rise of decentralized clinical trials (DCTs) has created a need for tamper-evident direct-to-patient packaging. For DCTs, there are companies such as Thermo Fisher Scientific that state they offer integrated packaging and shipping solutions.

Europe Clinical Trial Packaging Market Trends

Due to the robust regulatory environment in Europe and the European Union's Clinical Trials Regulation (CTR) expedited approval process, Europe plays a key part in developing the clinical trial packaging market. Countries like the UK and Germany lead the way in clinical research, adding to the regional demand for innovative packaging solutions. The emphasis on sustainability spurs innovations related to sustainable materials and types of recyclable packaging. The aging population in the region is another important factor that drives clinical trials relating to chronic and age-related conditions. The aging population has increased the importance of easy-to-open, user-friendly packaging. The focus for companies in Europe is to design packaging that balances participants' safety, compliance with regulations, and eco-friendly options.

Asia Pacific Clinical Trial Packaging Market Trends

Asia Pacific accounted for the fastest growth with a CAGR of 9.79% during the forecast period as a result of inexpensive manufacturing, growing pharmaceutical outsourcing, and increasing clinical trial activity. Global sponsors are lured to countries such as China and India because they can gain substantial savings on packaging and logistics when compared with Western markets. In addition to opportunity, rising R&D expenses and a developing pharmaceutical sector in developing markets, such as China, India, and Japan, are the largest drivers of growth for the market over the forecast period. There is rapid growth in global pharmaceutical demand, a rapidly aging population, increasing government programs, expanding contract manufacturing, and growing adoption of outsourcing. The increasing demand for complex packaging, temperature-controlled options for fragile drugs is driven by increased demand for biologics and biosimilars in the Asia Pacific.

Key Clinical Trial Packaging Companies:

The following are the leading companies in the clinical trial packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Thermo Fisher Scientific Inc.

- Clinigen Limited

- CCL Industries Inc.

- Gerresheimer AG

- WestRock Company

- Yourway

- SCHOTT Pharma

- Oliver

- PCI Pharma Services

- Sharp Services, LLC

- Borosil Scientific

- Nipro

- Others

Recent Developments

- In October 2022, Myonex, a global leader in clinical trial supply services, has announced that it had completed the acquisition of the clinical trial and packaging business of Hubertus Apotheke located in Berlin, Germany. The new company, Myonex GmbH, will support the company’s rapid growth and strengthen its footprint across the European Union.

- In July 2022, Sharp will collaborate with ClinsChain, a company specializing in clinical supply services for domestic and international clinical trials, to allow Chinese innovators to access wider markets while also enabling Sharp's pharma and biopharma clients to access the Chinese market more easily. Through the partnership, Sharp will be able to offer pharmaceutical clients local expertise on their clinical research, whilst leveraging the efficiencies of an existing mutually beneficial service relationship between Sharp and ClinsChain.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the clinical trial packaging market based on the below-mentioned segments:

Global Clinical Trial Packaging Market, By Material

- Plastic

- Glass

- Metal

- Paper & Corrugated Fiber

Global Clinical Trial Packaging Market, By Product

- Syringes

- Vials & Ampoules

- Bottles

- Bags & Pouches

- Others

Global Clinical Trial Packaging Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa