Anticoagulant Rodenticides Market Summary

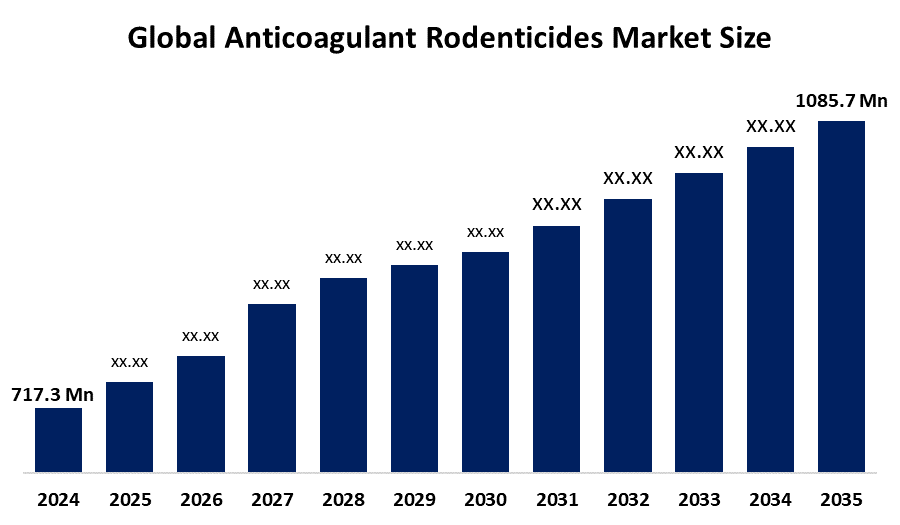

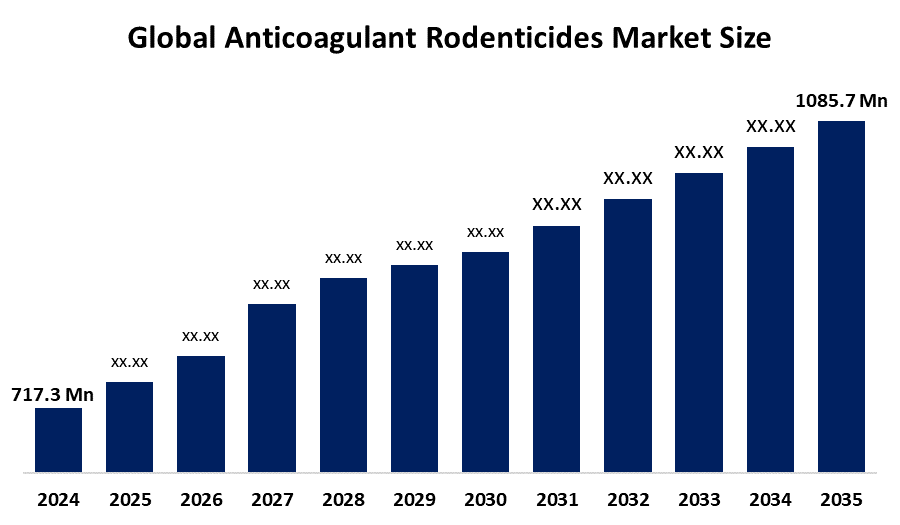

The Global Anticoagulant Rodenticides Market Size was estimated at USD 717.3 Million in 2024 and is projected to Reach USD 1085.7 Million by 2035, growing at a CAGR of 3.84% from 2025 to 2035. The Market for anticoagulant rodenticides is expanding due to the rise in rodent infestations in both urban and rural regions, as well as the practicality and efficiency of these treatments in managing rodent populations.

Key Regional and Segment-Wise Insights

- In 2024, North America held the largest revenue share and dominated the market globally.

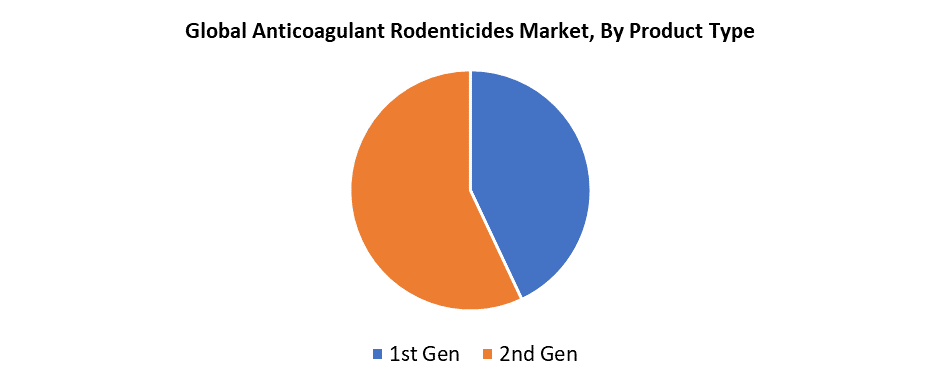

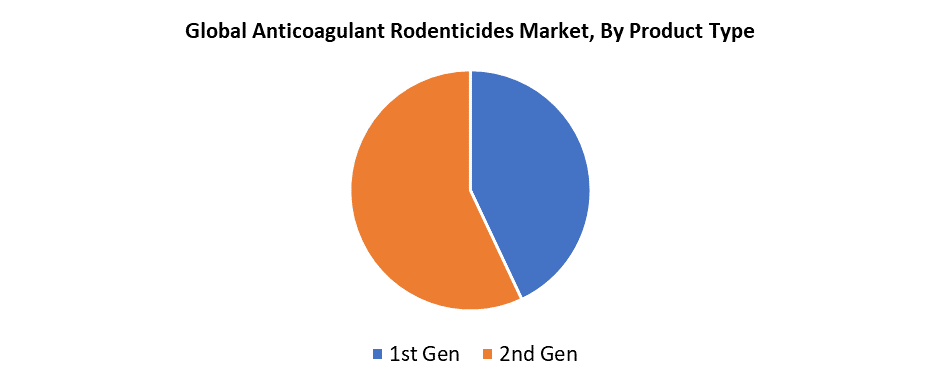

- In 2024, the 2nd Gen segment had the highest market share by product type, accounting for 57.4%.

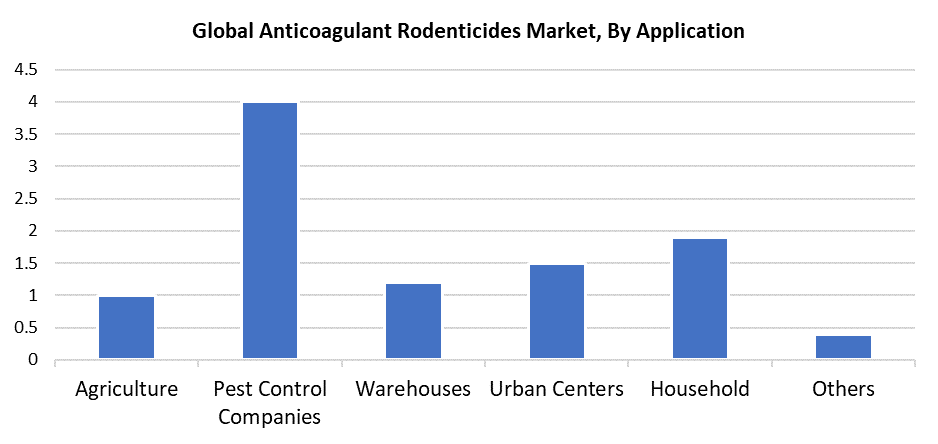

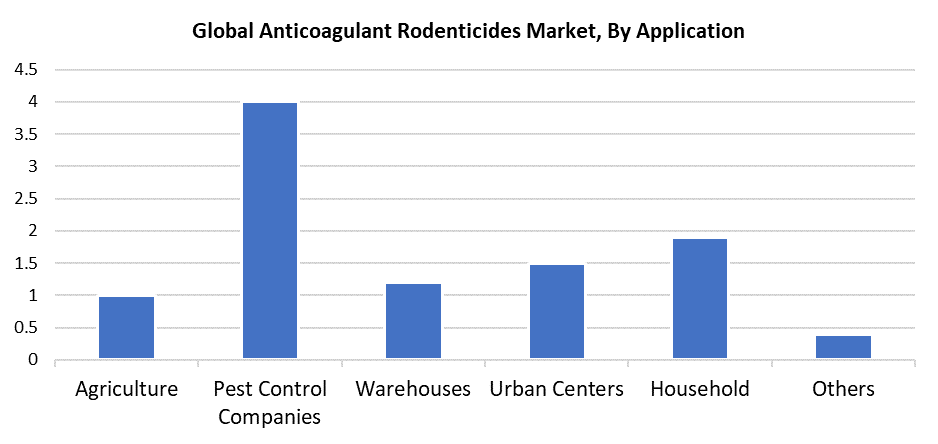

- In 2024, the pest control companies segment had the biggest market share by application.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 717.3 Million

- 2035 Projected Market Size: USD 1085.7 Million

- CAGR (2025-2035): 3.84%

- North America: Largest Market in 2024

The industry that manufactures and markets anticoagulant rodenticides for blood clot prevention in rodents is known as the anticoagulant rodenticides market. The anticoagulant rodenticides market will experience strong growth because of increasing rodent-related disease cases and expanding rodent populations across the globe. Urbanization and poor waste management, together with climate change, have elevated the need for efficient rodent control solutions. The implementation of targeted mitigation strategies by governments and municipalities, including New York City's rat control programs, has driven increased demand for advanced rodenticides. The high effectiveness, along with the slow-acting properties of anticoagulant rodenticides, makes them the preferred choice for use in agricultural and urban areas. Professional pest controllers, along with commercial property managers, use them increasingly since these products enable them to eliminate rodents while keeping rodent populations unaware, facilitating long-term control operations.

The increasing requirement of rodent control measures in agricultural practices to protect food production and crop yields stands as a major factor for the market expansion driver. Farmers are adopting advanced, efficient farming techniques, including chemical rodenticides, because of rising food security concerns, which drives this trend. The development of anticoagulant rodenticides in spray powder and bait block formats with precise active ingredient ratios is a priority for major companies, including BASF, BAYER AG, and Syngenta. The formulas work across various application settings that include both commercial and home-based environments. The current safety and environmental issues about secondary poisoning are being tackled through novel encapsulated formulations and selective targeting techniques. The market maintains consistent growth due to the evolving environment, which features innovation and increasing demand.

Product Type Insights

The second-generation anticoagulant rodenticides (SGARs) segment dominated the market in 2024 by securing 57.4% of the total market share through their efficient single-feed application method. The single-dose anticoagulant category contains rodenticides with powerful active components, including flocoumafen, brodifacoum, difethialone, bromadiolone, and difenacoum. The high enzyme binding properties of SGARs, together with their extended half-life and their organ retention capabilities, including liver accumulation, make them more dangerous than first-generation anticoagulants because they deliver lethal doses through single meals. Non-target species face substantial risks of secondary poisoning because of their enhanced toxicity levels. Environmental concerns have led to increased interest in first-generation anticoagulants, which possess lower toxicity and are predicted to gain higher market share during the forecast period.

The forecast period will witness the fastest CAGR of 2.6% for first-generation anticoagulant rodenticides due to increasing environmental protection concerns and regulatory modifications. The first-generation rodenticides require multiple feedings to achieve effectiveness, while being environmentally friendlier than second-generation rodenticides and having lower toxicity levels. These rodenticides minimize the chance of secondary poisoning to pets, predators, and other non-target species. The growing demand for sustainable rodent control alternatives increases because of stricter rules affecting second-generation products, especially within environmentally sensitive locations. The combination of legislative support alongside rising environmental awareness will drive widespread usage of first-generation anticoagulants.

Applications Insights

In 2024, the pest control companies sector accounted for the largest revenue share in the market due to a rising prevalence of rodents and growing awareness about sanitation and hygiene regulations. The demand for professional pest management has increased in residential, commercial, and agricultural spaces as a result of the increased rodent activity caused by urbanization and climate change. Pest control companies are important partners in rodent mitigation because they provide specialized solutions and prevention. Their expertise in controlled rodenticides and integrated pest management (IPM) practices ensures effective and long-lasting control. Furthermore, the sector's leading position in the rodent control market was further solidified by the reliance on professional services that were cultivated by increasing public health regulations with expectations of consumer sanitation and pest-free homes.

The household category is projected to grow at the fastest CAGR during the forecast period, driven by increasing urbanization and an uptick in rodent presence in living conditions. As urban populations increase, so does the demand for pest control to maintain a hygienic living environment free of rodents. This has led to the use of rodenticides being significantly higher now, especially concerning those that allow for non-professional use of anticoagulant rodenticides that are safer and easier. There have also been recent advancements in rodenticides, including tamper-resistant bait stations and lesser hazardous products that are consumable in a home setting. Additionally, with often-strict pest control regulations relating to residential housing, residents managing pest control in urban environments for rodent populations are being encouraged to manage pest control in a way that is both effective and compliant.

Regional Insights

In 2024, North America held the highest revenue share in the market for anticoagulant rodenticides, partly due to increasing concerns about rat infestations in urban, commercial, and agricultural environments. The high density of rat populations in this area increases the risk of contracting rodent-borne diseases like Hantavirus, leading to increased use of more effective rodent control. The governments of countries such as the United States, Canada, and Mexico have put considerable resources into rodent surveillance and control, predominantly in farms and food storage, to prevent contamination and protect public health. Strong revenue growth in the market is driven by having established manufacturers of rodenticides and, currently, the existence of health and hygiene regulations. Strong regional market growth is still maintained by the growth in urban and nearby warehouses, and pest control demand.

U.S. Anticoagulant Rodenticides Market Trends

The North American market for anticoagulant rodenticides in 2024 received its primary dominance from the United States because of the rising urban population, along with climate change-induced rodent infestation. The growing awareness of public health, together with strict sanitary regulations throughout residential, commercial, and agricultural settings, has driven up the necessity for effective rodent control solutions. The market growth is driven by regulations that mandate using pest control methods that protect both the environment and human health. New rodenticide formulations that enhance performance while lowering environmental impacts include safer bait formulations and enhanced potency levels. All factors support the robust U.S. market expansion while making it the leading anticoagulant rodenticides market in North America.

Asia Pacific Anticoagulant Rodenticides Market Trends

The Asia Pacific anticoagulant rodenticides market will experience significant growth, accounting for a 3.4% CAGR throughout the forecasted period, because of the agricultural output protection needs in this area. The pest problem gets worse because of extreme weather conditions such as floods and cyclones, and severe rains that provide ideal conditions for the rodent population to grow. The availability of agricultural field food creates the perfect conditions for rats to reproduce rapidly, which leads to population growth. The increase in rodent populations creates a higher demand for effective anticoagulant rodenticides because these factors require protection for crops and financial loss reduction. The market development in this region receives additional support through improved pest control education and enhanced regulations across China, India, and Southeast Asian countries.

Key Anticoagulant Rodenticides Companies:

The following are the leading companies in the anticoagulant rodenticides market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Heranba Industries Ltd.

- Syngenta

- UPL

- Rentokil Initial plc

- Bell Labs

- Kalyani Industries Limited

- PelGar International

- NEOGEN Corporation

- Bayer AG

- Liphatech, Inc.

- Others

Recent Developments

- In October 2024, BASF introduced an upgraded version of its Neosorexa Plus Blocks following the relaunch of its popular rodenticide Neosorexa. The powerful anticoagulant flocoumafen product enables farmers to control rodents effectively even when other anticoagulants fail. The improved palatability, combined with the extended longevity of the new formulation, delivers exceptional effectiveness even in challenging conditions. The product delivers results within two weeks.

- In October 2023, Syngenta launched its innovative SecureChoice remote rodent monitoring system throughout the United Kingdom. The monitoring system tracks rodent activity continuously throughout the day to alert pest control specialists to an immediate response. The system exists to enhance pest management efficiency through productivity growth, together with reduced personnel expenses and improved understanding of rodent patterns.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the anticoagulant rodenticides market based on the below-mentioned segments:

Global Anticoagulant Rodenticides Market, By Product Type

Global Anticoagulant Rodenticides Market, By Application

- Agriculture

- Pest Control Companies

- Warehouses

- Urban Centers

- Household

- Others

Global Anticoagulant Rodenticides Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa