Solar PV Market Summary

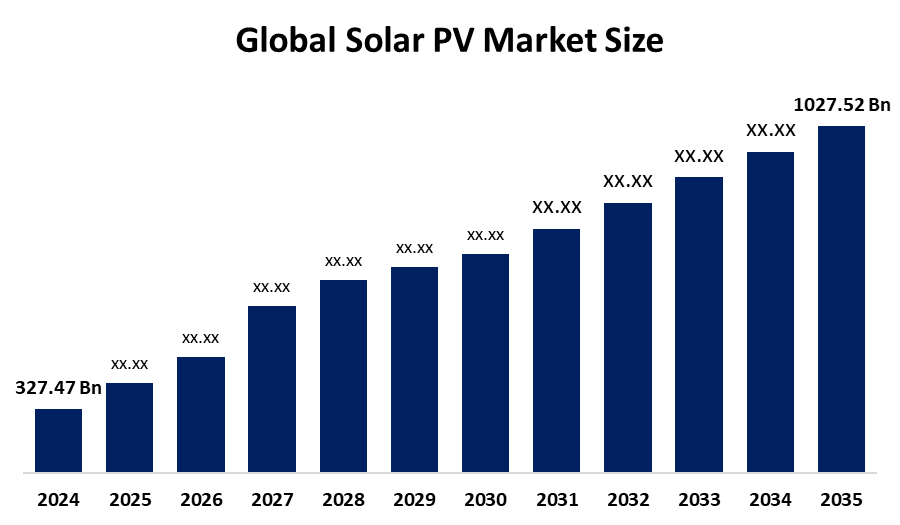

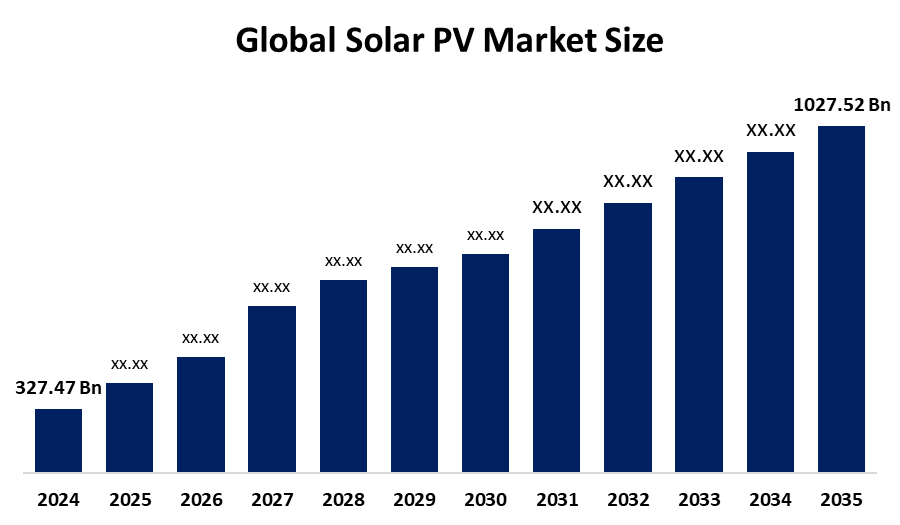

The Global Solar PV Market Size was valued at USD 327.47 Billion in 2024 and is Projected To reach USD 1027.52 Billion by 2035, Growing at a CAGR of 10.96% from 2025 to 2035. The market for solar PV (photovoltaic) is expanding significantly as a result of several causes, such as growing environmental concerns, government incentives, and falling solar technology costs.

Key Regional and Segment-Wise Insights

- In 2024, Asia Pacific solar PV held the Biggest revenue share, accounting for 54.3% of the Global market.

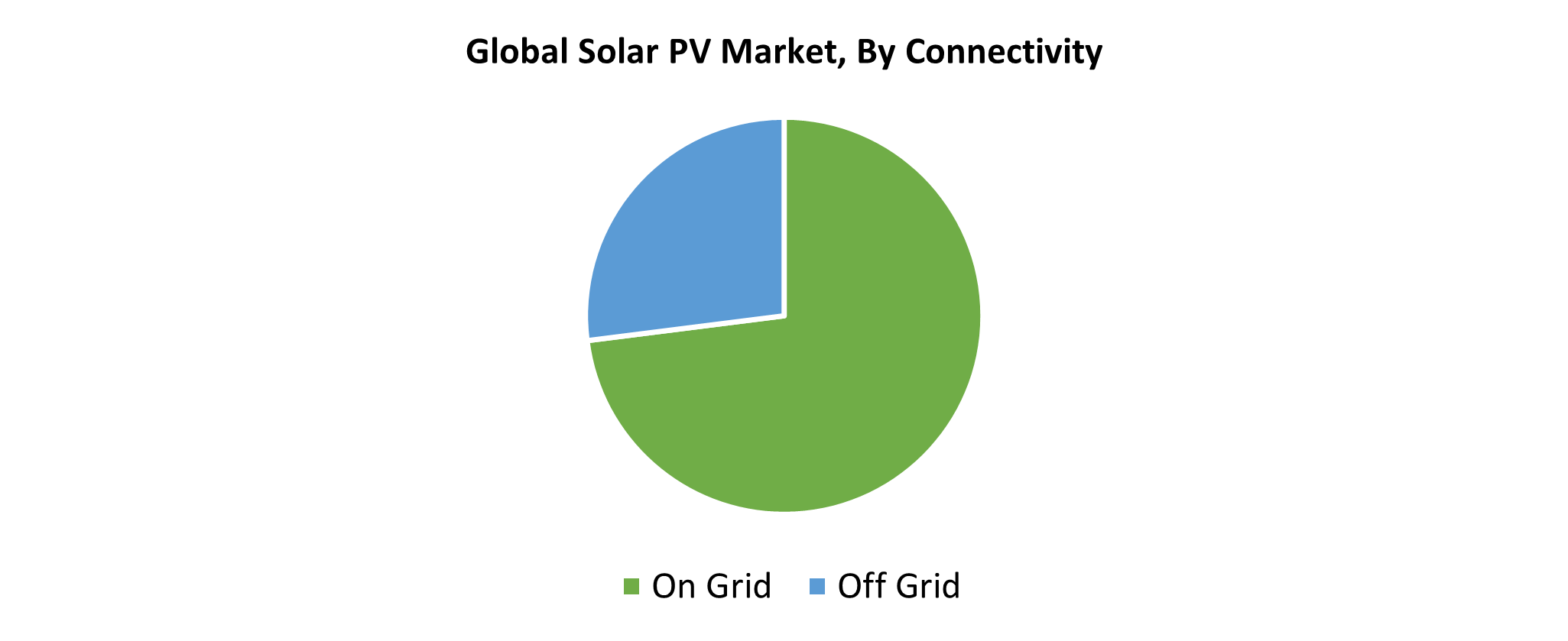

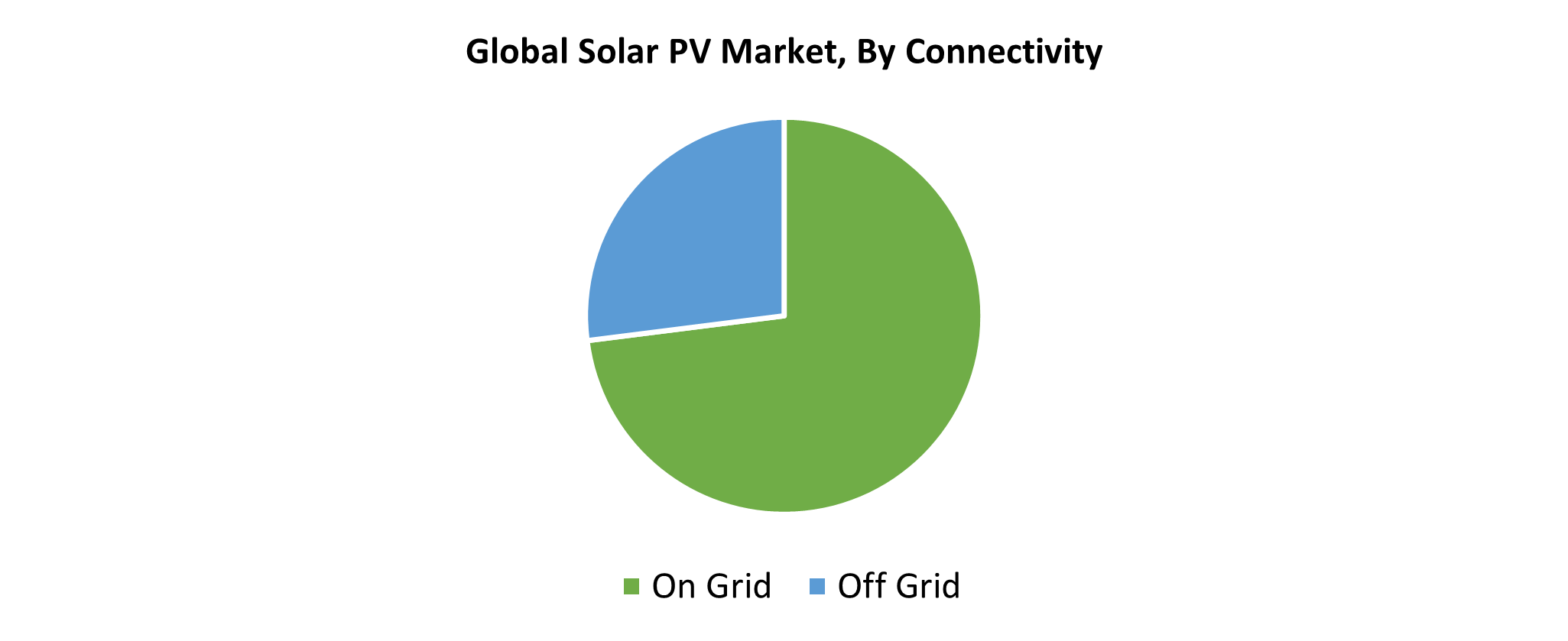

- The On-grid connectivity dominated the market by connectivity and generated the highest revenue share of 73.7% in 2024.

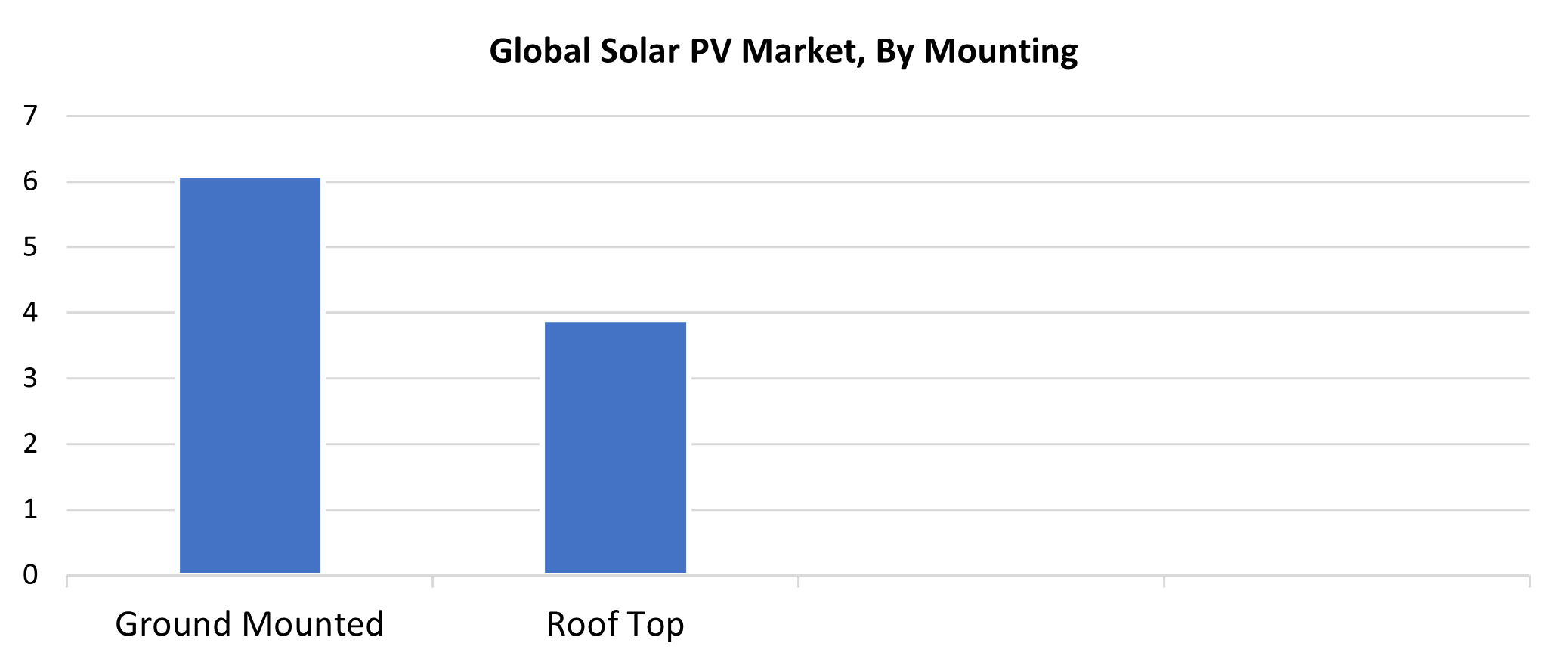

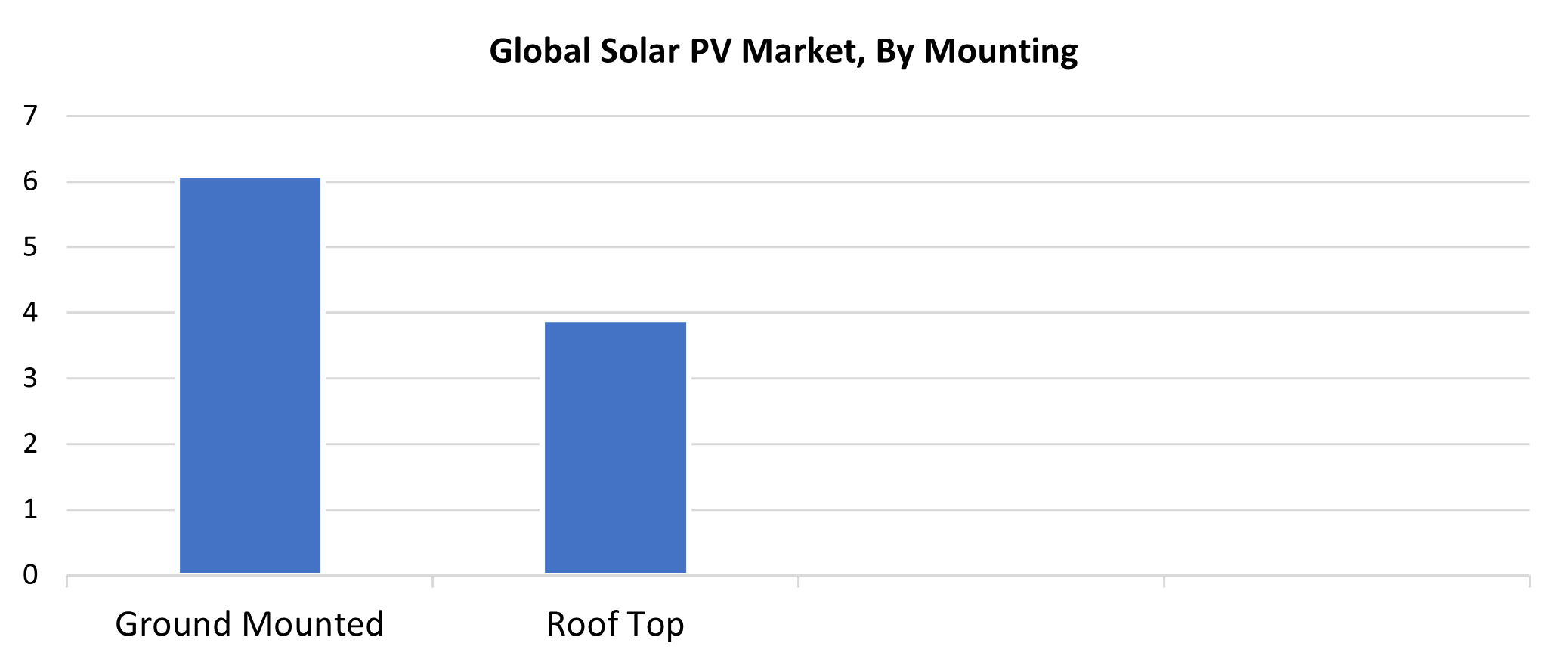

- In terms of mounting, ground-mounted dominated the market and had the highest revenue share in 2024, accounting for 61.4%.

Global Market Forecast and Revenue Outlook

- 2024 Market Size: USD 327.47 Billion

- 2035 Projected Market Size: USD 1027.52 Billion

- CAGR (2025-2035): 10.96%

- Asia Pacific: Largest market in 2024

The global sector for the manufacture, installation, and sale of solar photovoltaic (PV) systems is known as the solar PV market. Solar photovoltaic systems use solar panels consisting of photovoltaic cells to convert sunlight to electricity. As solar energy costs decline and more capital is put to work, the solar PV market will be in much stronger growth mode. The adoption of solar photovoltaic systems has been driven by the easy availability of solar resources, the price of the resource, and the expanded potential of the solar energy industry. Efforts to develop technology and R&D to improve power production from solar have created increased demand for solar photovoltaic systems, falling under the umbrella of solar capacity. Governments around the world have made the shift to clean and renewable energy alternatives as a method to reduce global warming and carbon emissions from non-renewable resources. solar is a viable and scalable alternative to traditional energy practice so it has experienced an increase in demand globally.

The push for solar PV solutions is driven in part by an increased need for energy independence and security, especially in off-grid remote hilly regions where energy generation and transmission are both highly challenged and suffering massive losses. Also, there is greater potential for the possibility of increased demand for solar PV systems, because of the increase and expansion of energy storage devices and electric vehicles (EVs) around the world. Organizations are now in the position to offer solar energy solutions to end customers at commercial rates because of an immense drop in manufacturing costs due to improving production volumes and an enormous drop in raw materials costs. Collectively, all these aspects are driving the growth of the solar PV sector around the world.

Connectivity Insights

On-grid connectivity was the largest revenue contributor in 2024, accounting for 73.7% of the market. On-grid or grid-tied solar MEMPV systems have grown steadily in popularity, primarily due to their low cost and ease of use, and ability to use the grid as a virtual battery, eliminating the need for batteries for energy storage. On-grid solar PV systems are the best option for utilities, businesses, and governments that want to switch to renewable alternatives, as these PV systems rely on electricity generation and feed it into the grid. On-grid solar PV systems have also grown in popularity amongst users due to their ability to feed excess energy back into the grid, which creates income opportunities through feed-in tariffs and net metering arrangements. Furthermore, on-grid systems benefit from economies of scale, as they can be developed and connected to the grid in larger installations that lower costs and create efficiencies.

In the projected time frame, the off-grid segment is expected to grow at the highest CAGR of 12.2%, primarily due to the increasing adoption of off-grid products in developing regions and sparsely populated areas. Technological advancements, such as microgrids and energy storage systems, have improved the quality and viability of off-grid solar PV systems, resulting in them being comparable to traditional energy sources. Furthermore, off-grid solar PV systems are becoming a vital way to provide energy to homes, schools, hospitals, small businesses, and governments, along with various organizations, which are beginning programs to increase energy reliability. Off-grid solar PV systems have also become increasingly affordable and available, due to cost reductions and innovative financing options, which will also increase adoption among a wide range of consumers.

Mounting Insights

Ground-mounted dominated the market in 2024, contributing the most significant revenue share of 61.4% to the market. Ground mounts have been used in utility-scale solar power generation extensively. The segment's continued dominance can be primarily attributed to the economics derived from large-scale installation, which reduced the cost of power generated on a per-unit basis. Large open spaces with little to no shade are ideal for ground-mounted installations because they can accommodate more solar panels, generate more electricity, and require less maintenance than rooftop systems. Ground-mounted mounted also allow for optimization of energy production using tracking systems and advanced monitoring technologies. The demand for ground-mounted installations is also supported by laws and regulations providing tax credits and development of renewable portfolio standards, requiring the development of solar energy in a larger framework.

The rooftop segment is estimated to have a significant CAGR during the forecasting period. People and businesses looking for ways to reduce their carbon footprint and costs are increasingly choosing rooftop solar photovoltaic installations on residential and commercial buildings. Rooftop installations are now more affordable and accessible due to the declining costs of solar panels. Government programs such as net metering regulations and tax rebates provide financial incentives for property owners to install rooftop solar PV systems. Private rooftop systems are getting even more popular with rising awareness of environmental sustainability and climate change, and demand for cleaner energy solutions.

Regional Insights

Asia Pacific solar PV led the global market with a revenue share of 54.3% in 2024. The boom in solar PV in the Asia Pacific is due to its rapid adoption of solar energy, due to governmental regulations, lower technology costs, and increased demand for energy. Governments of regional countries, including China, Japan, and India, have set ambitious renewable energy goals and provided compelling incentives and subsidies to foster solar PV adoption. With favorable policies and high-volume manufacturing capacity, China is a solar PV production and installation leader in the world. Additionally, Asia Pacific's position as a leader in the global solar PV market outlook is cemented by the region's growing interest in sustainable energy solutions, as well as declining costs and technological breakthroughs. Furthermore, a sizable market for solar energy solutions has been generated by the region's expanding economy, massive population, and rising energy needs.

North America Solar PV Market Trends

The North American solar PV market is expected to grow significantly throughout the forecast period due to the expansion of the solar energy sector, fueled by generous government policy/regulations, low technology costs, and a strong demand for clean energy. The solar industry will generally continue to expand, including underpinning characteristics of energy independence and reduced carbon footprint, while further development of storage technologies and increased corporate investment in renewables. Furthermore, the increased use of solar energy can be attributed to the falling prices of solar panels and accompanying systems, making solar a more viable alternative to fossil fuel sources. Also, new product launches, partnerships, collaborations, and investments contribute to the large growth rates.

U.S. Solar PV Market Trends

In 2024, the U.S. solar PV market had the highest market share and is the dominant market in North America. The nation continues to grow due to its reliance on solar power as a major source of energy. By enacting net metering laws, tax breaks, and renewable portfolio requirements, states have created advantageous regulatory frameworks. Technological improvements in PV efficiency, along with decreased production costs, have made solar energy more affordable throughout the United States. The U.S.'s aim for 100% clean electricity by 2035 is also facilitated by large utility projects and solar energy that is dispersed. The U.S. solar PV market is on a continued growth curve with ongoing investments and legislative support, which will support the U.S. clean energy transition.

Europe Solar PV Market Trends

In 2024, due to the region's commitment towards decreasing greenhouse gas emissions and meeting renewable energy goals, the European solar PV industry had a significant revenue share. A new market for solar energy has begun in Eastern European countries. Applications are being accelerated by new developments in energy storage options and cheaper solar technology. For instance, the momentum of the solar infrastructure investments in Germany, Spain, and Italy has notably increased, especially in community-based or decentralized rooftop systems, and projects such as the REPowerEU initiative are driving domestic production of solar and reducing dependency on imported fossil fuels. It is anticipated that the European solar PV market will play a principal role across the continent in the clean energy transition as a result of strong government support, business investment, and developments in technologies.

Key Solar PV Companies:

The following are the leading companies in the Solar PV market. These companies collectively hold the largest market share and dictate industry trends.

- RENESOLA

- SHARP CORPORATION

- Canadian Solar

- KYOCERA Corporation

- Jinko Solar

- First Solar

- Hanwha Group

- Wuxi Suntech Power Co., Ltd.

- REC Solar, Inc.

- Trinasolar

- SunPower Corporation

- JA SOLAR Technology Co., Ltd.

- Yingli Sola

- Others

Recent Developments

- In July 2024, Jinko Solar announced it has formed a joint venture in Saudi Arabia with Vision Industries Company (VI) and Renewable Energy Localization Company (RELC) through JinkoSolar Middle East DMCC, its subsidiary. A joint venture was formed to manufacture and operate a solar module and solar cell manufacturing plant in the economy. The production plant is anticipated to be around USD 1 billion in total investment, and it will be funded by a combination of internal and external financing.

- In April 2024, RENESOLA announced that it has partnered with BayWa r.e. to expand and enhance its marketing and sales efforts in Mexico. By using their respective strengths in solar energy, the two businesses are anticipated to collaborate in order to expand the reach of RENESOLA's solutions in the Mexican solar distribution industry. By 2024, they hope to have distributed 100 MW of solar modules.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the solar pv market based on the below-mentioned segments:

Global Solar PV Market, By Connectivity

Global Solar PV Market, By Mounting

Global Solar PV Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa