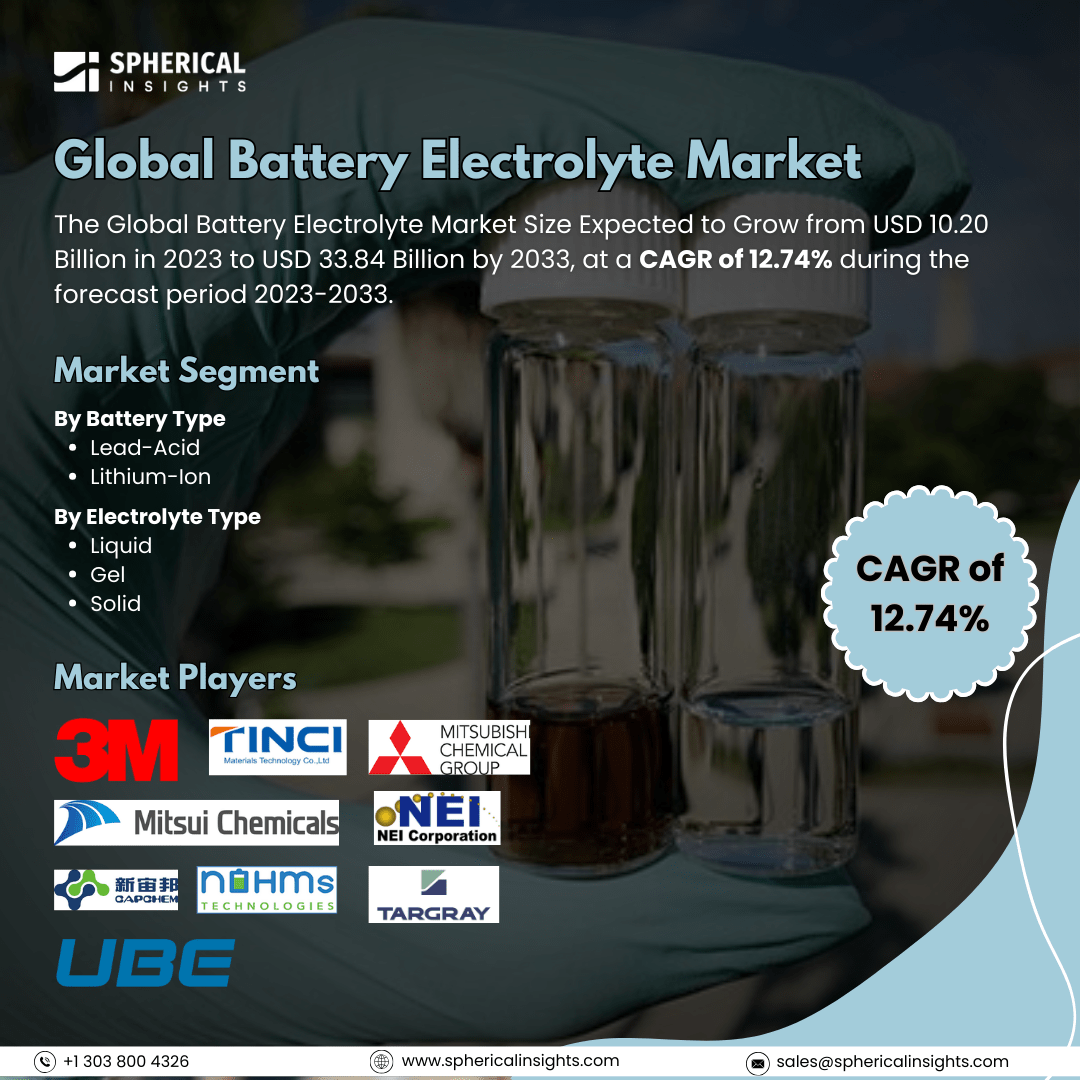

Global Battery Electrolyte Market Size to Exceed USD 33.84 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Battery Electrolyte Market Size Expected to Grow from USD 10.20 Billion in 2023 to USD 33.84 Billion by 2033, at a CAGR of 12.74% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Battery Electrolyte Market Size, Share, and COVID-19 Impact Analysis, By Battery Type (Lead-Acid and Lithium-Ion), By Electrolyte Type (Liquid, Gel, Solid), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The battery electrolyte industry is the world market involved in the manufacture, distribution, and innovation of electrolytes utilized by different battery technologies. Electrolytes are the critical battery elements that enable ions to flow from the anode to the cathode and make electrical current possible. Moreover, the battery electrolyte market is propelled by increased demand for electric vehicles (EVs), growth in renewable energy storage, and technology advancements in solid-state and lithium-ion batteries. Growing usage of consumer electronics, rising investment in battery R&D, and the need for high-energy-density, safer batteries also drive market growth. Further driving growth is government policies encouraging clean energy and advancements in battery recycling technologies. However, the battery electrolyte market is hindered by factors including high cost of production, safety issues (flammability of liquid electrolytes), supply chain vulnerabilities, environmental legislation, and technological difficulties in the creation of stable solid-state electrolytes.

The lithium-ion segment accounted for the largest share of the global battery electrolyte market in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of battery type, the global battery electrolyte market is divided into lead-acid and lithium-ion. Among these, the lithium-ion segment accounted for the largest share of the global battery electrolyte market in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its extensive application in electric vehicles (EVs), consumer electronics, and energy storage systems. Its benefits, such as higher energy density, longer life cycle, and lightweight, fuel demand, overtake the conventional lead-acid battery market.

The liquid segment accounted for a substantial share of the global battery electrolyte market in 2023 and is anticipated to grow at a rapid pace during the projected period.

On the basis of the electrolyte type, the global battery electrolyte market is divided into liquid, gel, and solid. Among these, the liquid segment accounted for a substantial share of the global battery electrolyte market in 2023 and is anticipated to grow at a rapid pace during the projected period. This is because of its prevalent application in lithium-ion and lead-acid batteries. Liquid electrolytes are highly ion-conductive, affordable, and highly efficient in performance, thus being the favourite among EVs, consumer electronics, and energy storage devices.

Asia Pacific is projected to hold the largest share of the global battery electrolyte market over the projected period.

Asia Pacific is projected to hold the largest share of the global battery electrolyte market over the projected period. This is powered by the supremacy of China, Japan, and South Korea in EV manufacturing and battery production. The region is supported by good government policies, a strong supply chain, and high demand for consumer electronics and energy storage devices, and thus is the dominant growth center for battery electrolytes.

North America is expected to grow at the fastest CAGR growth of the global battery electrolyte market during the projected period. This is led by fast-growing electric vehicle (EV) take-up, expanding investments in battery gigafactories, and aggressive government backing of renewable energy storage. The U.S. leads the growth with growing demand for lithium-ion batteries, innovation in solid-state battery technology, and initiatives to improve the domestic battery supply chain.

Company Profiling

Major vendors in the global battery electrolyte market are 3M Co., Guangzhou Tinci Materials Technology Co. Ltd, Mitsubishi Chemical Holdings Corporation, Mitsui Chemicals Inc., NEI Corporation, NOHMs Technologies Inc., Shenzhen Capchem Technology Co. Ltd, Targray Industries Inc., UBE Industries Ltd., and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, In Wangara, Western Australia, Australian Vanadium (AVL) announced the construction of a flow battery electrolyte factory. The AVL wants to produce 33MWh a year.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global battery electrolyte market based on the below-mentioned segments:

Global Battery Electrolyte Market, By Battery Type

Global Battery Electrolyte Market, By Electrolyte Type

Global Battery Electrolyte Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa