Global Online Life Insurance Market Size, Share, and COVID-19 Impact Analysis, By Policy Type (Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Variable Life Insurance and Others), By Age Group (Minors, Adults and Seniors), By Distribution Channel (Direct Sales, Insurance Aggregators, Brokers and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Industry: Banking & FinancialGlobal Online Life Insurance Market Insights Forecasts to 2033

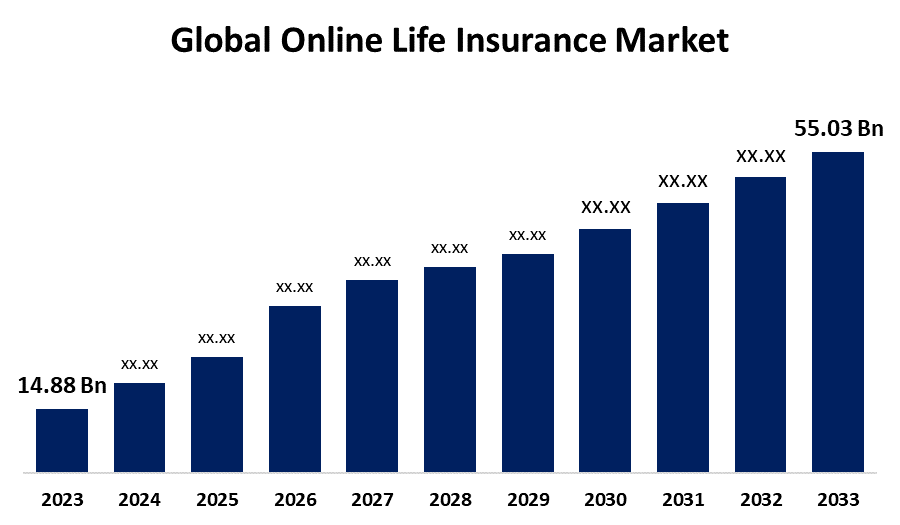

- The Global Online Life Insurance Market Size was estimated at USD 14.88 Billion in 2023

- The Market Size is Expected to Grow at a CAGR of around 13.97% from 2023 to 2033

- The Worldwide Online Life Insurance Market Size is Expected to Reach USD 55.03 Billion by 2033

- Asia Pacific is expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Online Life Insurance Market Size was worth around USD 14.88 Billion in 2023 and is predicted to grow to around USD 55.03 Billion by 2033 with a compound annual growth rate (CAGR) of 13.97% between 2023 and 2033. The online life insurance industry is fueled by growing digital adoption, heightened financial protection awareness, low-cost distribution for insurers, AI-driven underwriting, favorable government policies, and the rise of insurtech startups providing quick, personalized, and convenient digital insurance solutions.

Market Overview

The online life insurance market describes the virtual environment in which life insurance policies are investigated, contrasted, bought, and controlled by web-based platforms, such as insurers' websites, mobile phone apps, and aggregators. It allows people to access life insurance services without direct interaction, providing convenience, speed, and frequently lower prices. The online market for life insurance is expanding at a fast pace with the widespread usage of digital technology and the heightened accessibility of the internet and mobile phones across the globe. It becomes simpler for consumers to make quick comparisons among different life insurance policies through online platforms, allowing them to make better-informed decisions. In addition, regulatory changes across countries aimed at facilitating financial inclusion and safeguarding consumer interests are propelling the development of the online life insurance market. Regulators and governments are actively advocating the utilization of digital channels as a means of bringing insurance offerings to a greater population. The initiative is forcing insurers to think creatively and to improve their web offerings, so they can keep up with a rapidly digitalized market.

Report Coverage

This research report categorizes the online life insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the online life insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the online life insurance market.

Global Online Life Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 14.88 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 13.97% |

| 2033 Value Projection: | USD 55.03 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Policy Type (Term Life Insurance, Whole Life Insurance, Universal Life Insurance, Variable Life Insurance and Others), By Age Group (Minors, Adults and Seniors), By Distribution Channel (Direct Sales, Insurance Aggregators, Brokers and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa) |

| Companies covered:: | MetLife, Prudential Financial, AXA, Allianz, China Life Insurance, Berkshire Hathaway, Manulife Financial, AIA Group, Zurich Insurance Group, Generali Group, New York Life Insurance, Nippon Life Insurance, Ping An Insurance, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased internet penetration, smartphone adoption, and digital payment infrastructure have facilitated consumers to compare, research, and buy insurance online. The ease of 24/7 access and app-based convenience is driving consumer behavior towards digital-first insurance products. Additionally, online channels minimize the requirement for physical branches and agents, reducing acquisition and operating costs. Insurers are increasingly moving towards direct-to-consumer models where they can manage pricing, customer experience, and retention through data-driven, personalized engagement.

Restraining Factors

Most consumers are not well informed about life insurance products, particularly when they are buying online in the absence of an advisor. Misconceptions regarding coverage, benefits, and premium structures lead to hesitation or poor choices, lowering confidence in buying life insurance online. Further, life insurance policies, particularly those involving investment elements, are challenging to comprehend without tailored advice. The absence of human counsel in internet-based channels constrains customers from making the best understanding of policy intricacies, which deters them from making a purchase.

Market Segmentation

The online life insurance market share is classified into policy type, age group, and distribution channel.

- The term life insurance segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period.

Based on the policy type, the online life insurance market is divided into term life insurance, whole life insurance, universal life insurance, variable life insurance, and others. Among these, the term life insurance segment dominated the market in 2023 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by term life insurance provides low-cost, high coverage in comparison to whole or universal life policies. This renders it particularly appealing to price-conscious consumers like young adults and families who seek financial security without a huge monthly financial outlay. Its affordability is a key driver in online markets.

- The adults segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

Based on the age group, the online life insurance market is divided into minors, adults, and seniors. Among these, the adults segment accounted for a significant share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is due to adults, especially between the age group of 25–50, who are generally primary income earners who maintain a family. They want life insurance to ensure the future of their dependents in the event of untimely occurrences. Income replacement, protection of debts, and covering their families explain why they are the most active segment to buy insurance products.

- The direct sales segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the distribution channel, the online life insurance market is divided into direct sales, insurance aggregators, brokers, and others. Among these, the direct sales segment accounted for the biggest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to consumers who tend to feel safer buying life insurance directly from a familiar insurer compared to a third-party aggregator or broker. Brand loyalty and trust favor established insurers, which leads customers to their direct online channels for convenience and perceived reliability.

Regional Segment Analysis of the Online Life Insurance Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

North America is anticipated to hold the largest share of the online life insurance market over the predicted timeframe.

Get more details on this report -

North America is anticipated to hold the largest share of the online life insurance market over the predicted timeframe. North America has top insurtech companies such as Haven Life and Ethos that are focused on online life insurance. These players spur innovation through artificial intelligence-based underwriting, real-time quotes, and easy-to-use apps, making digital insurance affordable, quick, and desirable to a technology-savvy population. Regulators in the U.S. and Canada have kept pace with digital trends by permitting e-signatures, online disclosure, and electronic policy documents. These reforms provide a safe and compliant framework for insurers to conduct digital business, driving growth in online distribution of insurance.

Asia Pacific is expected to grow at a rapid CAGR in the online life insurance market during the forecast period. Most APAC nations have experienced a growth in internet and smartphone penetration, particularly in urban and semi-urban regions. Mobile-first consumers in nations such as India, China, and Indonesia are increasingly at ease using digital channels for financial products, driving online insurance uptake growth. Governments in the region, such as India and China, are actively encouraging digital financial services and insurance penetration. Initiatives such as India's Jan Dhan-Aadhaar-Mobile (JAM) trinity and Digital India have provided a solid foundation for the distribution of insurance online, particularly in remote geographies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the online life insurance market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- MetLife

- Prudential Financial

- AXA

- Allianz

- China Life Insurance

- Berkshire Hathaway

- Manulife Financial

- AIA Group

- Zurich Insurance Group

- Generali Group

- New York Life Insurance

- Nippon Life Insurance

- Ping An Insurance

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In December 2024, ICICI Prudential Life Insurance launched 'ICICI Pru Wish', a maiden health product in the life insurance sector, offering protection against women-specific critical illnesses and surgeries. ICICI Prudential Life Insurance has created this product jointly with Reinsurance Group of America, Incorporated (RGA), a global life and health reinsurer.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the online life insurance market based on the below-mentioned segments:

Global Online Life Insurance Market, By Policy Type

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Variable Life Insurance

- Others

Global Online Life Insurance Market, By Age Group

- Minors

- Adults

- Seniors

Global Online Life Insurance Market, By Distribution Channel

- Direct Sales

- Insurance Aggregators

- Brokers

- Others

Global Online Life Insurance Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the online life insurance market over the forecast period?The global online life insurance market is projected to expand at a CAGR of 13.97% during the forecast period.

-

2. What is the market size of the online life insurance market?The global online life insurance market size is expected to grow from USD 14.88 Billion in 2023 to USD 55.03 Billion by 2033, at a CAGR of 13.97% during the forecast period 2023-2033.

-

3. Which region holds the largest share of the online life insurance market?North America is anticipated to hold the largest share of the online life insurance market over the predicted timeframe.

Need help to buy this report?