Drilling Fluids Market Summary

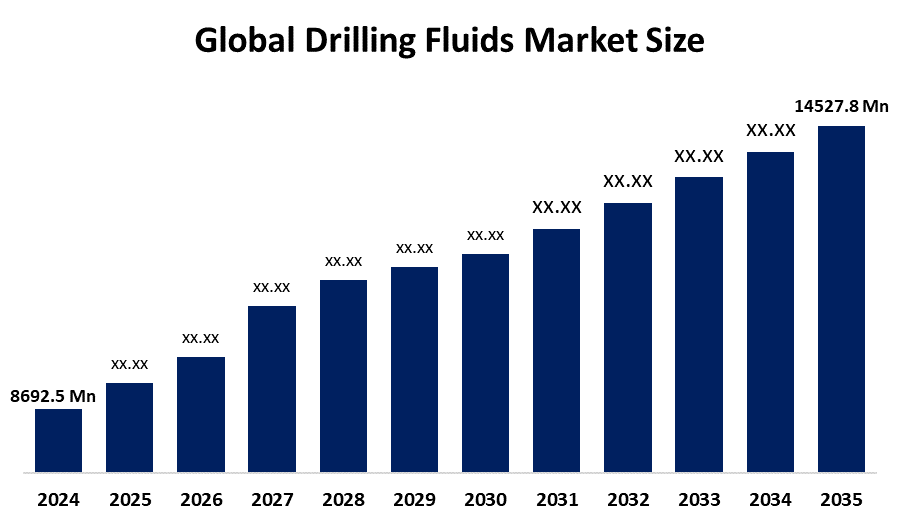

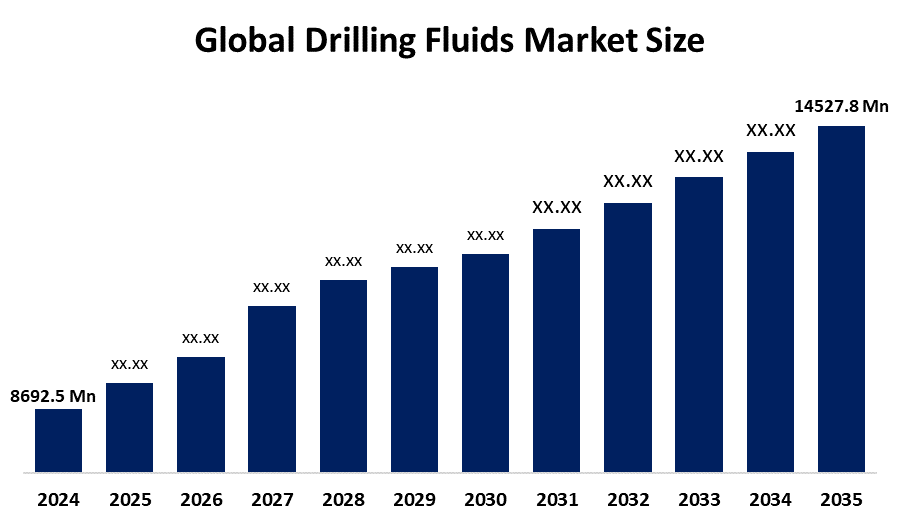

The Global Drilling Fluids Market Size was estimated at USD 8692.5 Million in 2024 and is projected to Reach USD 14527.8 Million by 2035, growing at a CAGR of 4.78% from 2025 to 2035. Growing energy consumption, improved drilling methods, and more exploration activity, especially in unconventional and offshore resources, are all contributing to the expansion of the worldwide drilling fluids market. In addition, the market is growing as a result of the construction industry's use of drilling fluids for foundation work and infrastructure projects like flyovers and metro lines.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share of over 24.7% and dominated the market.

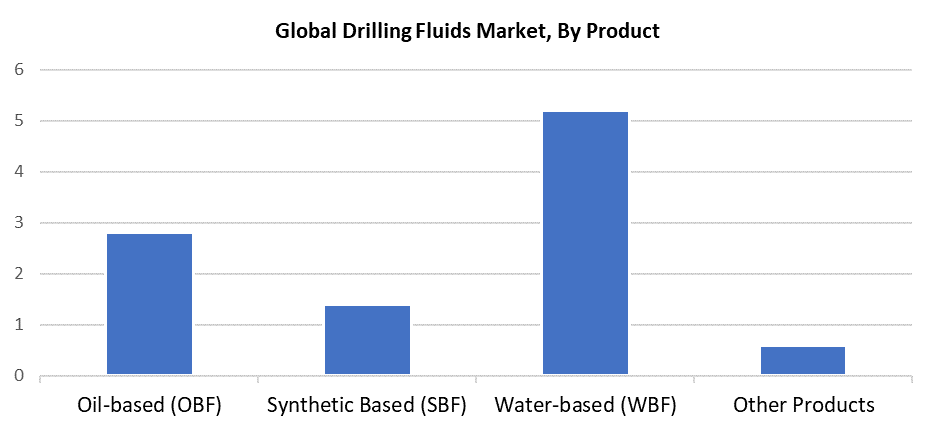

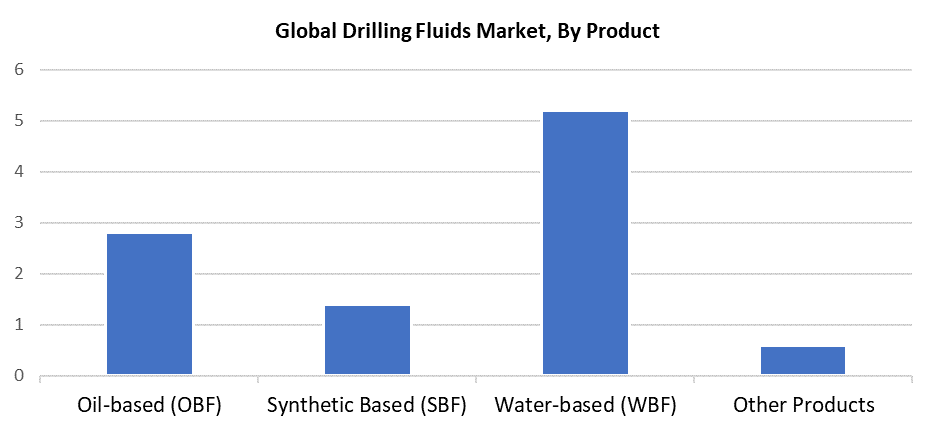

- In 2024, the Water-Based Fluids (WBF) segment had the highest market share by product, accounting for 52.6%.

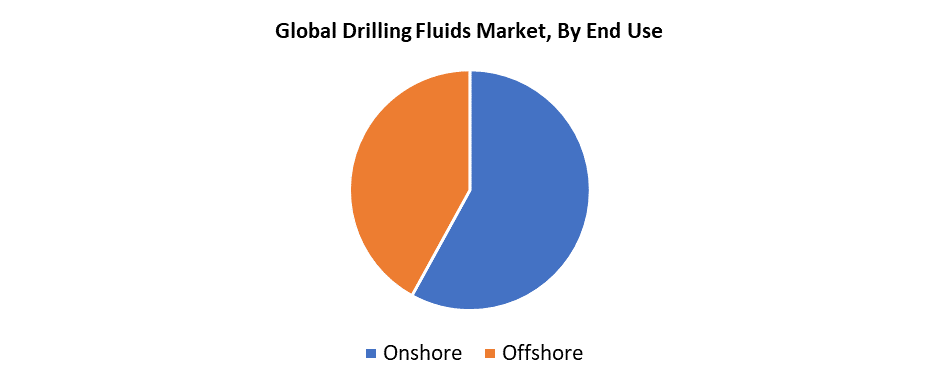

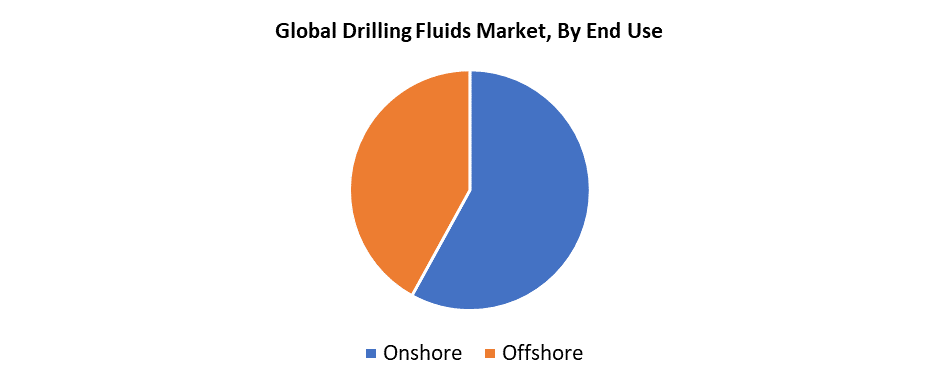

- In 2024, the onshore segment had the biggest market share by end-use, accounting for 58.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 8692.5 Million

- 2035 Projected Market Size: USD 14527.8 Million

- CAGR (2025-2035): 4.78%

- North America: Largest Market in 2024

The drilling fluids market includes the sector that manufactures and distributes specialized fluids for drilling applications in oil and gas extraction, as well as mining, construction, and water well drilling. The drilling fluids market is experiencing significant growth because of increasing offshore oil and gas exploration activities, especially in the Persian Gulf territories. The developing complexity of drilling operations, including deepwater and horizontal drilling, demands innovative drilling fluids that boost efficiency while lowering operational dangers. These fluids serve essential functions in managing pressure levels while maintaining borehole stability and providing drill bit lubrication, which becomes vital in complex geological environments. The worldwide energy demand expansion pushes corporations to discover new deposits, which in turn drives the requirement for innovative drilling fluids suitable for different environments. The development of oilfield services, together with new drilling fluid compositions, leads to market growth through improved drilling performance and cost-effectiveness.

The drilling fluids market encounters obstacles from both rigorous regulations and ecological preservation requirements. The chemical substances used in drilling fluids pose environmental risks through their potential to pollute both soil and water resources. The worldwide implementation of strict environmental regulations by governments forces increased production costs and limits the selection of particular fluid types. The increasing need for biodegradable and eco-friendly drilling fluids opens up new opportunities for innovation despite the current situation. Companies dedicate increased funds to research environmentally safe alternatives that fulfill legal requirements, maintain drilling effectiveness, thus transforming market dynamics and ensuring sustainable growth for the future.

Product Insights

The Water-Based Fluids (WBF) segment achieved a 52.6% revenue share and led the drilling fluids market globally in 2024. The high market share of Water-Based Fluids results from their widespread use in more than 75% of wells across the globe because they function well in multiple well conditions, including fresh water, formate brine, and saturated brine. The rising demand for environmentally friendly WBFs stems from increasing environmental awareness about the toxic and biodegradable properties of other drilling fluids. Offshore drilling operations become easier and more attractive because of the excellent discharge characteristics of WBFs. WBF continues to lead the changing drilling fluids industry because of its essential role in meeting the rising needs for high-pressure, high-temperature well fluid systems.

The worldwide drilling fluids market will experience the fastest growth from oil-based drilling fluids because of their superior lubrication and thermal stability properties. The combination of water and oil phases in drilling fluids makes them ideal for operations that require enhanced equipment protection from high temperatures and corrosion. The demand for oil-based fluids will surge substantially during the forecast period because exploration activities are moving into difficult-to-reach areas. Environmental concerns about toxicity and the disposal of these fluids have led to strict government regulations against their use. The ongoing development of environmentally friendly solutions that maintain performance will drive the stable growth of oil-based fluids throughout the upcoming period.

End-use Insights

The onshore sector led the market, accounting for 58.4% market share in 2024. The rising worldwide energy consumption has led to a surge in onshore oil drilling, which serves as the primary force behind this growth. The growth of the sector depends on extensive research and development work, which aims to boost production in established onshore oilfields while restoring abandoned wells. Major oil-producing countries, including Saudi Arabia, the US, China, and Russia, are dedicating significant investments to onshore exploration to boost their production capacities and energy security. The implementation of these programs results in higher market recognition and market demand and leads to increased production of oil and gas. The onshore segment remains vital to fulfill global energy requirements, which ensures its market dominance and ongoing growth.

The offshore segment is projected to grow rapidly because of rising worldwide offshore rig numbers, together with complete deep and ultra-deep water well developments. Offshore drilling activities in important regions such as the South China Sea and North Sea, the Gulf of Mexico, and the Persian Gulf regions have increased because of growing demands for specialized drilling fluids that operate in tough conditions. Market prospects receive additional support from ongoing projects and expansions taking place in African and Middle Eastern territories. The expanding offshore drilling operations of energy companies require advanced offshore drilling fluids to meet growing energy demands. The offshore exploration and production segment will experience substantial growth because of this development throughout the forecast period.

Regional Insights

North America led the drilling fluids market in 2024 by generating 24.7% of total revenue. The significant growth of shale gas drilling activities across the United States and Canada drives the market expansion. The growing need for complex drilling fluids that match different geological settings continues to rise because of rising offshore drilling operations across the United States, Mexico, and Canada. The main factors driving growth include essential oilfield technological advancements in the United States fields and substantial increases in oil and gasoline production. The substantial oil reserves of Canada, together with its status as the fifth-largest natural gas and crude oil producer worldwide, lead to high regional market demand. The energy sector growth in Canada has been the main reason for market expansion, which has positioned North America as a leading hub for drilling fluids development and usage.

U.S. Drilling Fluids Market Trends

The United States drilling fluids market is experiencing significant growth because of important oilfield projects in Texas, North Dakota, and the Gulf of Mexico. Unconventional hydrocarbon resource development receives strong federal government support, which accelerates sector growth at an even higher pace. The demand for specialized drilling fluids rises because modern drilling techniques, such as directional and horizontal drilling, enhance both operational efficiency and safety standards. The expanding offshore drilling initiatives, together with increasing upstream oil and gas activities, drive market growth. The market gains momentum because drilling fluids find increased application across mineral extraction operations and borehole drilling services. The combination of these factors positions the United States as a key emerging market for drilling fluids.

Asia Pacific Drilling Fluids Market Trends

The drilling fluids market in Asia Pacific is set to experience substantial growth because of the increasing exploration of deepwater and tight oil deposits in the region. The nations across this region focus on obtaining offshore and unconventional oil resources because onshore supplies are restricted for their rising energy needs. Market expansion occurs primarily because of advanced drilling technology, which enhances operational efficiency while reducing production costs. The technological advancements have made exploration operations both more economical and feasible because they enhance drilling precision and improve fluid performance and environmental standards. The Asia Pacific drilling fluids market grows because of industrial growth and increasing energy needs, along with government initiatives to boost local oil output, which positions Asia Pacific as a key energy development center for the future.

Europe Drilling Fluids Market

The rapid growth of the drilling fluids industry across Europe will result from the rising demand for complex drilling fluids in horizontal wells within essential nations such as Norway, Italy, Netherlands, Denmark UK, and France. The exploration and production activities in onshore and offshore areas throughout the region are expanding because of two factors: resource depletion and rising crude oil requirements. The demand for drilling fluids increased due to technological advancements in drilling methods, including horizontal and directional drilling, which enhance both operational efficiency and recovery performance. The market expansion for high-performance and environmentally friendly fluids in Europe stems from strict environmental regulations, and these requirements drive the market forward. The European initiatives for sustainability and energy security maintain steady demand for drilling fluids in the region.

Key Drilling Fluids Companies:

The following are the leading companies in the drilling fluids market. These companies collectively hold the largest market share and dictate industry trends.

- AkzoNobel N.V.

- Petrochem Performance Chemical Ltd. LLC

- China Oilfield Services Ltd.

- Baker Hughes, Inc.

- CES Energy Solutions Corp.

- Schlumberger Ltd.

- Scomi Group Bhd

- Weatherford International

- Chevron Phillips Chemical Company

- BASF SE

- Newpark Resources, Inc.

- DuPont

- Halliburton, Inc.

- Dow

- Others

Recent Developments

- In April 2023, ADNOC Drilling received a contract from ADNOC for drilling services at the Upper Zakum field, which stands as their premier offshore production facility. The agreement aims to enhance production output through the utilization of modern drilling equipment. ADNOC formed this partnership to expand offshore asset production while enhancing operational efficiency through environmentally conscious practices. The initiative demonstrates that advanced technology, along with skilled service providers, play a vital role in optimizing oil and gas extraction throughout the region.

- In March 2022, Repsol deployed an advanced riserless mud recovery system at the Yme field to boost drilling performance and environmental protection. The innovative technology recovers drilling fluids for recycling without requiring a riser, thus lowering environmental risks linked to traditional drilling methods. The system enables a more efficient drilling operation through reduced operational interruptions.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the drilling fluids market based on the below-mentioned segments:

Global Drilling Fluids Market, By Product

- Oil-based (OBF)

- Synthetic Based (SBF)

- Water-based (WBF)

- Other Products

Global Drilling Fluids Market, By End Use

Global Drilling Fluids Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa