Global Ecotoxicological Studies Market Insights Forecasts to 2035

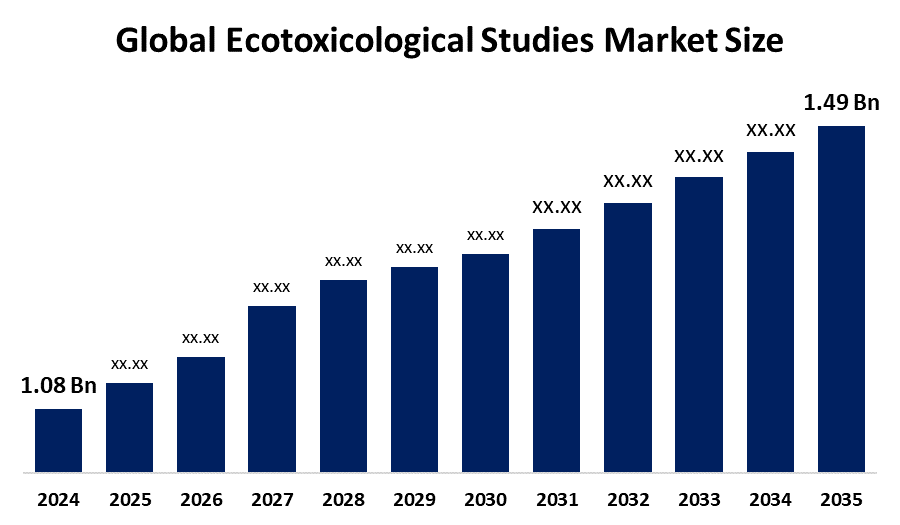

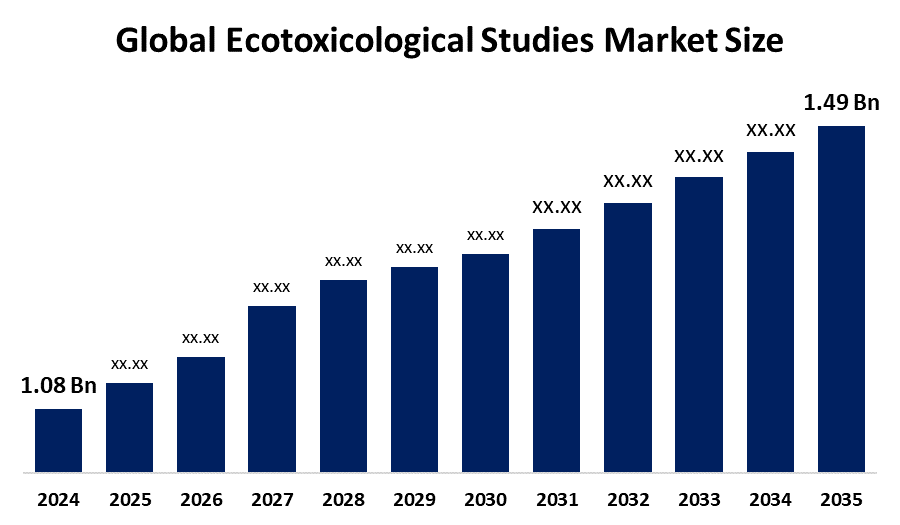

- The Global Ecotoxicological Studies Market Size Was Estimated at USD 1.08 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.97% from 2025 to 2035

- The Worldwide Ecotoxicological Studies Market Size is Expected to Reach USD 1.49 Billion by 2035

- Asia Pacific is expected to grow the fastest during the forecast period.

Ecotoxicological Studies Market

The Ecotoxicological Studies Market Size involves the scientific assessment of the potential harmful effects of chemical substances on the environment, particularly on aquatic and terrestrial organisms. These studies are essential in evaluating the ecological safety of various products and substances, including pesticides, pharmaceuticals, industrial chemicals, and consumer goods. Ecotoxicological testing typically includes a range of biological assessments such as acute and chronic toxicity tests conducted on organisms like algae, fish, daphnia, and soil invertebrates. The market is categorized by testing types, study methods (in vivo, in vitro, and in silico), and application areas across several industries. It supports regulatory compliance with international environmental safety standards and guidelines. As a critical component of environmental risk assessment, ecotoxicological studies provide valuable insights into the interactions between pollutants and ecosystems. The market is supported by a growing need for data-driven evaluations of ecological impact, helping organizations meet environmental safety requirements and ensure responsible product development.

Attractive Opportunities in the Ecotoxicological Studies Market

- Innovations such as computational modeling (in silico), organ-on-a-chip technologies, and advanced in vitro methods offer opportunities to reduce reliance on animal testing, lower costs, and improve predictive accuracy. These alternatives can accelerate testing timelines and meet growing ethical and regulatory demands.

- Increasing focus on emerging pollutants like microplastics, nanomaterials, and pharmaceuticals in the environment creates new areas for ecotoxicological assessment. Expanding services in this niche can open up untapped markets and address rising environmental concerns.

- Strengthening regulatory frameworks and rising environmental awareness in developing economies, especially in Asia Pacific, present significant growth potential. These regions are beginning to implement stricter environmental safety standards, boosting demand for ecotoxicological testing services and consulting.

Global Ecotoxicological Studies Market Dynamics

DRIVER: Increasing environmental awareness and the need to assess the ecological

Increasing environmental awareness and the need to assess the ecological impact of chemicals are leading to higher demand for ecotoxicological testing. Stringent regulations from agencies such as the Environmental Protection Agency (EPA), the European Chemicals Agency (ECHA), and similar global bodies require comprehensive toxicity data for chemical registration and approval, pushing companies to invest in these studies. The rapid growth of industries such as pharmaceuticals, agriculture, and chemicals also fuels the need to evaluate the environmental safety of their products. Additionally, the rise in research and development activities in sustainable product development and green chemistry further supports market expansion. Advances in testing technologies, including in vitro and in silico methods, are making studies more efficient and cost-effective, encouraging their adoption. Moreover, growing consumer and stakeholder pressure for environmental responsibility is prompting companies to proactively conduct ecotoxicological assessments to maintain brand reputation and compliance.

RESTRAINT: High cost associated with conducting comprehensive ecotoxicological assessments

One major challenge is the high cost associated with conducting comprehensive ecotoxicological assessments, particularly in vivo studies, which require specialized facilities, skilled personnel, and long testing periods. These expenses can be a burden for small and medium-sized enterprises. Additionally, the complexity and variability of ecosystems make it difficult to replicate environmental conditions accurately in laboratory settings, potentially limiting the reliability and applicability of test results. Ethical concerns surrounding animal testing also pose a challenge, as there is increasing pressure to reduce or replace animal-based studies, despite limited availability of validated alternative methods. Furthermore, the lengthy regulatory approval processes and evolving compliance requirements can delay product development and market entry. Lack of standardization in testing protocols across regions may also lead to inconsistent results and duplicated efforts, creating inefficiencies for companies operating internationally. These factors collectively hinder faster market growth and widespread adoption.

OPPORTUNITY: Development and adoption of alternative testing methods

One key opportunity lies in the development and adoption of alternative testing methods, such as computational modeling (in silico) and organ-on-a-chip technologies, which can reduce reliance on animal testing while improving predictive accuracy. There is also growing interest in ecotoxicological research related to emerging contaminants, including microplastics, nanomaterials, and pharmaceuticals in the environment, creating new areas for study and service offerings. Expanding regulatory frameworks in developing regions, where environmental safety standards are being strengthened, present untapped market potential for testing services and consulting. Collaborative research between academia, industry, and regulatory bodies can foster innovation and accelerate the development of new testing standards and methodologies. Additionally, integration of big data analytics and artificial intelligence into ecotoxicology can enhance data interpretation and streamline risk assessments, opening new avenues for efficiency and innovation in environmental testing and sustainability-focused product development.

CHALLENGES: Lack of available data for many chemicals

One major issue is the lack of available data for many chemicals, which makes it hard to fully understand their environmental impact. There is also a shortage of skilled professionals who have the combined knowledge of toxicology, ecology, and environmental science. Another challenge is accurately applying lab results to real-world ecosystems, as the environment is influenced by many interacting factors like pollution and climate change. Long-term and combined effects of different substances are especially hard to study. Differences in testing methods and regulations between countries can also lead to inconsistent results. Additionally, managing the large and complex amounts of data generated from these studies requires advanced tools and systems that not all organizations have. These challenges make it harder to carry out reliable and efficient ecotoxicological testing on a global scale.

Global Ecotoxicological Studies Market Ecosystem Analysis

The global ecotoxicological studies market ecosystem includes service providers (CROs and labs), regulatory bodies (EPA, ECHA), industrial clients (pharmaceuticals, agrochemicals, chemicals), research institutions, and technology developers. Service providers conduct tests to assess environmental risks, while regulators set safety standards. Industries rely on these studies for compliance and sustainability. Emerging technologies like in vitro, in silico models, and AI are enhancing testing efficiency. Europe leads the market due to strict regulations, followed by North America and the rapidly growing Asia-Pacific region. This ecosystem supports responsible product development and global environmental protection efforts.

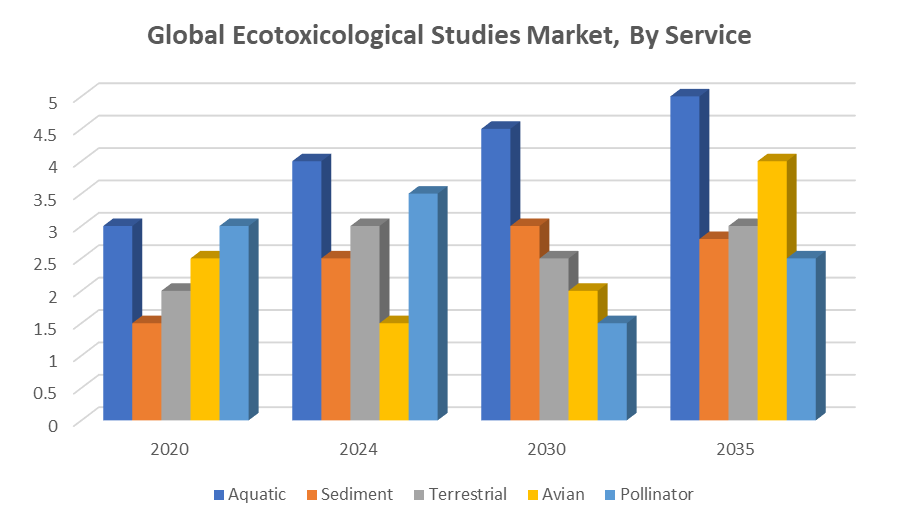

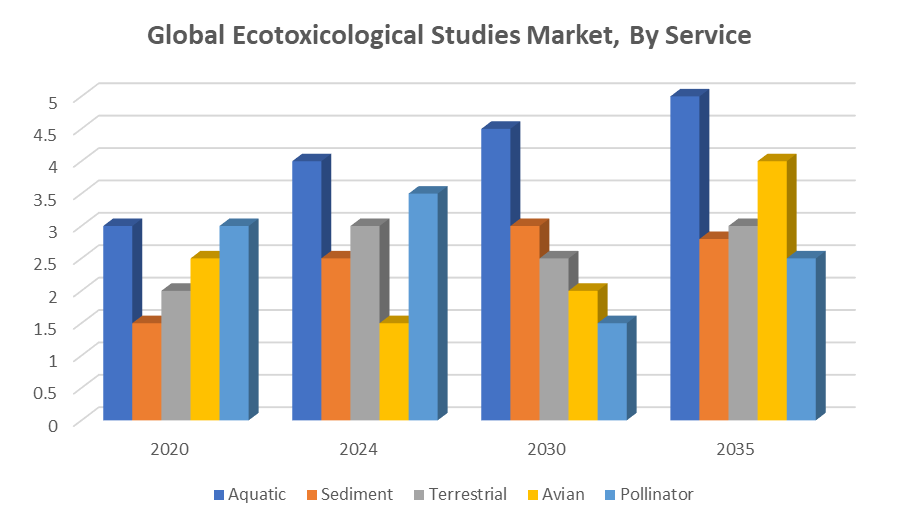

Based on the service, the aquatic segment held the highest revenue share and is expected to grow at a significant CAGR over the forecast period

The aquatic segment dominance is primarily due to the critical importance of assessing the impact of chemicals on aquatic ecosystems, which are often the first to be exposed to environmental pollutants. Aquatic ecotoxicology includes testing on fish, algae, daphnia, and other water-based organisms to evaluate acute and chronic toxicity. Regulatory bodies worldwide emphasize aquatic toxicity data for chemical registration, further driving demand. With growing concerns over water pollution, wastewater discharge, and the presence of emerging contaminants like microplastics and pharmaceuticals in aquatic environments, this segment is expected to continue expanding robustly. Advances in testing methodologies, including the use of early-life stage tests and alternative species, are also contributing to the segment’s growth and its continued leadership within the ecotoxicological services market.

Europe is anticipated to hold the largest market share of the ecotoxicological studies market during the forecast period

Europe is anticipated to hold the largest market share in the ecotoxicological studies market during the forecast period. This is driven by the region’s stringent environmental regulations, such as REACH (Registration, Evaluation, Authorisation, and Restriction of Chemicals), which require comprehensive ecotoxicological data for chemical registration and approval. Additionally, Europe has a well-established network of contract research organizations (CROs) and testing laboratories that offer advanced ecotoxicological services. The growing focus on environmental sustainability, increased funding for research, and heightened awareness about ecological safety further strengthen Europe’s position. These factors collectively contribute to Europe’s leading role in driving demand for ecotoxicological studies, ensuring rigorous environmental risk assessments, and supporting sustainable development across industries such as pharmaceuticals, agrochemicals, and chemicals.

Asia Pacific is expected to grow at the fastest CAGR in the ecotoxicological studies market during the forecast period

Asia Pacific is expected to grow at the fastest CAGR in the ecotoxicological studies market during the forecast period. This expansion is driven by several factors, including rapid industrialization, urbanization, and increased environmental awareness in countries like China, India, and Japan. The region's growing pharmaceutical, agricultural, and chemical industries are contributing to the rising demand for ecotoxicological assessments to evaluate and mitigate environmental impacts. Additionally, improved regulatory frameworks and cost-effective testing services are further supporting market growth in Asia Pacific . As environmental concerns intensify, the need for comprehensive ecotoxicological studies to safeguard ecosystems and public health is becoming increasingly critical in the region.

Recent Development

- In April 2023, Ricardo introduced the Persistence Assessment Tool, a software designed to improve chemical persistence assessments for environmental safety. This tool aids in navigating complex regulations and increasing demands for chemical biodegradation testing .

Key Market Players

KEY PLAYERS IN THE ECOTOXICOLOGICAL STUDIES MARKET INCLUDE

- Eurofins Scientific

- Smithers Group

- SGS SA

- Charles River Laboratories

- Covance Inc. (part of Labcorp)

- Fera Science Ltd.

- Microbiotests Inc.

- INTOX Pvt. Ltd.

- Noack Laboratories

- Ricardo plc

- Others

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the ecotoxicological studies market based on the below-mentioned segments:

Global Ecotoxicological Studies Market, By Service

- Aquatic

- Sediment

- Terrestrial

- Avian

- Pollinator

Global Ecotoxicological Studies Market, By Regional Analysis

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- South America

- Brazil

- Argentina

- Rest of South America

- Middle East & Africa

- UAE

- Saudi Arabia

- Qatar

- South Africa

- Rest of the Middle East & Africa