Hydrogen Compressor Market Summary

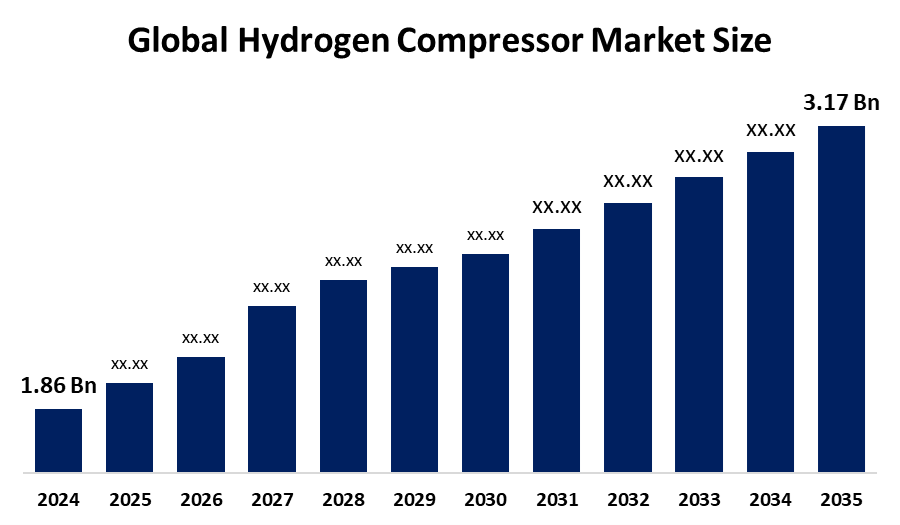

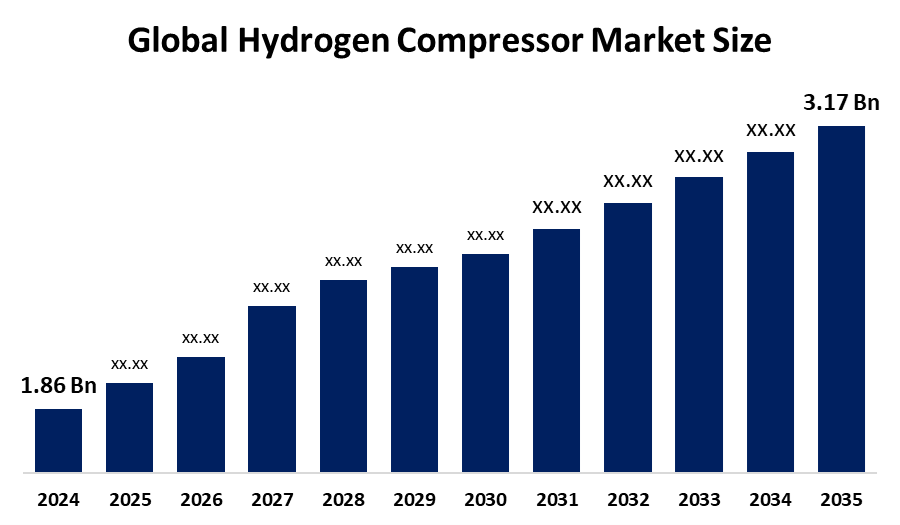

The Global Hydrogen Compressor Market Size was Estimated at USD 1.86 Billion in 2024 and is Projected To reach USD 3.17 Billion by 2035, Growing at a CAGR of 4.97% from 2025 to 2035. The growing use of hydrogen as a clean energy source and the ensuing demand for infrastructure expansion are the main factors propelling the market for hydrogen compressors.

Key Regional and Segment-Wise Insights

- In 2024, the North American market for hydrogen compressors held the largest revenue share, accounting for 25.7% of the total.

- In 2024, the U.S. market for hydrogen compressors held the largest revenue share and led the North American market.

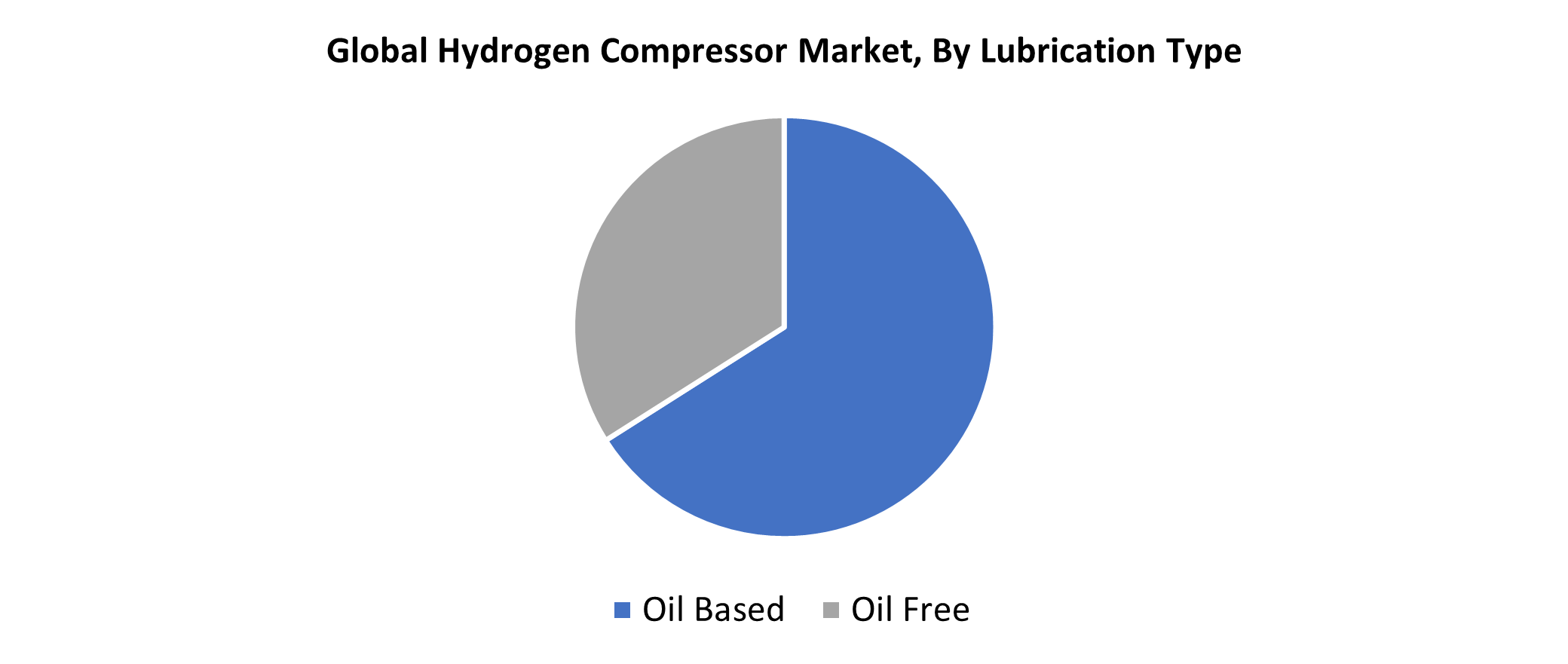

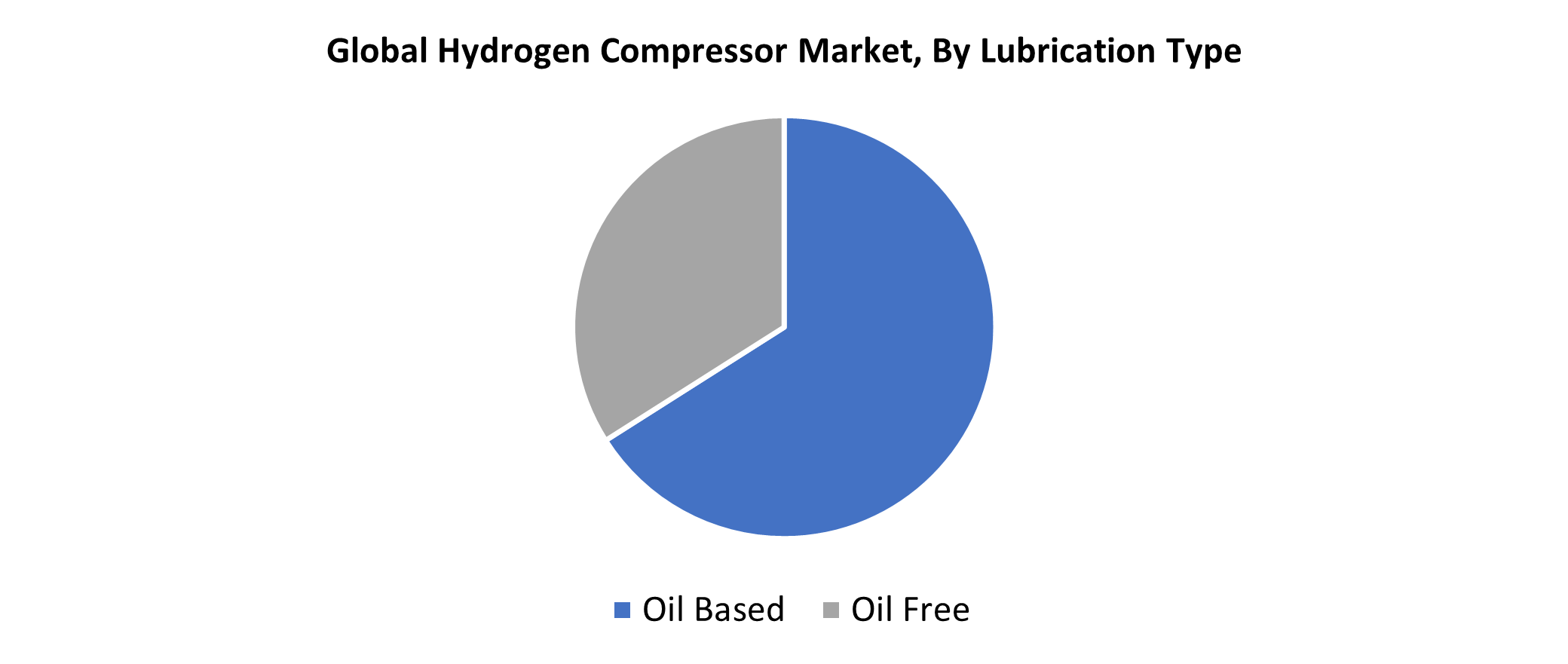

- In 2024, the oil-based segment dominated the market and generated the highest revenue share by lubrication type, accounting for 66.4% of the hydrogen compressor industry.

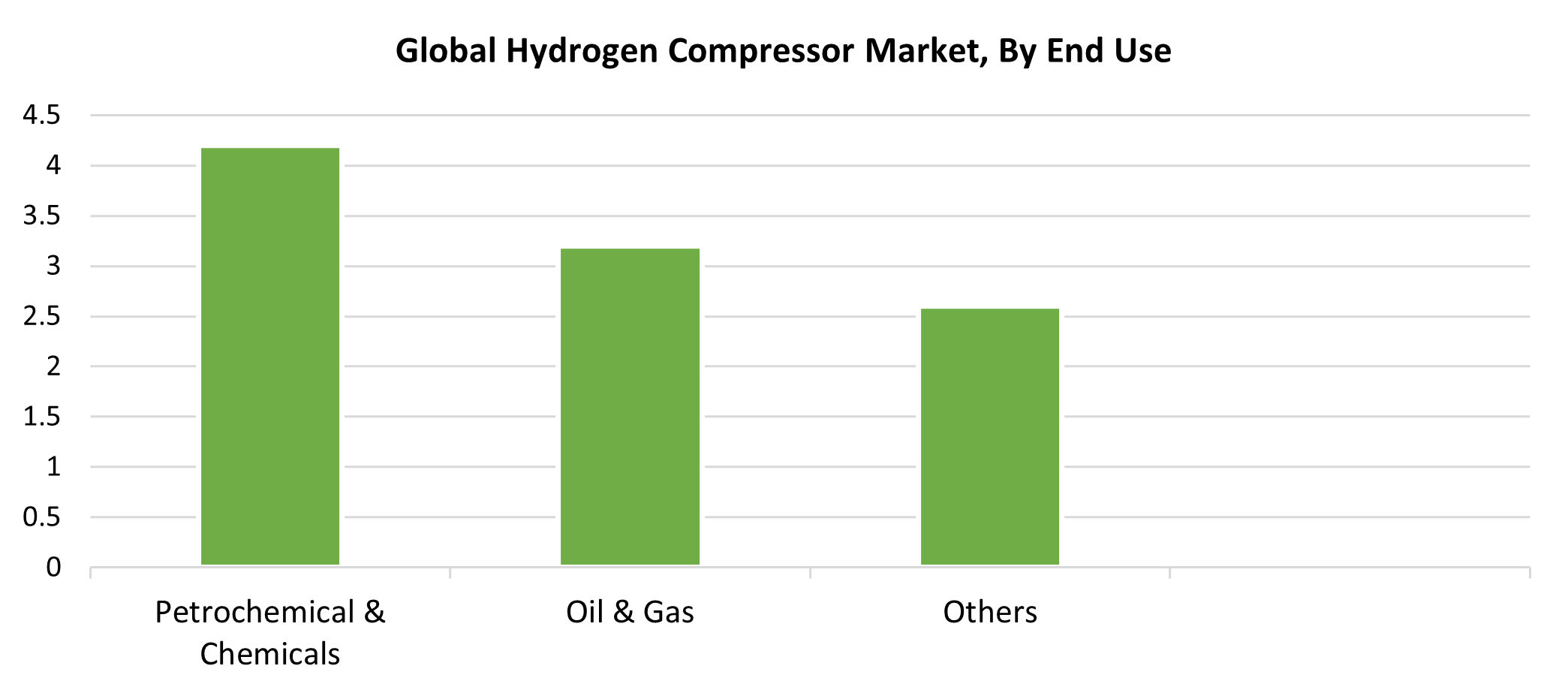

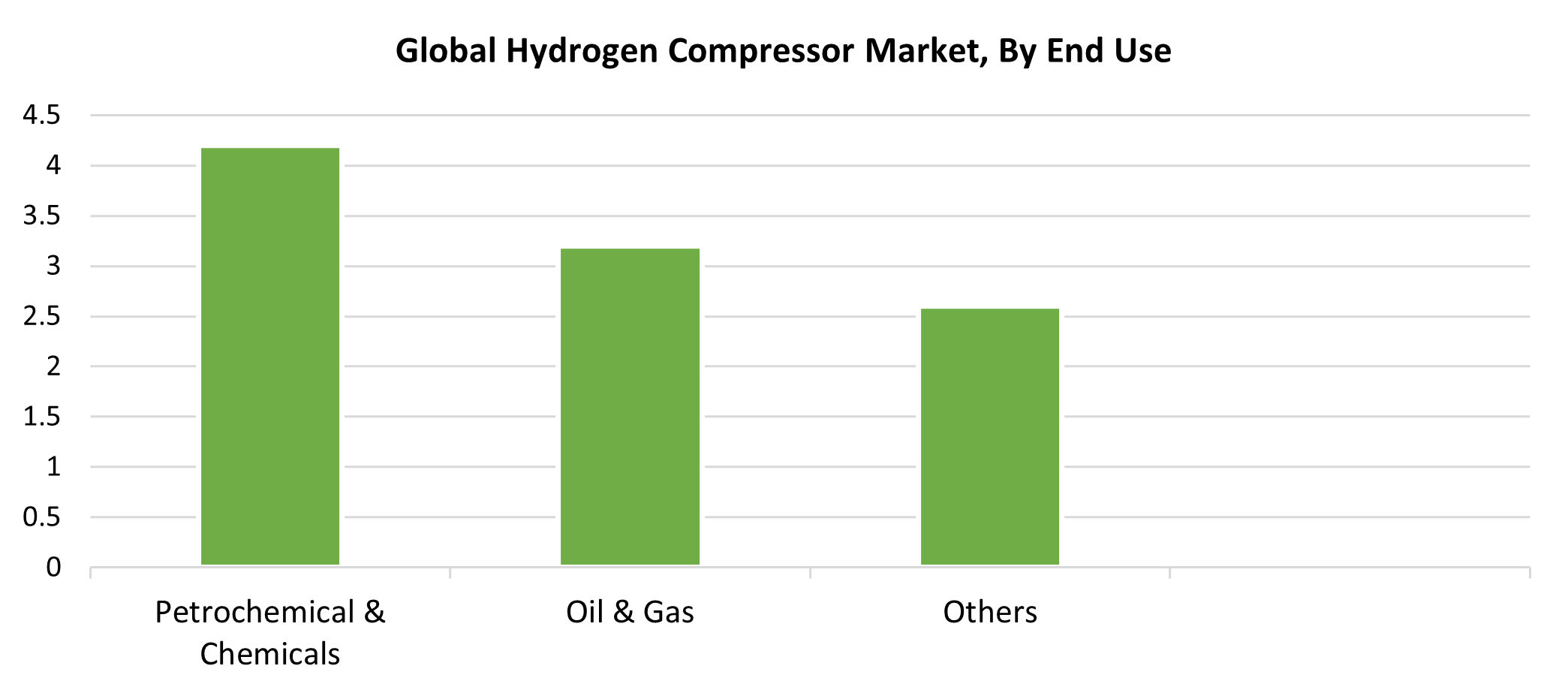

- In 2024, petrochemical and chemical companies held the biggest revenue share of 42.6%, dominating the market by end-use.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 1.86 Billion

- 2035 Projected Market Size: USD 3.17 Billion

- CAGR (2025-2035): 4.97%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The hydrogen compressor market is the global sector responsible for the development, production, and distribution of mechanical devices that raise the pressure of hydrogen gas. As the world transitions to a more sustainable energy mix, hydrogen is becoming increasingly seen as an important element of future energy. Countries around the world are providing incentives for the use of hydrogen and legislation in order to reduce greenhouse gas emissions and fight climate change. These laws include funding for research & development, infrastructure, and subsidies to produce hydrogen. This is likely to be one of the key drivers of the market for hydrogen compressors. Hydrogen is also used in many industrial processes, including methanol production, ammonia production, and refining. Recent growth in these industries, with increased production and a movement toward cleaner production methods, has led to growth in demand for hydrogen. Compressed gases are also used in these industrial processes to ensure that the gases are properly processed and treated.

Governments create regulations and incentives to drive the development of hydrogen technology, such as research and development, infrastructure development, and subsidies for the creation or production of hydrogen. The legal frameworks that foster investment in these technologies drive the market demand for this product. Compressor technology is constantly getting better. Reliability, cost-effectiveness, and efficiency are all enhanced with technology. Innovations such as oil-free compressors, improved materials, and new, better cooling systems are encouraging adoption by addressing challenges such as maintenance concerns, energy consumption, and improving overall system efficiency.

Lubrication Type Insights

With a high revenue share of 66.4% of the hydrogen Compressor market in 2024, the oil-based segment had the largest market share. Oil-based compressors are recognized for their reliability and efficient operation. The more effectively the lubricated system operates, the less wear and load on the moving parts. A longer service life and less maintenance are critical in industrial applications where downtime could be costly. Industries that need consistent, continuous production also prefer oil-based compressors, in particular for their long-term reliability. Oil-based compressors are usually lower in capital investment and have lower operating costs than oil-free compressors. The lubrication that oil provides lowers friction and increases the overall efficiency of the compression process, resulting in less energy use. Lower repair and replacement costs lead to lower operational costs of oil-based units. This economic advantage, particularly in price-sensitive industries, remains an important reason for selecting oil-based compressors.

Oil-free lubricated compressors will grow by an anticipated CAGR of 2.9% over the forecast period, as ultra-pure hydrogen is an integral element of fuel cell technologies, but is also widely used in chemical and pharmaceutical processes. The safety risks associated with oil compressors are partially addressed with oil-free compressors. Also, oil-based compressors raise safety issues, but oil-free compressors have fewer safety concerns. Hydrogen is very reactive, and it is important to note that using lubricants in compression systems presents safety issues. Additionally, they are also more eco-friendly because they no longer require oil lubrication, lowering the chances of leaking oil and the negative issues associated with disposing of oil. In industries using hydrogen, even small amounts of oil can poison catalysts, impact the purity of the final product, cause fouling of the equipment, potential breaches of regulations, and decreased performance of the whole system.

End-use Insights

The petrochemical and chemical industries will dominate the market, with the largest revenue share of 42.6% in 2024. Hydrogen is a critical component of many chemical and petrochemical processes, including the production of ammonia, methanol, and other critical compounds. These processes often require that certain components be present at very high pressure for effective reactions. Because of the high pressures needed, compressors are required as hydrogen must be compressed to be used efficiently for these procedures. The need for effective hydrogen compression is amplified by growing demands for these compounds. Hydrogen is considered to be a better process fuel for many applications in that it reduces the carbon footprint of chemical processes, which is particularly attractive in reducing greenhouse gas emissions for compliance. The growing need to comply with such regulations and reduce greenhouse gas is also driving more hydrogen-based processes, and therefore more demand for compressors that handle hydrogen.

As hydrogen is broadly employed for ammonia production, hydrotreating, and refining, the oil and gas segment is expected to grow at the fastest CAGR over the forecast period. Growth in the oil and gas industry is expected to stimulate the hydrogen compressor market because of the increase in investment. Demand for hydrogen compressors is forecast to rise as the number of hydrogen fuel cell vehicles increases. The growth of hydrogen compressors will also be due to an increased use of compressors brought on by the growing oil and gas industries in the Middle East. The demand for hydrogen compressors is also stimulated by the necessity of compressing hydrogen to a higher pressure for storage, pipeline transport, and various refinery operations.

Regional Insights

In 2024, the North American hydrogen compressor market accounted for the largest revenue share, 25.7% of the overall market, due to the substantial demand for green energy from industrial sectors, such as steel, chemical manufacturing, and refrigeration. All of these enterprises will need compressors to allow the effective and reliable transport and storage of hydrogen as part of decarbonizing these industries through hydrogen incorporation. This region has also been a hotspot for many technological advancements that have improved the competitiveness of its manufacturing. The demand for hydrogen as a clean fuel from these established manufacturing and factory floors is anticipated to bolster the hydrogen compressor market during the forecast period.

U.S. Hydrogen Compressor Market Trends

In 2024, the U.S. market for hydrogen compressors held the largest revenue share and led the North American market. This growth is due to rigid decarbonization targets that favor the use of green energy across different sectors, such as heavy industry and power generation. The hydrogen compressor industry is key for several applications, such as injecting hydrogen for natural gas systems that decarbonize energy usage.

Europe Hydrogen Compressor Market Trends

The hydrogen compressor market in Europe is anticipated to grow substantially in the next few years due to the region's role as a leader in the green energy revolution. As part of its Green Deal, the European Union has created ambitious targets for hydrogen production. Major countries such as Germany, France, and the Netherlands are putting significant amounts of investment into hydrogen infrastructure that includes transportation networks, storage, and electrolyzers, all of which need compressors. The need for improved hydrogen compressors will arise from potential uses in Europe, such as power plants, industry, hydrogen filling stations, and many more. Moreover, Europe can be a key market to stimulate future requirements for hydrogen compressors based on its aptitude to lead in technology advancement and its emphasis emphasizing using renewable energy supplies.

Asia Pacific Hydrogen Compressor Market

The Asia-Pacific hydrogen compressor market is expected to grow at the fastest CAGR, accounting for 4.6% over the forecast period, due to the rapid industrial growth of countries like South Korea, Japan, and China. Notably, key regional markets in the petrochemical, chemical, and oil and gas sectors are the major consumers of hydrogen gas, which have all shown measurable growth, resulting in the increasing demand for hydrogen compression units. Those countries have made major investments in sustainable energy sources, enabling their growth industries. Additionally, China is one of the world's largest and fastest-growing hydrogen compressor markets, with total hydrogen production and consumption being the highest in this region.

Key Hydrogen Compressor Companies:

The following are the leading companies in the Hydrogen compressor market. These companies collectively hold the largest market share and dictate industry trends.

- Hitachi, Ltd.

- ATLAS COPCO AB

- IDEX (Corken)

- Nel

- Ingersoll Rand

- HAUG Sauer Kompressoren AG

- Burckhardt Compression Holding AG

- Chart Industries (Howden Group)

- Fluitron

- Ariel Corporation

- Others

Recent Developments

- In April 2024, MITSUI E&S Co., Ltd. has announced the start of sales of high-flow hydrogen compressors targeted at hydrogen production equipment and station facilities. This compressor, having been promoted for a much higher flow rate than existing products on the market, permits delivery of hydrogen at a higher flow rate after it has been compressed to a maximum of 50 MPa at a rate of 95 kg/h. A water electrolysis machine of the 5 MW type can pressurize hydrogen with only a single compressor.

- In August 2023, Sundyne unveiled four new standard PPI diaphragm compressor packages to enhance the comfort, speed, and economy of PPI hydrogen compressor acquisition, installation, and service. With flows ranging from 10 kg/hr (22 lbs/hr) to 60 kg/hr (132 lbs/hr), the new compressor packages cover a pressure range from 20 bar (290 psi) on the suction to 550 bar (8,000 psi) on the discharge. Overall design and manufacturing for every package can be delivered to either European or North American specifications.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the hydrogen compressor market based on the below-mentioned segments:

Global Hydrogen Compressor Market, By Lubrication Type

Global Hydrogen Compressor Market, By End Use

- Petrochemical & Chemicals

- Oil & Gas

- Others

Global Hydrogen Compressor Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa