E-Bus Sales in India April 2025: Market Share, Growth Trends & Key Players:

Introduction

In 2025, India's electric bus (e-bus) Market is Expected to Grow significantly, indicating a radical change in the nation's public transportation system. Monthly sales data provide a clear picture of a market that is dynamic and changing rapidly, making it evident that electric mobility is now a reality rather than a pipe dream. E-bus adoption is booming in many states and urban areas due to strong government initiatives, growing environmental consciousness, and the demand for more affordable and eco-friendly urban transportation options. Mass procurement by state transport undertakings (STUs) is being encouraged by a robust legislative push, especially through programs like FAME II and the recently introduced PM e-Bus Sewa initiative. Meanwhile, the need for environmentally friendly alternatives to diesel-powered buses is being driven by increasing urbanization and traffic congestion in India's largest cities.

India Bus Market Statistics

- The India Electric Vehicle Market Size was valued at USD 51.89 Billion in 2024.

- The Market Size is Growing at a CAGR of 12.72%. from 2024 to 2035.

- The Market size is Expected to Reach USD USD 193.61 Billion by 2035.

Get The Free Sample Of This Report

India's E-Bus Market Gears Up for 3.6X Growth by FY27

The market for electric buses in India is rapidly changing; sales are expected to increase 3.6 times by FY27, from 3,644 units in FY24 to an anticipated 17,000 units. This dramatic increase reflects the nation's growing focus on environmentally friendly urban transportation, supported by strong governmental backing and rapid technological advancements. It is anticipated that the execution of initiatives like the PM e-Bus Sewa scheme, which intends to distribute 10,000 e-buses among cities with populations exceeding 300,000, will significantly enhance market penetration. Furthermore, electric buses are becoming increasingly cost-competitive compared to their diesel counterparts due to falling battery prices, improved vehicle range, and expanding charging infrastructure.

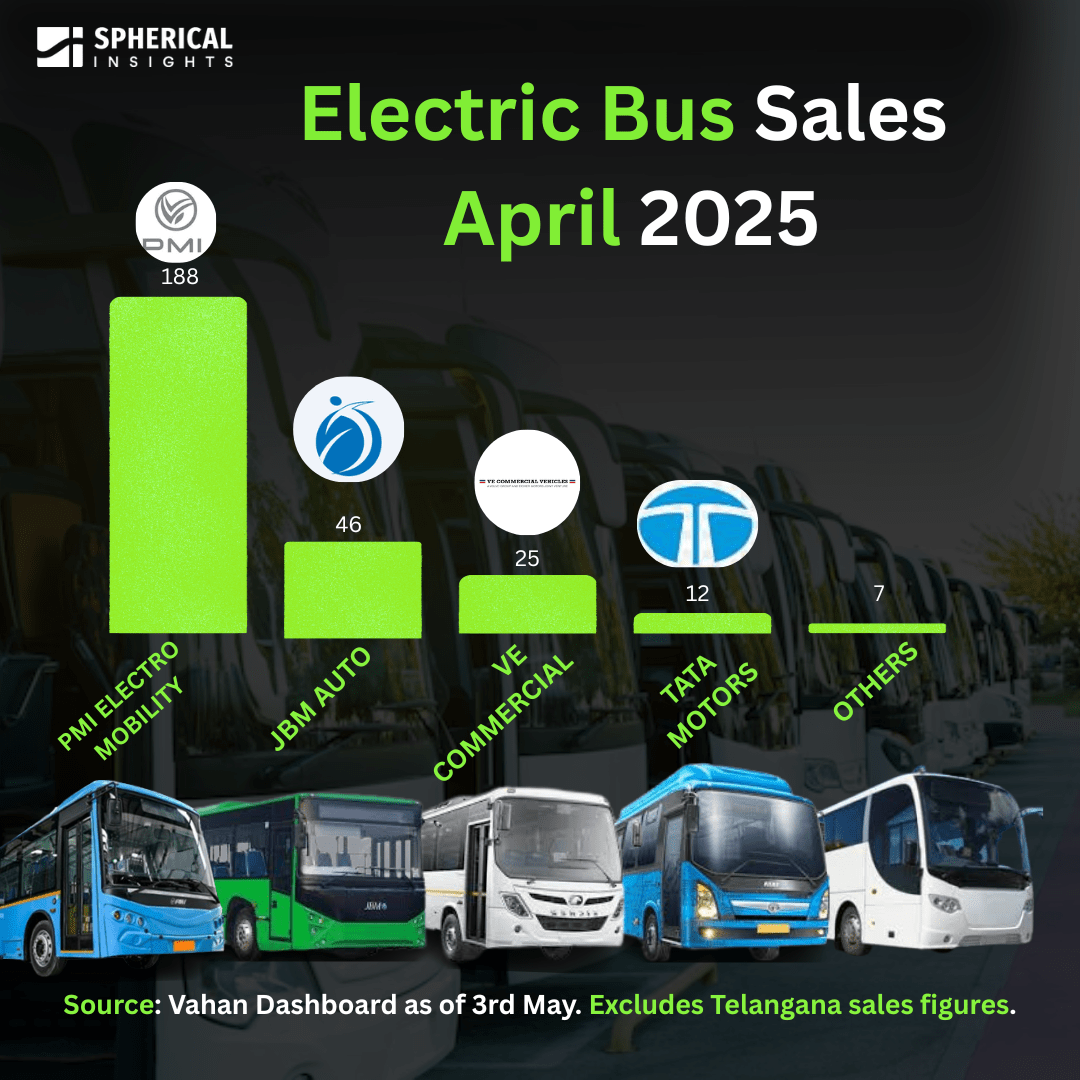

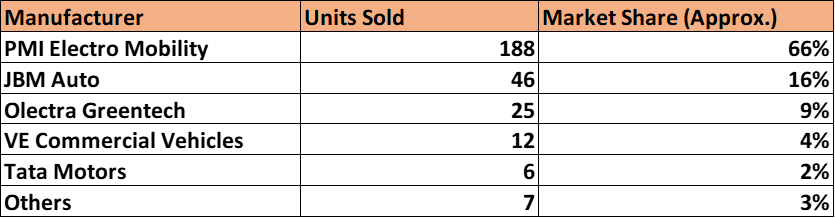

2025 Sales Snapshot: Who’s Leading the Pack?

In April 2025, India recorded a total of 284 electric bus sales. The competitive landscape revealed by this data shows clear winners:

Top Companies in E-Bus Sales in India

1. PMI Electro Mobility

In April 2025, PMI Electro Mobility achieved a noteworthy sales milestone, further solidifying its leadership position in the Indian electric bus sector. The company sold 188 e-buses in April, marking a remarkable month-over-month increase of 163 buses compared to just 25 units in March 2025. This dramatic increase highlights PMI's ambitious expansion plan and its capacity to scale operations effectively while satisfying demand. With this result, PMI secured a dominant 66.2% of the market, reinforcing its position as the leader in India's rapidly developing electric bus industry. Sales have surged, largely due to punctual delivery commitments, strong alliances with local transport agencies, and successful procurement wins under the PM e-Bus Sewa scheme. Offering a diverse range of products, from low-floor AC models to standard city buses, PMI has successfully addressed various urban mobility needs across different states. Furthermore, by emphasizing localized manufacturing and reliable after-sales support, the company has built trust with state transport undertakings (STUs).

2. JBM Auto

JBM Auto maintained its dominant position in the Indian electric bus industry in April 2025, selling 46 units and earning a good 16% monthly market share. Despite not being on the same scale as PMI Electro Mobility, JBM's steady presence highlights its significance in the nation's electrification campaign. The company's performance shows consistent demand for its complete, high-quality e-mobility solutions, which comprise battery technology, charging infrastructure, and electric buses. JBM Auto has been able to obtain orders from numerous state and local transportation authority’s due to its strategic focus on providing end-to-end electric mobility solutions. In metro areas and new Tier-1 cities, its buses, which are renowned for their cutting-edge design, energy efficiency, and intelligent features, are especially preferred for intra-city operations. Furthermore, JBM's fleet is a favored option for dependable, hygienic public transportation due to its emphasis on safety, cutting-edge telemetry, and operational uptime.

3. Olectra Greentech

One of the first companies in India's electric bus market, Olectra Greentech, saw a sharp decline in monthly sales, selling 25 units in April 2025 compared to 76 units in March 2025. Given that the company's market share decreased to 9% for the month, this reduction marks a serious short-term setback. The decline in numbers may be due to delayed conversion of continuing orders into dispatches, seasonal delivery gaps, or delays in project execution. Despite this, Olectra is still a powerful brand in the industry due to its solid manufacturing skills and long-standing alliances with other state transportation projects. Optra, which is well-known for its technological partnerships and wide range of products, including city and intercity electric buses, maintains a key place in India's larger electric mobility market. Its sustained existence and effective implementation in several states attest to the brand's dependability and clientele's confidence.

4. VE Commercial Vehicles (VECV)

VE Commercial Vehicles (VECV) sold 12 units in April 2025, gaining a 4% market share for the month. This was a modest but calculated start to your electric bus business. VECV's arrival as a new player in the e-bus market represents a significant shift in the sector, demonstrating how established commercial vehicle behemoths are starting to shift their focus to environmentally friendly mobility options. The company intends to assess product-market fit across certain geographies and progressively build up operations, despite the initial quantities appearing low. With decades of expertise in diesel and commercial mobility solutions, VECV offers strong engineering, a well-established production base, and a reputable name as a brand. It is anticipated that its initial e-bus solutions will prioritize operational viability, cost effectiveness, and durability—elements that are crucial for fleet operators and public transportation agencies.

5. Tata Motors

In April 2025, Tata Motors, a longstanding leader in the Indian automobile industry, reported selling six electric buses, giving them a 2% monthly market share. Given its past dominance in diesel and CNG commercial vehicles, the number may seem low, but Tata's move into the electric bus market is part of a larger strategic shift towards clean mobility. Although it is still in the early stages of deployment, the business's e-bus portfolio is anticipated to gain popularity as public transportation agencies increase their green fleets. The company has already shown its EV capabilities in the passenger car category. The strength of Tata Motors is its extensive dealer network, in-depth knowledge of the market, and established ties with state transport companies.

About the Spherical Insights & Consulting

Spherical Insights & Consulting is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

Which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

CONTACT US:

For More Information on Your Target Market, Please Contact Us Below:

Phone: +1 303 800 4326 (the U.S.)

Phone: +91 90289 24100 (APAC)

Email: inquiry@sphericalinsights.com, sales@sphericalinsights.com

Contact Us: https://www.sphericalinsights.com/contact-us

Follow Us: LinkedIn | Facebook | Twitter