Top 10 Largest Online Banking in the World: Check Size, Reach, and Digital Capabilities

Modern financial services are now anchored by the Online Banking industry, which has revolutionized how people and corporations access, manage, and transfer money worldwide. Today's Online Banking platforms offer seamless experiences through mobile apps, websites, and APIs, thanks to robust cybersecurity standards, evolving customer expectations, and rapid advancements in digital technology. From facilitating international transfers and real-time payments to providing AI-powered financial analytics and integrated investment services, the digital banking industry continues to evolve rapidly.

Financial institutions are making significant investments in cloud computing, data analytics, and user-friendly digital infrastructures as traditional banking gives way to digital-first and mobile-only platforms to remain competitive and adhere to regulatory requirements. In this article, we identify the top 10 biggest online banking platforms globally, assessing them according to market dominance, innovation, user base, and volume of digital transactions.

Market Overview and Current Scenario:

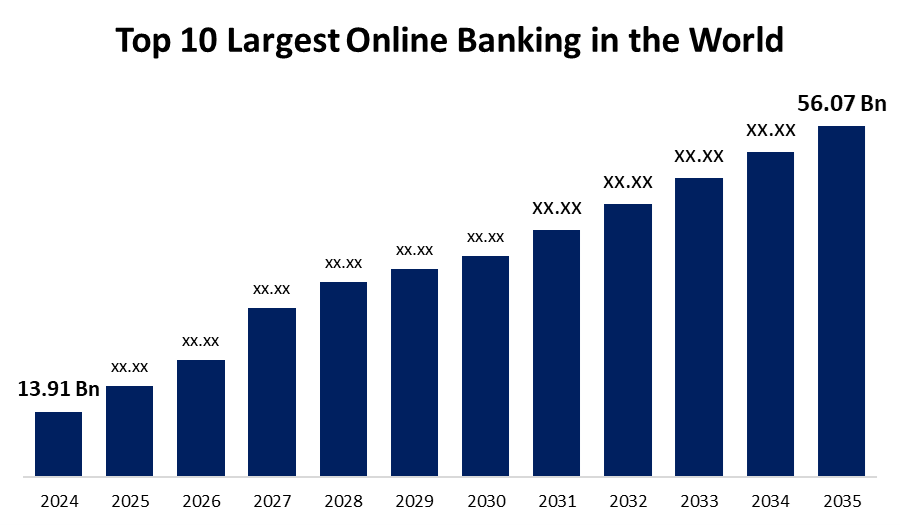

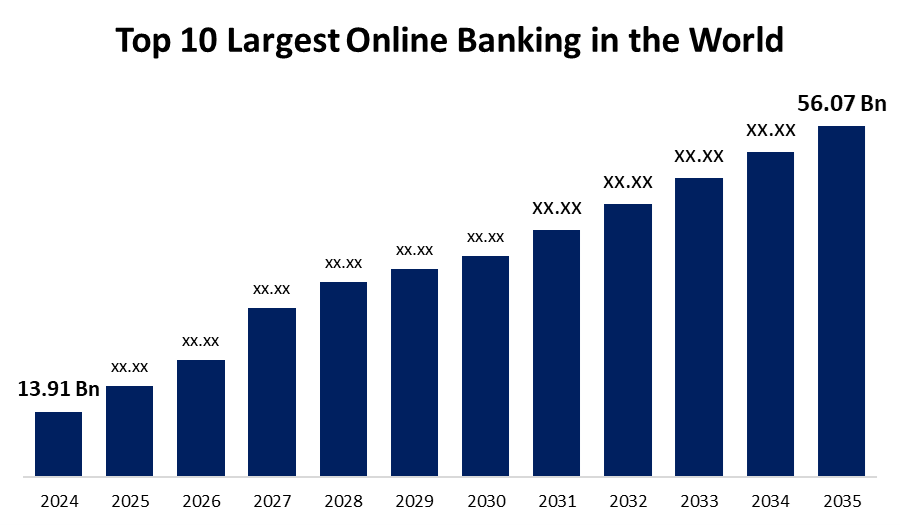

According to a research report published by Spherical Insights & Consulting, The Global Online Banking Market Size is expected to grow from USD 13.91 Billion in 2024 to USD 56.07 Billion by 2035, at a CAGR of 13.51% during the forecast period 2025-2035. Growing internet usage, smartphone proliferation, and consumer demand for contactless and cashless transactions are the main causes of the increase. To enhance customer experience and expedite procedures, banks in many countries are implementing open banking APIs, improving their mobile banking apps, and integrating artificial intelligence. Neobanks, another name for digital banks, are becoming more and more popular, particularly with younger consumers looking for individualized financial management tools and ease of use.

Additionally, the fact that there are almost 3.6 billion online bank users globally as of 2024 shows how traditional banking practices are giving way to digital platforms. Further demonstrating an increasing desire for accessibility, speed, and convenience, 39% of users worldwide now view banking applications as their main tool for managing financial transactions. The tech-savvy millennial generation, which is responsible for 79.3% of this shift, is also enthusiastic about Online Banking options. It is anticipated that in the upcoming years, their digital-first mentality and growing economic clout would further quicken the uptake and development of online banking services.

Online Banking Market Size & Statistics:

The Market for Online Banking was Estimated To be Worth USD 13.91 Billion in 2024.

The Market is Going to Expand at a CAGR of 13.51% between 2024 and 2035.

The Global Online Banking Market is Anticipated to reach USD 56.07 Billion by 2035.

Asia Pacific is Expected to Grow the fastest during the forecast period.

North America is Expected to Generate the highest demand during the forecast period.

Get The Free Sample Of This Report

Regional growth and demand:

The Asia-Pacific (APAC) region currently leads the global demand for the Online Banking Market.

The Asia-Pacific (APAC) region currently leads global demand for the Online Banking market, driven by strong smartphone penetration, extensive digitalization, and changing consumer preferences, all of which contribute to the significant growth of the online banking sector in the Asia-Pacific. With 295.5 million consumers currently using digital financial services, the online banking industry in India is expanding rapidly. Boasting a growth rate of 39.5% annually, the nation's digital lending market is projected to reach 720 billion Dollar by 2030, representing 55% of India's 1.3 trillion Dollar lending market. The surge in demand for online banking products is evidenced by this rapid growth.

The Chinese Online Banking business is also expanding quickly; by 2026, the mobile banking sector is expected to reach 4.6 billion Dollar , driven by a user base that prioritizes mobile devices and strong fintech integration. In general, the Asia-Pacific mobile banking market is expected to reach over 615.6 million Dollar by 2026, while the region's mobile payments are expanding by 29% a year, with the goal of reaching 8.94 trillion Dollar by 2027. The online banking business is seeing steady development, growing at an annual pace of 4.5% between 2020 and 2025, even in developed nations like Japan, as consumers grow more accustomed to using digital platforms.

The United States continues to lead the Global Online Banking Market, driven by strategic investments from financial institutions and high customer adoption rates. By 2025, the U.S. is expected to have 216.8 million digital banking users, reflecting its technologically advanced financial landscape. Consumer sentiment further supports this trend, with 91% of Americans rating their financial services as good to exceptional. In 2021, the U.S. held a 28.78% global market share in digital banking, showcasing its strong influence. Banks in the region are prioritizing modernizing online and mobile banking platforms (39%) and enhancing client experience (81%) as part of their digital transformation efforts.

Top 10 Largest Online Banks in the World:

The Online Banking industry has become a vital component of contemporary financial ecosystems in a time of swift digital transition. Banks are investing more in safe, innovative, and user-friendly solutions as a result of the billions of people who manage their funds online. Online Banking services are changing how people and organizations engage with financial institutions, from chatbots driven by artificial intelligence to mobile banking apps. The top 10 biggest online banking platforms in the world are highlighted in the list.

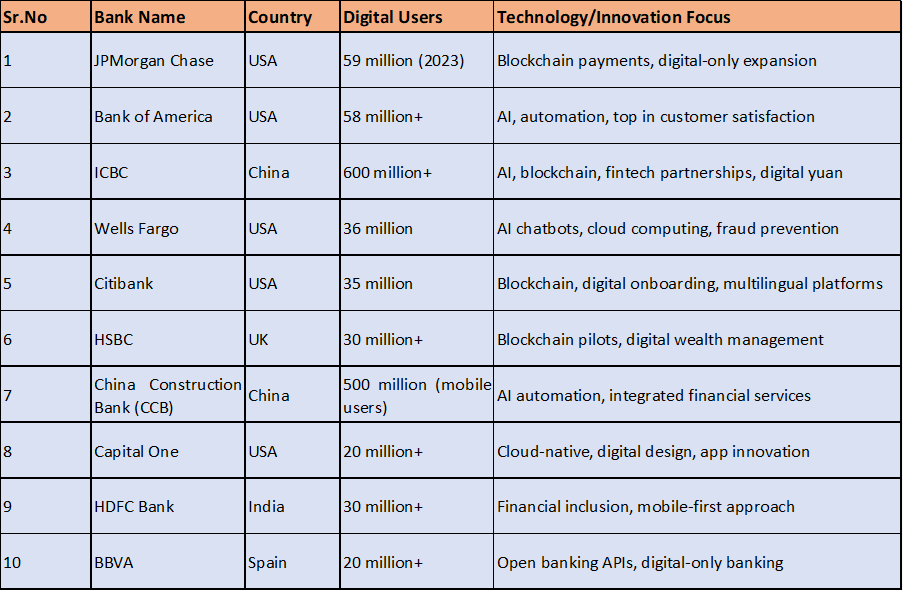

Comparison of the Top 10 Largest Online Banking Companies in the World Based on Digital Reach, Innovation, and Key Features:

1. JPMorgan Chase (USA)

As of 2023, JPMorgan Chase has around 59 million digitally active users, making it the market leader in the United States and a global leader in digital banking. Features like real-time investment tracking, smooth bill payments, and AI-powered financial insights are all included in the bank's mobile app. The user experience is made more dynamic and intuitive by its Chase Digital Assistant, which offers tailored financial advice and warnings. The bank is also making significant investments in blockchain-based payment systems, which improve transaction speed and security, as part of its digital transformation strategy. Younger, tech-savvy clients who like online banking over traditional branches are the aim of JPMorgan's expansion of its digital-only offerings. JPMorgan Chase, which has more than $3.9 trillion in assets and is frequently ranked among the biggest banks in the world, is a leader in financial technology, innovation, and digital client engagement.

2. Bank of America (USA)

As of 2023, Bank of America had more than 58 million verified digital customers, making it one of the biggest digital banking companies in the US. The AI-powered virtual assistant "Erica," which has managed over 2 billion interactions and helps users with transactions, financial advising, and account management, is a noteworthy feature. With biometric login capabilities and real-time fraud alerts integrated into its app, the bank places a strong emphasis on security. Customers can easily make instantaneous peer-to-peer payments thanks to integration with Zelle. Through its online platforms, Bank of America also provides investing services and budgeting tools. It has achieved high ranks in customer satisfaction surveys thanks to its constant focus on enhancing the user experience.

3. Industrial and Commercial Bank of China (ICBC)

ICBC, the biggest bank in the world in terms of total assets, with more than 600 million online banking customers and a strong internet presence. By 2023, the bank will have a strong digital ecosystem that caters to both corporate and retail clients. Real-time fund transfers, investment portfolio management, smart lending, and cross-border transactions are among the services offered by ICBC's online and mobile platforms. To improve its AI, big data, and blockchain capabilities, the bank has teamed with a number of fintech companies. This has led to quicker loan processing and more individualized financial solutions. To further solidify its position in China's cashless economy, ICBC is also actively working with the Chinese government to develop digital yuan wallets.

4. Wells Fargo (USA)

As of 2023, Wells Fargo, one of the top banking companies in America, has about 36 million active online users. A feature-rich mobile app that provides credit score tracking, cardless ATM access, and real-time transaction alerts is part of the bank's digital banking infrastructure. Wells Fargo has implemented a digital-first strategy, emphasizing customer experience through technology and transparency, in reaction to previous trust difficulties. Improved security procedures, streamlined digital onboarding, and chatbots powered by AI are some of the bank's innovative initiatives. In order to assist consumers in better managing their funds, it has also created tools for spending analysis and budgeting. Wells Fargo has made significant investments in data analytics and cloud computing to improve its digital services and update its infrastructure.

5. Citibank (USA)

Citibank, which has about 35 million digital users in more than 100 countries, has made a name for itself in the worldwide digital banking market. The bank's web and mobile platforms provide easy access to international accounts, real-time money transfers, tools for foreign exchange, and information for financial planning. As a leader in digital-only banking products, Citibank has a significant online presence throughout Asia and Latin America. It has streamlined customer acquisition and increased transaction speed through its investments in blockchain and AI-driven onboarding platforms. Additionally, in order to draw in tech-savvy customers, Citibank offers robo-advisory services and smart portfolio tools. Regional customisation and multilingual support improve the app's usefulness for clients from other countries.

6. HSBC (UK)

With more than 30 million digital clients in 64 countries as of 2023, London-based HSBC is a major force in digital banking worldwide. With its "Wealth Dashboard," which provides AI-based financial advisory tools, the bank has achieved notable advancements in digital wealth management. Users of the HSBC mobile app can monitor their portfolios, trade foreign equities, and get tailored financial advice. The bank is improving cybersecurity and cross-border payments as blockchain trials receive more attention. In an effort to enhance customer experience and save operating expenses, HSBC has also made significant investments in mobile-first innovations. Its ongoing investments in cloud-based technology and fintech collaborations help to assist its digital transformation.

7. China Construction Bank (China)

One of the "Big Four" Chinese banks, China Construction Bank (CCB), has embraced digital transformation to a remarkable degree. By 2023, CCB will have served more than 500 million mobile banking customers by offering a single platform for retail banking, insurance, and wealth management. The bank's AI-powered services improve client happiness and operational efficiency by automating customer service duties and providing real-time financial support. Loan approvals, intelligent credit analysis, and smooth digital onboarding are all supported by CCB's mobile platform. The bank keeps growing its fintech ecosystem by working with digital companies to develop big data and blockchain solutions. CCB's dominance in the Asia-Pacific online banking sector is highlighted by its capacity to deploy digital services throughout China's enormous population.

8. Capital One (USA)

One of the most technologically sophisticated banks in the US is Capital One, as is well known. With more than 20 million digital clients by 2023, the bank has established a solid reputation thanks to its cloud-native and mobile-first architecture. Its highly regarded mobile app offers voice-command capabilities, card management, AI-powered budgeting tools, and real-time alerts. In order to improve security and enable faster feature deployment, Capital One has shifted a large portion of its infrastructure to the cloud. Additionally, the bank has made significant investments in machine intelligence to improve fraud detection and customize consumer experiences. Partnerships with IT firms and ongoing app improvement are examples of its dedication to innovation. The focus on user-centric design in Capital One's strategy guarantees that its offerings live up to the demands of tech-savvy clients.

9. HDFC Bank (India)

The biggest private sector lender in India, HDFC Bank, has become a leader in digital banking, with more than 30 million subscribers as of 2023. Instant financial transfers, real-time account updates, and digital KYC are just a few of the digital services that the bank provides through its "NetBanking" and "MobileBanking" platforms. With its strong UPI (Unified Payments Interface) connectivity and specialized digital lending environment, HDFC makes it possible to process loans from start to finish without requiring paper documentation. Investment alternatives, EMI calculators, and AI-powered personal finance tools are all available on the bank's mobile app. HDFC uses chatbot technology to provide round-the-clock customer service as well. Through the introduction of modern banking to rural and semi-urban areas, its digital-first strategy advances India's objective of financial inclusion.

10. BBVA (Spain)

As a pioneer in digital banking in Europe and Latin America, BBVA, a Spanish company, has made a name for itself. With more than 20 million people using the internet regularly in 2023, BBVA has concentrated on creating a customer-focused, digital-only business model. AI-powered solutions for budgeting, tracking savings goals, managing investments, and financial education are available through the bank's award-winning mobile app. By implementing open banking APIs early on, BBVA promoted innovation through third-party fintech collaborations and allowed for safe data sharing. Its digital platform facilitates smooth international transfers, blockchain-enabled services, and real-time account information. With its online platform, BBVA offers users 24/7 banking and drastically lowers operating costs.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter