Carbon Footprint Management Market Summary

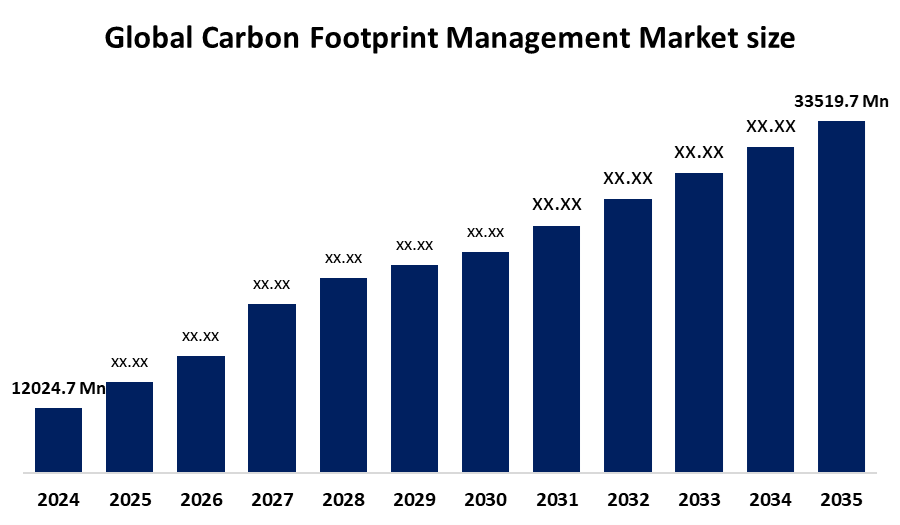

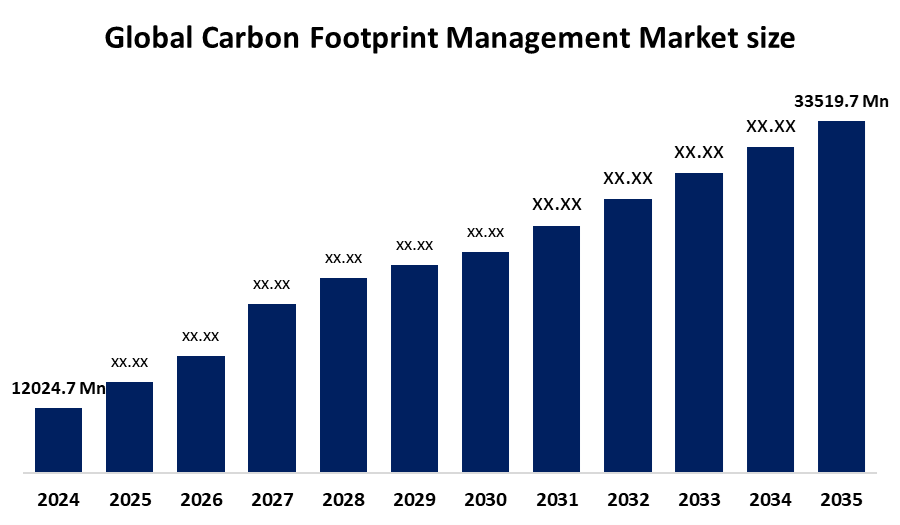

The Global Carbon Footprint Management Market size was Estimated at USD 12024.7 Million in 2024 and is Projected To Reach USD 33519.7 Million by 2035, Growing at a CAGR of 9.77% from 2025 to 2035. The market for carbon footprint management is expanding significantly as a result of tighter government laws, growing industry energy demand, and growing concerns about climate change. Its growth is also being aided by technical developments, increased consumer awareness, and the focus on Environmental, Social, and Governance (ESG) considerations.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific held the greatest revenue share of 55.6%, dominating the carbon footprint management market.

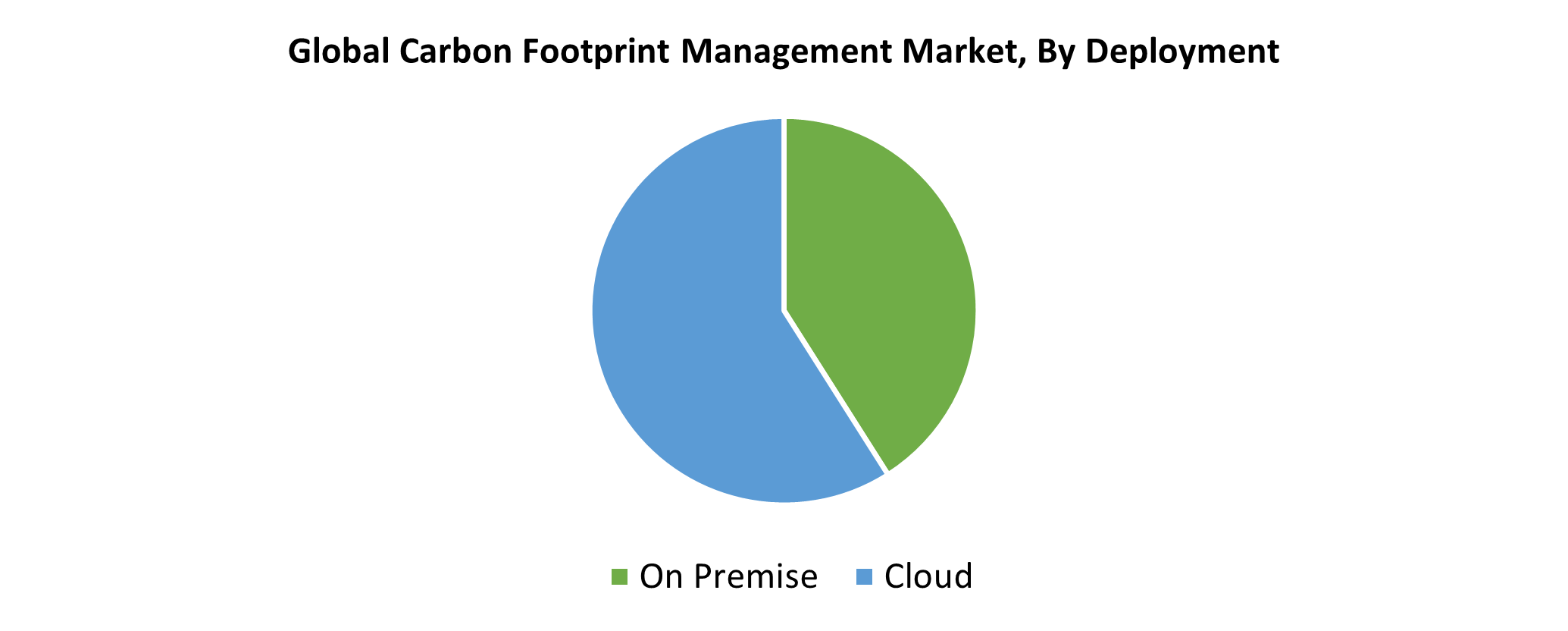

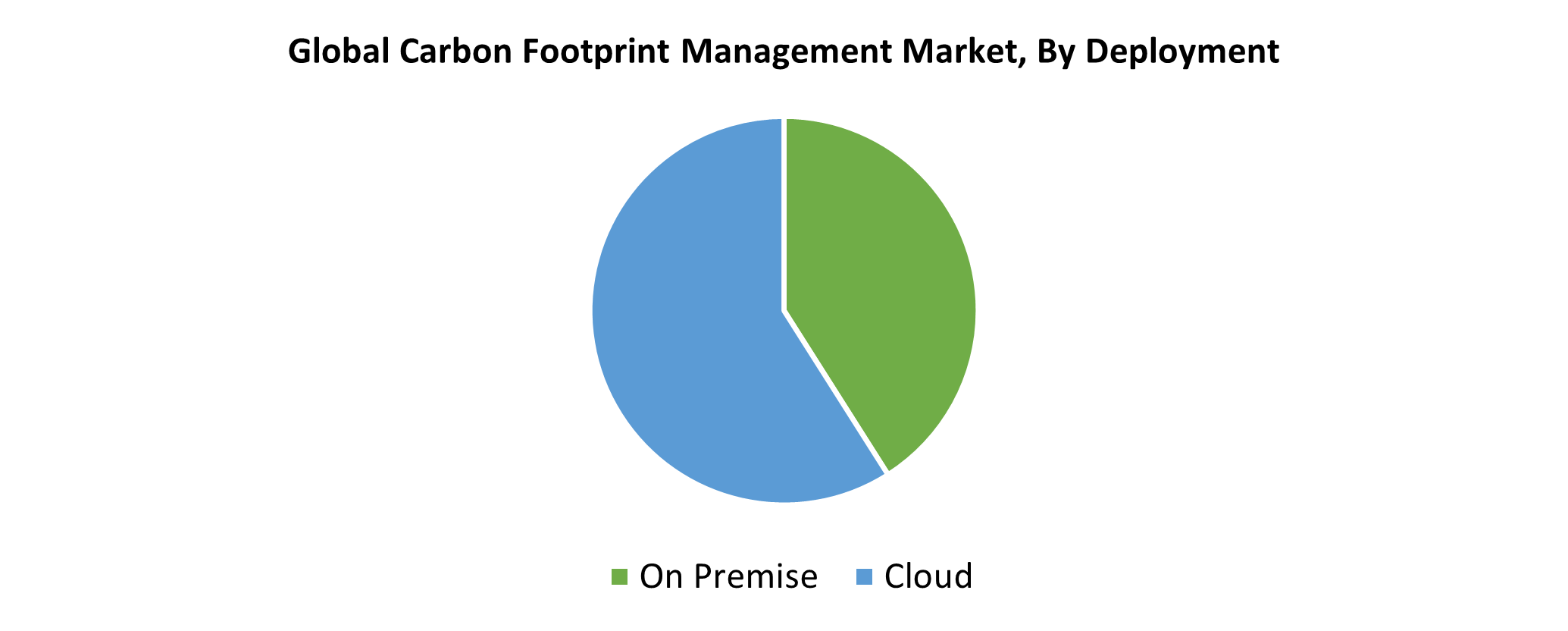

- In 2024, the cloud segment held the largest revenue share and led the market based on deployment.

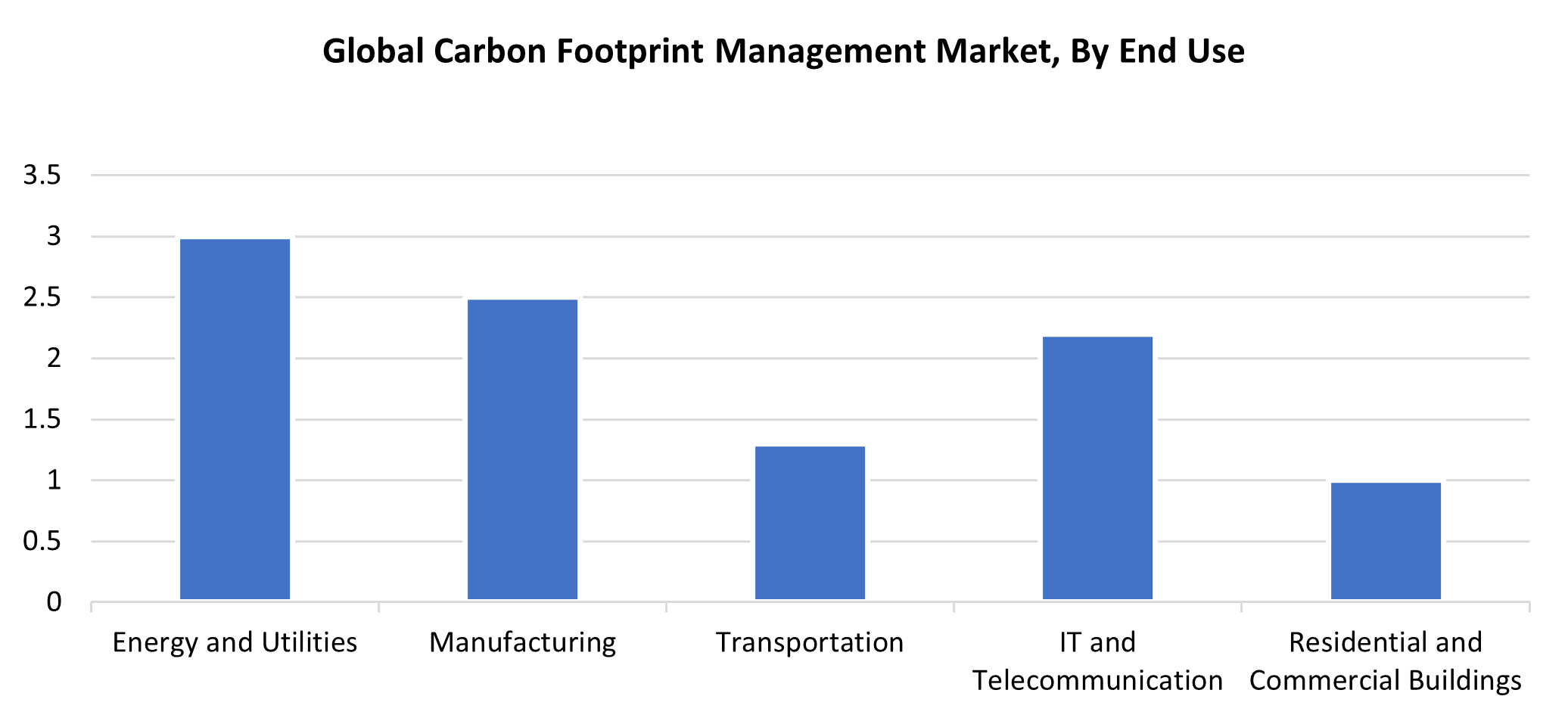

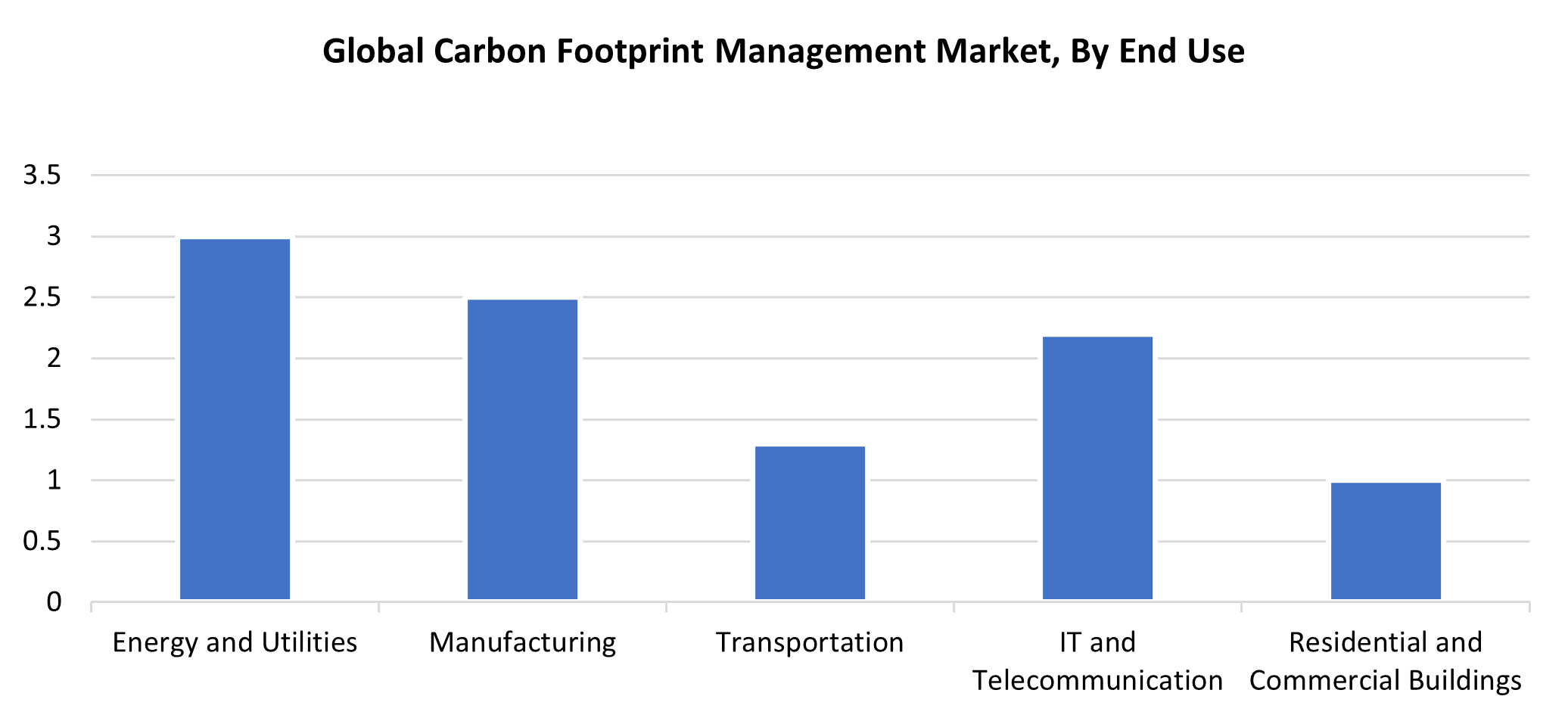

- Energy & Utilities dominated the market and generated the highest revenue share of 30.7% in 2024 based on end use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 12024.7 Million

- 2035 Projected Market Size: USD 33519.7 Million

- CAGR (2025-2035): 9.77%

- Asia Pacific: Largest market in 2024

The carbon footprint management market encompasses the systems, products, and services used to monitor, report, and reduce greenhouse gas emissions, primarily carbon dioxide, from human activity. It also involves tracking and managing emissions produced by people, businesses, or products, as well as the designs developed to offset those emissions and reduce their global impact. The demand for carbon footprint management systems is fueled by governments around the world establishing stricter environmental laws and carbon pricing schemes that compel companies to track and reduce their carbon emissions. In addition, a variety of companies are setting ambitious sustainability objectives, including achieving carbon neutrality, thus creating a greater market demand for tools and methods to measure, track, manage, and reduce the carbon footprint.

Technological advances in artificial intelligence (AI) and Internet of Things integration have improved the accuracy and efficiency of carbon tracking systems. Businesses now face rising environmental disclosure requirements, which lead them to invest in comprehensive carbon footprint management solutions. Emerging economies now recognize the importance of sustainable practices, which boosts the overall industry potential. The characteristics of this sector create a substantial opportunity for both growth and innovation within the carbon footprint management industry. The expanding market receives support from businesses that adopt efficient carbon footprint management methods because institutional investors and stakeholders prioritize environmental factors in their investment decisions. It is anticipated that expanding R&D and testing a number of pilot plants will reduce the cost of CCS technology and improve its commercial viability. The market for carbon footprint management has grown more quickly because of low-carbon investment programs like NER300 and NER400, which include provisions for funding large-scale commercial CCS pilot plants.

Deployment Insights

In 2024, Cloud's segment accounted for the largest revenue share. Business organizations adopting cloud-based software systems have triggered a quick surge in demand for cloud-based carbon footprint management solutions. The market demand for cloud-based carbon management solutions has grown because they offer multiple benefits, including economic efficiency alongside easy expansion capabilities and universal access. The solutions fit any business scale or location since they allow organizations to utilize carbon footprint management tools through internet connections. Organizations can successfully handle their carbon footprint data and strategic plans regardless of their operational scale and geographical position because of this adaptable system.

An on-premises carbon footprint management solution functions to oversee sustainability data and carbon emissions reporting within organizational facilities. The on-site system architecture enables these solutions to deliver superior performance when compared to cloud-based applications, thus making them ideal for organizations that need to follow rigorous compliance and observation protocols. The benefits of on-site operations continue to grow in popularity because they remain crucial for organizations that need to protect critical information or operate within highly controlled sectors. The projected market forecast shows that the on-premise segment will maintain a lower market position as organizations across multiple industries adopt cloud-based carbon footprint management software during the forecast period.

End-use Insights

The largest portion of revenue in 2024 came from the energy and utilities sector which comprised over 30.7% of total revenue. Utilities, together with energy companies, play a major role in producing carbon emissions, yet they represent the key elements for decreasing these emissions. Energy and utility companies can substantially minimize their environmental impact through the implementation of carbon offset initiatives and the adoption of cleaner energy sources, including renewable power. The businesses gain new development opportunities alongside improved offerings because they participate in climate change mitigation efforts. The expanding public understanding of climate change, alongside rising sustainable energy requirements, drives the expansion of the carbon footprint management industry.

The manufacturing sector held a significant market share in 2024 because cement production, together with metal manufacturing, generates substantial CO2 emissions. Several enterprises operating within this sector must minimize their carbon footprint to protect the environment and avoid regulatory dangers, along with reputation damage. The implementation of software programs to track and reduce carbon output, together with low-carbon procedures, boosts market interest in carbon footprint control solutions. The industrial sector needs to protect itself from both legal threats and damage to its reputation. Research efforts focus on decreasing emissions, especially CO2 from blast furnace operations because of the present trend.

Regional Insights

The North American market is anticipated to expand significantly over the course of the projected period. The expansion of the industry receives strong support from environmental regulations implemented at both the federal and state levels throughout North America. Organizations must utilize carbon footprint management solutions to satisfy regulatory requirements since the Clean Power Plan and cap-and-trade systems provide positive measures for power plant emission reduction. The movement toward sustainability among businesses depends on carbon footprint management implementation because shareholder demands, together with customer requirements and ESG investment focus, push this practice. The increased public awareness about climate change and its consequences has led customers and communities to demand environmentally responsible corporate actions, which drives the requirement for carbon footprint management.

U.S. Carbon Footprint Management Market Trends

The United States holds the leading position in North America for Carbon Footprint Management because of government measures, including the Inflation Reduction Act, that support businesses in their decarbonization efforts. The implementation of AI carbon tracking tools, lifecycle assessment systems, and offset platforms happens across both large corporations and SMEs as they work toward achieving net-zero targets. Digital technologies are becoming more prevalent in the industry and transportation, and energy sectors to monitor and decrease their carbon emissions. The United States takes the lead in carbon management innovation because investor relations require more transparency and compliance, which drives faster adoption.

Asia Pacific Carbon Footprint Management Market Trends

The Asia Pacific region held the largest portion of revenue distribution in 2024, which accounted for 55.6%. The geographic layout of Asia Pacific provides ideal locations to capture and store carbon. The main causes of this increase include growing environmental consciousness, urbanization, and rapid industrialization. The governments across China, India, Japan, and Australia are driving organizations to adopt carbon footprint management systems through their enforcement of stronger carbon reporting laws and sustainable practice incentives. International trading partners' demands for environmentally friendly supply chains are pushing the market toward increased adoption of carbon tracking devices. The combination of rising corporate ESG requirements with the region's extensive manufacturing operations is creating exceptional demand for affordable, scalable carbon management solutions.

Europe Carbon Footprint Management Market Trends

The European market for carbon footprint management expanded because of rigorous environmental regulations, together with ambitious climate targets. The Green Deal of the European Union and Carbon Border Adjustment Mechanism (CBAM) authorities require industries to develop complete carbon management plans. The French and German governments have taken advanced steps to establish complex carbon tracking and reporting systems because they aim to hit their net-zero targets. The market environment remains influenced by the ongoing focus on reducing emissions from both transportation operations and industrial processes.

Key Carbon Footprint Management Companies:

The following are the leading companies in the carbon footprint management market. These companies collectively hold the largest market share and dictate industry trends.

- Wolters Kluwer

- Schneider Electric

- Ecova

- IBM Corporation

- IsoMetrix

- Dakota Software

- ProcessMAP

- SAP

- ENGIE

- Others

Recent Developments

- In July 2023, IBM developed a new solution that enables businesses to track greenhouse gas emissions from cloud operations while enhancing their sustainability results throughout their multicloud and hybrid environments. The IBM Cloud Carbon Calculator provides users with an AI-powered dashboard that delivers emissions data for different IBM Cloud workloads, such as financial services, HPC, and AI operations.

- In February 2023, Wolters Kluwer Enablon, together with Makersite, formed a strategic alliance that will support manufacturing businesses to achieve Net Zero and their ESG targets. The two industry leaders support enterprises in achieving Net Zero through their supply chain decarbonization efforts. The process starts with data collection and continues through modeling and reporting, as well as planning and forecasting operations for all three GHG emission scopes.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the carbon footprint management market based on the below-mentioned segments:

Global Carbon Footprint Management Market, By Deployment

Global Carbon Footprint Management Market, By End Use

- Energy and Utilities

- Manufacturing

- Transportation

- IT and Telecommunication

- Residential and Commercial Buildings

Global Carbon Footprint Management Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa