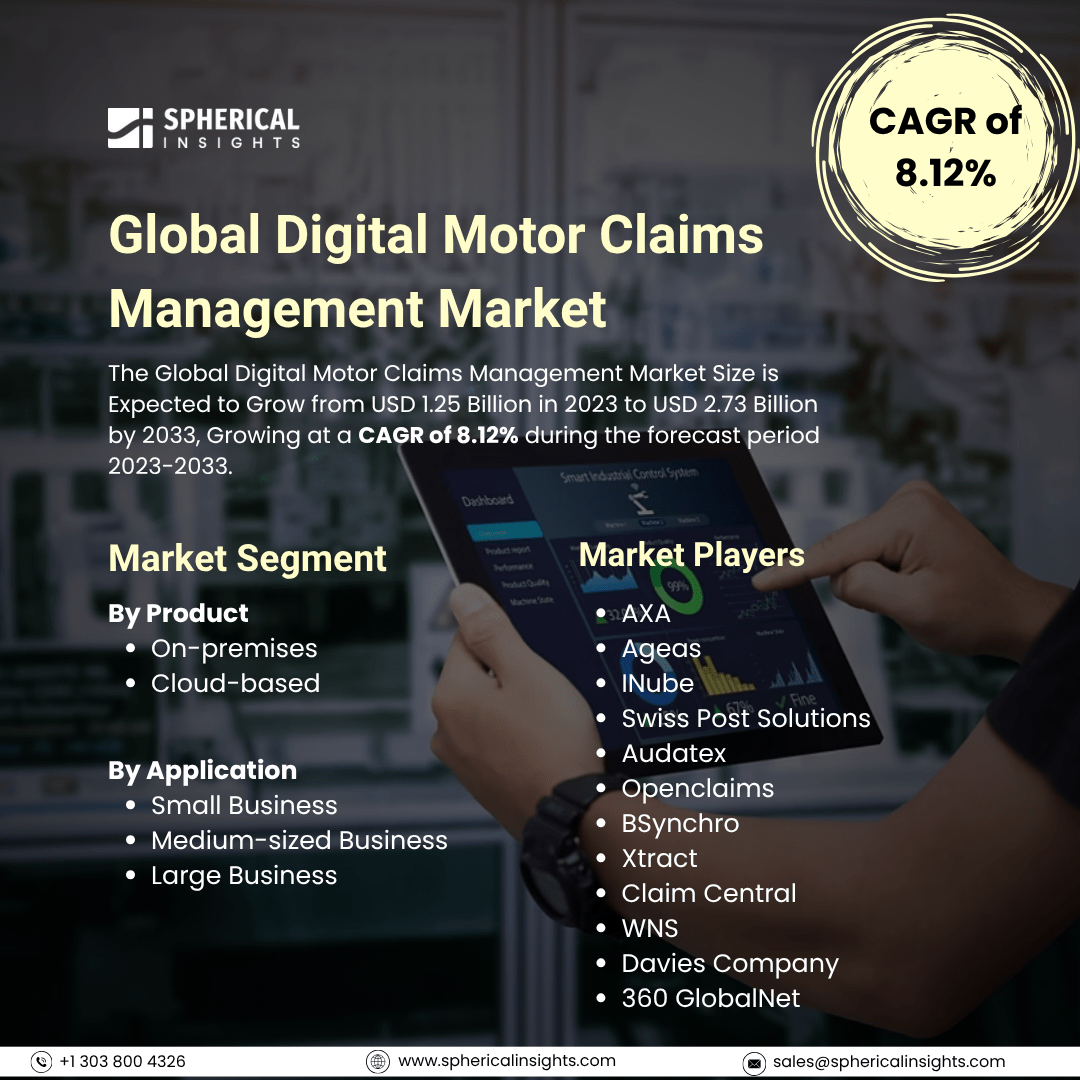

Global Digital Motor Claims Management Market Size To Exceed USD 2.73 Billion By 2033

According to a research report published by Spherical Insights & Consulting, The Global Digital Motor Claims Management Market Size is Expected to Grow from USD 1.25 Billion in 2023 to USD 2.73 Billion by 2033, Growing at a CAGR of 8.12% during the forecast period 2023-2033.

Browse 210 market data Tables and 45 Figures spread through 190 Pages and in-depth TOC on the Global Digital Motor Claims Management Market Size, Share, and COVID-19 Impact Analysis, By Product (On-premises and Cloud-based), By Application (Small Business, Medium-sized Business, and Large Business), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033

The worldwide digital motor claims management market is described as the business that focuses on the insurance industry and leverages digital technologies to streamline the process of managing and settling motor automotive claims. This market includes solutions such as claims processing software, fraud detection tools, and automation systems that enhance efficiency, accuracy, and transparency for insurers and policyholders. The market growth is influenced by increasing insurance claims worldwide. Moreover, digital technologies are being increasingly invested in by insurance companies to reduce expenses, boost efficiency, and enhance the general customer experience, which boosts the market growth. Moreover, the market for digital motor claims management is booming, especially as demand for individualized insurance products increases. However, the market expansion is hampered due to high upfront costs and the possibility of a database breach.

The cloud-based segment dominated the global digital motor claims management market in 2023 and is anticipated to grow at a significant CAGR over the forecast period.

On the basis of the product, the global digital motor claims management market is differentiated into on-premises and cloud-based. Among these, the cloud-based segment dominated the global digital motor claims management market in 2023 and is anticipated to grow at a significant CAGR over the forecast period. This is due to their scalability, affordability, and quick deployment, along with adaptability have changed the financial sector.

The large businesses segment held the largest share of the global digital motor claims management market in 2023 and is predicted to grow at a substantial CAGR over the forecast period.

On the basis of the application, the global digital motor claims management market is classified into small businesses, medium-sized businesses, and large businesses. Among these, the large businesses segment held the largest share of the global digital motor claims management market in 2023 and is predicted to grow at a substantial CAGR over the forecast period. This segment growth is driven by their significant investments in such solutions for monitoring or surveillance.

Asia Pacific is anticipated to hold the largest share of the global digital motor claims management market over the forecast period.

Asia Pacific is expected to hold the greatest share of the global digital motor claims management market over the forecast period. The regional market growth is driven by the number of motor vehicles has increased due to rapid industrialization, urbanization, and a growing middle class, which has raised insurance claims. Insurance firms in the area are implementing digital solutions to expedite their claims-handling procedures to overcome these obstacles.

Europe is projected to grow at the fastest CAGR of the global digital motor claims management market over the forecast period. The market growth throughout the region is further accelerated due to a stringent regulatory environment and the requirement for effective claims processing. Further driving the market expansion in Europe are the growing number of automobile industry and the growing emphasis on customer satisfaction related to vehicle safety and maintenance.

Company Profiling

Major vendors in the global digital motor claims management market are AXA, Ageas, INube, Swiss Post Solutions, Audatex, Openclaims, BSynchro, Xtract, Claim Central, WNS, Davies Company, 360 GlobalNet, Network Insurance Group, and others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global digital motor claims management market based on the below-mentioned segments:

Global Digital Motor Claims Management Market, By Product

Global Digital Motor Claims Management Market, By Application

- Small Business

- Medium-sized Business

- Large Business

Global Digital Motor Claims Management Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa