Aluminum Die Casting Market Summary

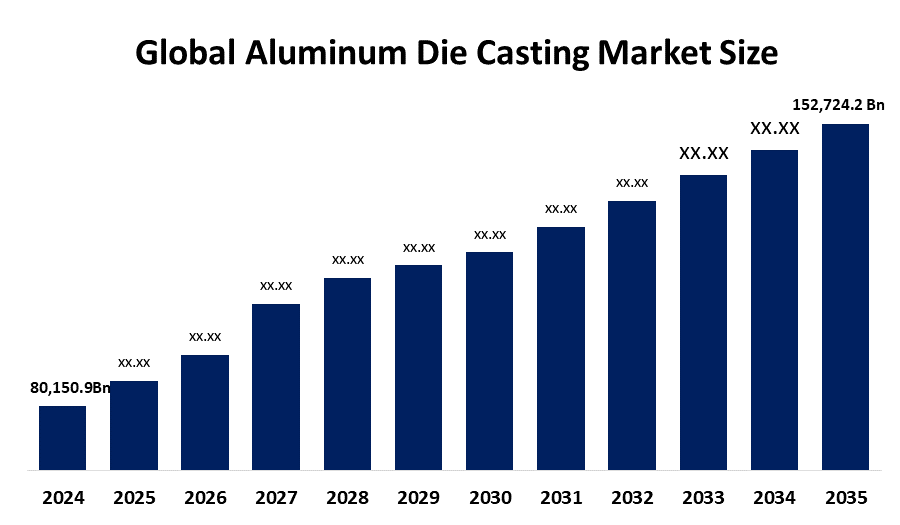

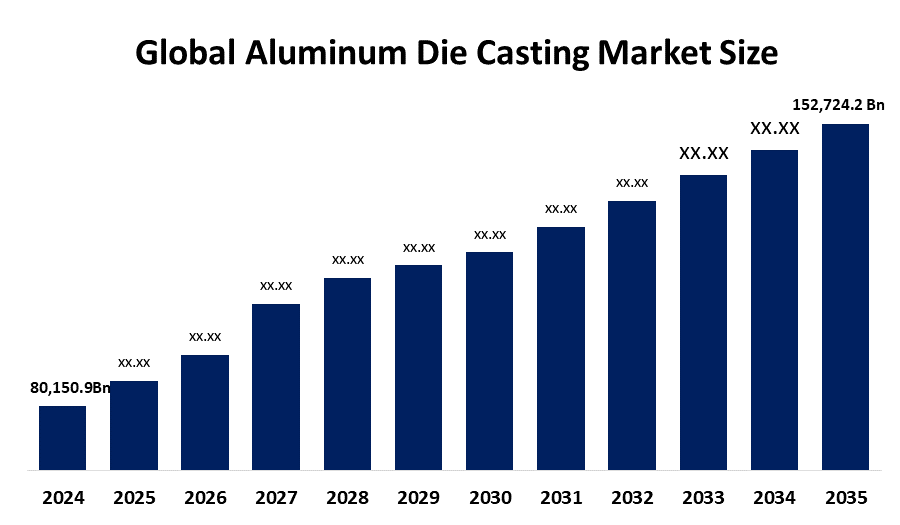

The Global Aluminum Die Casting Market Size was Estimated at USD 80,150.9 Million in 2024 and is projected to Reach USD 152,724.2 Million by 2035, Growing at a CAGR of 6.04% from 2025 to 2035. The Growing need for lightweight, strong, and high-performing components across a range of industries, especially in the electronics and automotive sectors, is the main factor propelling the expansion of the aluminum die casting market.

Key Regional and Segment-Wise Insights

- In 2024, the Asia Pacific aluminum die casting market held the largest revenue share of 50.6% and led the global market

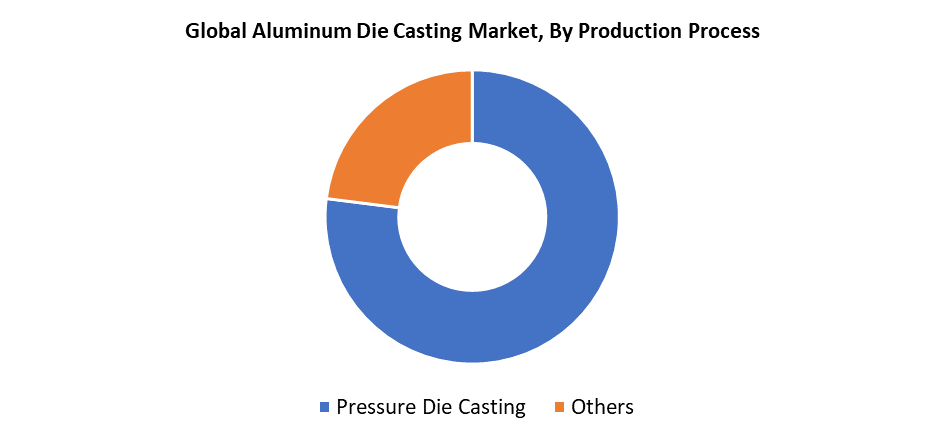

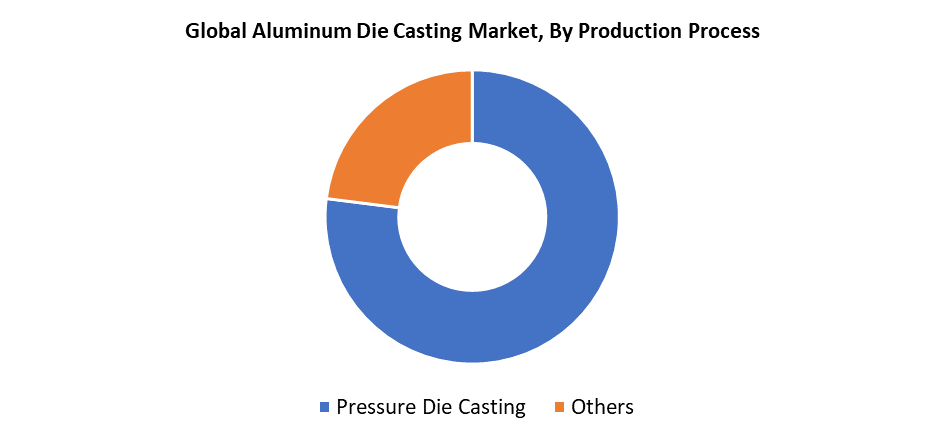

- In 2024, pressure die casting held the largest revenue share of 77.3% and led the market based on production process.

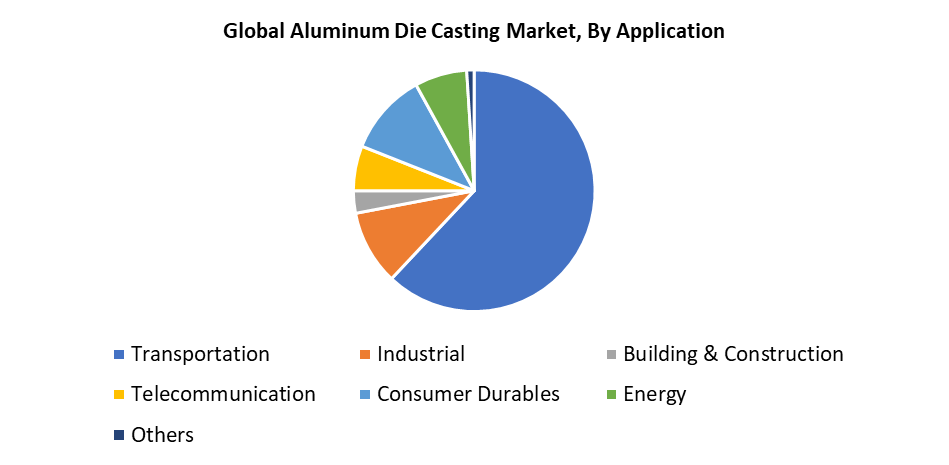

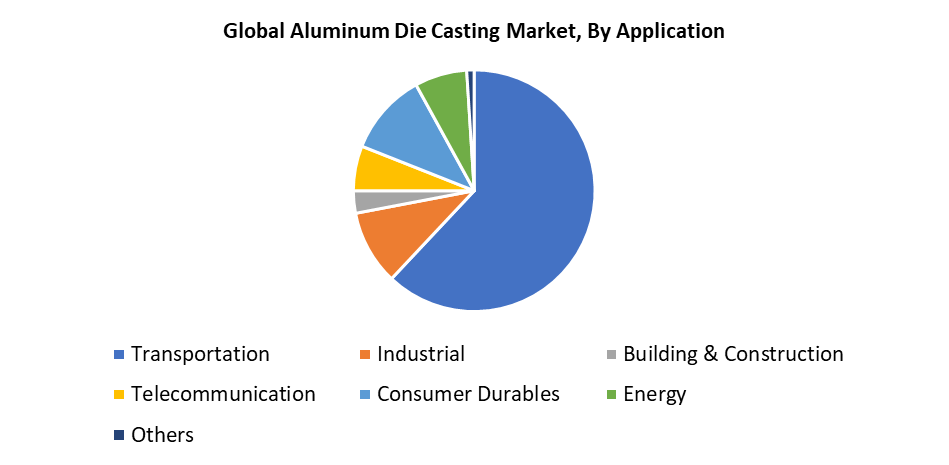

- Transportation dominated the market and generated the highest revenue share of 62.3% in 2024 based on application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 80,150.9 Million

- 2035 Projected Market Size: USD 152,724.2 Million

- CAGR (2025-2035): 6.04%

- Asia Pacific: Largest Market in 2024

The worldwide industry for producing metal components by injecting molten aluminum under high pressure into a mold cavity (die) is referred to as the aluminium die casting market. This method produces precision, high-volume components for a number of sectors, including electronics, appliances, and automotive. The global market is largely influenced by the increasing priority on sustainable manufacturing practices across industries. It is energy efficient and truly recyclable, which fits perfectly with this emphasis. Aluminum is also a highly recyclable material, which, in turn, promotes energy and resource conservation, and minimizes carbon emissions, providing an environmentally friendly process. Demand is expected to grow as companies try to meet regulatory requirements and attain their sustainability objectives.

The use of aluminum die castings in the construction industry continues to grow for applications such as prefabricated buildings, shop partitions, windows, curtain walls, and cladding. It is ideally suited to many applications because of its characteristics of being lightweight, strong, and resistant to corrosion, which is leading to the development of this field. The trend of construction investment increasing, especially in non-residential construction, is reflective of the building and construction industry's demand for innovative materials like aluminum die castings. The industry continues to benefit from support in the markets, with common use in the aircraft industry being a key advantage, providing many benefits, including resilience to corrosion and weight reduction, which provide high strength-to-weight ratios. The lightweight properties of the method also support sustainable initiatives by saving fuel as well as being energy efficient in areas such as the energy and transportation industries, which continues to expand market opportunities.

Production Process Insights

In 2024, pressure die casting had the largest share, of 77.3%, and its unique characteristics, such as excellent mechanical qualities, tight dimensional tolerance, smooth surface finish, and ease of effective cavity filling, further fuel the market. Pressure die casting makes it possible to manufacture complex geometries and thin-walled structures with precision, thus providing an efficient means of manufacturing lightweight aluminum parts that must perform to stringent requirements. In addition to the best practices for quality systems, improvements to die casting processes and new technologies have forced the evolution of pressure die casting. The evolution of pressure die casting has been enabled by advancements in quality control systems, automation, and new generation simulation tools that will speed up productivity, increase efficiency, and be more cost-effective.

The final product of other die-casting techniques, like vacuum die casting and squeeze die casting, has a much finer grain structure, increased tensile strength, and greater resistance to stress rupture, making it appropriate for high-performance, demanding applications. Aluminum die casting methods, including vacuum and squeeze techniques, find extensive application in making turbine blades and solar sensors. The main benefits of vacuum die casting and squeeze die casting consist of improved surface quality and enhanced material management, respectively.

Application Insights

The transport industry has the biggest revenue share of 62.3% in 2024, because of the demand for lighter vehicles. The market trend toward lighter automobiles is a major factor in the current utilization of aluminum products. The lighter, remarkably durable parts produced using the aluminum die casting technique and the increased emphasis on sustainability in the transportation sector are all contributing to the reduction of emissions from transportation. It is also worth noting that aluminum die casting provides a very high strength-to-weight ratio and resists corrosion, which allows producers in the transportation industry to produce lighter parts with great increases in the fuel efficiency of their vehicles. Aluminum die casting provides precise results and quick production timelines which makes it suitable for various transportation applications that address the rising demand for sustainable transportation solutions.

Additionally, significant is the industrial application of aluminum die-casting, which comprises agriculture, construction, and mining equipment. These industries consume a significant amount of aluminum cast products for their mechanical components. Demand for construction machinery is expected to grow with the continual growth in infrastructure spending in Asian economies, which will also support market growth. New opportunities will continue to emerge in concert with industrial expansion and considerable investment in adopting new industrial production methods. The aluminum die casting method should also help to provide sustainable revenue generation long-term for market participants, through better repeatability and higher quality final products. Also, we expect that the variety of applications and versatility for various industrial applications will help address demand for aluminum die casting services and solutions.

Regional Insights

The North American aluminum die casting market is projected to grow at a steady rate during the 2024-2035 forecast period due to a combination of post-pandemic recovery trends and concern over sustainability. Demand for aluminum die-cast products is anticipated to continue as businesses in the region are focused on restoring pre-COVID levels of production and integrating more sustainable solutions into their operations. Additionally, numerous other North American businesses are actively investing in clean technology and investing in green aluminum solutions, which should help boost market growth during the forecast time period. The overall demand for aluminum die casting in the region is being spurred by a number of catalysts, including an increase in automotive manufacturing activity, increased spending on aerospace and military, as well as a strong emphasis on sustainability.

U.S. Aluminum Die Casting Market Trends

The rising demand for strong, lightweight components in the industrial and automotive sectors is driving solid growth in the U.S. aluminum die casting marketplace. In addition, advancements in the technology of high-pressure die casting have improved the accuracy of production and efficiency, which has contributed to market growth. The transition toward electric and fuel-efficient manufacturing practices in the automotive industry has raised the need for die-cast aluminum components, including engine blocks, along with structural elements. Furthermore, it is anticipated that government efforts to increase domestic aluminum output and reduce carbon emissions will support the aluminum die casting industry's future expansion.

Asia Pacific Aluminum Die Casting Market Trends

In 2024, the Asia Pacific region will be dominant in the global aluminum die casting market, holding a 50.6% largest revenue share. The production facilities in Asia Pacific generate the highest profitability because trained labor costs remain low for the aluminum die casting industry. The region provides easier access to the aluminum die casting industry because manufacturers and vehicles and quick industrial growth, and an inexpensive skilled workforce drive its initial adoption of aluminum die casting across worldwide markets. The Asia-Pacific market continues to expand because it serves a large customer population that gains more disposable income and buys an increased number of electronic products and appliances. The Asia Pacific market contains numerous aluminum die casting companies, which consist of both manufacturing operations and different-sized businesses.

Europe Aluminum Die Casting Market Trends

The increasing demand in the automotive, aerospace, and electronics industries creates solid growth for aluminum die casting in Europe. Components must be strong, low-weight, and resistant to corrosion in automotive applications, especially as it pertains to electric vehicles (EVs) and lightweight structural components. Aluminum die casting provides these properties and has seen increased use as the heightened focus on light-weighting in order to achieve greater levels of fuel economy and the responsibility of complying with stringent pollution controls. Italy, France, and Germany are the leading markets based on developed infrastructure for manufacturing vehicles. Additionally, overall market growth is being supported by the aerospace industry and its preference for aluminum die-cast parts, and its inherent precision and durability.

Key Aluminum Die Casting Companies:

The following are the leading companies in the aluminum die casting market. These companies collectively hold the largest market share and dictate industry trends.

- Alcast Technologies

- Consolidated Metco, Inc.

- FAIST Group

- BUVO Castings

- Martinrea Honsel Germany GmbH

- GF Casting Solutions

- Chongqing CHAL Precision Aluminium Co., Ltd.

- Endurance Technologies Limited

- GIBBS

- Madison-Kipp Corporation

- Ryobi Limited

- Others

Recent Developments

- In September 2024, Sundaram Clayton Ltd, a manufacturer of auto components, announced the commencement of commercial production of aluminium die castings at its new facility located in the SIPCOT industrial area in the Tiruvallur district of Tamil Nadu.

- In August 2024, UBE Machinery Corporation, Ltd., the prominent company of the machine business of UBE Group, has developed a new die casting machine for giga casting, a die casting process using aluminum alloy to integrally cast body structure parts for battery electric vehicles (BEVs), etc. The new product offers a die clamping force of 9,000 metric tons, which is the highest die clamping force available for local delivery in Japan.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the aluminum die casting market based on the below-mentioned segments:

Global Aluminum Die Casting Market, By Production Process

- Pressure Die Casting

- Others

Global Aluminum Die Casting Market, By Application

- Transportation

- Industrial

- Building & Construction

- Telecommunication

- Consumer Durables

- Energy

- Others

Global Aluminum Die Casting Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa