Flexible Intermediate Bulk Container Market Summary

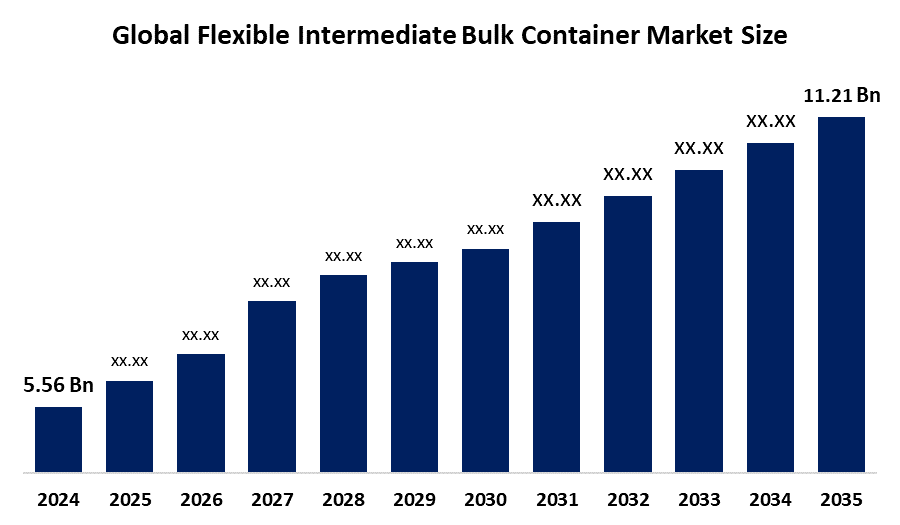

The Global Flexible Intermediate Bulk Container Market Size Was Estimated at USD 5.56 Billion in 2024 and is Projected to Reach USD 11.21 Billion by 2035, Growing at a CAGR of 6.58% from 2025 to 2035. The market for flexible intermediate bulk containers, or FIBCs, is expanding due to the growing need for lightweight, reasonably priced bulk packaging in sectors like construction, chemicals, and food. Furthermore, Growing international trade and consumer demand for eco-friendly, reusable packaging options support market growth.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 35.3% and dominated the market globally.

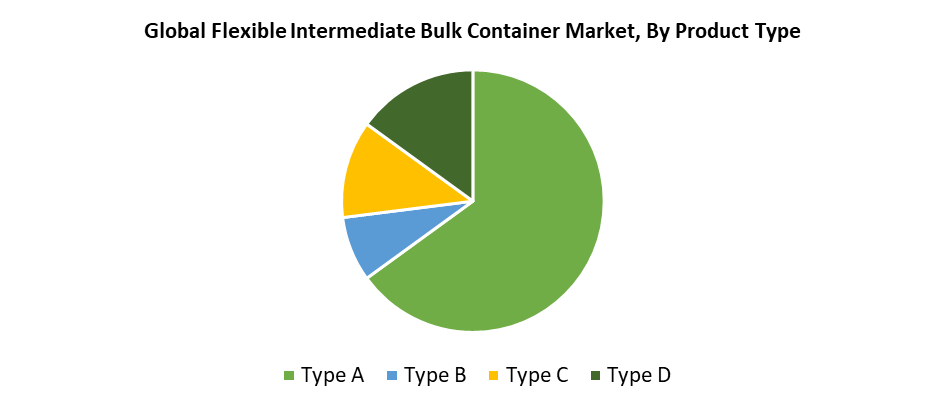

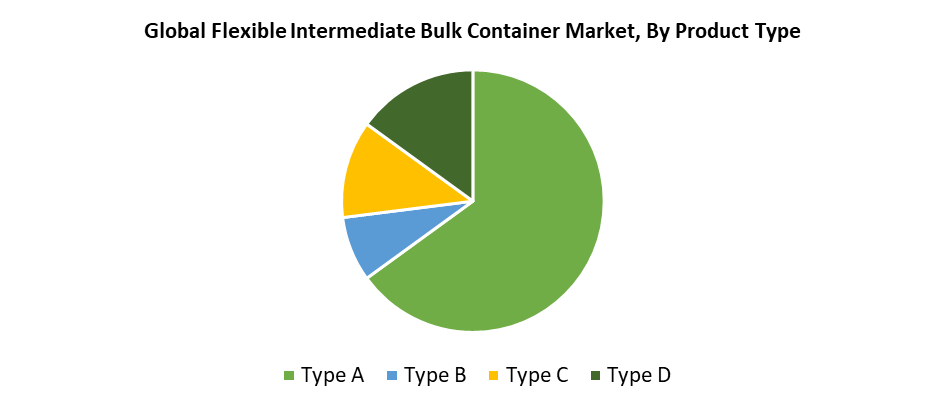

- In 2024, the Type A segment had the highest market share by product type, accounting for 65.4%.

- In 2024, the food segment had the biggest market share by end use, accounting for 31.5%.

Global Market Forecast and Revenue Outlook

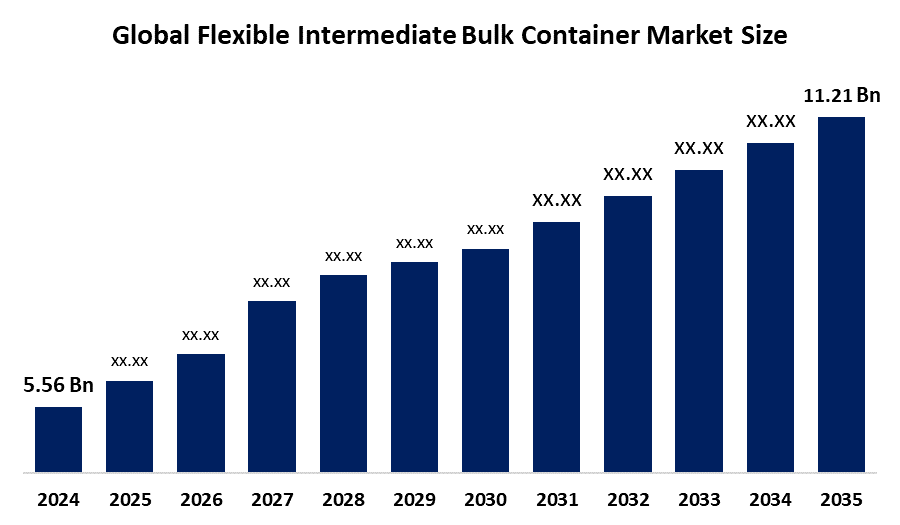

- 2024 Market Size: USD 5.56 Billion

- 2035 Projected Market Size: USD 11.21 Billion

- CAGR (2025-2035): 6.58%

- North America: Largest Market in 2024

- Asia Pacific: Fastest-Growing Market

The Flexible Intermediate Bulk Container (FIBC) market encompasses the business sector that manufactures, distributes, and sells large woven fabric containers used to store and transport dry bulk materials. The FIBC market continues to grow rapidly because major industrial sectors, including food and chemicals, agriculture, and pharmaceuticals, are undergoing rapid industrialization. The sectors that transport dry flowable goods in bulk need economical, safe, and effective packaging solutions that FIBCs fulfill perfectly. The reusable nature of FIBCs combined with their high payload capacity and minimal weight, makes them environmentally friendly and reduces transportation costs. The implementation of FIBC containers advances rapidly because of agricultural export growth and modern logistics adoption in developing markets, including Brazil and India. The advancement of FIBC technology through Type C and D bags for static control also propels market growth by resolving safety concerns when handling sensitive and hazardous chemicals.

Sustainability alongside regulatory compliance act as main expansion factors in the FIBC industry because companies now face growing pressure to meet ESG standards and reduce their carbon footprints. The FIBCs made from recyclable polypropylene function as a green alternative to traditional packaging containers such as metal containers and plastic drums. Budget-conscious businesses find FIBCs attractive because their reusable design and stackable nature make storage and transportation costs lower. The rising demand for industrial-grade FIBCs that can transport sand, cement, and ores emerges from development projects in Africa, Southeast Asia, and Latin America. The market growth continues because international trade volumes increase alongside automation and smart packaging advancements.

Product Type Insights

The Type A segment led the flexible intermediate bulk container (FIBC) market in 2024 by generating 65.4% of total revenue. The segment maintains its leading position due to its low cost and user-friendly design, and wide availability in the market. The dry non-flammable materials, including grains and powders, along with building supplies, need Type A FIBCs for safe transportation. Industries with standard packaging requirements choose this design because its basic structure reduces manufacturing costs. Their high-volume management capabilities, combined with their robustness and reusability, make them highly appealing to users. Their position as the most popular FIBC type in the market is cemented by their extensive use in the food, construction, and agriculture sectors, which maintain high demand levels.

The Type D category is expected to grow at a 6.8% CAGR throughout the forecast period because users increasingly demand secure handling solutions for hazardous products without grounding requirements. The static-dissipative fabric construction of Type D FIBCs enables them to safely disperse static electricity through corona discharge, thus minimizing ignition risks in dangerous situations. The bags serve best for applications involving combustible dusts or vapors in facilities that lack adequate grounding infrastructure, such as specialty chemical, pharmaceutical, and food manufacturing industries. The combination of advanced safety characteristics and simple operation, together with strict regulatory compliance, drives increasing interest towards Type D FIBCs for high-risk applications that require reliable electrostatic protection.

End Use Insights

The food category dominates the flexible intermediate bulk container (FIBC) market with revenue shares of 31.5% in 2024 because of rising demand for bulk packaging that protects contents from contamination and maintains hygienic conditions. The food products, sugar, grains, flour, and starch, along with spices, use FIBCs as their primary storage and transport containers because they offer excellent protection against moisture and contaminants while meeting food-grade standards. These containers play an essential role in food businesses because they handle large quantities effectively without compromising product quality standards. The growing worldwide need for packaged and processed foods and the implementation of tougher food safety standards in developing countries drive the increasing use of top-quality FIBCs. The rising number of food exports and increasing population numbers create substantial expansion opportunities.

The pharmaceutical sector is expected to experience the fastest CAGR of 5.4% during the forecast period because of rising demands for sterile bulk packaging and expanding worldwide pharmaceutical manufacturing. The manufacturing of FIBCs takes place in cleanroom environments that follow Good Manufacturing Practices (GMP). These containers are specifically engineered to meet rigorous safety and sanitary requirements. The supply chain utilizes these containers as a suitable solution to transport small powders along with excipients and active pharmaceutical ingredients (APIs) while preventing product wastage and maintaining sterility. The rising global trade in pharmaceutical raw materials, together with enhanced quality and hygiene standards, has driven the growing popularity of pharma-grade FIBCs as a secure and effective packaging solution.

Region Insights

In 2024, the global flexible intermediate bulk container (FIBC) market is dominated by the North America region, accounting for 35.3% of the total market share. This market supremacy results from a strong industrial foundation that focuses on food, pharmaceutical, and chemical sectors, which must meet FDA and OSHA standards. FIBCs serve as a common transportation solution for agricultural commodities, food-grade powders, and dangerous chemical substances. The manufacturing of FIBCs achieves both regulatory compliance and superior quality through strict regulatory requirements and advanced production methods. Large market participants with broad distribution capabilities, together with developed logistics systems, operate within this market area. North America's FIBC market expands because environmental awareness rises and consumers shift toward packaging solutions that can be reused.

Europe Flexible Intermediate Bulk Container Market Trends

Flexible intermediate bulk containers (FIBCs) experience significant market growth across Europe because of sustainable packaging initiatives, together with strict environmental legislation and an advanced chemical industry. The main users of FIBCs belong to the United Kingdom and France, together with Germany and the Netherlands, which focus on the food, chemical, and pharmaceutical sectors. High-performance, anti-static FIBCs need to meet EU package safety standards because Germany leads chemical export markets. The EU Circular Economy Action Plan pressures manufacturers to develop packaging solutions that combine recyclability with reuse capabilities. The region has advanced materials technology through its dedication to plastic waste reduction. The European market experiences steady growth because of automated logistics systems combined with increased requirements for high-quality customized FIBCs.

Asia Pacific Flexible Intermediate Bulk Container Market Trends

The flexible intermediate bulk container (FIBC) market is expected to grow at the fastest CAGR in the Asia Pacific region because of increasing manufacturing centers and quick industrial growth, and rising exports of chemicals and agricultural products. The market receives its main customers from China, together with India and Indonesia, due to rising demands in chemical production, construction projects, and agricultural operations. The transportation of large-volume cargo depends on FIBCs for China to export chemicals, while India requires them to store its grain and fertilizer supplies. The region benefits from competitive labor costs and abundant raw materials, along with government initiatives to develop infrastructure that enhances trade and logistics operations. The Asia Pacific region currently leads worldwide in both production and consumption of FIBCs because bulk transportation solutions and packaging investments are promoting FIBC adoption.

Key Flexible Intermediate Bulk Container Companies:

The following are the leading companies in the flexible intermediate bulk container market. These companies collectively hold the largest market share and dictate industry trends.

- Greif

- SafeFlex International Ltd.

- Langston Bag

- Codefine

- JohnPac

- IPG

- Dewitt

- Palmetto Industries International Inc.

- Commercial Syn Bags Limited

- K-PACKING

- Halsted Corporation

- Bulk Corp International

- FORMOSA SYNTHETICS PVT. LTD.

- Others

Recent Developments

- In April 2024, Packem Umasree, a joint venture between Packem S.A. of Brazil and Umasree Texplast of India, became the first company in the world to use recycled PET from discarded bottles to make 100% sustainable FIBCs. In April 2024, the firm marked this milestone by opening its first plant in India, close to Ahmedabad. Their dedication to environmentally friendly packaging solutions is demonstrated by the new facility.

- In September 2021, Dutch-Bangla Pack Ltd. (DBPL) of LC Packaging finished its third manufacturing expansion by erecting a 4,000 square meter addition on top of the current one. With its cutting-edge clean room, this new facility will increase output by 1 million FIBCs per year, reaching a total of approximately 3.2 million.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the flexible intermediate bulk container market based on the below-mentioned segments:

Global Flexible Intermediate Bulk Container Market, By Product Type

- Type A

- Type B

- Type C

- Type D

Global Flexible Intermediate Bulk Container Market, By End Use

- Food

- Chemical

- Pharmaceutical

- Others

Global Flexible Intermediate Bulk Container Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa