Retail Ready Packaging Market Summary

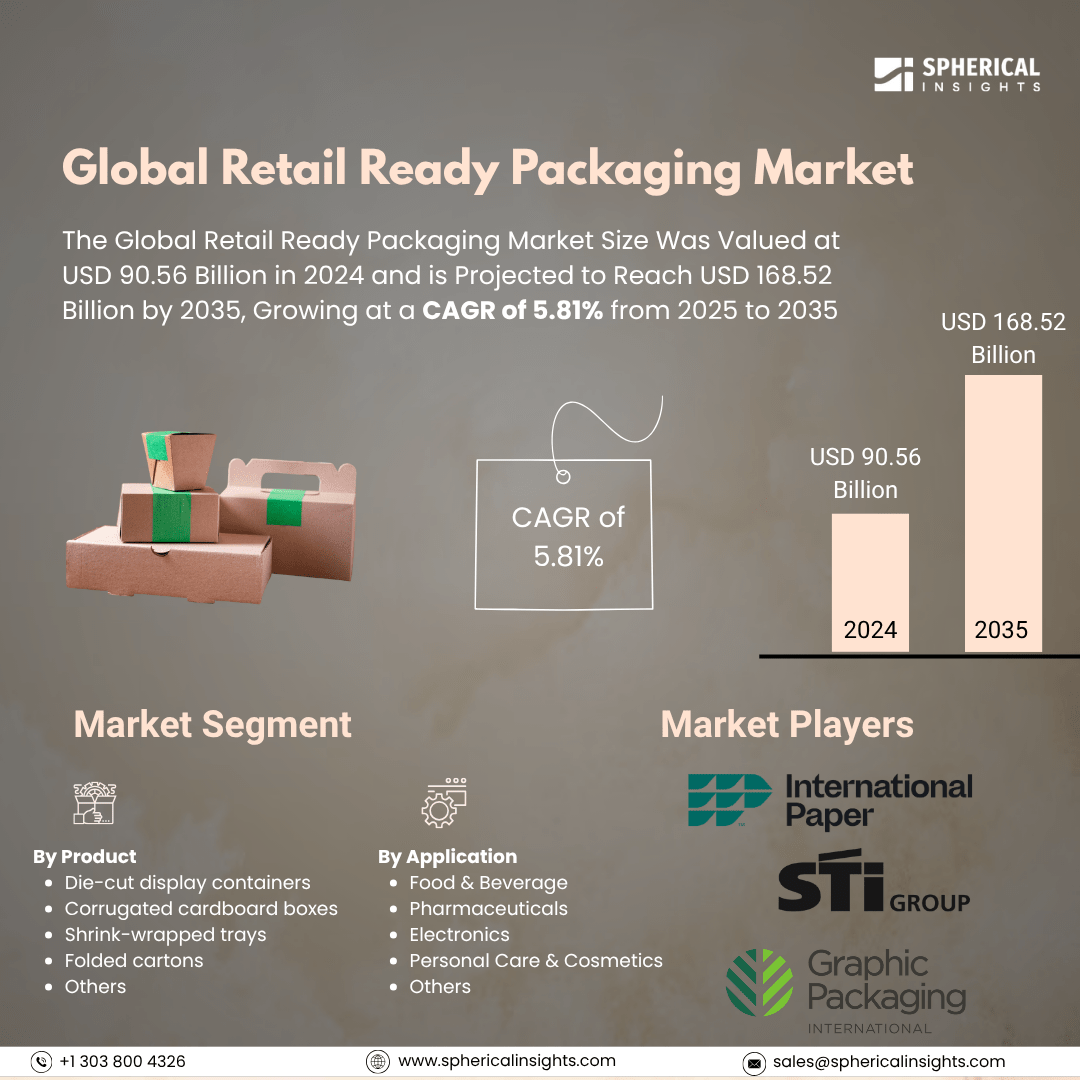

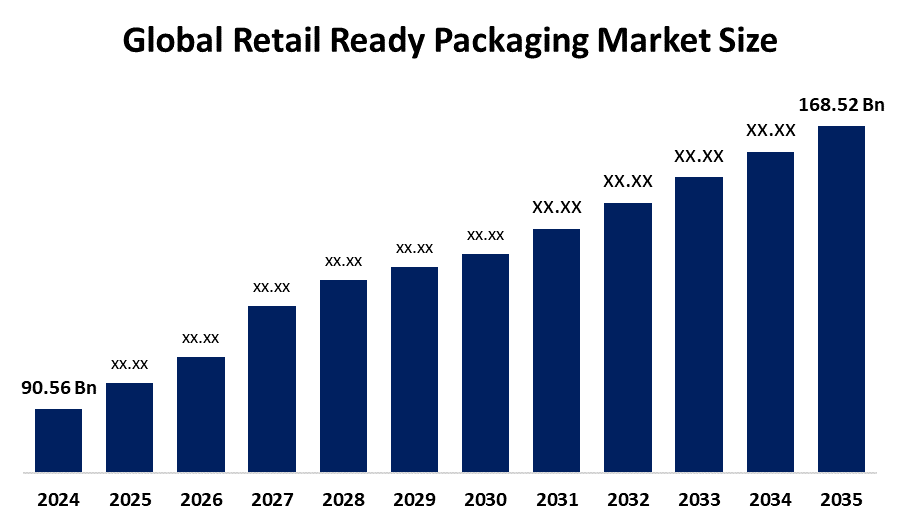

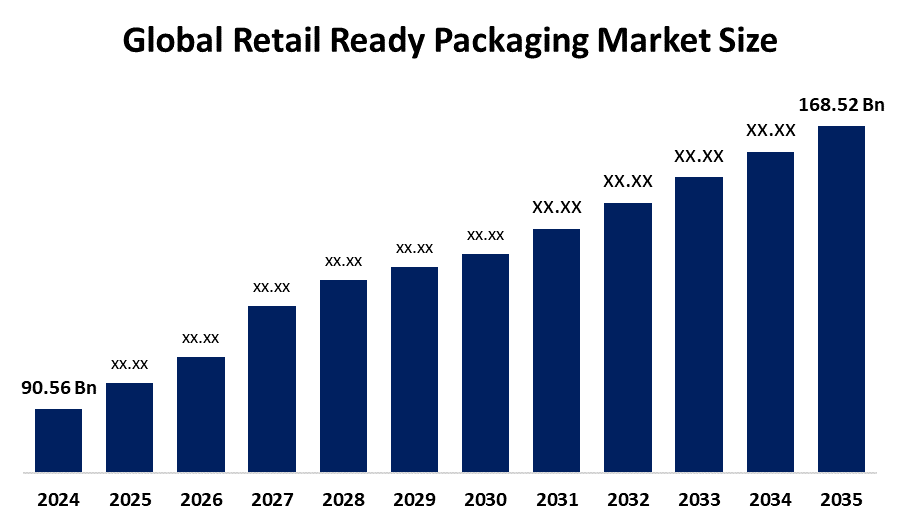

The Global Retail Ready Packaging Market Size Was Valued at USD 90.56 Billion in 2024 and is Projected to Reach USD 168.52 Billion by 2035, Growing at a CAGR of 5.81% from 2025 to 2035. Several reasons, such as the requirement for effective shelf-ready solutions, the growth of the retail industry, the rising need for environmentally friendly packaging, and technological advancements, are driving the Retail Ready Packaging (RRP) market's notable expansion.

Key Regional and Segment-Wise Insights

- In 2024, the retail-ready packaging market in Asia Pacific held the biggest revenue share, accounting for 35.3%.

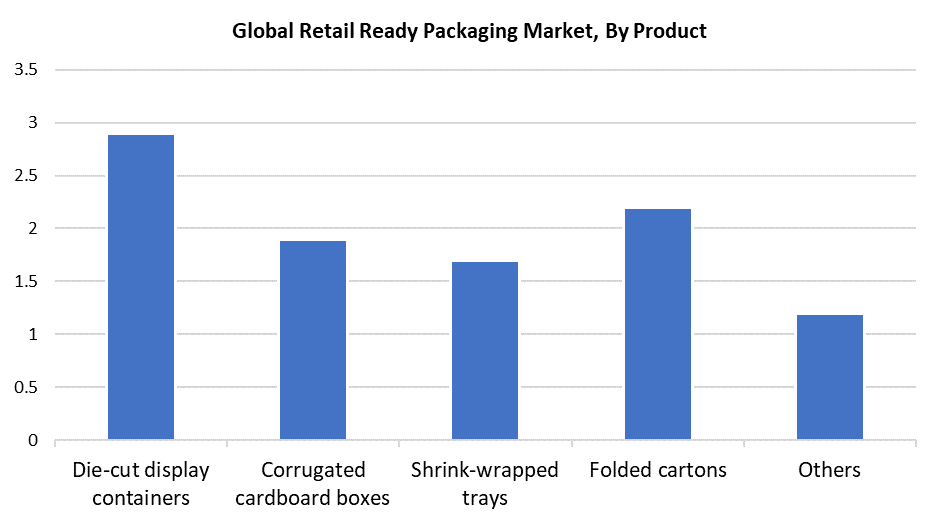

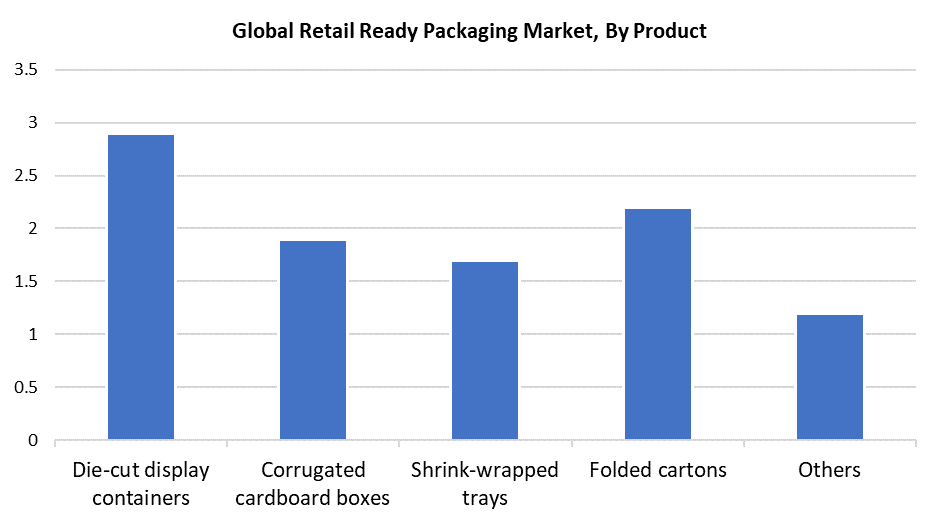

- With the biggest revenue share of 29.7% in 2024, the die-cut display containers segment led the market by product.

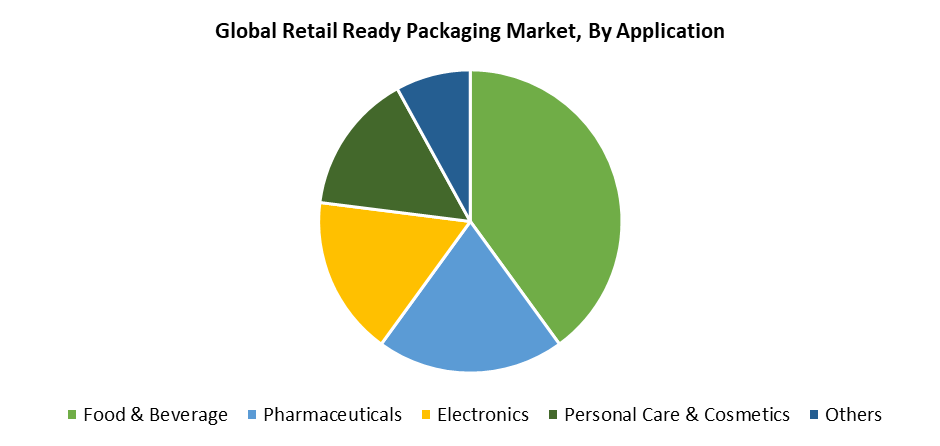

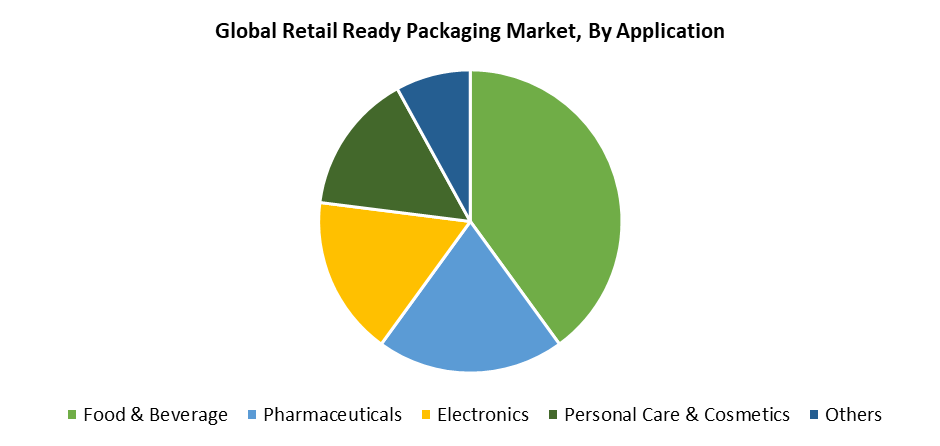

- In 2024, the food and beverage category held the biggest market share by application.

Global Market Forecast and Revenue Outlook

- 2024 Revenue: USD 90.56 Billion

- 2035 Projected Market Size: USD 168.52 Billion

- CAGR (2025-2035): 5.81%

- Asia-Pacific: Largest market in 2024

Ready for retail packages, which are designed to directly hit store shelves without any further unpacking or repacking, are known as retail-ready packaging (RRP) or shelf-ready packaging (SRP). The retail industry has driven substantial expansion of retail-ready packaging (RRP) because of increasing requirements for efficient and appealing packaging solutions. Retailers adopt RRP increasingly because it eliminates store-level repackaging requirements, thus enabling better shelf management and reduced labor expenses. Companies shifted toward recyclable and eco-friendly packaging materials due to rising sustainability awareness, regulatory requirements, alongside consumer demand for sustainable products. The supply chain becomes more efficient through RRP because it enables fast shelf replenishment while decreasing product handling requirements. The simple and cost-effective nature of RRP has made it highly desirable for industries that need maximum product exposure and operational efficiency, such as electronics, food and beverage, healthcare, and cosmetics.

Additionally, the food and beverage industry drives demand for RRP because this solution decreases packaging waste while extending product shelf life, which results in safer food products and reduced spoilage. Small merchants and major supermarket chains currently utilize these solutions to maximize merchandising effectiveness and store operational efficiency. The e-commerce sector's rapid expansion drives the adoption of RRP because online merchants focus on packaging solutions that enable faster order fulfillment while enhancing product visibility and unboxing satisfaction. Sophisticated packaging designs address the evolving needs of retailers and consumers through their combination of strength and portability with aesthetic appeal. RRP continues to gain popularity because it functions as a strategic method to increase brand awareness and minimize operational costs.

Product Insights

The die-cut display containers segment dominated the retail-ready packaging market in 2024, accounting for 29.7% revenue share. The containers have a customized design that decreases waste and increases product exposure. The containers, which are produced from corrugated sheets through exact stamping procedures, serve multiple retail needs because they provide unmatched flexibility in shape, dimensions, and branding possibilities. The containers minimize operational and storage costs by allowing operators to stack them efficiently and place them easily on shelves while using less tape. Retailers select these containers because they deliver effective store shelf presentation along with strong transit protection. The demand for these containers continues because they provide flexible applications and attractive designs to the food and beverage, personal care, and home goods sectors.

The folded cartons market is expected to experience a strong CAGR of 5.2% throughout the forecast period due to rising requirements for economical, adaptable, and sustainable packaging solutions. These strong, lightweight containers provide reliable product protection at a significantly reduced cost for transportation. Their smooth surface enables high-quality printing, which produces vibrant graphics, thorough labeling, and powerful branding that enhances both shelf appeal and consumer interaction. The food and beverage, personal care, and pharmaceutical sectors extensively employ folded cartons as their packaging solution because these containers provide both functional and aesthetic value. The adoption of folded cartons as retail-ready packaging solutions continues to grow because they are recyclable and made from eco-friendly materials, which support global sustainability targets.

Application Insights

The food and beverage industry drove the retail-ready packaging market in 2024 because it needs packaging solutions that combine effectiveness with safety and visual appeal. Packaging requirements for products with rapid turnover, including baked goods, dairy products, snacks, and beverages, demand packaging solutions that support both attractive shelf presentation and fast shelf restocking. Retail-ready packaging serves merchants by enabling better operational efficiency and reduced labor expenses through features that include simple product handling, product protection, and exceptional shelf visibility. The market receives benefits through the rising consumer interest in packaging solutions that are environmentally friendly yet match active lifestyles. Food and beverage companies use RRP as an essential tool to embed branding elements directly into packaging designs, which boosts product appeal.

Throughout the projected timeframe, the pharmaceuticals segment is expected to experience the fastest growth because of expanding worldwide healthcare requirements alongside growing OTC drug sales. Retail-ready packaging enables pharmacists and shop personnel to quickly detect products and organise them while simplifying product replacement operations, thus enhancing store operational efficiency through reduced human mistakes and decreased restocking durations. The rising competition among pharmaceutical brands drives companies to implement RRP solutions that enhance product shelf presentation and accelerate distribution processes while delivering unique competitive advantages. The packaging solution enables businesses to meet regulatory standards while providing clear product labels that maintain both consumer safety and trust. The pharmaceutical retail sector increasingly adopts RRP because customers prefer packaging solutions that offer simplicity alongside protection and attractive design as healthcare accessibility expands and people choose self-medication more often.

Regional Insights

The North American retail-ready packaging market will experience a 4.3% CAGR during the forecasted period because of rising disposable incomes, expanding young population, and strong consumer purchasing ability. Large retail chains, including Walmart, Target, and Home Depot, drive increased demand for effective and attractive RRP solutions as their operations expand. Leading package manufacturers like Smurfit Kappa and International Paper are also promoting innovation with their adaptable and sustainable designs. The region's high emphasis on environmental consciousness is hastening the transition to materials that are recyclable and biodegradable. The industry benefits from three main factors, including E-commerce-ready packaging as well as smart packaging features such as RFID and user-friendly design elements like easy-open packaging.

U.S. Retail Ready Packaging Market Trends

The retail-ready packaging (RRP) market across Europe will show substantial growth because of both strict environmental regulations and increasing consumer interest in sustainable practices. European manufacturers use more biodegradable, recyclable, and low-waste materials to comply with EU sustainability goals. The expansion of e-commerce created an increased demand for RRP solutions that enable easy handling and fast restocking alongside efficient shipping operations. The trend of personalized branding and minimalist design grows because these approaches boost shelf visibility and customer experience. The integration of smart packaging technologies, such as RFID, enables businesses to track inventory and enhance supply chain visibility. The European RRP industry undergoes rapid transformation to meet customer expectations regarding environmentally-friendly packaging that combines practicality with visual appeal through innovative solutions and regulatory adherence.

Asia Pacific Retail Ready Packaging Market Trends

The Asia Pacific retail-ready packaging (RRP) market held the largest revenue share in 2024 accounting for 35.3% of worldwide sales. The market grew because of ongoing technical developments, a thriving e-commerce industry, and rising urban population density. Urban populations in China, India as well and Southeast Asian nations drive the demand for efficient and attractive packaging solutions because their fast-moving lifestyles require suitable products. New technological developments, such as automation, digital printing, intelligent labeling, and innovative materials, enhance both supply chain operations and brand distinction. Sustainability stands as a primary focus because of the rising adoption of recyclable and environmentally friendly packaging materials. The dynamic retail environment in the region enables high levels of personalization because of intense customer expectations and market competition. The combination of innovative strategies with urbanization trends establishes Asia Pacific as the worldwide leader in retail retail-ready packaging market share.

Key Retail Ready Packaging Companies:

The following are the leading companies in the retail-ready packaging market. These companies collectively hold the largest market share and dictate industry trends.

- International Paper

- STI - Gustav Stabernack GmbH

- Graphic Packaging International, LLC

- Smurfit Westrock

- The Cardboard Box Company

- DS Smith

- Vanguard Packaging, LLC

- BoxesIndia

- Weedon Group Ltd

- Green Bay Packaging Inc.

- Bennett

- WestRock Company

- Mondi

- Abbe

- Others

Recent Developments

- In August 2024, for Woodforde's, Smurfit Westrock produced shelf-ready beer packaging that would stand out on congested store shelves, withstand water damage, and encourage recurring business.

- In June 2024, Smurfit Kappa announced its acquisition of Artemis Ltd., a Bag-in-Box packaging facility located in Shumen, Bulgaria. The food and beverage packaging company Artemis produces wine films and caps as well as Bag-in-Box product bags. The acquisition of Artemis will enable Smurfit Kappa to enhance its Bag-in-Box product range and innovation capabilities while strengthening its market position in Eastern Europe and expanding its customer base.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the retail ready packaging market based on the below-mentioned segments:

Global Retail Ready Packaging Market, By Product

- Die-cut display containers

- Corrugated cardboard boxes

- Shrink-wrapped trays

- Folded cartons

- Others

Global Retail Ready Packaging Market, By Application

- Food & Beverage

- Pharmaceuticals

- Electronics

- Personal Care & Cosmetics

- Others

Global Retail Ready Packaging Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa