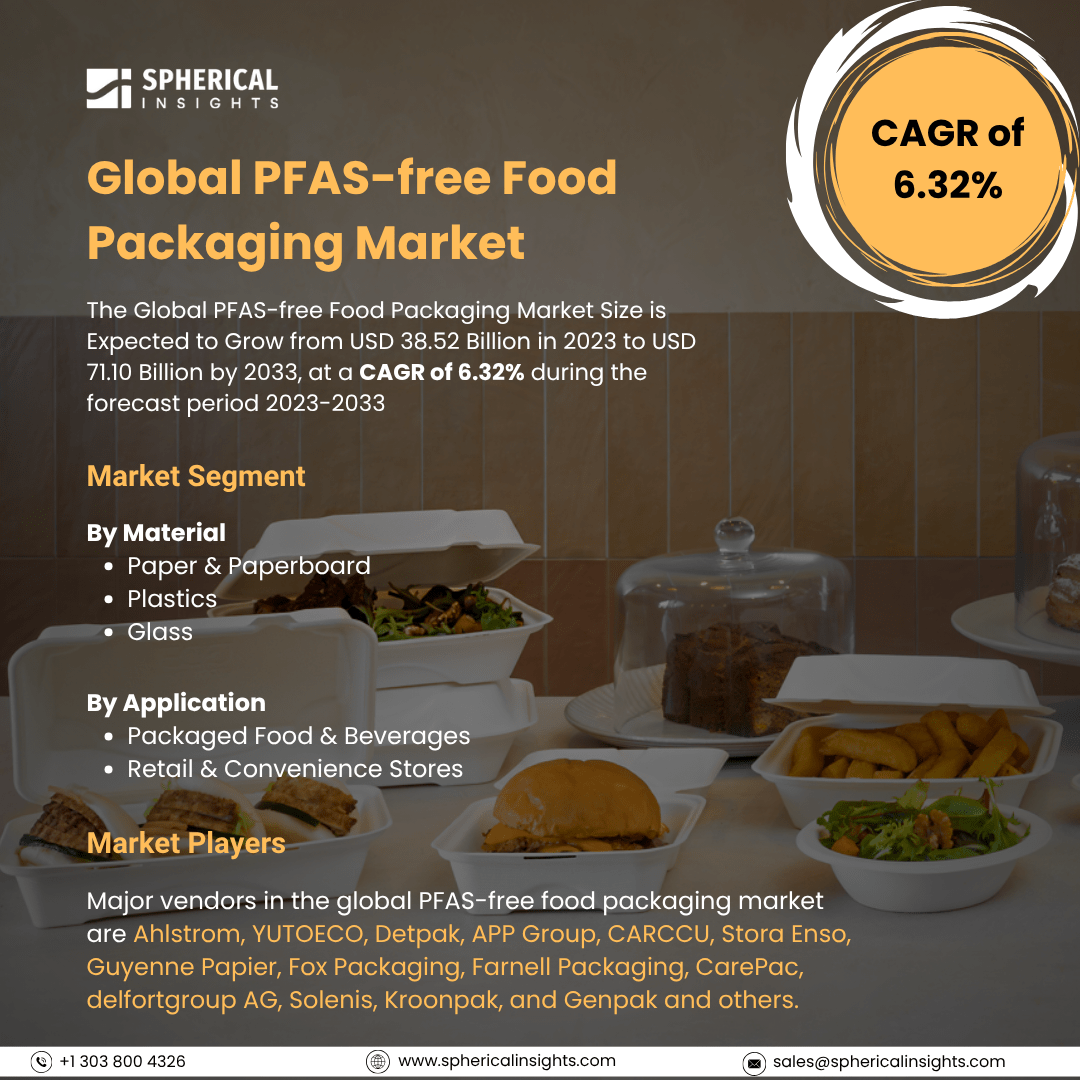

Global PFAS-free Food Packaging Market Size To Exceed USD 71.10 Billion by 2033

According to a research report published by Spherical Insights & Consulting, The Global PFAS-free Food Packaging Market Size is Expected to Grow from USD 38.52 Billion in 2023 to USD 71.10 Billion by 2033, at a CAGR of 6.32% during the forecast period 2023-2033.

Browse 210 Market Data Tables And 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global PFAS-free Food Packaging Market Size, Share, and COVID-19 Impact Analysis, By Material (Paper & Paperboard, Plastics and Glass), By Application (Packaged Food & Beverages, Retail & Convenience Stores), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

The PFAS-free food packaging industry includes food packaging materials that are compounded without per- and polyfluoroalkyl substances (PFAS). This industry segment is fueled by growing recognition of the possible health and environmental implications of PFAS, combined with regulatory forces and consumer sentiment for more sustainable and safer solutions. PFAS-free food packaging is packaging materials that are purposefully made and produced devoid of any per- and polyfluoroalkyl substances (PFAS). These chemicals have been used because of their water- and oil-repellent characteristics in many food packaging applications. This is because of increasing worry over their possible health and environmental effects, most manufacturers are now adopting PFAS-free packaging. Furthermore, the increasing consumer awareness of the harmful effects of per- and polyfluoroalkyl substances (PFAS) is triggering the market growth. Additionally, rising concerns about food safety and potential contamination have led consumers to seek safer and more sustainable packaging solutions actively. However, high prices, poor performance, and a dearth of reliable infrastructure for testing and certification are some of the issues facing the market for PFAS-free food packaging.

The plastic segment dominated the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the material, the global PFAS-free food packaging market is divided into paper & paperboard, plastics and glass. Among these, the plastic segment dominated the largest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. In the food packaging industry, plastics, which are mostly made from bio-based and biodegradable materials like polylactic acid (PLA) and polyhydroxyalkanoates (PHA), are becoming more popular as PFAS-free substitutes. These plastics are appropriate for uses like pouches, wraps, and containers because of their strength, portability, and improved resistance to oxygen and moisture.

The packaged food & beverages segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the global PFAS-free food packaging market is divided into packaged food & beverages, retail & convenience stores. Among these, the packaged food & beverages segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. Products like ready-to-eat meals, frozen foods, snacks, drinks, and other pre-packaged items that need protective packaging to keep their freshness and avoid contamination are included in this category. To address growing consumer concerns about food safety and environmental impact, PFAS-free packaging solutions are being adopted more and more in this market.

North America is anticipated to hold the highest share of the global PFAS-free food packaging market over the projected period.

North America is anticipated to hold the highest share of the global PFAS-free food packaging market over the projected period. Strict regulatory frameworks, consumer awareness, and industry innovation all contribute to this optimistic outlook. Perfluoroalkyl substances (PFAS) are subject to stricter regulations in the U.S. and Canada. Some states, including Maine, Washington, and California, have completely banned PFAS from food packaging. Major food packaging manufacturers have been compelled to expedite their shift to PFAS-free alternatives due to regulatory pressure.

Asia Pacific is estimated to grow at the fastest CAGR in the global PFAS-free food packaging market during the forecast period. Strict laws in nations like South Korea, Australia, and Japan have produced a strong regulatory framework that encourages the use of PFAS-free substitutes. These nations have imposed some of the strictest regulations on PFAS in food contact materials in the world, which has compelled producers to develop and modify their packaging.

Company Profiling

Major vendors in the global PFAS-free food packaging market are Ahlstrom, YUTOECO, Detpak, APP Group, CARCCU, Stora Enso, Guyenne Papier, Fox Packaging, Farnell Packaging, CarePac, delfortgroup AG, Solenis, Kroonpak, and Genpak and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global PFAS-free food packaging market based on the below-mentioned segments:

Global PFAS-free Food Packaging Market, By Material

- Paper & Paperboard

- Plastics

- Glass

Global PFAS-free Food Packaging Market, By Application

- Packaged Food & Beverages

- Retail & Convenience Stores

Global PFAS-free Food Packaging Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa