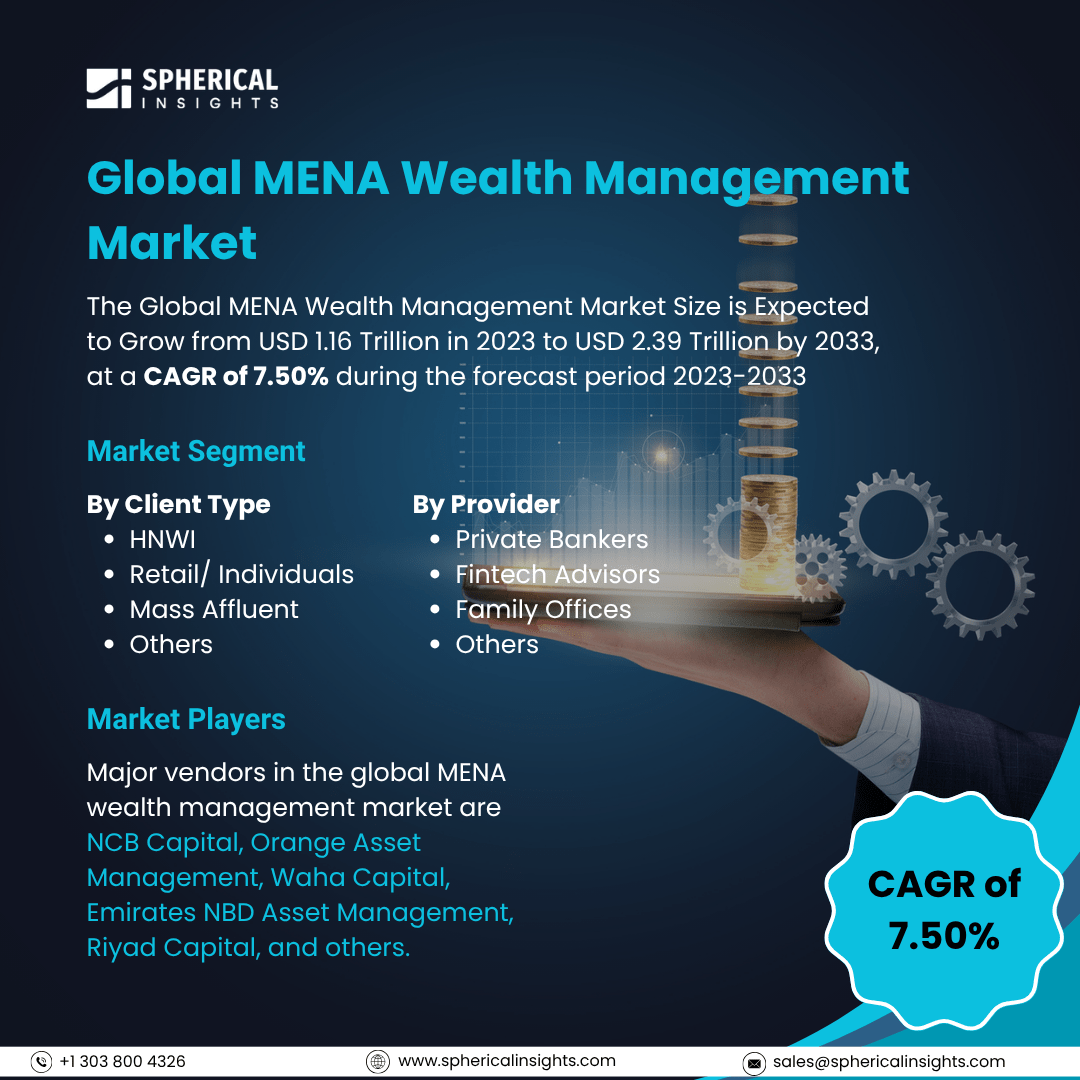

Global MENA Wealth Management Market Size To Exceed USD 2.39 Trillion by 2033

According to a research report published by Spherical Insights & Consulting, The Global MENA Wealth Management Market Size is Expected to Grow from USD 1.16 Trillion in 2023 to USD 2.39 Trillion by 2033, at a CAGR of 7.50% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global MENA Wealth Management Market Size, Share, and COVID-19 Impact Analysis, By Client Type (HNWI, Retail/ Individuals, Mass Affluent, and Others), By Provider (Private Bankers, Fintech Advisors, Family Offices, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 – 2033

The MENA wealth management market refers to the financial services sector within the Middle East and North Africa (MENA) region that offers tailored investment and advisory solutions to high-net-worth individuals (HNWIs), ultra-high-net-worth individuals (UHNWIs), families, and institutional clients. These services encompass investment advisory, portfolio management, estate planning, tax optimization, retirement planning, and philanthropic advisory, all aimed at preserving, growing, and transferring wealth across generations. Furthermore, the MENA wealth management market is driven by rising high-net-worth individuals, economic diversification efforts (especially in Gulf countries), robust oil revenues, and increasing demand for Sharia-compliant financial products. Technological advancements, regulatory reforms, and regional financial hubs like Dubai further boost investment inflows. Younger, tech-savvy investors and growing interest in sustainable investments also shape evolving wealth strategies. However, restraining factors for the global MENA wealth management market include regulatory complexities, geopolitical instability, limited financial literacy, underdeveloped digital infrastructure, and economic dependence on oil, impacting investor confidence and market expansion.

The HNWI segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

On the basis of the client type, the global MENA wealth management market is divided into HNWI, retail/ individuals, mass affluent, and others. Among these, the HNWI segment accounted for the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the rising wealth accumulation, increased demand for personalized financial services, and diversified investment portfolios. Continued regional economic growth and expanding cross-border investment opportunities are expected to fuel this segment's significant CAGR, as HNWIs seek sophisticated advisory, tax optimization, and legacy planning solutions.

The fintech advisors segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period.

On the basis of the provider, the global MENA wealth management market is divided into private bankers, fintech advisors, family offices, and others. Among these, the fintech advisors segment accounted for the largest share in 2023 and is anticipated to grow at a remarkable CAGR during the forecast period. The segmental growth is attributed to the increasing digital adoption, demand for low-cost, automated investment solutions, and enhanced user experience. Growth is driven by tech-savvy investors, real-time portfolio management, and AI-powered insights, positioning fintech as a scalable, accessible alternative to traditional wealth advisory across the MENA region.

North America is projected to hold the largest share of the global MENA wealth management market over the forecast period.

North America is projected to hold the largest share of the global MENA wealth management market over the forecast period. The regional growth is attributed to strong economic ties, robust financial infrastructure, and a high concentration of global asset management firms. The region's established expertise in cross-border wealth services and increasing investments from MENA-based HNWIs further drive its market dominance during the forecast period.

Asia Pacific is expected to grow at the fastest CAGR in the global MENA wealth management market during the forecast period. The segmental growth is attributed to rising wealth creation, increasing outbound investments, and stronger economic cooperation with MENA countries. Growing demand for diversified portfolios, digital advisory services, and cross-border financial solutions among affluent individuals in Asia further fuels this rapid growth during the forecast period.

Company Profiling

Major vendors in the global MENA wealth management market are NCB Capital, Orange Asset Management, Waha Capital, Emirates NBD Asset Management, Riyad Capital, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Leading UAE brokerage Emirates NBD Securities teamed up with the Abu Dhabi Securities Exchange (ADX) to give traders immediate access to the listed companies on the exchange. This allowed ADX to offer digital onboarding to another UAE stock exchange as well as instant trading account opening.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global MENA wealth management market based on the below-mentioned segments:

Global MENA Wealth Management Market, By Client Type

- HNWI

- Retail/ Individuals

- Mass Affluent

- Others

Global MENA Wealth Management Market, By Provider

- Private Bankers

- Fintech Advisors

- Family Offices

- Others

Global MENA Wealth Management Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa