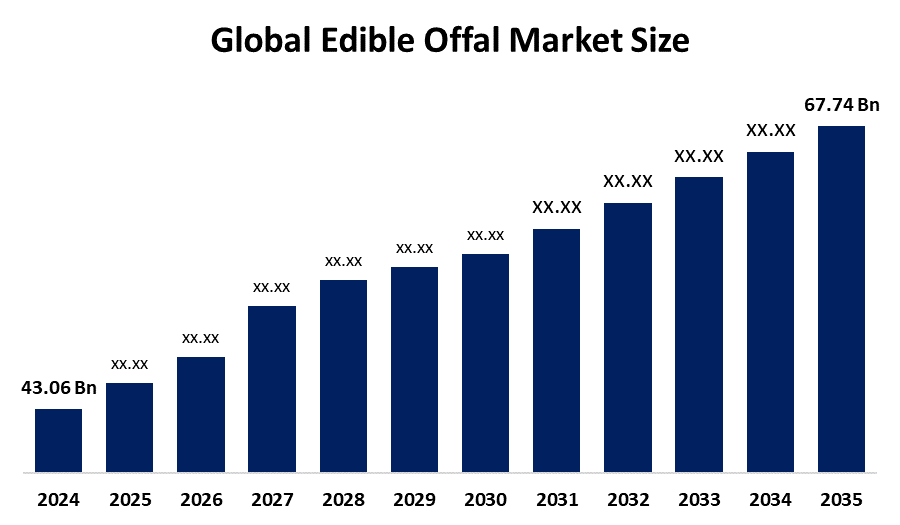

Global Edible Offal Market Insights Forecasts to 2035

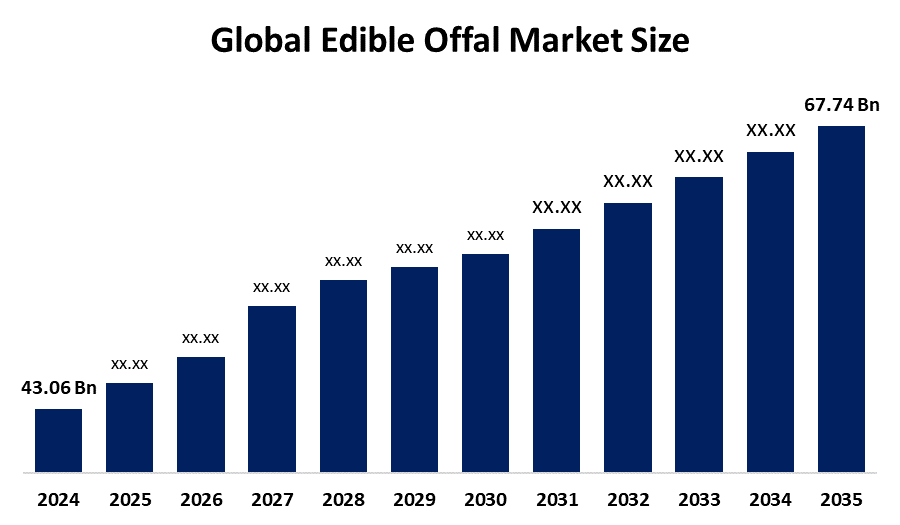

- The Global Edible Offal Market Size Was Estimated at USD 43.06 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.2% from 2025 to 2035

- The Worldwide Edible Offal Market Size is Expected to Reach USD 67.74 Billion by 2035

- Europe is expected to grow the fastest during the forecast period.

Edible Offal Market

The global edible offal market encompasses the production, trade, and consumption of animal internal organs and other non-muscle parts, such as liver, kidneys, heart, and intestines. These products are highly nutritious, offering essential vitamins, minerals, and proteins. Offal is used in various culinary traditions, especially in many cultures in Asia, Europe, and Latin America. It is consumed as a key ingredient in dishes such as pâté, sausages, and stews. Additionally, edible offal finds applications in processed foods, pet food, and by-products in industries like leather. Despite varying cultural preferences and attitudes towards offal consumption, the market continues to expand as consumers seek alternatives to traditional meat cuts. It also holds importance in promoting food sustainability, as utilizing these parts of animals reduces waste. Offal products are also processed into nutritional supplements and animal feed, further contributing to the overall market landscape.

Attractive Opportunities in the Edible Offal Market

- The growing nose-to-tail eating trend promotes using all parts of the animal, including offal, reducing food waste and supporting sustainability. This offers opportunities for restaurants and food brands to cater to consumers seeking eco-friendly and nutritious options.

- Offal's nutrient density is appealing to health-conscious consumers, creating demand for nutrient-dense supplements. Brands can develop organ meat-based products, like freeze-dried capsules, targeting wellness-focused individuals looking for natural, whole-food supplements.

Global Edible Offal Market Dynamics

DRIVER: Rise in sustainable and waste-reducing food practices has led to a greater emphasis

Increasing awareness of the nutritional benefits of offal is a significant contributor. These products are rich in essential vitamins, minerals, and proteins, making them a valuable source of nutrition. Second, the rise in sustainable and waste-reducing food practices has led to a greater emphasis on utilizing all parts of the animal, including offal, which helps minimize food waste. Third, the rising disposable incomes in developing regions are enabling consumers to access a wider variety of food products, including offal, which is traditionally consumed in many cultures. Additionally, the growing popularity of organ meats in processed foods and specialty products, such as sausages and pate, is fueling demand. Lastly, offal’s use in pet food and animal feed, which is a growing segment, further drives market expansion, making it an essential component in various industries.

RESTRAINT: Negative perception surrounding offal consumption in many Western countries

One of the main challenges is the negative perception surrounding offal consumption in many Western countries, where these products are often viewed as unappealing or "taboo." This cultural aversion limits the market potential in certain regions, despite the nutritional benefits. Additionally, offal's relatively short shelf life compared to muscle meats presents logistical challenges, requiring specialized storage and transportation conditions, which can increase costs. The market is also sensitive to fluctuations in the price of raw materials, as offal is typically a by-product of the meat industry, meaning its supply and pricing can be affected by broader meat production trends. Furthermore, concerns over food safety, such as the risk of contamination with diseases like BSE (bovine spongiform encephalopathy), may deter consumers from purchasing offal, especially in markets with stringent food safety regulations. These factors collectively limit broader market growth.

OPPORTUNITY: Growing trend of "nose-to-tail" eating

One notable opportunity lies in the growing trend of "nose-to-tail" eating, where consumers seek to utilize all parts of the animal, promoting sustainability and reducing food waste. This movement has led to increased interest in offal products, particularly in high-end restaurants and gourmet food sectors. Additionally, the expanding trend of ethnic and multicultural cuisines in urban areas offers a platform for offal consumption, as many traditional dishes incorporate offal as key ingredients. Another opportunity exists in the health and wellness sector, where offal’s nutrient density is gaining attention, particularly among consumers focused on biohacking and holistic nutrition. There is also potential in the functional food market, where offal can be used to develop nutrient-dense supplements. Lastly, as plant-based diets gain popularity, the market could benefit from rising interest in more sustainable, whole-animal sourcing for meat alternatives and by-products.

CHALLENGES: Lack of consistent supply

The edible offal market faces several challenges that differ from its restraining factors. One significant challenge is the lack of consistent supply, as the availability of offal depends on the slaughter of animals, which can fluctuate due to factors such as meat production trends or changes in farming practices. This can result in supply chain disruptions and price volatility. Additionally, there is a challenge in maintaining quality and consistency, as offal is highly perishable and requires strict processing, storage, and transportation conditions. The market also struggles with limited consumer education, as many people are unfamiliar with how to prepare or cook offal, which can lead to hesitancy in purchasing these products. Furthermore, the competition from alternative protein sources, including plant-based and lab-grown meats, poses a growing challenge, as these products may offer similar nutritional benefits without the cultural or logistical barriers associated with offal. Lastly, regulatory challenges related to health and food safety standards can complicate market expansion.

Global Edible Offal Market Ecosystem Analysis

The Global edible offal market ecosystem involves key players such as livestock producers, slaughterhouses, and processing companies that clean, package, and convert offal into products like sausages and pâté. Distribution occurs through retailers, butchers, and foodservice providers, with end consumers ranging from households to pet food manufacturers. Regulatory bodies ensure food safety, while technology providers innovate in preservation and packaging. Sustainability advocates push for offal as a solution to reduce food waste, creating a holistic, interconnected market environment.

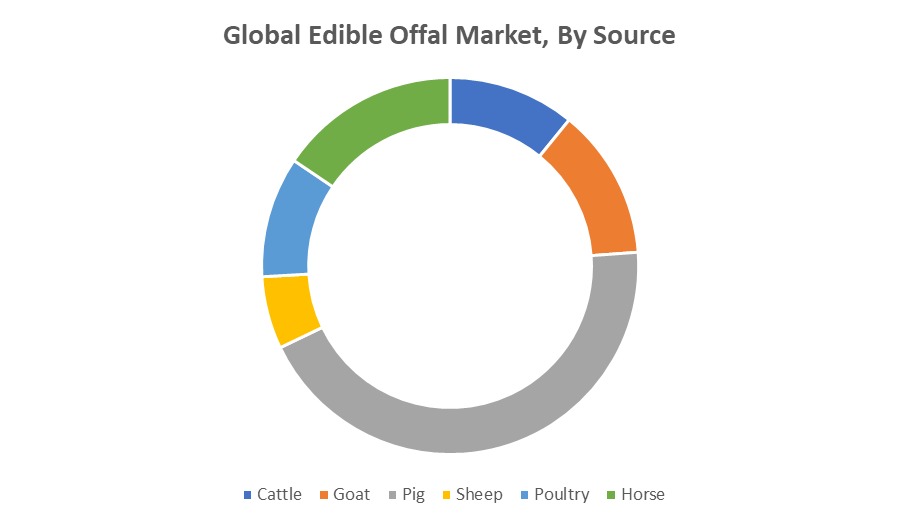

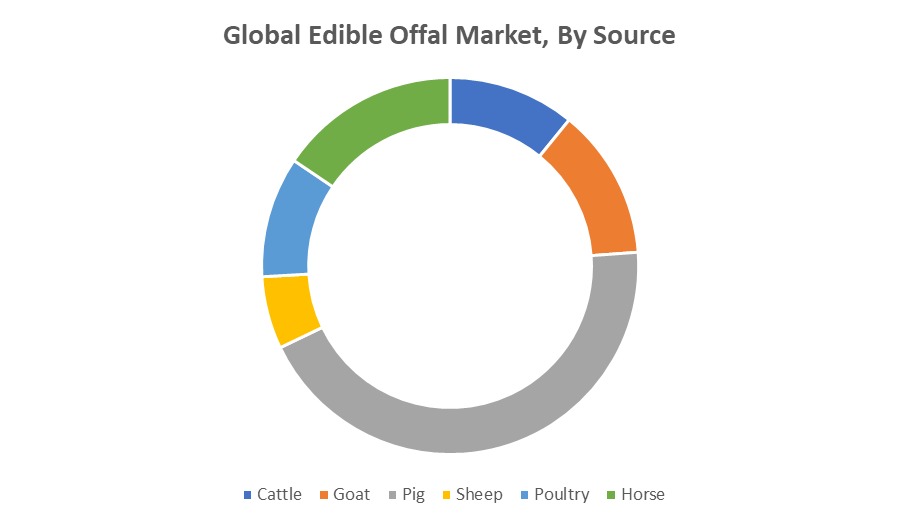

Based on the source, the pig offal segment held the leading revenue share over the forecast period

The pig offal segment is expected to maintain the leading revenue share in the global edible offal market throughout the forecast period. This dominance is largely due to the high consumption of pig offal in various cuisines, particularly in regions like Asia, Europe, and Latin America. Pig offal, including liver, kidneys, and intestines, is widely used in processed food products such as sausages, pâté, and stews. Additionally, its cost-effectiveness, versatility, and nutritional value contribute to its strong market position. The increasing demand for pork-based offal in both traditional dishes and modern culinary innovations further supports its market leadership.

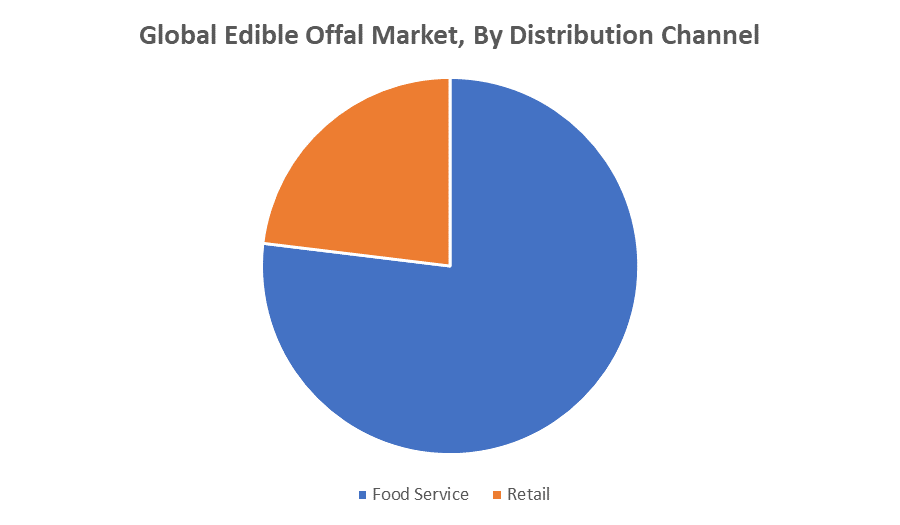

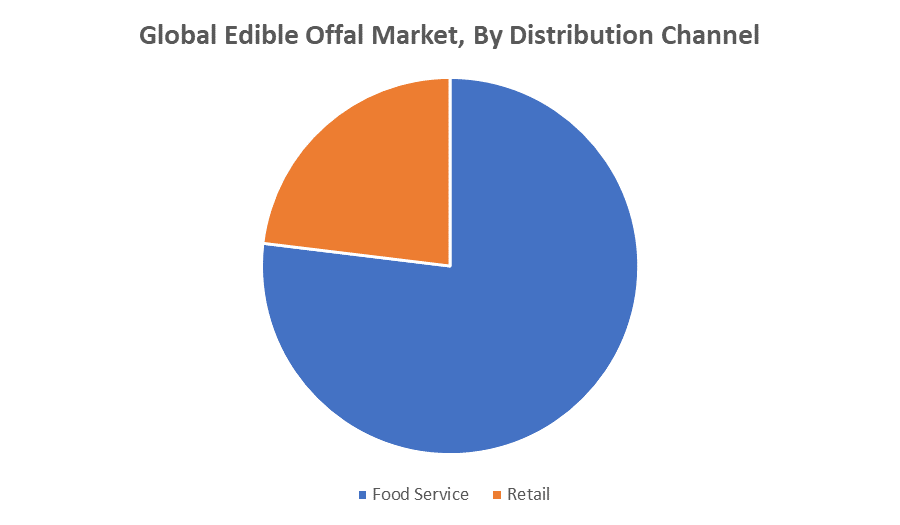

Based on the distribution channels, the food service segment held the major revenue share during the forecast period

The dominance is driven by the growing use of offal in restaurants, food chains, and catering services, particularly in regions where offal is a traditional part of the cuisine. Offal's inclusion in gourmet dishes, ethnic cuisines, and niche food offerings, such as organ meat specialties, further fuels its popularity in the foodservice industry. As culinary trends shift towards more sustainable and nose-to-tail eating practices, food service providers are increasingly incorporating offal to meet consumer demand for diverse and authentic dining experiences. Additionally, offal’s use in high-demand processed food items and in innovative menus helps solidify its prominence within the food service sector.

Asia Pacific is anticipated to hold the largest market share of the edible offal market during the forecast period

Asia Pacific is expected to hold the largest market share in the global edible offal market during the forecast period. This is primarily due to the region’s long-standing cultural acceptance and consumption of offal. Countries like China, Japan, Korea, and various Southeast Asian nations have a rich tradition of utilizing animal offal in daily cuisine, including dishes like soups, stews, and sausages. The high nutritional value, cost-effectiveness, and diverse culinary applications of offal further drive its popularity in the region. Additionally, the rising disposable incomes and urbanization in countries like China and India are leading to greater demand for offal-based products in both traditional and modern food establishments. The expanding food service and retail sectors in these countries also contribute to the market's growth in Asia Pacific. As a result, the region is poised to maintain its dominance in the global edible offal market.

Europe is expected to grow at the fastest CAGR in the edible offal market during the forecast period

Europe is projected to grow at a CAGR in the global edible offal market during the forecast period. This growth is attributed to a combination of factors, including the increasing interest in sustainable eating practices, such as nose-to-tail consumption, where all parts of the animal are utilized. Offal is also gaining traction in Europe due to rising awareness of its nutritional benefits, as it is rich in vitamins, minerals, and protein. Furthermore, the growing trend of organic and locally sourced foods is encouraging the use of offal in high-end restaurants and gourmet food services. Traditional dishes from countries like France, Spain, and Italy that feature offal, along with its inclusion in processed food products like pâté and sausages, are also boosting demand. As consumers continue to seek more diverse and sustainable food options, the edible offal market in Europe is poised for rapid expansion.

Recent Development

- In March 2023, Nestlé expanded its Pure Pet Food line by introducing new products incorporating organ meats like chicken liver and kidneys. These pet food offerings cater to the growing demand for sustainable, high-protein, and natural pet food options.

- In April 2023, Ancestral Supplements, a leading brand in the organ meat supplement space, launched a new line of freeze-dried liver and organ capsules in April 2023. These products are targeted at health-conscious individuals seeking natural ways to boost energy, immunity, and overall wellness.

Key Market Players

KEY PLAYERS IN THE EDIBLE OFFAL MARKET INCLUDE

- JBS S.A.

- Tyson Foods

- BRF S.A.

- Sealed Air Corporation

- China National Chemical Corporation (ChemChina)

- Danish Crown

- Vion Food Group

- FrieslandCampina

- Smithfield Foods

- Animex Foods

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the edible offal market based on the below-mentioned segments:

Global Edible Offal Market, By Source

- Cattle

- Goat

- Pig

- Sheep

- Poultry

- Horse

Global Edible Offal Market, By Distribution Channel

Global Edible Offal Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa