Global Power Metering Market Size to Exceed USD 49.85 Billion by 2033

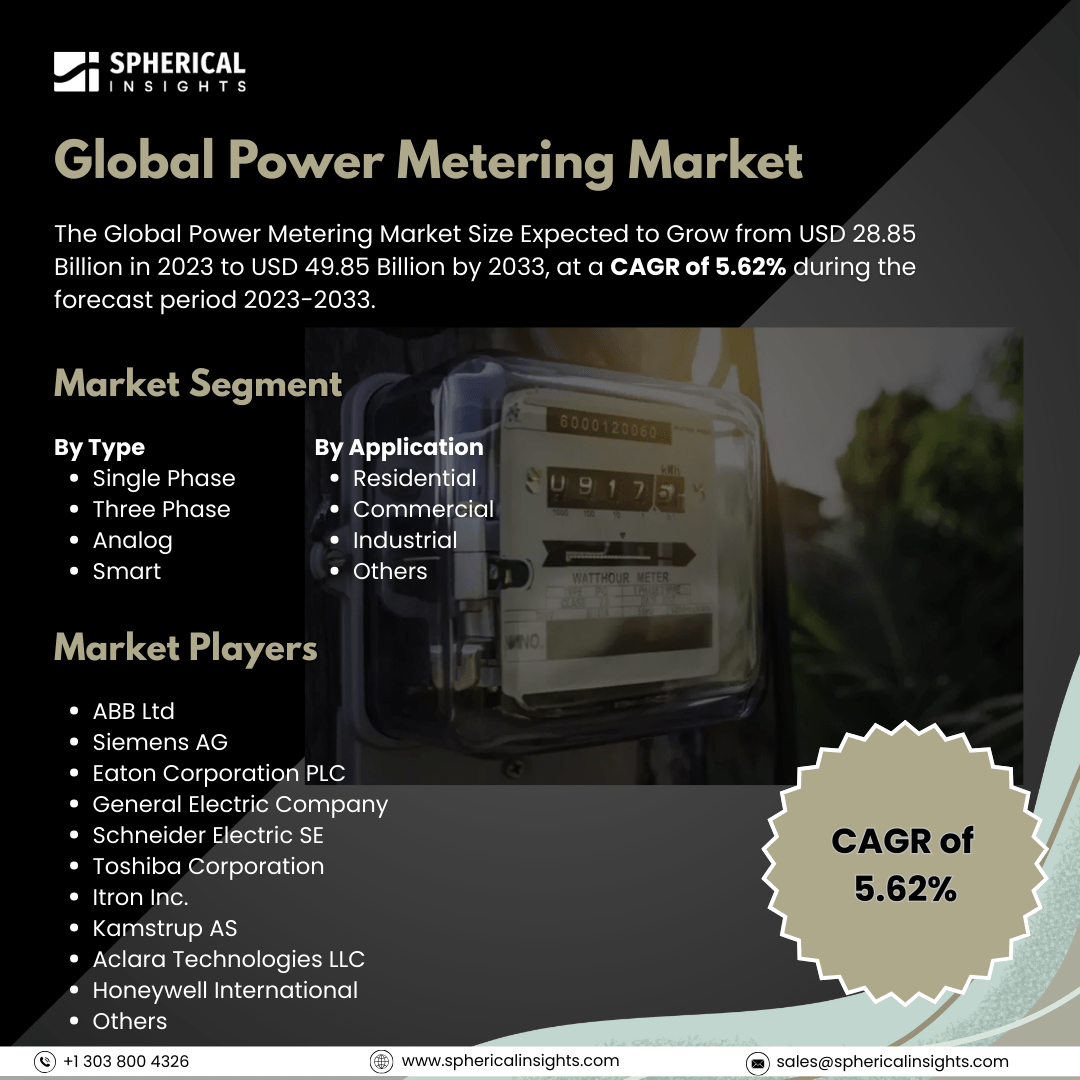

According to a research report published by Spherical Insights & Consulting, The Global Power Metering Market Size Expected to Grow from USD 28.85 Billion in 2023 to USD 49.85 Billion by 2033, at a CAGR of 5.62% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Power Metering Market Size, Share, and COVID-19 Impact Analysis, By Type (Single-Phase, Three-Phase, Analog, Smart), By Application (Residential, Commercial, Industrial, Others), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The power metering market is the business of products that measure, monitor, and analyse electrical energy consumption in domestic, commercial, and industrial usage. The meters optimize energy usage, enhance efficiency, and allow for proper billing. Moreover, the power metering market is fueled by energy efficiency demand increases, increasing implementation of smart grid technology, and government policies enhancing advanced metering infrastructure (AMI). Growing demand for electricity usage, incorporation of renewable energy systems, and increasing IoT-enabled intelligent meters further amplify market growth. Utilities and industries also look towards real-time monitoring solutions to ensure less wastage of energy, enhance billing accuracies, and increase overall efficiency in power management. However, restraints of the power metering market are high initial costs of installation, cybersecurity issues in smart meters, poor infrastructure in emerging markets, data privacy, and resistance to change from conventional metering systems.

The smart segment accounted for the largest share of the global power metering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of type, the global power metering market is divided into single-phase, three-phase, analog, and smart. Among these, the smart segment accounted for the largest share of the global power metering market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is spurred by growing smart grid adoption, regulatory requirements, and real-time monitoring of energy demands, smart meters provide precise billing, remote control, and improvement in energy efficiency, making them the first choice for residential, commercial, and industrial use across the globe.

The residential segment accounted for a substantial share of the global power metering market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the application, the global power metering market is divided into residential, commercial, industrial, and others. Among these, the residential segment accounted for a substantial share of the global Power Metering market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is driven by rising electricity use, government regulations for the installation of smart meters, and the expansion in energy efficiency needs. Increased urbanization, smart home penetration, and utility programs for smart metering infrastructure (AMI) further enhance demand for residential power meters.

Asia Pacific is projected to hold the largest share of the global power metering market over the projected period.

Asia Pacific is projected to hold the largest share of the global power metering market over the projected period. This is led by fast urbanization, growing electricity demand, and government plans for smart grid installation in nations such as China, India, and Japan. The region's high emphasis on energy efficiency, infrastructure growth, and extensive use of smart meters also plays a role in its leading market position.

North America is expected to grow at the fastest CAGR of the global power metering market during the projected period. This is driven by rising smart grid investments, government regulations for advanced metering infrastructure (AMI), and the expanding use of IoT-enabled smart meters. The emphasis of the region on energy efficiency, renewable energy integration, and upgrade of old power infrastructure further drives market growth, especially in the U.S. and Canada.

Company Profiling

Major vendors in the global power metering market are ABB Ltd, Siemens AG, Eaton Corporation PLC, General Electric Company, Schneider Electric SE, Toshiba Corporation, Itron Inc., Kamstrup AS, Aclara Technologies LLC, Honeywell International, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, The Government of India launched the Smart Meter National Program (SMNP). The initiative will replace 250 million traditional electricity meters with prepaid smart meters, as well as upgrade feeders and transformers. The project will be financed with an estimated capital outlay of INR 1.5 trillion (around USD 17.97 billion) and is planned to be implemented over the next five financial years.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global power metering market based on the below-mentioned segments:

Global Power Metering Market, By Type

- Single Phase

- Three Phase

- Analog

- Smart

Global Power Metering Market, By Application

- Residential

- Commercial

- Industrial

- Others

Global Power Metering Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa