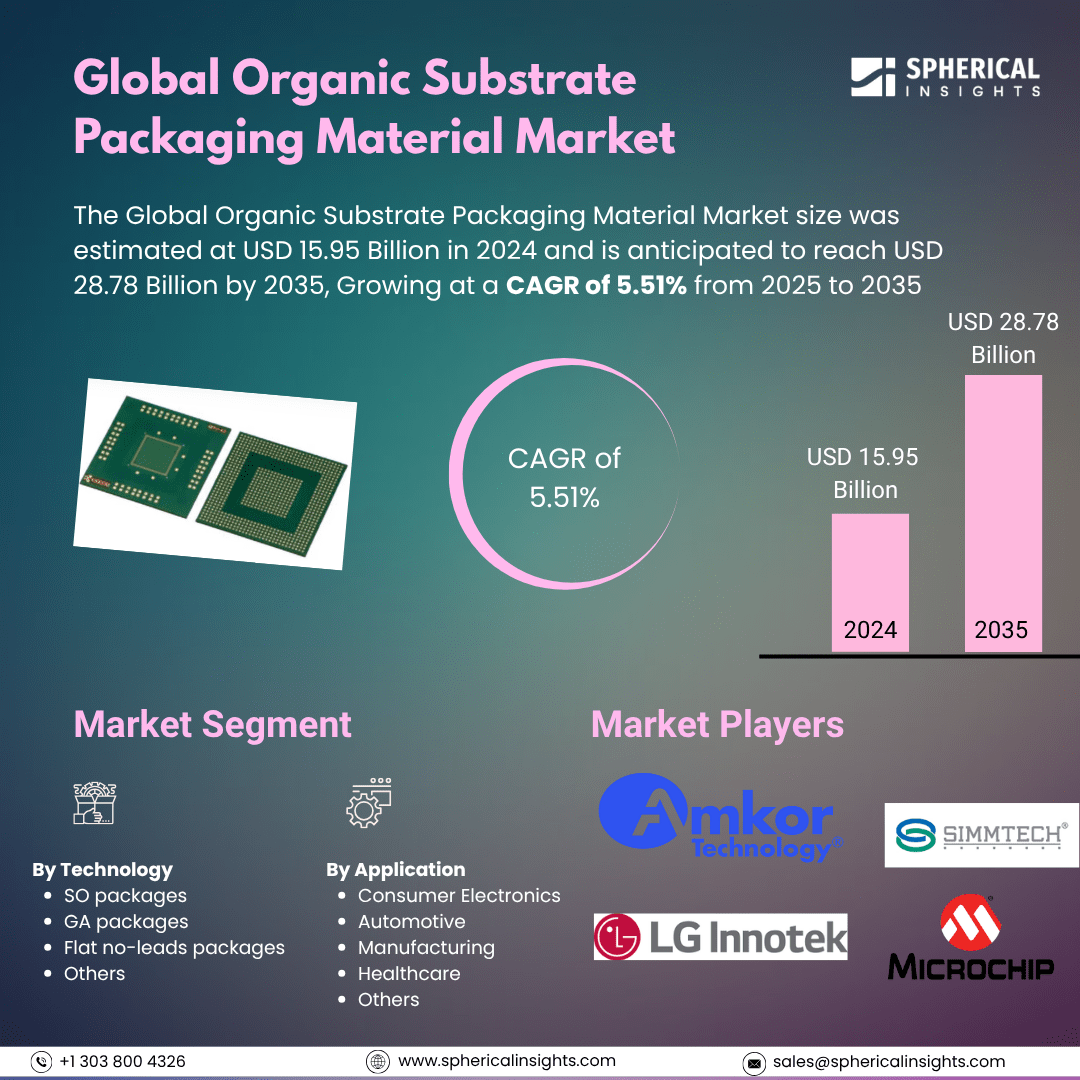

Organic Substrate Packaging Material Market Summary

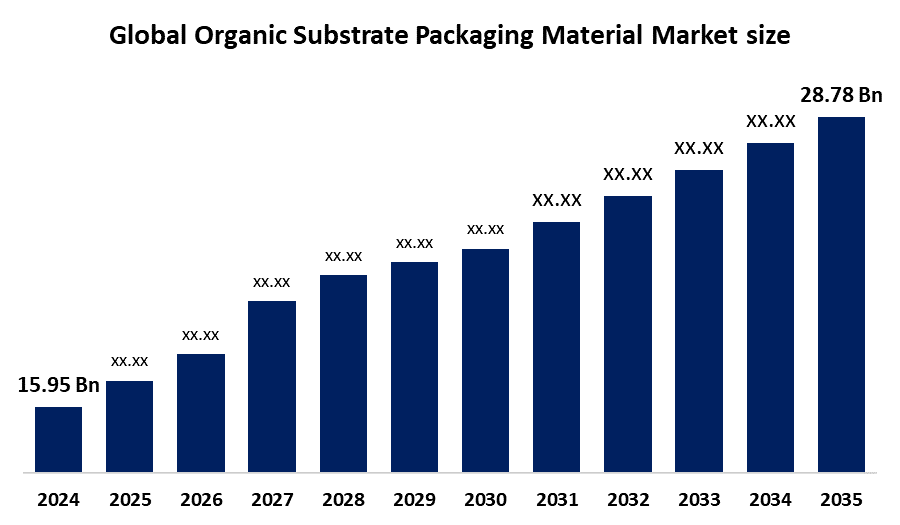

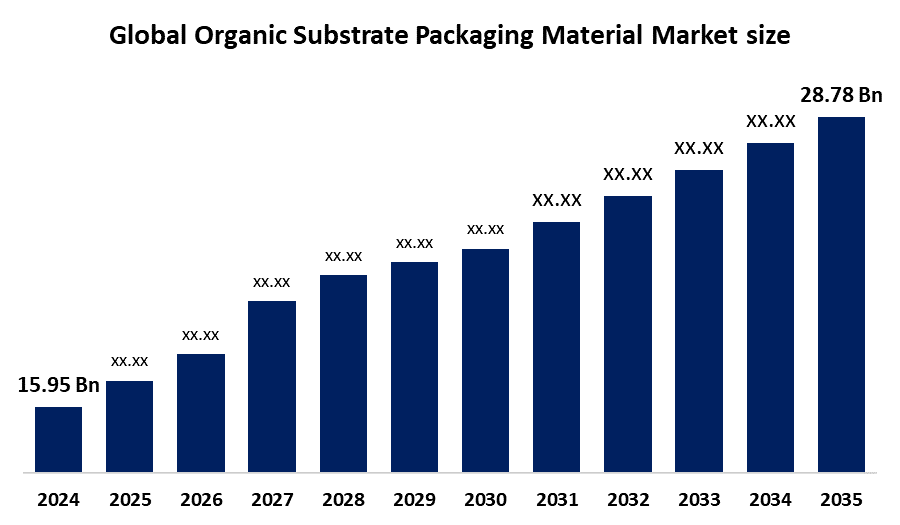

The Global Organic Substrate Packaging Material Market size was estimated at USD 15.95 Billion in 2024 and is anticipated to reach USD 28.78 Billion by 2035, growing at a CAGR of 5.51% from 2025 to 2035. The market for organic substrate packaging materials is expanding for several reasons, chief among them being the growing demand for high-performance, compact electronic devices and the emergence of environmentally friendly packaging options.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the largest revenue share of over 61.3% and dominated the market globally.

- In 2024, the small outline (so) packages segment had the highest market share by technology, accounting for 40.5%.

- In 2024, the consumer electronics segment had the biggest market share by application, accounting for 44.7%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 15.95 Billion

- 2035 Projected Market Size: USD 28.78 Billion

- CAGR (2025-2035): 5.51%

- Asia Pacific: Largest Market in 2024

- North America: Fastest Market in 2024

The Organic Substrate Packaging Material Market encompasses the complete process of developing, manufacturing, and distributing packaging materials made from bio-based materials that serve diverse applications, including the electronics industry. The market for organic substrate packaging materials experiences fast growth because of advances in semiconductor packaging technology combined with increasing interest in compact high-performance devices. The adoption of organic substrates advances through System-in-Package (SiP) Flip Chip and Fan-Out Wafer Level Packaging (FOWLP) technologies, which deliver higher I/O densities alongside reduced dimensions and improved signal integrity. The materials suitable for advanced chipsets include Resin-coated copper and BT resin, together with Ajinomoto Build-up Film (ABF), because they offer both cost-effectiveness and thermal stability. The advancement of 5G networks alongside AI accelerators and custom SoCs from Apple and Samsung drives increased demand for advanced organic substrate packaging solutions in consumer and industrial electronics applications.

The worldwide movement toward electrification and sustainability across various industries serves as an additional driver for expanding market demand. The development of bio-based substrates continues to meet environmental standards while maintaining performance standards, and semiconductor applications demand sustainable packaging materials. The automotive sector drives substantial demand because electric vehicles and advanced driver-assistance systems (ADAS) continue their rapid growth. Organic substrates deliver essential reliability and heat tolerance to automotive electronic components such as ECUs and battery management systems. The market growth for organic substrate packaging materials gains momentum because OEMs, including Continental and Bosch, work with substrate suppliers to ensure performance under demanding conditions.

Technology Insights

Small Outline (SO) packages segment dominated the market by accounting for more than 40.5% of the total market revenue in 2024. The main drivers of this growth stem from their compact dimensions, along with cost-effectiveness and the ability to manufacture in large volumes. The dependable electrical performance combined with the simple surface mounting capability of SO packages makes them typical components in consumer electronics, automotive systems, and industrial devices. The rising demand for smaller electronic components in infotainment systems, smartphones, home electronics, and automobile small ECUs continues to drive their market acceptance. SO packages hold the position as the preferred packaging solution because they offer both production efficiency and adaptability.

The Grid Array packaging segment continues to grow at a fast pace because Ball Grid Array (BGA) and Chip Grid Array (CGA) types provide enhanced electrical and thermal performance, together with increased input/output (I/O) density. These packages are core components for modern computing systems and 5G infrastructures, as well as AI accelerators and data center hardware, since they provide compact form factors with fast data processing capabilities. Various industries, such as gaming, high-performance computing, and telecommunications, require small yet powerful devices for their operations. The reliability of GA packages stems from their enhanced heat dissipation capabilities and improved signal integrity features. The ability to support increased pin counts with robust connections continues to drive the widespread adoption of these packages across consumer and business-grade devices.

Application Insights

The organic substrate packaging material sector in 2024 experienced its largest market share through consumer electronics applications, accounting for 44.7% of the total market. The market leader emerges from the growing need for portable devices, which include gaming consoles, laptops, together with smartwatches, tablets, and smartphones. The high wire density, together with superior insulation and enhanced thermal stability, makes organic substrates optimal for high-density interconnects within these products. The new packaging solutions became essential due to the significant semiconductor component complexity increase, which emerged from 5G technology implementation, AI integration, and IoT expansion. The switch to organic substrates from traditional ceramic or metal substrates receives manufacturer support because of rising environmental concerns, which match sustainability goals and eco-friendly manufacturing practices.

The automotive segment will experience the fastest CAGR of 5.4% during the forecast period because of rapid electrification and digitization of vehicles. The electronics within electric powertrain components, infotainment systems, ADAS, and ECUs need organic substrate packaging materials to function properly. The increasing popularity of electric vehicles (EVs) alongside autonomous driving technology has caused a substantial growth in electronic components inside vehicles. The applications need substrates that are both compact and thermally stable and extremely dependable to perform in demanding automotive environments. The technical requirements for organic substrates are met while they help maintain signal integrity and enable device miniaturization. The shift toward advanced organic packaging solutions in automotive electronics receives a boost from strict emission regulations and worldwide efforts to create smart connected mobility.

Regional Insights

The Asia Pacific region led the market for organic substrate packaging materials by holding 61.3% of global sales in 2024. The supremacy of this market segment is driven by fast industrial development, together with a booming electronics manufacturing base and substantial market demand for advanced packaging solutions. Major countries in Asia, including China, Japan, South Korea, and Taiwan, drive the high-performance organic substrate market because they lead the consumer electronics and semiconductor industries worldwide. The local production capabilities get a boost through government initiatives, including India's semiconductor development programs and China's "Made in China 2025". The area benefits from manufacturing facilities at scale as well as robust supply chains and affordable labor costs. The rapid growth of AI, 5G, IoT, and electric car electronics has pushed leading industry players to focus their investments on new organic substrate solutions.

North America Organic Substrate Packaging Material Market Trends

During the projection period, North America will demonstrate the fastest CAGR of 4.3% because of strong technological innovation and substantial R&D spending combined with expanding demand from high-performance computing, automotive, and aerospace sectors. The semiconductor companies Intel, AMD, and NVIDIA develop AI chips, HPC systems, and 5G applications in their U.S. and Canadian operations. These companies require sophisticated organic substrates. Packaging materials with superior reliability and thermal stability are in increased demand because of the growing adoption of electric vehicles (EVs). The aerospace and defense sectors need resilient substrates under extreme conditions, including polyimide and LCP. Through its robust semiconductor design capabilities and government initiatives like the CHIPS Act, the region achieves substrate supply chain security through industrial partnerships and increases local production capacity.

Europe Organic Substrate Packaging Material Market Trends

The organic substrate packaging market in Europe shows strong growth because of strict environmental policies, together with the automotive industry moving toward electrification. The automotive industry in Germany, France, and the Netherlands demands high-reliability substrates for ADAS and EVs, which fuels market growth for modern automotive electronics. The strong medical device industry in the region promotes market expansion through its demand for biocompatible materials. The market receives growth support from the EU Green Deal and waste reduction targets, which promote the use of recyclable and halogen-free substrates. The rising consumer demand for eco-friendly packaging solutions pushes BASF and UPM-Kymmene to lead the development of biodegradable solutions. The shift toward plant-based, environmentally safe packaging solutions gains momentum through barrier technology developments and increased adoption by organic companies that focus on high-end products.

Key Organic Substrate Packaging Material Companies:

The following are the leading companies in the organic substrate packaging material market. These companies collectively hold the largest market share and dictate industry trends.

- Amkor Technology Inc.

- LG Innotek Co.Ltd

- Simmtech Co., Ltd

- Microchip Technology Inc.

- AT&S

- Texas Instruments Incorporated

- Shinko Electric Industries Co. Ltd

- Kyocera Corporation

- ASE Kaohsiung

- Daeduck Electronics Co. Ltd

- Others

Recent Developments

- In November 2024, Kyocera Corporation faces challenges in its semiconductor organic packaging materials business because of weaker-than-expected market demand. The AI chip supply chain entry faces obstacles from the market downturn, which is expected to improve gradually.

- In September 2024, Amkor Technology's S-SWIFTTM utilizes high-density organic dielectrics to revolutionize IC packaging and improve die-to-die interconnect performance. The dual damascene technique enables the incorporation of RDL in organic materials, which enhances fine-pitch characteristics and surpasses silicon technology constraints for data centers, AI, and HPC applications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the organic substrate packaging material market based on the below-mentioned segments:

Global Organic Substrate Packaging Material Market, By Technology

- SO packages

- GA packages

- Flat no-leads packages

- Others

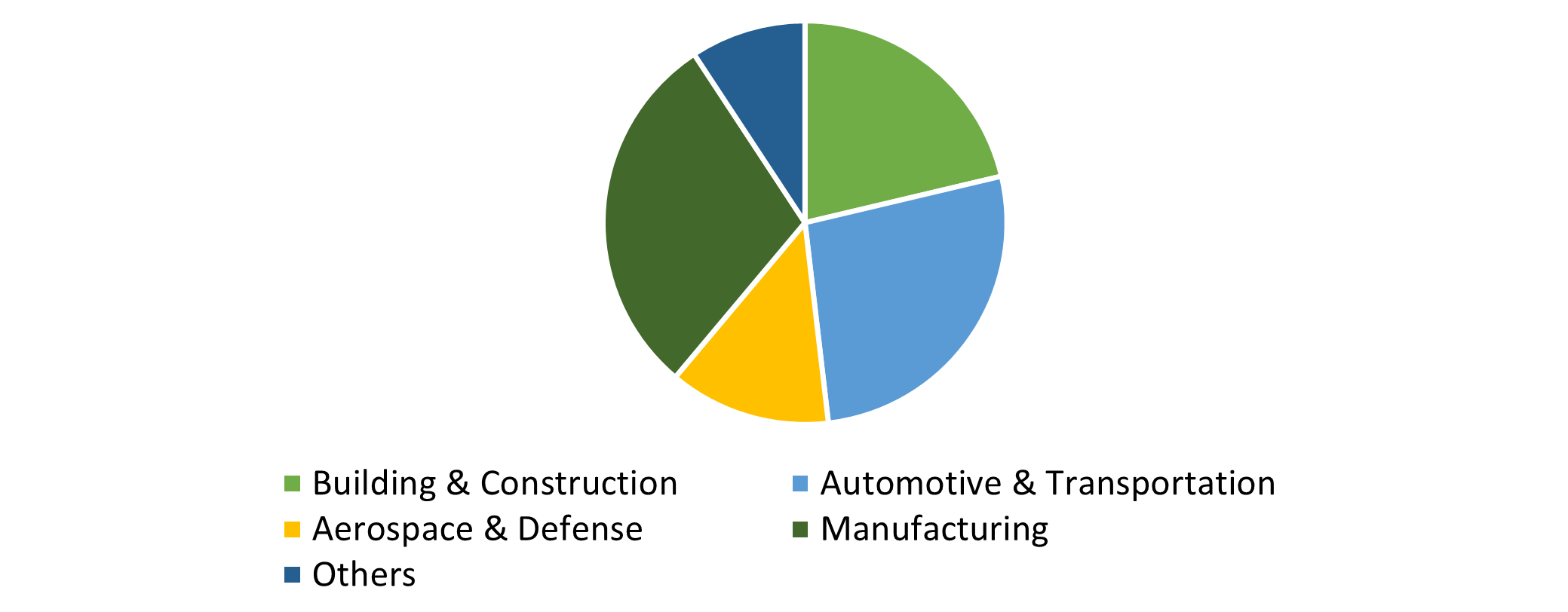

Global Organic Substrate Packaging Material Market, By Application

- Consumer Electronics

- Automotive

- Manufacturing

- Healthcare

- Others

Global Organic Substrate Packaging Material Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa