Global Neobanking Market Size, Share, and COVID-19 Impact Analysis, By Account Type (Business account, Savings account), By Services (Mobile-banking, Payments, money transfers, savings, Loans, Others), By Application Type (Personal, Enterprises, Other applications), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2022 - 2032

Industry: Banking & FinancialGlobal Neobanking Market Insights Forecasts to 2032

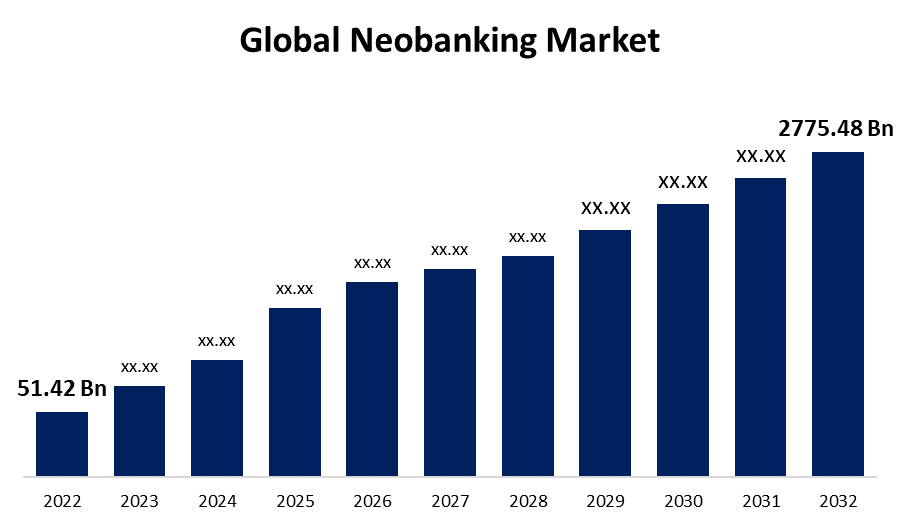

- The Global Neobanking Market Size was valued at USD 51.42 Billion in 2022.

- The Market is Growing at a CAGR of 49.01% from 2022 to 2032

- The Worldwide Neobanking Market Size is expected to reach USD 2775.48 Billion by 2032

- Asia Pacific is expected to grow the fastest during the forecast period

Get more details on this report -

The Global Neobanking Market Size is expected to reach USD 2775.48 Billion by 2032, at a CAGR of 49.01% during the forecast period 2022 to 2032.

A Neobank is a type of direct bank that only conducts business online and does not have traditional physical branch networks; it is also known as an online bank, internet-only bank, digital bank, or electronic bank. Neo Banks are financial institutions that work with licenced banks to conduct business. They use API banking to automate financial processes and provide their customers with access to a centralised dashboard from which they can manage everything from accounting to reconciliations and payments. Neobanks are fintech firms that offer automated and mobile-first financial arrangements instalments and money transfers, money loaning, and so on. In general, neobanks have a completely different business model than traditional banks. In any case, neobanks, like traditional banks, make money only between cash inflow and loaning. Also, because there is no physical location and everything is done online, client expenses are substantially decreased. Because neobanks are consumer-centric, they provide customised services to their clients that are enabled by technology. Neobanks do not have their bank licence and must rely on bank partners to provide bank licence administrations. As the financial landscape shifts towards client experience and fulfilment, a gap has developed. As the financial landscape shifts towards client experience and fulfilment, a gap has opened between what traditional banks offer and what clients expect. Neobanks are also attempting to fill that void.

Global Neobanking Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 51.42 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 49.01% |

| 2032 Value Projection: | USD 2775.48 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Account Type, By Services, By Application Type and By Region. |

| Companies covered:: | Movencorp Inc., Mybank, N26, Revolut Ltd., Simple Finance Technology Corp., Ubank Limited, Webank, Inc., Atom Bank PLC, Fidor Bank Ag, Monzo Bank Ltd, and |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise of digital technology and the internet, as well as changing consumer behaviour and preferences, have all contributed to the growth of the neobanking market. The neobanking market is expected to expand further in the coming years. This growth is expected to be fuelled by factors such as increasing smartphone penetration, rising demand for digital banking services, and the continued development of fintech infrastructure. Furthermore, neobanks are increasingly collaborating with traditional banks and financial institutions, which is expected to drive neobanking service adoption. The increased adoption of digital banking solutions, such as mobile banking and online account opening, is a current market trend. Another trend is neobanks' expansion into new markets, such as SME lending and investment services, as well as partnerships with traditional financial institutions to provide white-label banking services. Furthermore, Accelerated customer base expansion, innovative revenue generation and modernization models, and increased product launches globally are expected to contribute significantly to market growth over the forecast period. To make payments faster, many financial service providers are launching services through mobile apps. For example, Revolut announced the launch of Google Pay in November 2020 for its customers in Greece, Bulgaria, Estonia, Austria, Hungary, Lithuania, Latvia, Portugal, the Netherlands, and Romania in order to make online and in-store payments faster and easier.

Restraining Factors

Authenticity and financial security are two major barriers that are expected to stifle the global neobanking market's growth over the forecast period. Since many people are going digital, fraudsters have begun coming up with creative ways to trick unsuspecting customers. It is malicious software designed to attack smartphone operating systems. It crashes the operating system and exposes private data stored on the phone. Fraudsters can gain access to personal banking information by using banking apps or other data that may have saved somewhere on cell phones. They can gather your personal financial information this will cause consumer can loss money As attacks become more frequent and powerful, mobile malware poses a challenge to the neobanking industry.

Market Segmentation

By Account Type Insights

The business accounts segment dominates the market with the largest revenue share over the forecast period.

On the basis of account type, the neobanking market is segmented into business accounts and savings accounts. Among these, the business accounts are dominating the market with the largest revenue share over the forecast period. Various businesses around the world are embracing neobanking as the preferred method of payment for large payouts. Furthermore, the ability of neobank platforms to provide simplicity and ease of processes in disbursals to vendors and other stakeholders by reducing human intervention is expected to drive segment growth.

By Services Insights

The money transfer segment is witnessing significant CAGR growth over the forecast period.

Based on the services, the neobanking market is segmented into mobile banking, payments, money transfers, savings, loans, and others. Among these, the money transfer segment is witnessing significant growth over the forecast period. The process is very simple to transfer funds between accounts; Consumer can transfer money from one location to another locations within minutes. Also, Consumers easily pay monthly bills via online money transfer. There is no need to go to airports or railway stations to book tickets. This segment has the largest share over the forecast period for a variety of reasons.

By Application Insights

The enterprises dominate the market with the largest revenue share over the forecast period.

Based on application, the neobanking market is segmented into personal, enterprises, and other applications. Among these, the enterprise segment is dominating the market with the largest revenue share over the forecast period. Credit management, transaction management, and asset management are among the services provided by enterprise platforms. Several neobank service providers for SMEs are working to expand their product portfolios through acquisitions in order to provide a better customer experience. For example, in December 2021, Open, a provider of SME Neobanking platforms, announced the purchase of Fining, a consumer Neobanking platform, for USD 10 million in cash and stock.

Regional Insights

Europe dominates the market with the largest market share over the forecast period.

Get more details on this report -

Europe segment accounted for the largest market share over the forecast period. The development of numerous innovative technologies and the early adoption of new technologies can be attributed to the regional market's growth. Furthermore, companies are focusing on the launch of product platforms and the formation of partnerships in order to strengthen their market position. Several regional neobanks have established brick-and-mortar distribution channels to establish an O2O type of distribution, thereby creating market growth opportunities.

Asia Pacific is expected to grow the fastest during the forecast period. The increasing use of smartphones, along with the growing adoption of Internet services, is expected to accelerate market growth. Furthermore, factors such as simple and convenient banking services and the rise of digital-only banks in countries such as Japan, India, and China are expected to contribute to regional market growth. Furthermore, the region's young demographics are expected to be an additional benefit for the adoption of neobanks.

List of Key Market Players

- Movencorp Inc.

- Mybank

- N26

- Revolut Ltd.

- Simple Finance Technology Corp.

- Ubank Limited

- Webank, Inc.

- Atom Bank PLC

- Fidor Bank Ag

- Monzo Bank Ltd

Key Market Developments

- In August 2023, In Singapore, Revolut Ltd. launched Instant Card Transfers.

- In October 2022, Kitzone Neo Bank, based in Rajasthan, is introducing India's first guaranteed cashback debit cards, as well as the Mini ATM and POS Terminal.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the neobanking market based on the below-mentioned segments:

Neobanking Market, Account Type Analysis

- Savings Account

- Business Account

Neobanking Market, Services Analysis

- Mobile-Banking

- Payments

- Money Transfers

- Savings

- Loans

- Others

Neobanking Market, Application Analysis

- Personal

- Enterprises

- Others

Neobanking Market, Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- Uk

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Need help to buy this report?