Cement Packaging Market Summary

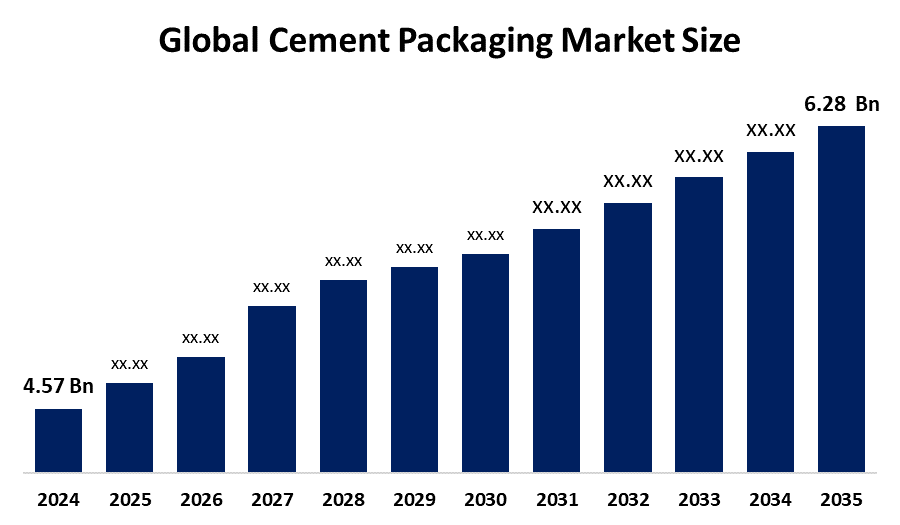

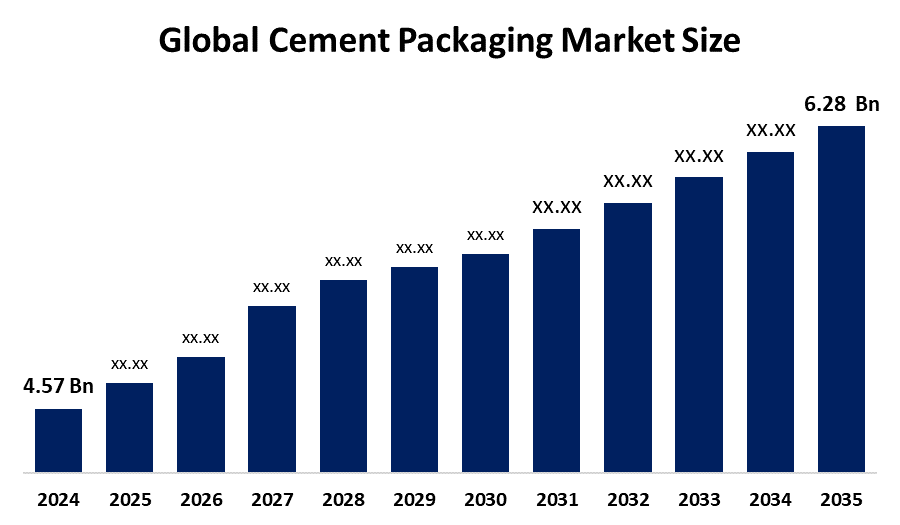

The Global Cement Packaging Market Size Was Estimated at USD 4.21 Billion in 2024 and is Projected to Reach USD 6.28 Billion by 2035, Growing at a CAGR of 3.7% from 2025 to 2035. Growing infrastructure development and building activities globally, especially in emerging nations, are the main factors propelling the cement packaging market's expansion.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of 39.4% and dominated the cement packaging market globally.

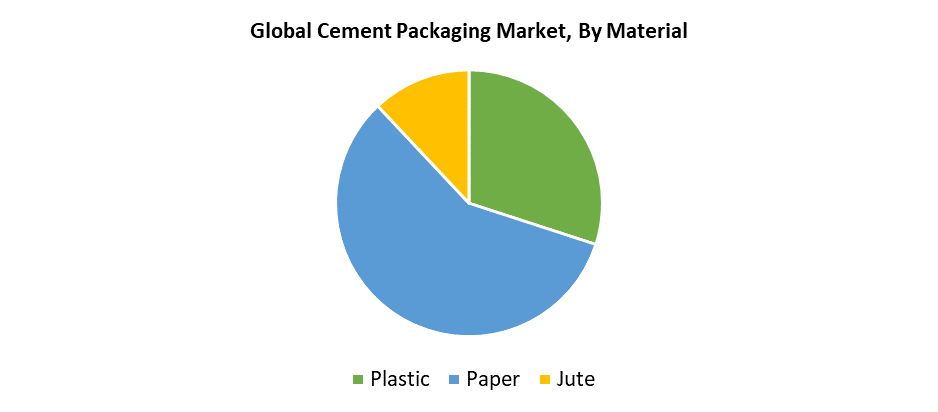

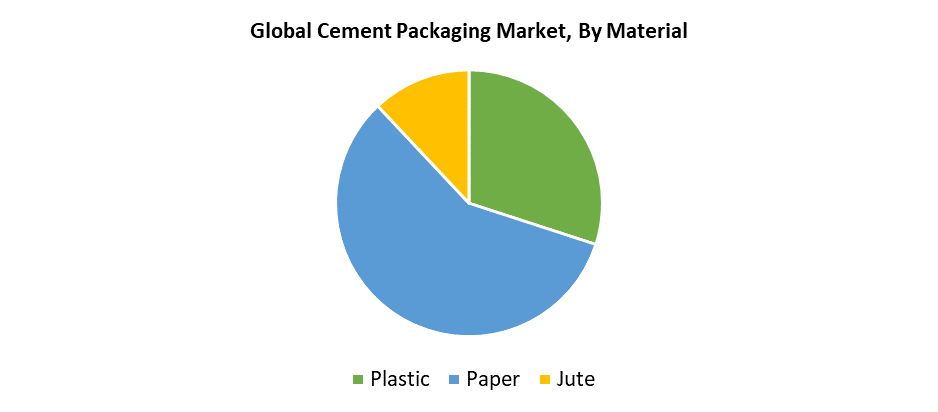

- In 2024, the paper segment had the highest market revenue share by material, accounting for nearly 58.5%.

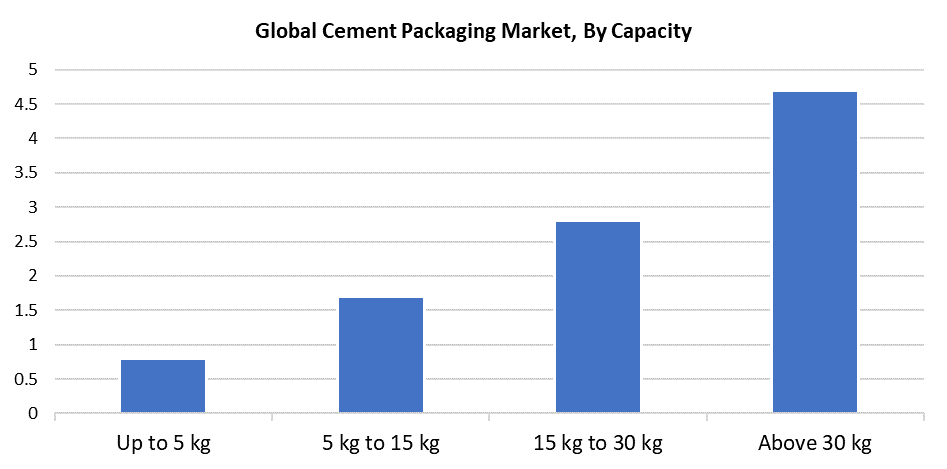

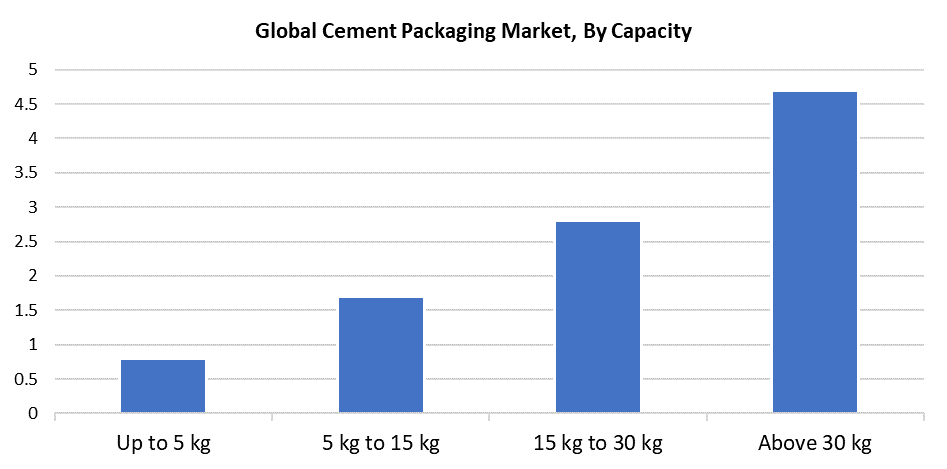

- In 2024, the segment above 30 kg had the biggest market share by capacity, accounting for over 47.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 4.57 Billion

- 2035 Projected Market Size: USD 6.28 Billion

- CAGR (2025-2035): 3.7%

- Asia Pacific: Largest market in 2024

The cement packaging market encompasses all methods and supplies that protect cement throughout its storage, transport, and sale period. The cement packaging market experiences fast expansion because of increasing infrastructure construction activities, mainly in developing nations such as China and India, together with multiple African countries. The demand for cement continues to increase quickly because of fast urban growth, along with significant government initiatives, including China's Belt and Road Initiative and India's Smart Cities Mission. The transportation and storage requirements of bulk and moisture-sensitive cement demand durable, leak-proof packaging solutions. The rising need for high-performance packaging solutions such as laminated polypropylene bags and multi-wall paper sacks grows directly from this expanding requirement. The increase in global transportation and affordable housing government expenditure leads to greater demand for packaged cement because dependable packaging becomes essential for building supply chains.

Additionally, the cement packaging industry continues to expand because of increasing support for sustainable solutions, together with environmental regulations. The government, along with international bodies, requires manufacturers to transition away from plastic towards recyclable and biodegradable packaging solutions that include kraft paper sacks with biodegradable liners. The adjustments support worldwide initiatives that decrease plastic waste and carbon emissions. The technological advancements of valve bags and form-fill-seal systems appeal to high-volume cement manufacturers because they enhance operational efficiency by minimizing waste and reducing production downtime. Packaging has transformed into a marketing tool because the retail cement market continues to grow. Businesses that serve both B2B and direct-to-consumer markets need packaging that combines visual appeal with branding and durability.

Material Insights

The paper sector dominated the cement packaging market with a 58.5% revenue share in 2024, while its environmentally friendly characteristics will drive substantial market growth. The multi-walled bags made from kraft paper function as biodegradable packaging, which supports worldwide environmental targets. Some solutions use coatings or liners to enhance moisture resistance while maintaining sustainability. The segment expands because of rising environmental understanding, together with plastic restrictions and customer demands for sustainable packaging. The paper trend continues to accelerate because of rising concerns about landfill waste and plastic product deterioration. The segment benefits from the paper's economical pricing, recyclable nature, and its ability to meet modern sustainability standards across the packaging and construction industries.

The plastic packaging section of cement continues to grow because it delivers exceptional toughness along with moisture protection for intense applications. The construction of valve and form-fill-seal (FFS) plastic bags includes polyethylene (PE) and polypropylene (PP), which enable these bags to withstand harsh handling and environmental conditions during transportation and storage. The multi-layered bags provide enhanced humidity protection that is vital to maintain cement quality. The growing demand for packaging that resists moisture and tearing in humid environments serves as the main factor driving this segment. The use of plastic packaging leads to longer product shelf life while offering cost savings through bulk manufacturing, thus becoming an optimal choice for cement manufacturers who want durable and efficient production for large volumes.

Capacity Insights

The segment above 30 kg accounted for more than 47.4% of the market share during 2024. Bulk cement packaging solutions continue to grow due to rising market demands. This category includes large sacks and jumbo bags, which businesses use for delivering cement directly to construction sites as well as industrial applications. The quick development of infrastructure projects in growing economies, including ports, highways, airports, and smart cities, is what drives growth. Large-scale construction projects and the growing number of ready-mix concrete factories also contribute to the expansion of this market. Bulk packaging is perfect for high-volume cement consumption because it provides economic effectiveness, shorter handling times, and improved logistics.

The cement packing market shows its highest popularity through 15 to 30 kg capacity bags, which builders and contractors choose for their everyday construction needs. The bags designed in this category maintain a perfect equilibrium between portability and bulk, thus they enable easy manual handling and location-based storage. The product attracts interest because of its connection to the rapid development of urban housing, as well as massive worldwide real estate projects and infrastructural expansion. The packaging size appeals to regional suppliers and small-scale construction projects because it maximizes logistics efficiency and reduces waste production. The segment maintains steady demand because it delivers cost-effective material consumption while fulfilling building requirements from both small-scale and large-scale construction operations.

Regional Insights

The cement packaging market received its largest revenue share from the Asia Pacific region, accounting for 39.4% during 2024, because of the extensive infrastructural projects and quick urban development in the region. The huge building investments in China, along with India and Indonesia, are creating rising needs for cement, together with trustworthy packaging solutions. The rapid growth of industries in this area, alongside government infrastructure enhancement initiatives, leads to continuous market development. Emerging nations within the area experience rising regulatory pressures along with sustainability awareness, which drives the implementation of eco-friendly packaging solutions. The various market drivers in Asia Pacific unite to fuel cement packaging demand while cementing the region as a strategic area for upcoming market expansion.

North America Cement Packaging Market Trends

The North American market for cement packaging experiences growth because of significant investments in infrastructure alongside renovation projects and rising demand for eco-friendly packaging solutions. The United States and Canada are directing funds toward green buildings and infrastructure projects such as roads, bridges, hospitals, and schools to promote cement usage. Manufacturers now utilize flexible intermediate bulk containers (FIBCs) and high-strength woven polypropylene bags to meet the needs of substantial industrial applications. Market growth happens because of government programs that support housing and transportation infrastructure development. The region's established construction industry advances operational efficiency and innovation when it integrates with the expanding automation of packaging operations. The North American cement packaging industry flourishes because of combined factors that advance sustainability, durability, and modern technological adoption.

Europe Cement Packaging Market Trends

The cement packaging industry in Europe operates under European high building standards and strict environmental law enforcement, and circular economy principles. Kraft paper bags, together with recyclable plastic packaging, see increased market demand because the European Union's Green Deal and mandatory CE marking regulations require sustainable packaging materials. The construction sectors of Germany, France, and the United Kingdom drive market development because they focus on energy-efficient building practices. The region benefits from robust legal systems that support environmental sustainability and waste control, and responsible ecological conduct. The market sees faster growth through both technological investments in green packaging systems and the transition to materials that can be recycled and biodegraded. The market continues to grow at a steady pace because of advanced infrastructure combined with new technology adoption and expanding automation systems for packaging operations.

Key Cement Packaging Companies:

The following are the leading companies in the cement packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Mondi

- Umasree Texplast Pvt. Ltd.

- Stora Enso

- R. G. Plasto-packs Pvt. Ltd.

- Dhuleva Industries

- UltraTech

- Billerud

- Smurfit Westrock

- NNZ Inc.

- Knack Polymers

- Yiyang Wanlin Weave Packing Co., Ltd.

- Others

Recent Developments

- In February 2024, Magsort, which operates as a Finnish decarbonization firm, and Emirates Arkan Steel (ESA) established a strategic alliance to execute an innovative initiative that will operate through ESA's cement factory located in Al Ain. The partnership will start a first industrial-scale pilot using Magsort technology to treat steel slag, which aims to reduce the CO2 footprint by 15% and uses less fuel and limestone.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the cement packaging market based on the below-mentioned segments:

Global Cement Packaging Market, By Material

Global Cement Packaging Market, By Capacity

- Up to 5 kg

- 5 kg to 15 kg

- 15 kg to 30 kg

- Above 30 kg

Global Cement Packaging Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa