Food Packaging Equipment Market Summary

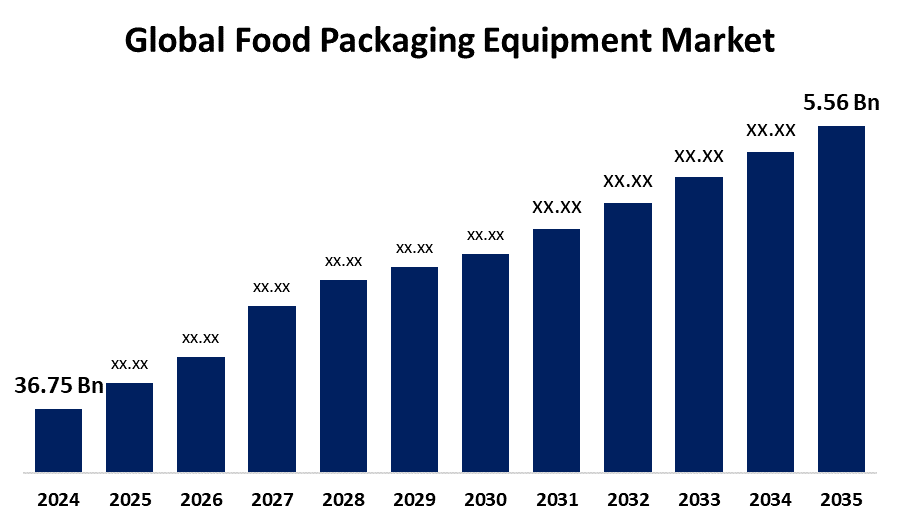

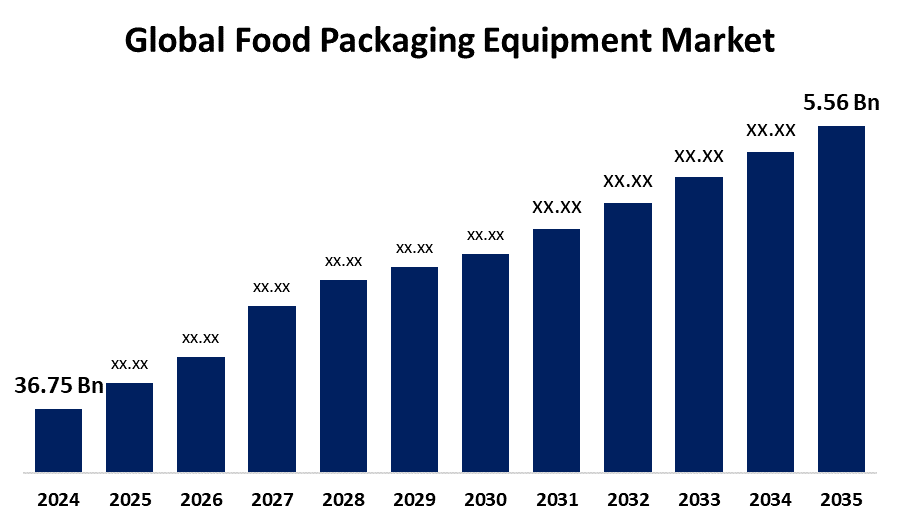

The Global Food Packaging Equipment Market Size was estimated at USD 20.27 Billion in 2024 and is projected to reach USD 36.75 Billion by 2035, growing at a CAGR of 5.56% from 2025 to 2035. A number of important reasons are driving the growth of the food packaging equipment market, such as the growing demand for packaged foods, consumer preference for convenience and ready-to-eat meals, and attention to food safety and cleanliness.

Key Regional and Segment-Wise Insights

- With the biggest revenue share of 36.5% in 2024, the Asia Pacific food packaging equipment market led the global market.

- In 2024, the Asia Pacific market for food packaging equipment was dominated by China, which accounted for the biggest revenue share.

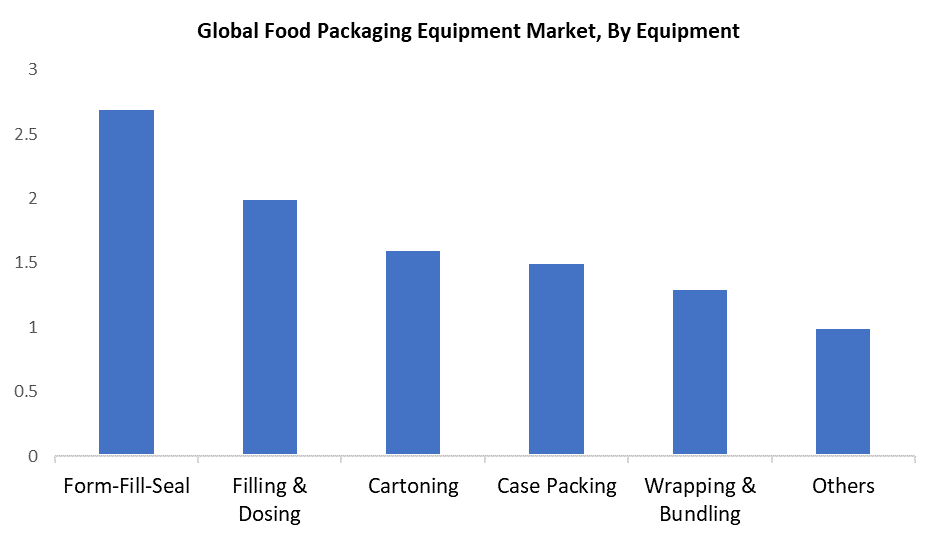

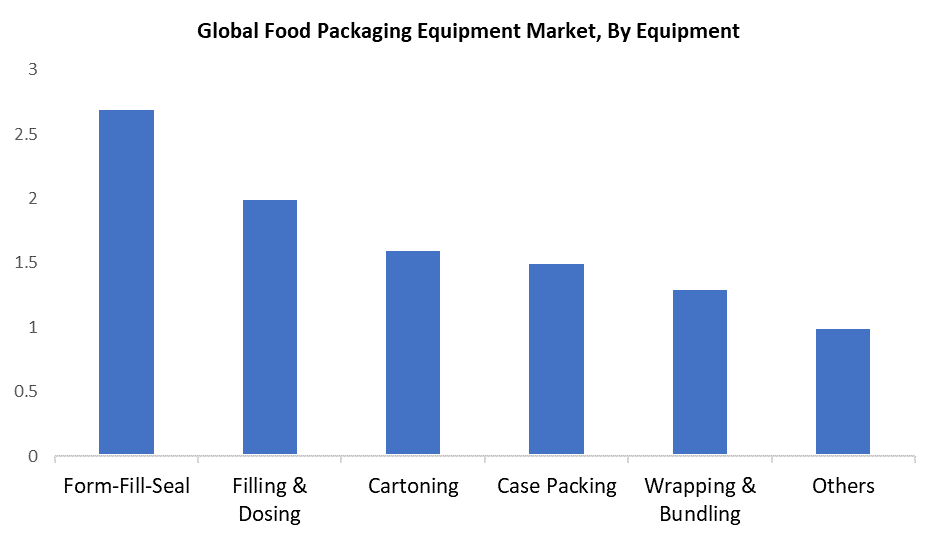

- The market was dominated by the form-fill-seal (FFS) segment, accounting for the highest revenue share of 27.6% in 2024 based on equipment.

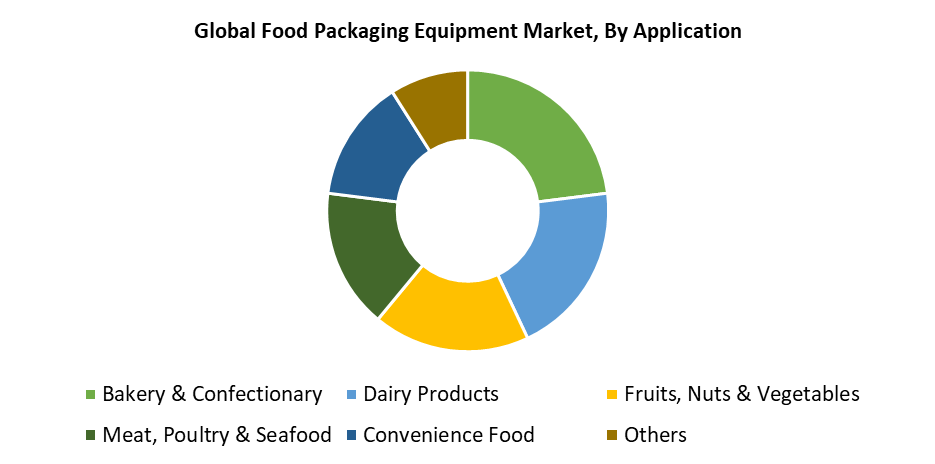

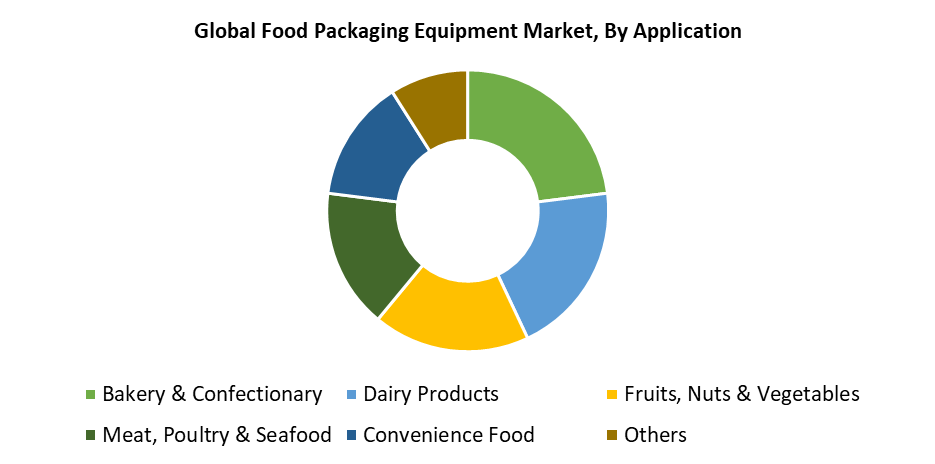

- In 2024, the bakery and confectionery segment held the biggest revenue share of 23.7% and led the market by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 20.27 Billion

- 2035 Projected Market Size: USD 36.75 Billion

- CAGR (2025-2035): 5.56%

- Asia Pacific: Largest market in 2024

The market for food packaging equipment includes the tools and technology used to package food items, guaranteeing their lifespan, quality, and safety. Food packaging equipment market expansion primarily results from consumers choosing convenience foods along with the need for extended product shelf life. The rising consumer interest in packaged and ready-to-eat foods, because of their busy lives, drives manufacturers to acquire effective packaging solutions that operate at high speeds. The technological progress in automation, together with robots and intelligent packaging systems, enables organizations to operate more efficiently while decreasing human errors and enhancing food protection standards. Current packaging technology adoption receives additional momentum from businesses needing to fulfil food safety and hygiene regulations. Modern market dynamics are being driven by sustainability because businesses are adopting efficient equipment along with environmentally friendly materials to reduce environmental impact and meet customer and legal requirements.

Food packaging businesses currently undergo transformation because Industry 4.0 technologies such as the Internet of Things (IoT), Big Data analytics, and smart manufacturing systems are spreading across the sector. These developments guarantee food quality and cut waste by enabling real-time tracking and environmental monitoring across the supply chain. The latest smart packaging technologies provide traceable solutions that enhance consumer interaction along with product differentiation capabilities. Modern packaging technology that ensures secure and tamper-proof delivery must emerge to support the rapidly expanding direct-to-consumer and e-commerce delivery market. These trends, together with rising urbanization and increasing disposable incomes in developing nations, demonstrate extensive market opportunities for growth and value creation in the future.

Equipment Insights

The form-fill-seal (FFS) equipment segment dominated the market in 2024 by generating 27.6% of the overall revenue. The rising demand for packaging solutions that combine sustainability with automation and efficiency has driven the market leadership of this sector. The machines combine the entire process of forming, filling, and sealing into one streamlined operation, which boosts production throughput while reducing worker expenses. The market for single-serve packaged goods continues to expand rapidly along with the food and beverage industry. The FFS machines enable sustainability through reduced material use and waste production while they preserve product quality and extend shelf life, and meet food safety standards. The ongoing technological development of automation systems and packaging materials drives their growing popularity across multiple food packaging uses.

The filling and dosing equipment is expected to experience a 4.3% CAGR during the forecast period because of the increasing need for automated processes and precise packaging operations in the food and beverage industry. The main factors driving this growth are manufacturers' needs to deliver consistent product quality and reduce human interaction while maximizing production output in high-volume manufacturing environments. Manufacturers are adopting advanced filling and dosing systems to cut down on waste while ensuring accurate portioning, which helps maintain quality standards and regulatory compliance. Operating efficiency and flexible production capabilities improve through technology developments that include real-time monitoring systems alongside AI-based diagnostics and flexible packaging material compatibility. The latest market developments respond to evolving customer expectations for sustainable products, personalized solutions, and easy-to-use options.

Application Insights

Bakery and confectionery products held the largest revenue share, accounting for 23.7% during 2024, because customers want baked foods with a longer shelf life and simple packaging. People living busy lives select fast food options, so manufacturers invest in modern packaging technologies that preserve product freshness along with hygienic standards and attractive designs. The growing number of supermarkets, retail stores, and bakery chains creates increased demand for efficient packaging systems with high production rates. The packaging system of this segment serves multiple purposes because it protects products from moisture, contamination, and handling damage while preserving product texture and flavor. The segment maintains strong market growth through its fundamental factors, together with increasing worldwide demand for packaged snacks and sweets.

The dairy products segment is expected to hold a CAGR of 4.5% throughout the forecasted period, because of rising demand for processed dairy items such as cheese, yogurt, and milk. The increasing pace of modern lifestyles drives consumers to purchase more convenient packaged dairy products, which results in the ongoing growth of this market. The growing popularity of automated packaging solutions results from consumer demands for precise filling and dosing operations that deliver consistent product results while controlling waste and meeting strict hygiene regulations. Packaging technology development enables products to achieve longer shelf lives without reducing their fresh quality. The market expansion receives additional support from its dual-purpose applications in beverage industry operations because it enables labeling and palletizing functions and also permits use in alcoholic beverage packaging for new growth opportunities.

Regional Insights

The Asia Pacific region led the global food packaging equipment market in 2024 by achieving 36.5% of total revenue. Economic growth and rising urban populations, together with increasing disposable incomes in developing markets including China, India, and Southeast Asia, drive this leadership position. The growing middle class, together with changing consumer habits, drives packaged food demand, which accelerates modern packaging technology adoption. Packaging innovations designed for single-serve formats as well as resealable and portable options match the evolving preferences of consumers. The food packaging market in Asia Pacific benefits from China's and Japan's investments in automation and smart manufacturing because these nations stand as the second and third largest economies worldwide, according to the IMF rankings.

China held the leading position in the Asia Pacific food packaging equipment market during 2024 because of its large food sector and growing middle class with increasing disposable income. Chinese consumers have driven the rise of innovative packaging technology applications because they need more processed foods and convenient meal options. Both domestic and foreign companies have diverted large amounts of funding to automation technology and smart packaging solutions. The food packaging equipment market grows because of governmental rules that promote sustainable operations, food safety standards, and quality control measures. These factors together position China as the leading force in the Asia Pacific food packaging equipment industry.

Europe Food Packaging Market Trends

The European food packaging equipment industry will experience substantial growth through strict food safety regulations and increasing sustainability regulations. The market trends emerge from rising consumer requirements for innovative packaging products that extend shelf life while using sustainable materials and minimizing waste. Reliable and secure packing solutions that maintain product quality during transport face rising market demand because of the growth of online grocery shopping. Leading nations, including Germany and Italy, are developing automated precision packaging machinery for portion-controlled and convenience meals because consumer lifestyles are evolving. The European Union's sustainability framework drives manufacturers in Europe to develop machinery that operates with biodegradable and compostable packaging materials.

North America Food Packaging Market Trends

The North American food packaging equipment sector is expected to experience significant growth throughout the forecasted period, because of the region's packaged food consumption and food processing business density. Food service providers who adopt digital technologies drive industry growth through enhanced payment systems and expanded product choice. The increasing demand for convenient and ready-to-eat products, along with changing lifestyle patterns, triggers investments in advanced packaging solutions. The United States holds the leading position in the region because of its substantial food production capacity and strict food safety regulations. The rising environmental awareness promotes the use of eco-friendly packaging machinery that operates with sustainable materials. Modern food safety standards and operational efficiency, as well as traceability, benefit from the implementation of IoT-enabled equipment and other smart packaging technologies, which are being adopted at an increasing rate.

Key Food Packaging Equipment Companies:

The following are the leading companies in the food packaging equipment market. These companies collectively hold the largest market share and dictate industry trends.

- MULTIVAC

- Illinois Tool Works Inc.

- Coesia S.p.A.

- Krones AG

- Tetra Pak International S.A.

- Robert Bosch Packaging Technology GmbH

- ARPAC LLC.

- I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.

- GEA Group Aktiengesellschaft

- OPTIMA Packaging Group GmbH

- Others

Recent Developments

- In December 2024, Tetra Pak and Yellow Dreams revealed plans to invest €3 million in constructing a modern recycling facility at Ittervoort in the Netherlands. The facility will enhance Europe's recycling infrastructure by processing polyAl composite material, which consists of polyethylene and aluminum retrieved from used beverage cartons. The partnership between Tetra Pak and Yellow Dreams demonstrates their commitment to sustainable solutions and food packaging industry innovation through enhanced carton recycling and reuse, which reduces environmental impact.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the food packaging equipment market based on the below-mentioned segments:

Global Food Packaging Equipment Market, By Equipment Type

- Form-Fill-Seal

- Filling & Dosing

- Cartoning

- Case Packing

- Wrapping & Bundling

- Others

Global Food Packaging Equipment Market, By Application

- Bakery & Confectionary

- Dairy Products

- Fruits, Nuts & Vegetables

- Meat, Poultry & Seafood

- Convenience Food

- Others

Global Food Packaging Equipment Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa