Global Electric Bus Market Size, Share, and COVID-19 Impact Analysis, By Type (BEV, FCEV and PHEV), By Battery Capacity (Below 100 kWh, 100 - 300 kWh and Above 300 kWh), By Seating Capacity (Below 40 Seats, 40 - 70 Seats and Above 70 Seats), By Application (Intracity and Intercity), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2025 - 2035

Industry: Automotive & TransportationGlobal Electric Bus Market Insights Forecasts to 2035

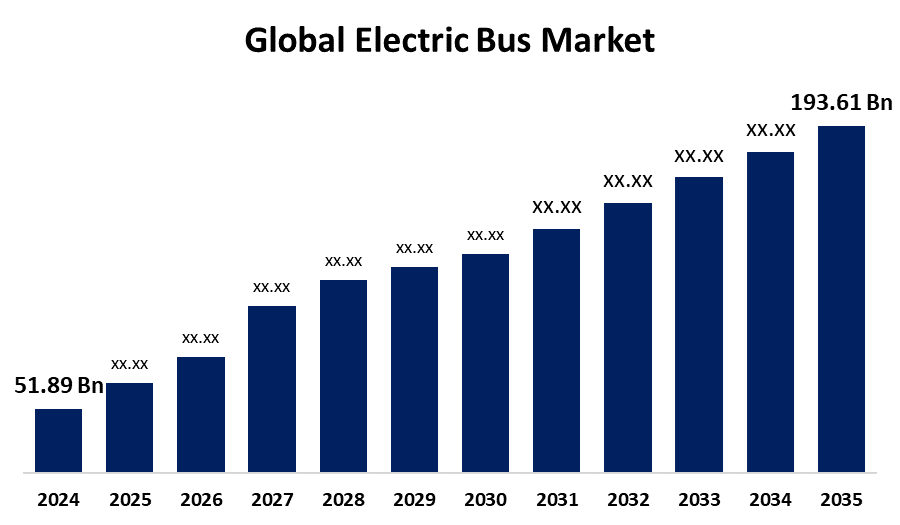

- The Global Electric Bus Market Size Was Estimated at USD 51.89 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.72% from 2025 to 2035

- The Worldwide Electric Bus Market Size is Expected to Reach USD 193.61 Billion by 2035

- Europe is Expected to Grow the fastest during the forecast period.

Get more details on this report -

The Global Electric Bus Market size was worth around USD 51.89 Billion in 2024 and is predicted to Grow to around USD 193.61 Billion by 2035 with a compound annual growth rate (CAGR) of 12.72% from 2025 to 2035. The environmental concerns, government incentives, the need for stricter emissions standards, urbanization, advances in technology, reduced operating expenses, increasing fuel prices, awareness of public health, and increased investment in smart city infrastructure and green public transportation solutions are estimated to drive the electric bus market during the forecast period.

Market Overview

The electric bus industry is the worldwide market dealing with the development, manufacturing, and deployment of buses using electricity as power instead of internal combustion engines. The electric bus industry seeks to substitute conventional diesel-run buses with cleaner alternatives that emit less greenhouse gas and air pollutants in urban areas. Electric buses are viewed as eco-friendly options to the increasing rate of pollution because not only are the buses green-friendly but have also been established as cost-effective, particularly during these unprecedented times of the time with disruptions in the fuel supply chain. Additionally, some electric bus producers are producing electric buses to achieve a competitive advantage globally, which subsequently propels the market's growth.

For instance, in February 2024, Urban Sphere launched its Ivoryline 9m electric bus range at the SIAT Expo 2024 in Pune. Built with 70% local content, the bus is equipped with a 193.1 kWh LFP battery and 180 kWh motor and has a 300 km range and 45-minute fast charging. The company entered into MOUs to deliver 500 units to Kenya and more than 50,000 units to the Philippines within the next decade. Urban Sphere looks to make India a worldwide center for environmentally friendly transport solutions.

In Addition, India's cabinet has approved a scheme to spend 109 billion rupees ($1.3 billion) on incentives for the adoption of electric vehicles in its efforts to curb pollution and move towards cleaner fuels. Additionally, the PM-eBus Sewa project aims to deploy over 38,000 electric buses by 2029.

Government initiatives worldwide are accelerating the adoption of electric buses. In the European Union, nearly half of new bus registrations in 2024 were zero-emission models, with countries like the Netherlands, Finland, and Iceland achieving 100% battery-electric city bus sales. California has invested over $1.3 billion to fund more than 2,300 electric school buses, aiming for a zero-emission fleet by 2035. Thailand offers tax incentives for companies transitioning to electric buses, aiming to convert 30% of its annual vehicle production to EVs by 2030. These factors are expected to boost the electric bus market during the forecast period.

Report Coverage

This research report categorizes the electric bus market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the electric bus market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the electric bus market.

Global Electric Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 51.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.72% |

| 2035 Value Projection: | USD 193.61 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 239 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Type, By Battery Capacity, By Seating Capacity, By Application, By Region and COVID-19 Impact Analysis. |

| Companies covered:: | BYD Company Limited, AB Volvo, Proterra, MAN, Nissan Motor Corporation, Ashok Leyland Limited, Daimler Truck AG, Zhengzhou Yutong Bus Co., Ltd., TATA Motors Limited, Hyundai Motor Company, and other key vendors. |

| Growth Drivers: | Increased Demand For Fuel-Efficient, High-Performance, Low-Emission Buses is The Primary Factor Driving The Worldwide Electric Bus Market. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Electric buses have zero tailpipe emissions, and as such, are a central solution to curbing air pollution and carbon emissions in cities. With cities and nations concentrating on meeting climate objectives, electric buses form an integral part of their strategy to address air pollution and the global climate crisis. Further, improvements in battery technology have improved the range, efficiency of electric buses with energy, and costs. Batteries are getting smaller, stronger, and faster to charge, making electric buses more convenient and affordable to use on long-distance urban and suburban lines. Better battery life further lowers replacement and maintenance costs, leading to demand for the electric bus market.

Restraining Factors

Electric buses will normally be more expensive upfront than traditional diesel buses, mainly because of costly battery technology. Although operational savings can offset this over time, the initial cost is still a main impediment, particularly for cities or nations with low budgets for upgrades to their public transit systems. Additionally, while range has increased through development in battery technology, electric buses are still constrained by battery capacity. On more extensive routes, range anxiety is an issue, and buses with enough range are pricier. The necessity for constant recharging during long operations also makes mass deployment of electric buses problematic.

Market Segmentation

The electric bus market share is classified into type, battery capacity, seating type, and application.

- The battery electric vehicle segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period.

Based on the type, the electric bus market is divided into BEV, FCEV, and PHEV. Among these, the battery electric vehicle segment dominated the market in 2024 and is projected to grow at a substantial CAGR during the forecast period. The growth is driven by BEVs have fewer mechanical parts than hybrid or diesel buses, resulting in fewer maintenance requirements and expenses. Electricity is normally less expensive than fossil fuels, reducing the cost of fuel. These savings in the long run make BEVs cheaper for transit authorities, which helps to propel their use in transit schemes across urban transport networks.

- The 100-300 kWh segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the battery capacity, the electric bus market is divided into below 100 kWh, 100 - 300 kWh, and above 300 kWh. Among these, the 100-300 kWh segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. The growth is attributed to this battery range provides the best balance between performance and cost. Smaller ones restrict range, and larger ones add massive weight and expense to vehicles. The 100–300 kWh range delivers enough energy without ballooning costs, which makes it the most financially prudent option for transit agencies with performance and budget limitations.

- The below 40 seats segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

Based on the seating type, the electric bus market is divided into below 40 seats, 40 - 70 seats, and above 70 seats. Among these, the below 40 seats segment accounted for the largest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The segmental growth is due to below 40 seats capacity equates to common urban commuter frequencies, having ample space without being under- or over-capacity. This capacity guarantees maximum passenger flow on city routes, allowing transit agencies to provide efficient service without operating unnecessarily large or underused buses for off-peak hours.

- The intracity segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period.

Based on the application, the electric bus market is divided into intracity and intercity. Among these, the intracity segment accounted for a significant share in 2024 and is anticipated to grow at the fastest CAGR during the forecast period. The growth is attributed to intracity buses have conventionally used short, predetermined routes with multiple stops, which best fit the existing electric bus battery range capabilities. These fixed routes minimize the potential for range anxiety and facilitate easy charging schedule planning, providing uninterrupted and effective service during the day.

Regional Segment Analysis of the Electric Bus Market

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, U.K., Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Rest of APAC)

- South America (Brazil and the Rest of South America)

- The Middle East and Africa (UAE, South Africa, Rest of MEA)

Asia Pacific is anticipated to hold the largest share of the electric bus market over the predicted timeframe.

Get more details on this report -

Asia Pacific is anticipated to hold the largest share of the electric bus market over the predicted timeframe. China leads the world in electric bus adoption, with more than 60% of production. China's leadership is a result of robust government subsidies, heavy infrastructure investment, and strict emissions regulations. Cities such as Shenzhen have entirely electrified fleets, setting a precedent globally and anchoring Asia Pacific's leading position in the market. APAC governments, particularly in India and China, actively promote electric buses via subsidies, tax concessions, and special policies. Initiatives such as China's New Energy Vehicle (NEV) policy and India's FAME initiatives reduce the cost of adoption, enhancing the viability of EVs for transit agencies and aiding the region in leading electric bus sales globally.

Europe is expected to grow at a rapid CAGR in the electric bus market during the forecast period. The European Union has some of the world's most stringent car and truck emission standards. Cities are replacing diesel buses and requiring zero-emission fleets in response to carbon neutrality targets, propelling fast electric bus uptake and making Europe the market's fastest-growing region. Europe is home to leading-edge electric bus manufacturers such as Volvo, VDL, and Solaris. They lead the innovation in battery performance and fleet management, enabling municipalities to roll out smart, scalable electric transit systems. This technology advantage helps fuel Europe's fast growth in the electric bus market.

North America is predicted to hold a significant share of the electric bus market throughout the estimated period. North America is home to cutting-edge electric bus producers like Proterra, New Flyer, and Lion Electric. They lead the charge in designing high-performing electric buses and charging technology. Their innovations enable fleet scalability and reliability, local manufacturing providing quicker deployment and economic advantages to North America's significant market share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the electric bus market, along with a comparative evaluation primarily based on their type of offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes type development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BYD Company Limited

- AB Volvo

- Proterra

- MAN

- Nissan Motor Corporation

- Ashok Leyland Limited

- Daimler Truck AG

- Zhengzhou Yutong Bus Co., Ltd.

- TATA Motors Limited

- Hyundai Motor Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2025, Olectra Greentech placed an order of 2,325 electric bus chassis from BYD using the Blade battery with higher safety and performance. This partnership is in favor of electric bus deployment in several Indian cities.

- In January 2025, at the Bharat Mobility Global Expo 2025, JBM Auto introduced four new electric buses: Galaxy luxury coach, Xpress intercity bus, e-MediLife medical mobile unit, and e-SkyLife tarmac coach. The buses have modular battery packs and ultra-fast charging.

- In January 2025, EKA Mobility launched India's widest range of electric commercial vehicles, such as the EKA 12M urban transit bus, EKA 9M mid-size commuter bus, and EKA 7M compact electric feeder bus. These buses will offer eco-friendly transport solutions to different industries.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the electric bus market based on the below-mentioned segments:

Global Electric Bus Market, By Type

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Electric Vehicle (PHEV)

- Fuel Cell Electric Vehicle (FCEV)

Global Electric Bus Market, By Battery Capacity

- Below 100 kWh

- 100 - 300 kWh

- Above 300 kWh

Global Electric Bus Market, By Seating Capacity

- Below 40 Seats

- 40 - 70 Seats

- Above 70 Seats

Global Electric Bus Market, By Application

- Intracity

- Intercity

Global Electric Bus Market, By Regional Analysis

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa

Frequently Asked Questions (FAQ)

-

1. What is the CAGR of the electric bus market over the forecast period?The Global Electric Bus Market Size is projected to expand at a CAGR of 12.72% during the forecast period.

-

2. What is the market size of the electric bus market?The Global Electric Bus Market Size is expected to grow from USD 51.89 Billion in 2024 to USD 193.61 Billion by 2035, at a CAGR of 12.72% during the forecast period 2025-2035.

-

3. Which region holds the largest share of the electric bus market?Asia Pacific is anticipated to hold the largest share of the electric bus market over the predicted timeframe.

Need help to buy this report?