India Electric Vehicle Market Size, Share, and COVID-19 Impact Analysis, By Product (BEV {Battery Electric Vehicle}, and HEV {Hybrid Electric Vehicle}), By Vehicle Type (Passenger Cars and Commercial Vehicles), By Platform (Two Wheeler, Three Wheeler, & Four Wheeler), and India Electric Vehicle Market Insights, Industry Trend, Forecasts to 2032

Industry: Automotive & TransportationIndia Electric Vehicle Market Insights Forecasts to 2032

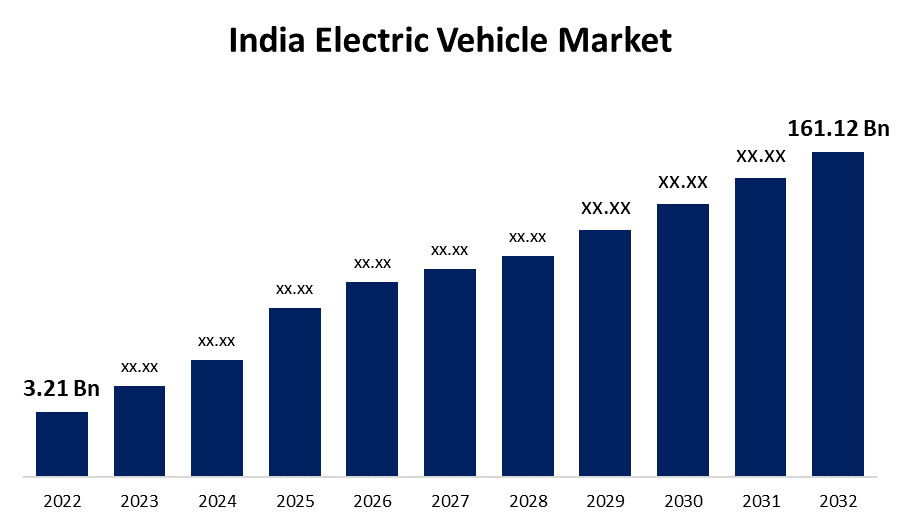

- The India Electric Vehicle Market Size was valued at USD 3.21 Billion in 2022.

- The Market Size is Growing at a CAGR of 47.9% from 2022 to 2032

- The Market size is expected to reach USD 161.12 Billion by 2032.

Get more details on this report -

The India Electric Vehicle Market Size is expected to reach USD 161.12 Billion by 2032, at a CAGR of 47.9% during the forecast period 2022 to 2032.

Market Overview

The market is witnessing an increase in the demand for and adoption of electric micro-mobility vehicles such as electric two-wheelers and electric three-wheelers. Due to rapidly increasing traffic congestion, the Indian market is particularly price-sensitive, and the bulk of the Indian people favor two-wheelers for daily transportation. As a result, the cheap cost of electric two-wheelers and three-wheelers in India compared to four-wheelers, together with two-wheelers' high appropriateness to Indian road traffic circumstances, is expected to enhance the adoption of electric two-wheelers and three-wheelers throughout the projection period.

Report Coverage

This research report categorizes the market of India electric vehicle market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the India electric vehicle market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the India electric vehicle market.

India Electric Vehicle Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 3.21 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 47.9% |

| 2032 Value Projection: | USD 161.12 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Vehicle Type, By Platform |

| Companies covered:: | BMW Group, Daimler AG, Toyota, Volkswagen, Renault Group, Ford Motor Company, Mahindra & Mahindra, TATA motors, Hyundai, MG Motors, and Ola Electric |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Rising gasoline prices in India are one of the primary factors expected to promote demand for electric vehicles in the area. Vehicles fueled by fossil fuels are less expensive to buy than EVs. Their running costs, however, are considerable because of rising fuel and diesel prices. In comparison, the operational costs of electric cars are much lower than those of fossil-fuel-powered automobiles. As a result, shifting consumer preferences toward electric cars in reaction to rising fossil fuel prices are expected to boost market growth throughout the forecast period. Furthermore, the government's focus on combating climate change by strengthening pollution control standards and implementing scrapping plans for conventional cars is expected to fuel market development in the next years. Also, because the Indian automobile industry is price-sensitive, a continual decrease in the cost of lithium-ion batteries has a beneficial impact on market growth. Battery cost decrease is a critical driver for EV adoption, as it lowers the total cost of operation (TCO) parity and the high upfront prices of EVs in India. Battery costs have dropped by roughly 85% in the previous decade, resulting in greater EV adoption across all vehicle categories.

Restraining Factors

Electric car penetration in India remains modest when compared to other countries. Consumer awareness in the region is likewise extremely low. As a result, several fires in the electric two-wheelers of key players such as Ola Electric, Pure EV, and Okinawa have raised concerns about the safety of operating these vehicles. The Indian government also analyzed the EV models from these prominent brands to determine the fundamental reason and people responsible for these safety flaws. Following that, several companies recalled their EV vehicles to avert additional fire hazards.

Market Segment

- In 2022, the BEV {battery electric vehicle} segment is influencing the largest CAGR over the forecast period.

Based on the product, the India electric vehicle market is segmented into BEV {battery electric vehicle}, and HEV {Hybrid Electric Vehicle}. Among these segments, the BEV {battery electric vehicle} segment dominates the largest market share over the forecast period due to BEVs, or battery electric vehicles, being electric cars with rechargeable batteries and no traditional gasoline engine. The battery pack, which is recharged from the grid, provides all of the energy used to move the vehicle. Electricity stored in a battery pack is used to power an electric motor and rotate the wheels in BEVs. When the batteries run low, they are refilled with grid energy via a specific charging device or wall outlet.

- In 2022, the passenger cars segment is dominating the largest market share during the forecast period.

On the basis of vehicle type, the India electric vehicle market is segmented into passenger cars and commercial vehicles. Among these segments, the passenger cars segment dominates the largest market share during the forecast period due to the variety of alternatives, comfort, and luxury available, they produce clean emissions. Considering the rising trend of purchasing passenger EVS, commercial vehicles will also see a significant increase during the forecast period. For example, Tata Motors, India's top automobile manufacturer, has partnered with the State Bank of India to deliver (e-DFS) Electronic Dealer Finance solutions to its approved passenger EV dealers in August 2022. This agreement would go a long way toward encouraging EV culture and EV adoption in India. It will be included in the nation's national electric mobility mission plan.

In 2022, the four wheeler segment is influencing the largest CAGR during the forecast period.

Based on the platform, the India electric vehicle market is segmented into two wheeler, three wheeler, & four wheeler. Among these segments, the four wheeler segment dominates the largest market share over the forecast period. When compared to (IC) Internal Combustion engines, city commuters find it more cost-effective. Four-wheelers have more battery space than two-wheelers, resulting in a longer range on a single charge. This gives the section a competitive advantage over the other two parts.

Two-wheelers dominate four-wheelers and are the fastest-growing sector. In India, two-wheelers are widely employed for transportation. Furthermore, increased traffic congestion on Indian highways is driving the population to adopt micro-mobility for daily commutes and transit. Furthermore, rising gasoline prices, as well as increased knowledge and availability of electric two-wheelers, are expected to accelerate the penetration of electric two-wheelers in the Indian market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the India electric vehicle market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market. Also, due to their capacity to deliver a one-stop purchasing experience, consumers favor store-based channels.

List of Key Companies

- BMW Group

- Daimler AG

- Toyota

- Volkswagen

- Renault Group

- Ford Motor Company

- Mahindra & Mahindra

- TATA motors

- Hyundai

- MG Motors

- Ola Electric

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, Hero Electric inked a strategic agreement with Mahindra Group. Under this agreement, Mahindra will manufacture two of Hero Electric's most popular electric scooters, the Optima and NYX, at its Pithampur factory in Madhya Pradesh. For many years, the Mahindra Group has pioneered electric three- and four-wheelers, while also pushing the transition to EV throughout the consumer and B2B segments.

- In January 2022, Bajaj Auto announced the opening of a new EV production line in India, with a total capacity of 5 lakh EVs per year. The new Bajaj Chetak EV will be manufactured with locally sourced components to avoid reliance on foreign parts. In comparison to the present Chetak, the new Chetak might be released at a lower price.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2022 to 2032. Spherical Insights has segmented the India Electric Vehicle Market based on the below-mentioned segments:

India Electric Vehicle Market, By Product

- BEV {Battery Electric Vehicle}

- HEV {Hybrid Electric Vehicle}

India Electric Vehicle Market, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

India Electric Vehicle Market, By Platform

- Two Wheeler

- Three Wheeler

- Four Wheeler

Need help to buy this report?