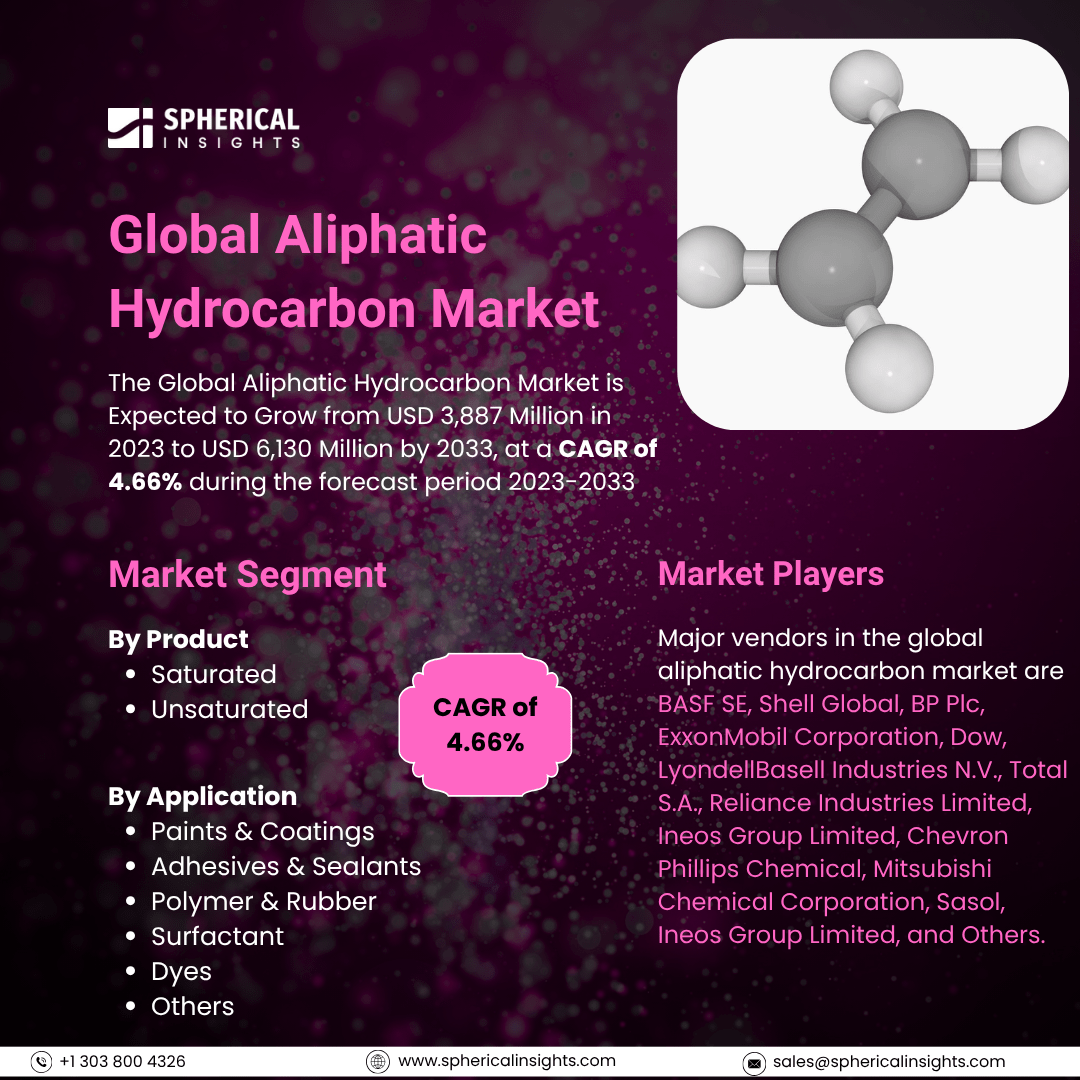

Global Aliphatic Hydrocarbon Market Size To Exceed USD 6,130 Million by 2033

According to a research report published by Spherical Insights & Consulting, The Global Aliphatic Hydrocarbon Market Size is Expected to Grow from USD 3,887 Million in 2023 to USD 6,130 Million by 2033, at a CAGR of 4.66% during the forecast period 2023-2033.

Browse 210 Market Data Tables and 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global Aliphatic Hydrocarbon Market Size, Share, and COVID-19 Impact Analysis, By Product (Saturated and Unsaturated), By Application (Paints & Coatings, Adhesives & Sealants, Polymer & Rubber, Surfactant, Dyes, and Others), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

The aliphatic hydrocarbon market refers to the global demand for organic compounds made up of hydrogen and carbon atoms in straight or branched chains, or non-aromatic rings, to be utilized in different industrial and commercial uses. The aliphatic hydrocarbon is defined as a series of organic substances, that is hydrocarbons, wherein a structure involving chains (or branches) or rings of hydrogen and carbon atoms is present but no aromatic (benzene-like) ring exists. Aliphatic hydrocarbons make up a large percentage of crude oil. These compounds have linear or branched open-chain structures, which include n-alkanes, isoalkanes, cycloalkanes (naphthenes), terpenes, and steranes. Aliphatic hydrocarbons may either be saturated or unsaturated with double carbon bonds. Furthermore, the growth is due to the rising demand for the product in various applications such as paints & coatings, aerosol, oil & gas, adhesive & sealants, mining, and water treatment. The demand for aliphatic hydrocarbon globally has risen over the past few years due to higher global automobile production and sales. The product is mainly applied in huge volumes to produce lubricants and solvents in the automotive sector. However, raising the emphasis on sustainability and renewable energy sources is pushing the demand away from fossil fuels, which is harming the product market.

The saturated segment dominated the largest share in 2023 and is anticipated to grow at a CAGR of 55.72% during the forecast period.

Based on the product, the global aliphatic hydrocarbon market is divided into saturated and unsaturated. Among these, the saturated segment dominated the largest share in 2023 and is anticipated to grow at a CAGR of 55.72% during the forecast period. This is due to their extensive use in products such as waxes, lubricants, and paints & coatings. Saturated hydrocarbons are referred to as alkanes and are organic compounds made up entirely of carbon and hydrogen atoms with a single bond between them.

The paints & coatings segment held the highest share in 2023 and is anticipated to grow at a CAGR of 22.24% during the forecast period.

Based on the application, the global aliphatic hydrocarbon market is divided into paints & coatings, adhesives & sealants, polymer & rubber, surfactant, dyes, and others. Among these, the paints & coatings segment held the highest share in 2023 and is anticipated to grow at a CAGR of 22.24% during the forecast period. This is due to the rising demand for coatings and paints from the construction and automotive sectors. The product is mostly utilized as a thinner solvent in coatings and paints to alter the paints' viscosity making application easier and a smooth finish ensured.

North America is anticipated to hold the highest share of the global aliphatic hydrocarbon market over the projected period.

North America is anticipated to hold the highest share of the global aliphatic hydrocarbon market over the projected period. This is due to favorable market fundamentals for commercial property and a robust economy as well as increasing state and federal investment in institutional buildings and public infrastructure. In March 2023, the U.S. government announced a $2 trillion investment plan to counter the coronavirus pandemic, to improve infrastructure like hospitals, roads, and other essential facilities.

Asia Pacific is estimated to grow at the fastest CAGR of the global aliphatic hydrocarbon market during the forecast period. This is due to increasing construction activity and demand from the auto industry in developing nations like India, Japan, and South Korea. China's aliphatic hydrocarbon market is witnessing remarkable growth. This is largely contributed by the growth of industries that depend on hydrocarbons heavily, including automotive, construction, and manufacturing. Demand comes from the usage in lubricants, solvents, and other chemical processes.

Company Profiling

Major vendors in the global aliphatic hydrocarbon market are BASF SE, Shell Global, BP Plc, ExxonMobil Corporation, Dow, LyondellBasell Industries N.V., Total S.A., Reliance Industries Limited, Ineos Group Limited, Chevron Phillips Chemical, Mitsubishi Chemical Corporation, Sasol, Ineos Group Limited, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global aliphatic hydrocarbon market based on the below-mentioned segments:

Global Aliphatic Hydrocarbon Market, By Product

Global Aliphatic Hydrocarbon Market, By Application

- Paints & Coatings

- Adhesives & Sealants

- Polymer & Rubber

- Surfactant

- Dyes

- Others

Global Aliphatic Hydrocarbon Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa