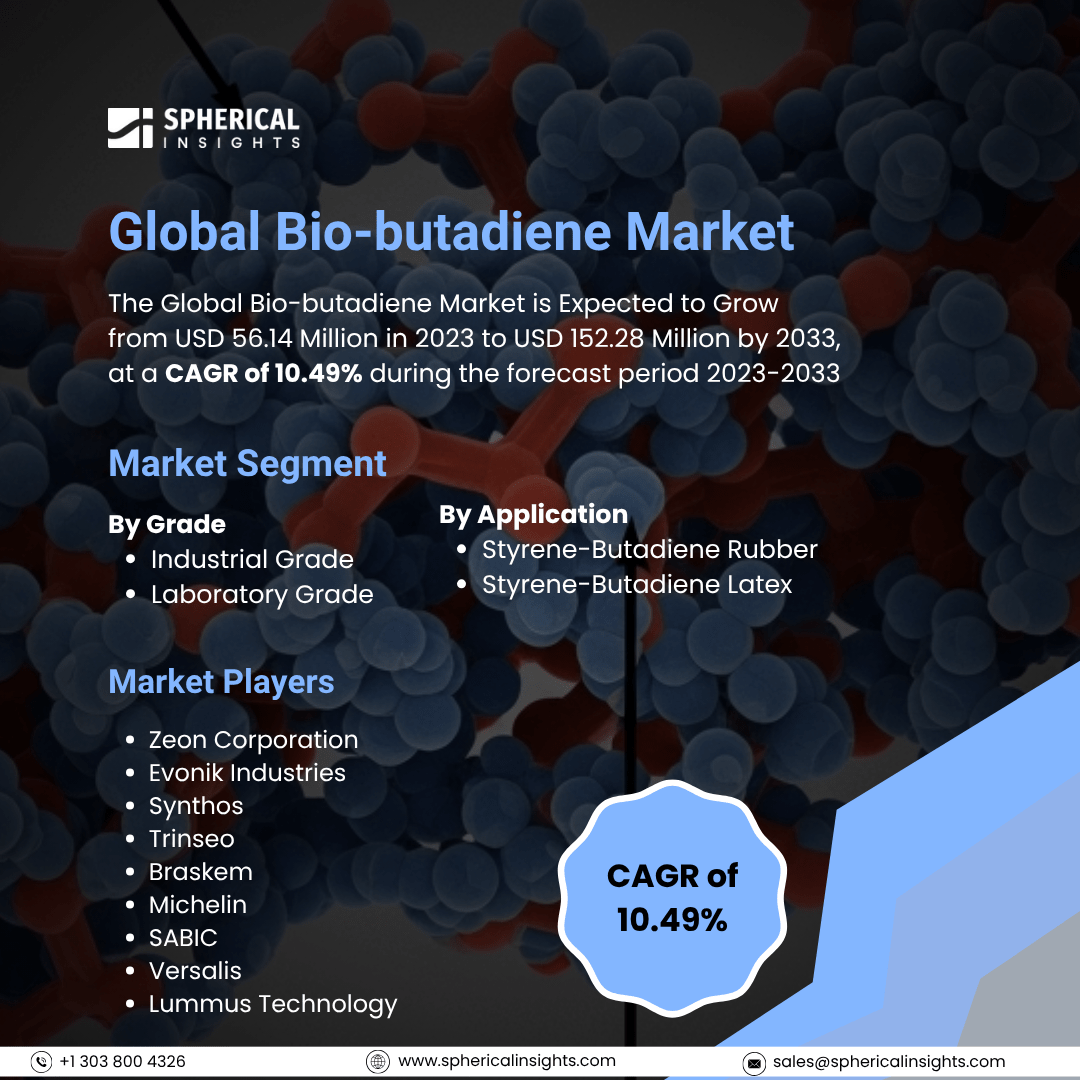

Global Bio-butadiene Market Size To Exceed USD 152.28 Million by 2033

According to a research report published by Spherical Insights & Consulting, The Global Bio-butadiene Market Size is Expected to Grow from USD 56.14 Million in 2023 to USD 152.28 Million by 2033, at a CAGR of 10.49% during the forecast period 2023-2033.

Browse 210 Market Data Tables and 45 Figures Spread Through 190 Pages and In-Depth TOC On the Global Bio-butadiene Market Size, Share, and COVID-19 Impact Analysis, By Grade (Industrial Grade and Laboratory Grade), By Application (Styrene-Butadiene Rubber and Styrene-Butadiene Latex), and By Region (North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa), Analysis and Forecast 2023 - 2033.

The bio-butadiene industry covers the production and consumption of renewable butadiene from biomass and agricultural residues that provide a renewable substitute for petrochemical-derived butadiene in synthetic rubbers, plastics, and latexes. Bio-butadiene is a bio-based, renewable butadiene replacement for petrochemical butadiene, obtained from biomass or crop residues, applied in the production of synthetic rubbers such as polybutadiene and styrene-butadiene rubber that are needed to manufacture auto tires, and in other processes. This renewable strategy seeks to lessen dependency on fossil fuels, lessen its negative effects on the environment, and satisfy the increasing need for environmentally friendly materials across a range of industries. Furthermore, in addition, the product is used in coatings and adhesives for use in construction and other industrial processes. The product can aid in the creation of bio-based substitutes in these fields, encouraging environmentally friendly industrial procedures and a more sustainable building sector. However, significant improvements in process efficiency, feedstock availability, and economies of scale are necessary to achieve cost competitiveness with counterparts derived from petroleum.

The industrial grade segment dominated the largest share in 2023 and is anticipated to grow at a CAGR of 8.72% during the forecast period.

Based on the grade, the global bio-butadiene market is divided into industrial grade and laboratory grade. Among these, the industrial grade segment dominated the largest share in 2023 and is anticipated to grow at a CAGR of 8.72% during the forecast period. The industrial grade of the product is utilized in plastics, rubber, and chemical synthesis industries. It serves as a raw material for manufacturing synthetic rubber, fine chemicals, and plastics. Chemically and in terms of performance, industrial-grade bio-butadiene is usually comparable to or very similar to petroleum-based butadiene and can be a suitable alternative in industries where butadiene is an essential raw material.

The styrene-butadiene rubber segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period.

Based on the application, the global bio-butadiene market is divided into styrene-butadiene rubber and styrene-butadiene latex. Among these, the styrene-butadiene rubber segment held the highest share in 2023 and is anticipated to grow at a significant CAGR during the forecast period. It is a general-purpose synthetic rubber from the copolymerization of butadiene and styrene monomers. It is highly valued for its high abrasion resistance, strength, and elasticity, and is used as a key material in many industrial uses as a synthetic polymer, SBR is reliable in quality and properties and has been adopted by many industries where strong and resilient materials are required.

North America is anticipated to hold the highest share of the global bio-butadiene market over the projected period.

North America is anticipated to hold the highest share of the global bio-butadiene market over the projected period. The fast-growing automotive sector is one of the major growth drivers for the North American product market. According to OICA, the regional output of automobiles and commercial vehicles. Hence, the growing end-use sectors in the region are propelling the growth of the product market in North America.

Asia Pacific is estimated to grow at the fastest CAGR of the global bio-butadiene market during the forecast period. This is due to the growing demand for the product in many end-use industries such as tires and industrial rubber. The Asian Pacific population relies on industrial rubber because of its broad usage in daily life. It is applied in nearly all end-use industries, from automotive and construction to electrical.

Company Profiling

Major vendors in the global bio-butadiene market are Zeon Corporation, Evonik Industries, Synthos, Trinseo, Braskem, Michelin, SABIC, Versalis, Lummus Technology, Invista, and Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2024, France's first industrial-scale demonstrator plant for butadiene production from bioethanol was jointly launched by Michelin, IFPEN (French Institute of Petroleum and New Energies), and Axens.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2023 to 2033. Spherical Insights has segmented the global bio-butadiene market based on the below-mentioned segments:

Global Bio-butadiene Market, By Grade

- Industrial Grade

- Laboratory Grade

Global Bio-butadiene Market, By Application

- Styrene-Butadiene Rubber

- Styrene-Butadiene Latex

Global Bio-butadiene Market, By Regional

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa