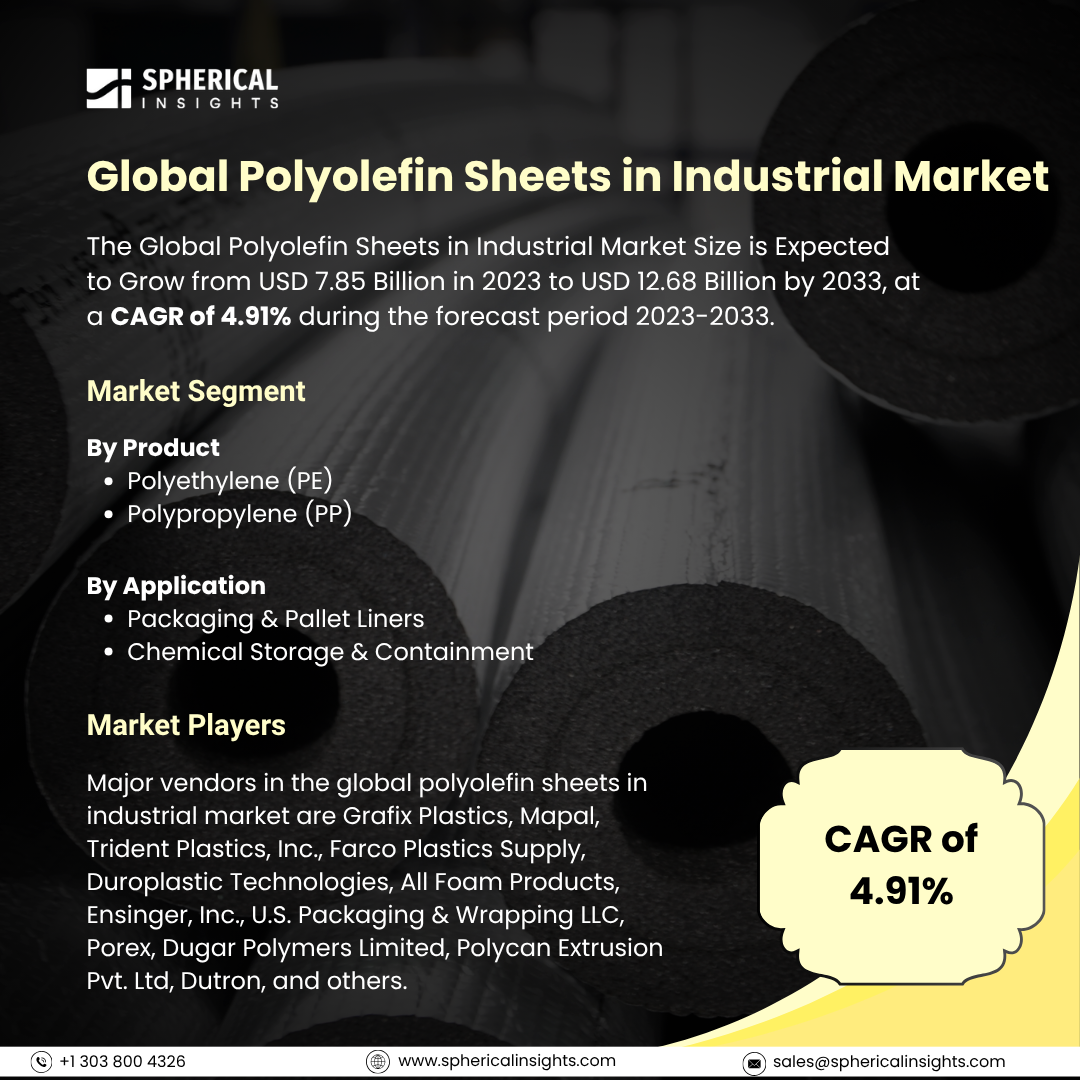

Global Polyolefin Sheets in Industrial Market Size To Exceed USD 12.68 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global Polyolefin Sheets in Industrial Market Size is Expected to Grow from USD 7.85 Billion in 2023 to USD 12.68 Billion by 2033, at a CAGR of 4.91% during the forecast period 2023-2033.

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global Polyolefin Sheets in Industrial Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyethylene (PE), Polypropylene (PP)), By Application (Packaging & Pallet Liners, Chemical Storage & Containment), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

Thin, flat sheets composed of polyolefins, a family of thermoplastic polymers derived from ethylene and propylene, are referred to as polyolefin sheets in the industrial market. These sheets' qualities of flexibility, durability, chemical resistance, and affordability make them popular in a wide range of industrial applications. These are especially popular in the construction, automotive, and packaging sectors. Food packaging, consumer goods, industrial products, structural plastics, and medical applications frequently use these nonpolar, odorless, and nonporous materials. These are therefore also referred to as commodity thermoplastics. The two most popular commodity plastics in the world are PE and PP. Furthermore, the adoption of polyolefin sheets is also significantly influenced by sustainability and regulatory compliance. This is because polyolefin sheets are 100% recyclable and heavy metal-free; these present an appealing alternative to the growing pressure on industries to use recyclable and eco-friendly materials. Their appeal in international markets is increased by their adherence to regulations like REACH and RoHS. However, rising raw material costs, the need for environmentally friendly solutions, and the effects of shifting demand across different industries are some of the issues facing the industrial market for polyolefin sheets.

The polyethylene (PE) segment dominated the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the product, the global polyolefin sheets in industrial market is divided into polyethylene (PE), polypropylene (PP). Among these, the polyethylene (PE) segment dominated the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of their exceptional chemical resistance, durability, and resistance to moisture. Polyethylene sheets, particularly High-Density Polyethylene (HDPE) and Low-Density Polyethylene (LDPE), are frequently utilized in industrial settings. While LDPE sheets are used in packaging, insulation, and all-purpose protective barriers, HDPE sheets are favored in heavy-duty applications like liners, tanks, and protective surfaces.

The packaging & pallet liners segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the global polyolefin sheets in industrial market is divided into packaging & pallet liners, chemical storage & containment. Among these, the packaging & pallet liners segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. This is because of their exceptional chemical resistance, low moisture absorption, and durability, polyolefin sheets are frequently used in industrial settings as pallet liners and packaging materials. These sheets serve as barriers between goods and pallets, guarding against corrosion, physical harm, and contamination while in storage and transit.

North America is anticipated to hold the highest share of the global polyolefin sheets in industrial market over the projected period.

North America is anticipated to hold the highest share of the global polyolefin sheets in industrial market over the projected period. This is because of a strong emphasis on technological innovation, high demand from important end-use sectors, and sophisticated manufacturing infrastructure. The automotive sector is one of the biggest drivers of growth in North America, particularly in light of the move toward lightweight materials for EV design and fuel efficiency. Car interiors, battery separators, under-hood parts, and protective barriers all use polyolefin sheets.

Asia Pacific is estimated to grow at the fastest CAGR in the global polyolefin sheets in industrial market during the forecast period. This optimistic outlook is a result of growing manufacturing, rapid industrialization, and expanding infrastructure. China, India, Japan, and South Korea are among the leading contributors, using polyolefin sheets in consumer goods, automotive, packaging, and construction. Furthermore, China's industrial modernization policies and government programs like "Make in India"are speeding up the use of advanced materials, like polyolefin sheets, in construction and building.

Company Profiling

Major vendors in the global polyolefin sheets in industrial market are Grafix Plastics, Mapal, Trident Plastics, Inc., Farco Plastics Supply, Duroplastic Technologies, All Foam Products, Ensinger, Inc., U.S. Packaging & Wrapping LLC, Porex, Dugar Polymers Limited, Polycan Extrusion Pvt. Ltd, Dutron, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global polyolefin sheets in industrial market based on the below-mentioned segments:

Global Polyolefin Sheets in Industrial Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

Global Polyolefin Sheets in Industrial Market, By Application

- Packaging & Pallet Liners

- Chemical Storage & Containment

Global Polyolefin Sheets in Industrial Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa